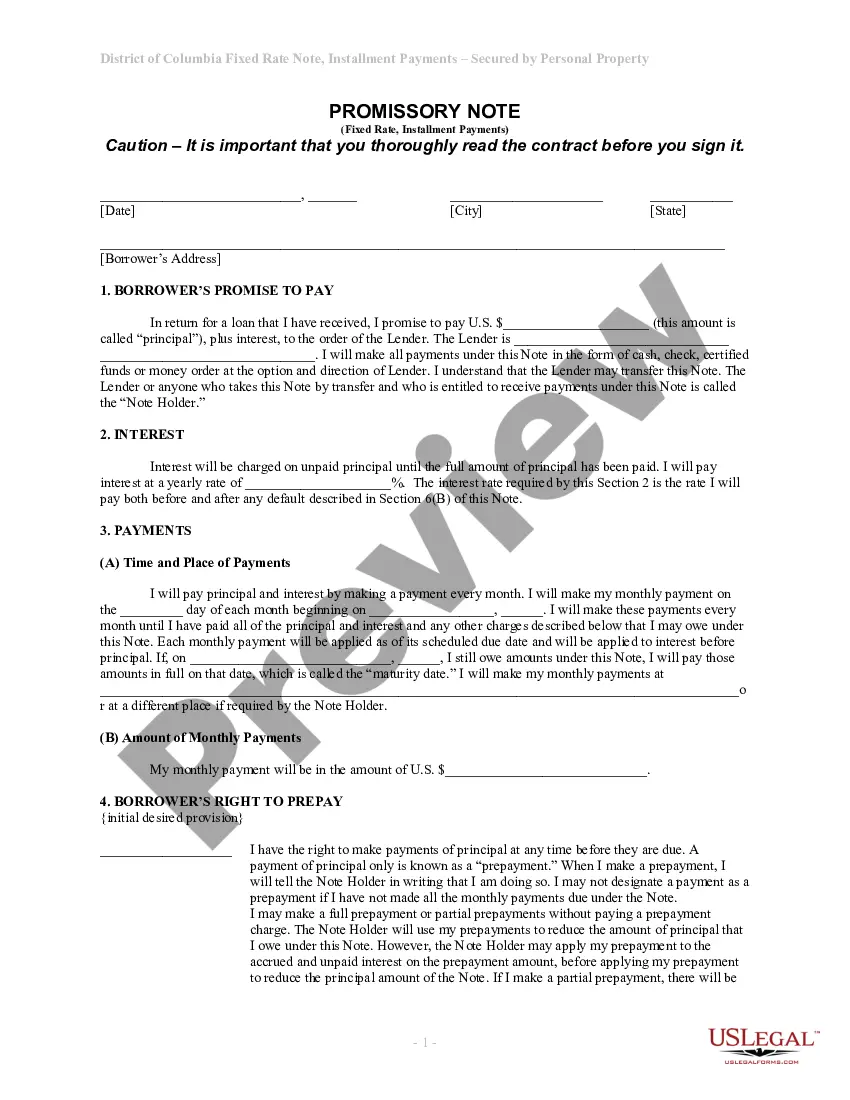

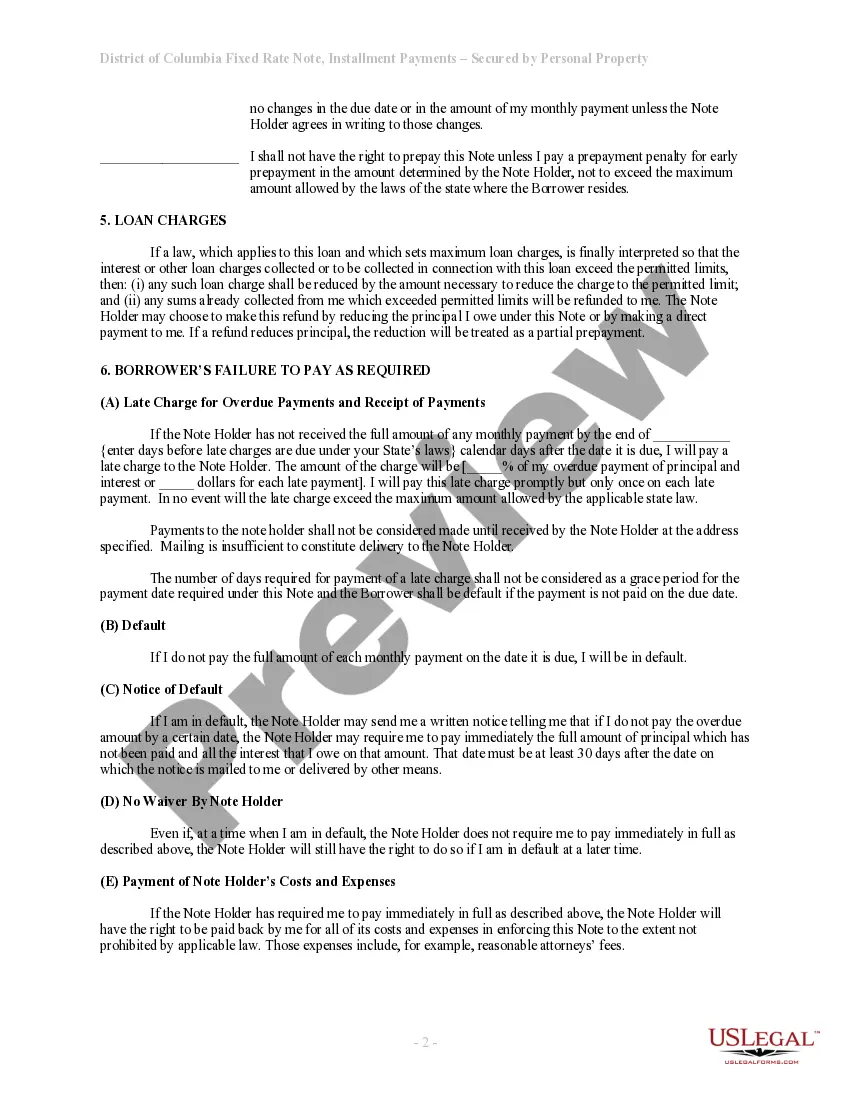

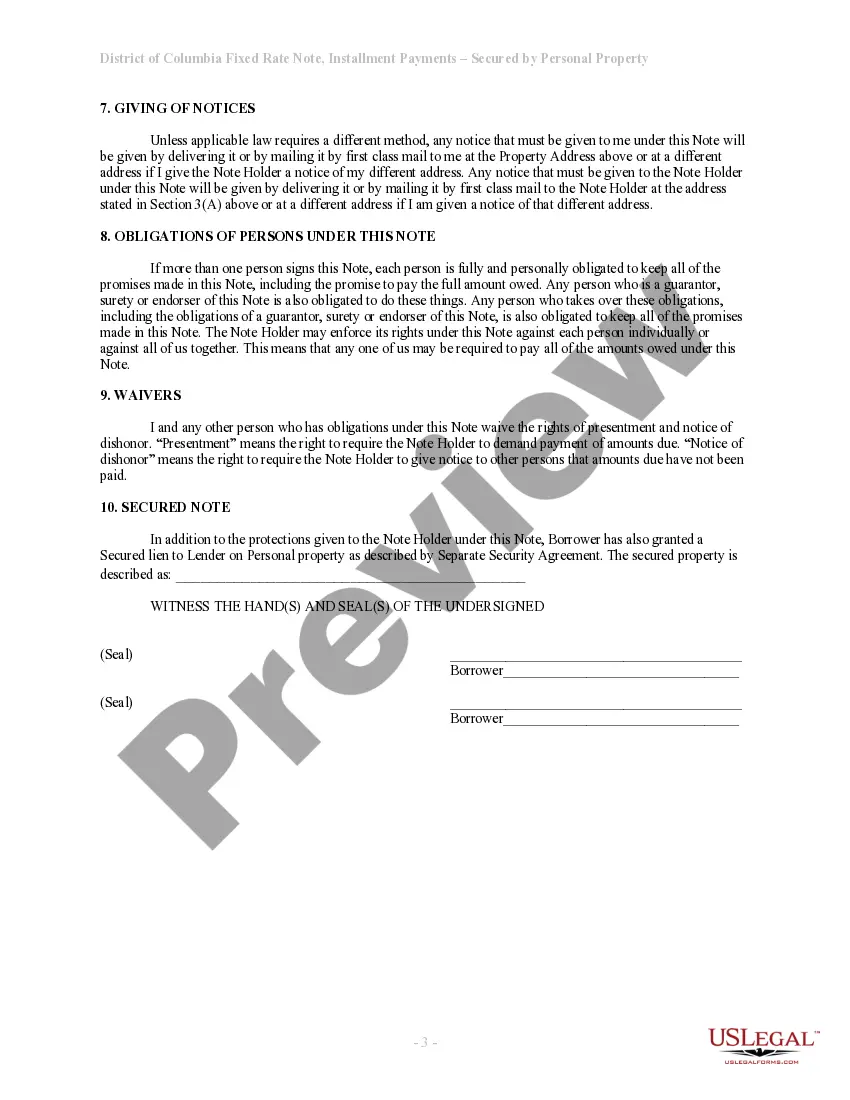

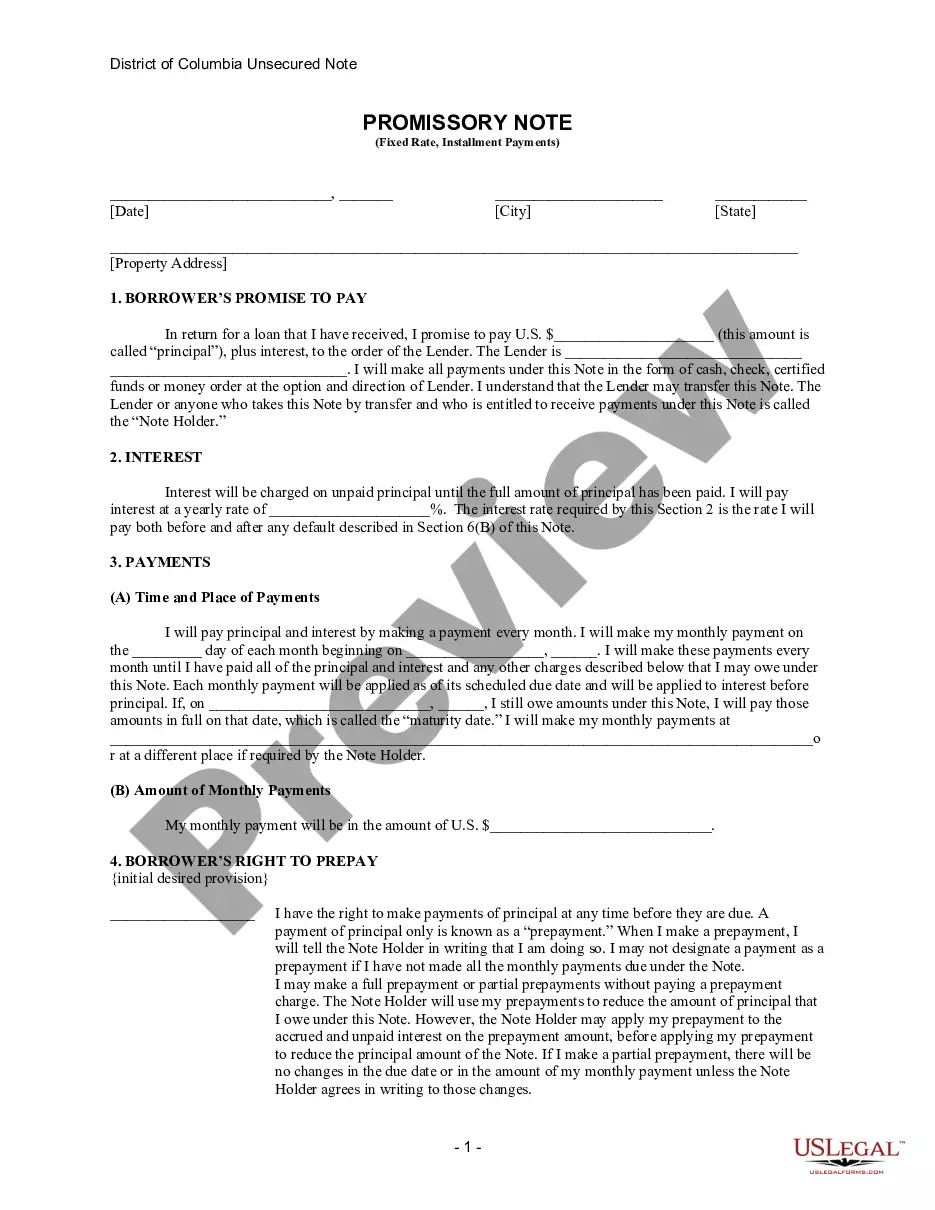

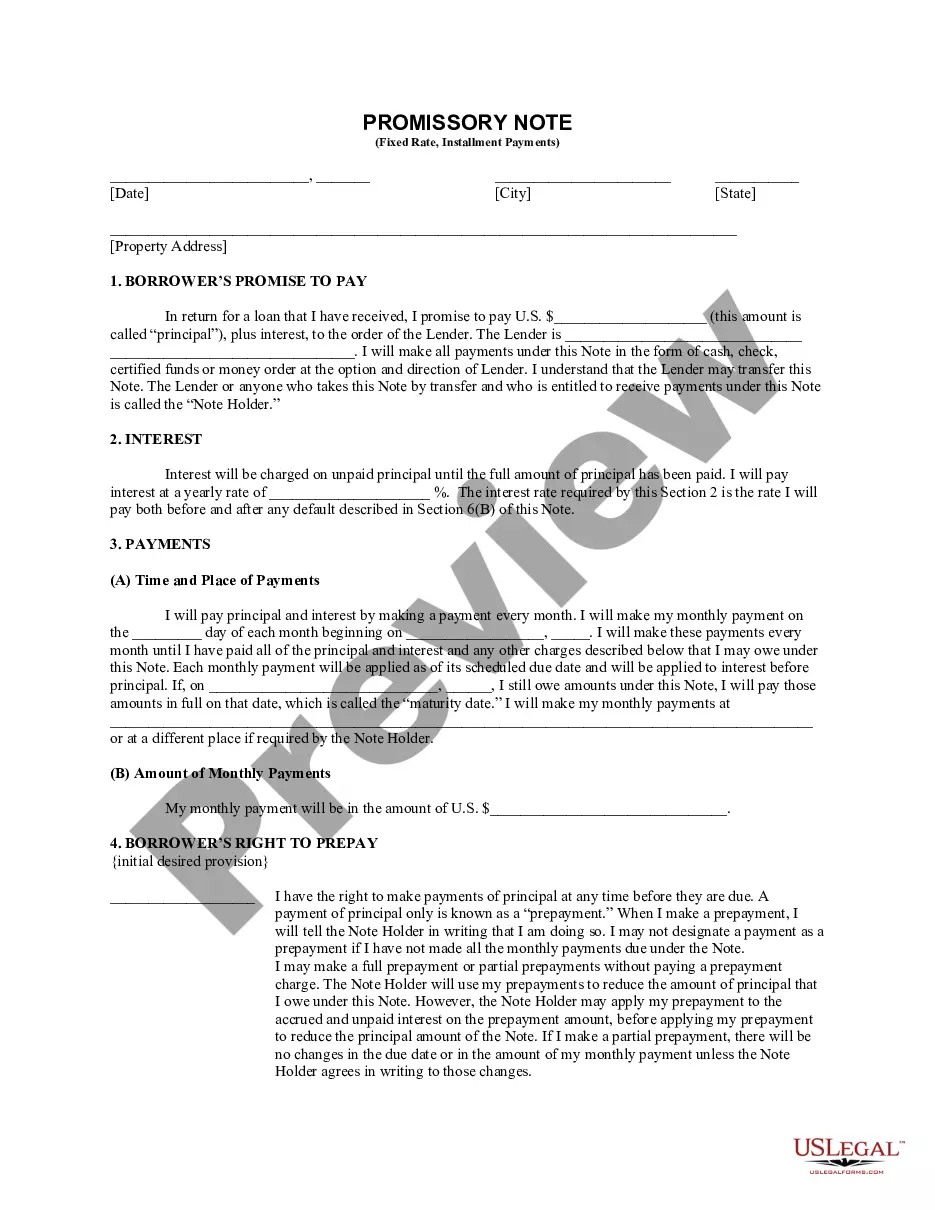

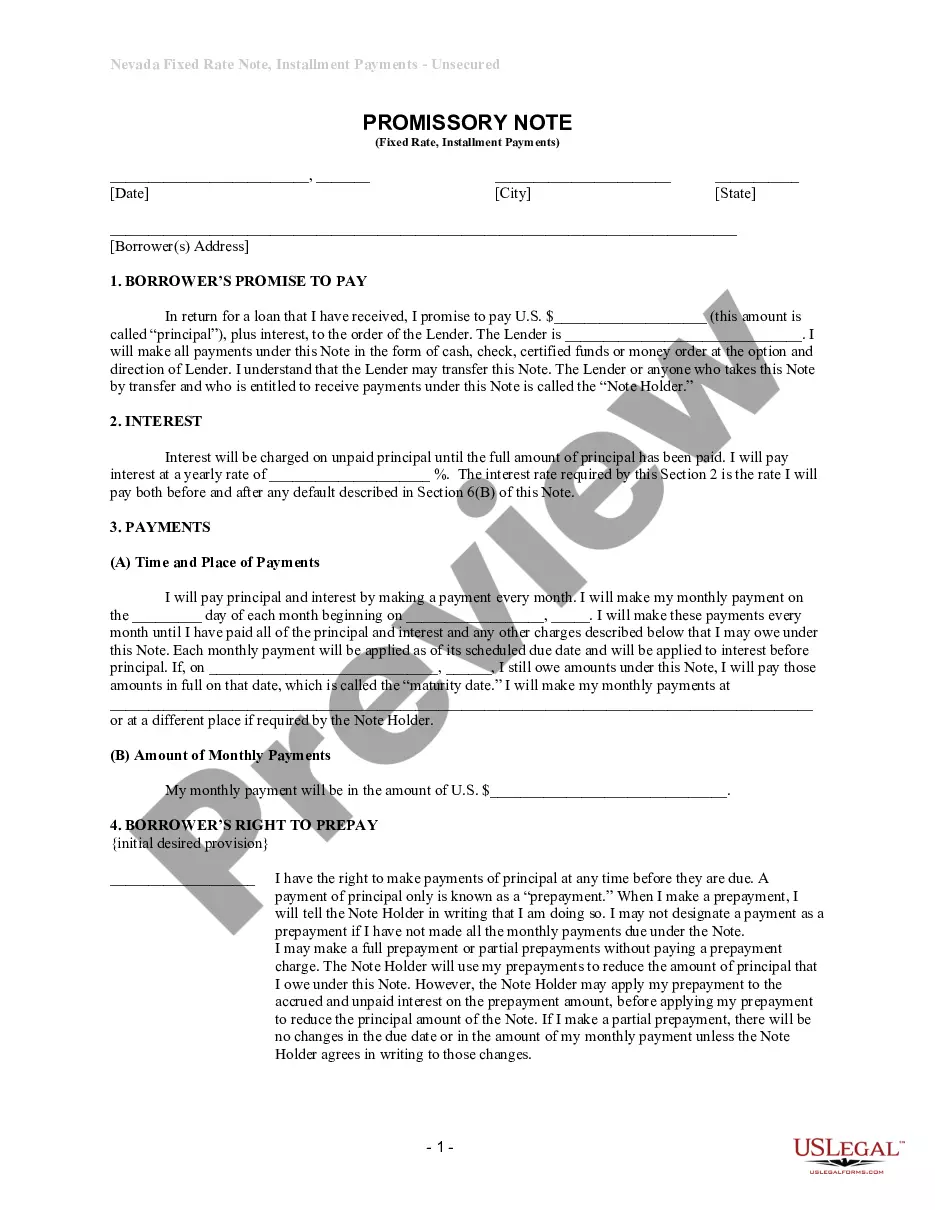

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

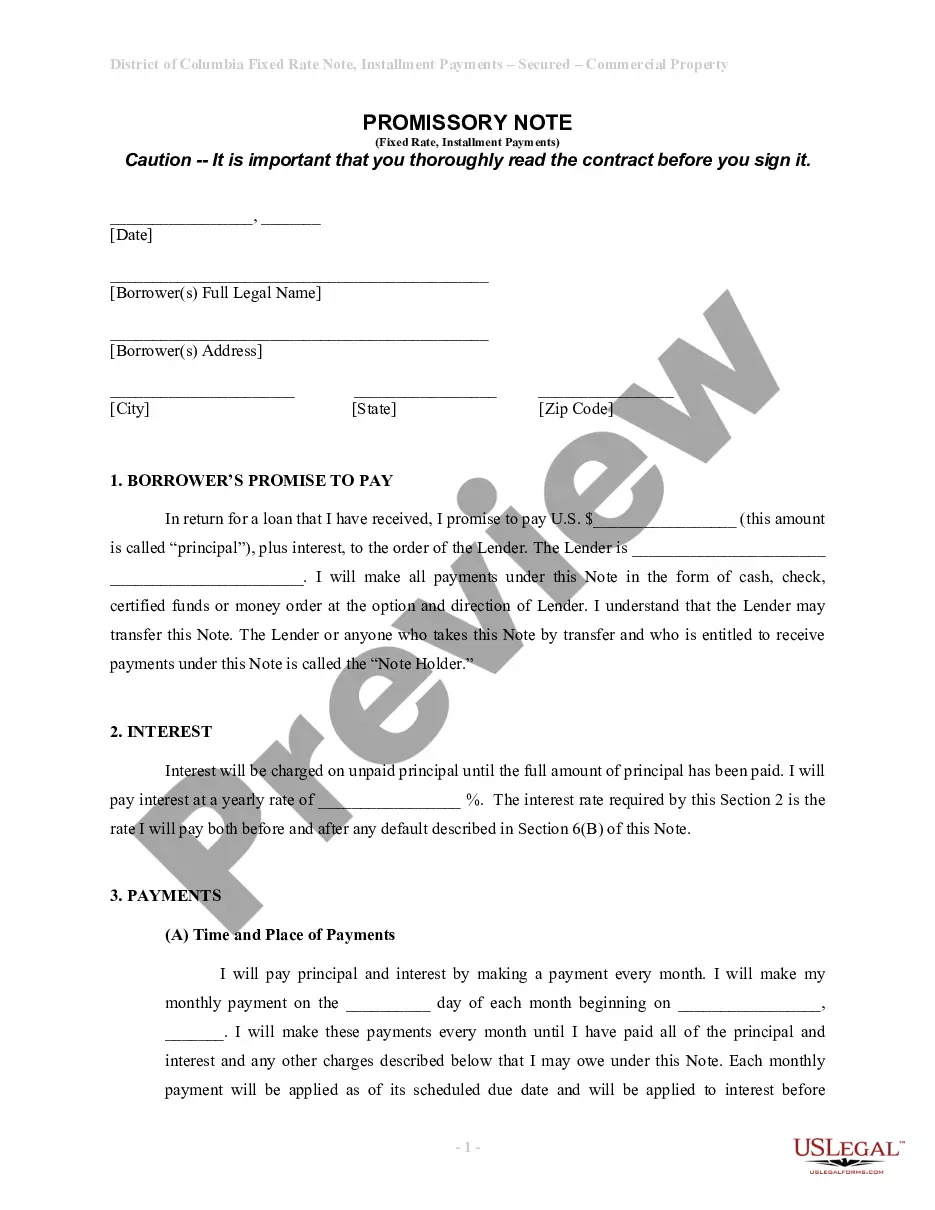

District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out District Of Columbia Installments Fixed Rate Promissory Note Secured By Personal Property?

The greater the documentation you need to prepare - the more anxious you become.

You can find countless District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property samples online, yet you’re unsure which ones to trust.

Eliminate the complication and simplify the process of obtaining samples with US Legal Forms.

Fill in the required information to create your account and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. Access every file you receive in the My documents section. Just navigate there to generate a new version of your District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property. Even with well-prepared forms, it’s still wise to consider consulting a local attorney to review the completed form to ensure your document is properly filled out. Achieve more while spending less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property’s page.

- If you’ve not previously used our site, follow these steps to register.

- Ensure that the District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property is valid in your state.

- Verify your choice by reviewing the description or by using the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

A security agreement is the document that creates security for a promissory note. In the case of a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property, this agreement lays out the borrower's rights and obligations. It also identifies the secured property, ensuring clarity for both parties. Having this document is crucial as it protects the lender's interests in case of default.

Writing a simple promissory note begins with clearly stating the borrower's promise to repay a specified amount to the lender. Include essential details such as the amount lent, payment terms, and interest rate. Keep the language straightforward, and if needed, leverage UsLegalForms to access templates for drafting a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property that suits your needs.

Filling out a promissory note requires careful attention to detail. You will need sections for the date, names of the parties involved, the principal amount, repayment schedule, interest rate, and any collateral provided. To ensure accuracy and legality, consider utilizing the templates from UsLegalForms, which cater specifically to creating a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property.

Yes, you can electronically file a DC tax return through the District of Columbia Office of Tax and Revenue's online portal. This method offers a convenient way to submit your taxes, including personal property tax. When planning your tax liabilities, consider utilizing a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property for flexible payment options.

In the District of Columbia, property classifications generally include real property and personal property, with personal property further categorized into various types like tangible and intangible assets. Knowing these classifications can help you if you're filing taxes or dealing with financial products. A District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property might be beneficial in managing your declared assets effectively.

The DC FP-31 personal property tax form is utilized to report the value of personal property owned by businesses when filing taxes in Washington D.C. Accurate completion of this form is essential for ensuring compliance with local tax regulations. If you're managing tax obligations, consider how a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property can help in financial planning.

Finding your DC taxes requires checking with the District of Columbia Office of Tax and Revenue, where you can access your tax account and see any outstanding balances. It's important to stay updated on your tax situation to manage your finances effectively. Should you need help making payments, a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property may provide the necessary support.

To file your personal property taxes in the District of Columbia, you need to complete the required forms, such as the FP-31, with details about your personal property. You can file online through the D.C. Office of Tax and Revenue's website or by submitting paper forms. Consider implementing a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property for easier financial planning related to your tax payments.

The FP-31 is a specific form used to report personal property tax in Washington D.C. This form helps businesses declare their taxable personal property to ensure accurate tax assessment. Completing the FP-31 accurately is crucial, and using a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property can provide financial flexibility in meeting tax obligations.

Claiming personal property taxes in the District of Columbia involves reporting the value of your personal property on the appropriate tax forms. You can do this through the online tax portal or mailing in hard copies of your claims. For optimal management of your financial obligations, consider utilizing a District of Columbia Installments Fixed Rate Promissory Note Secured by Personal Property to assist in your claims process.