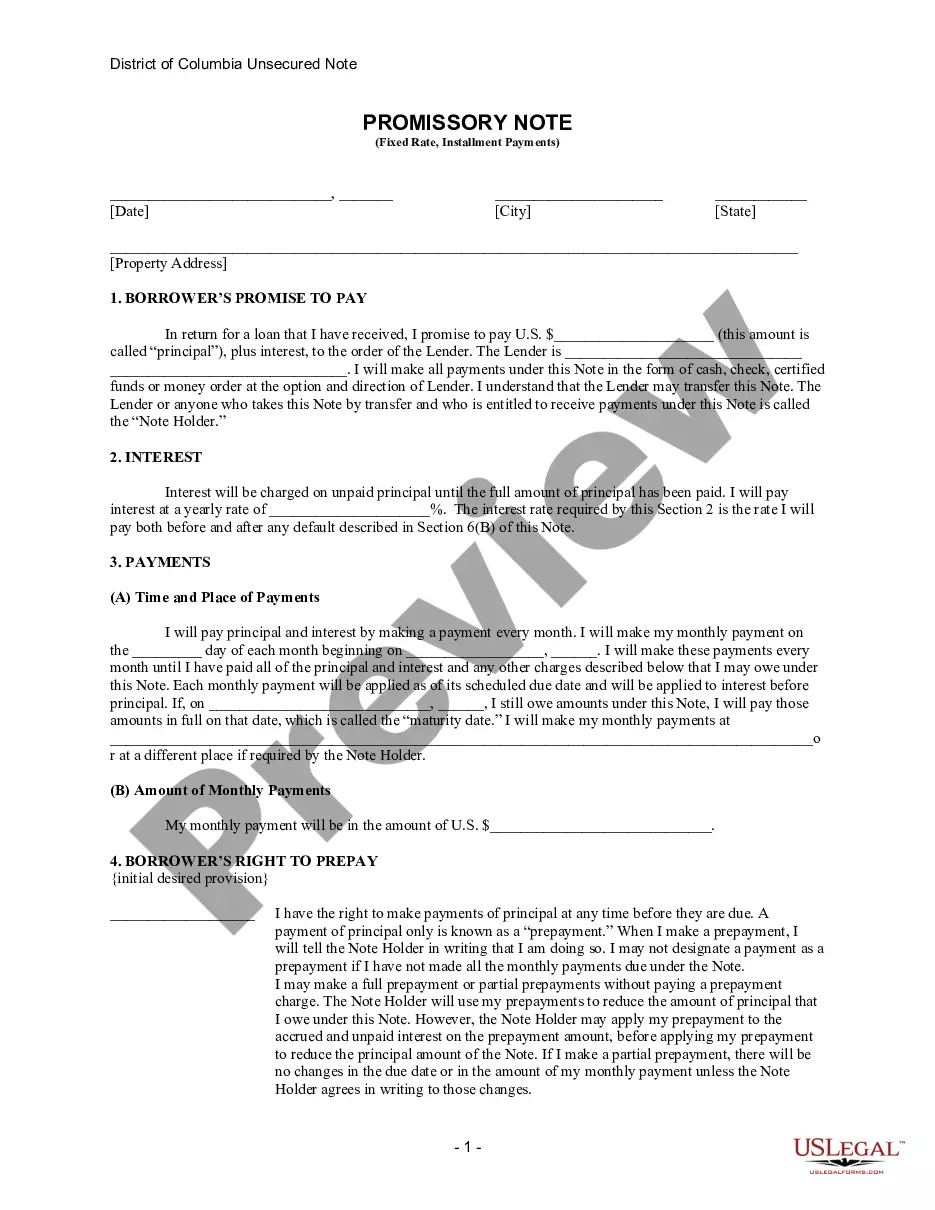

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out District Of Columbia Unsecured Installment Payment Promissory Note For Fixed Rate?

The more documentation you need to complete - the more anxious you become.

You can discover numerous District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate formats online, yet you are unsure which ones to trust.

Eliminate the stress and make locating samples simpler by using US Legal Forms.

Enter the requested information to create your account and complete payment for the order using PayPal or credit card. Select a convenient document format and obtain your template. Access every sample you receive in the My documents section. Simply visit there to prepare a new version of your District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate. Even with professionally crafted templates, it remains essential to consider consulting your local attorney to verify that the completed form is accurate. Achieve more for less with US Legal Forms!

- If you currently maintain a subscription to US Legal Forms, Log In to your account, and you’ll find the Download option on the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate’s page.

- If you have not previously utilized our website, complete the registration process with the following steps.

- Ensure the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate is legitimate in your state.

- Verify your choice by reviewing the description or by using the Preview function if available for the chosen document.

- Click Buy Now to begin the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

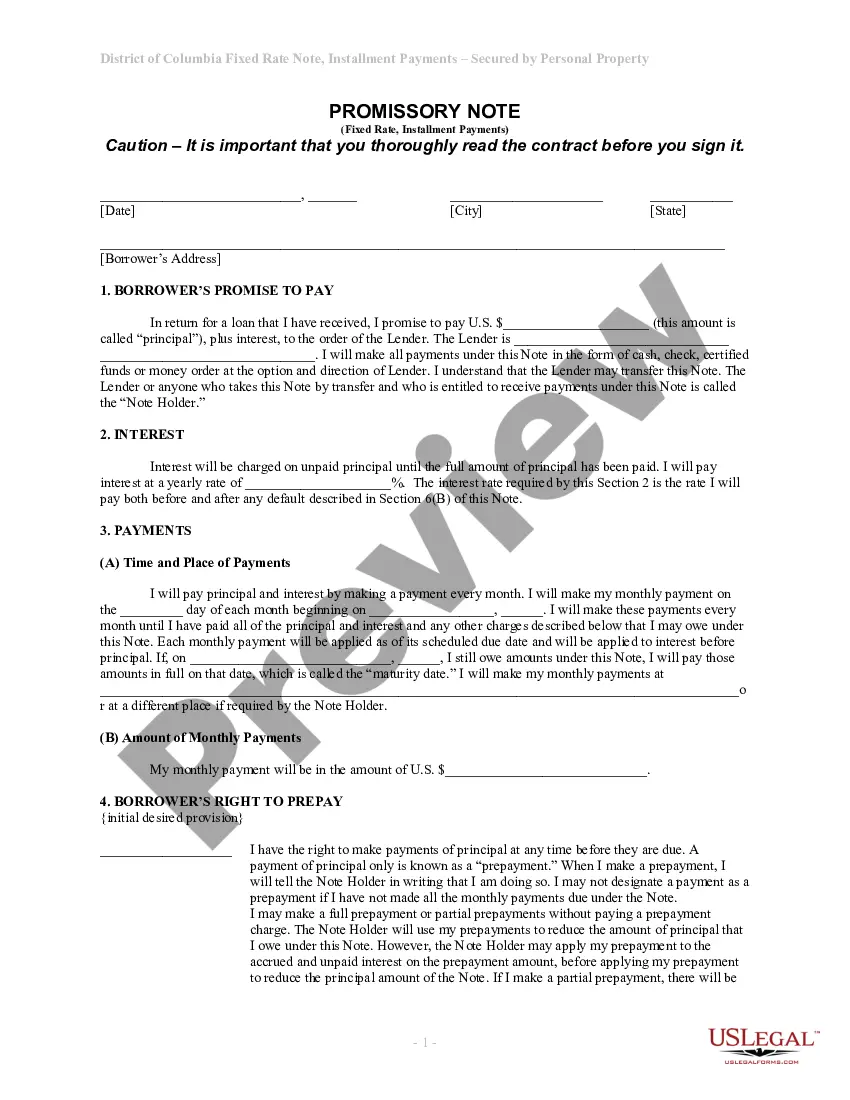

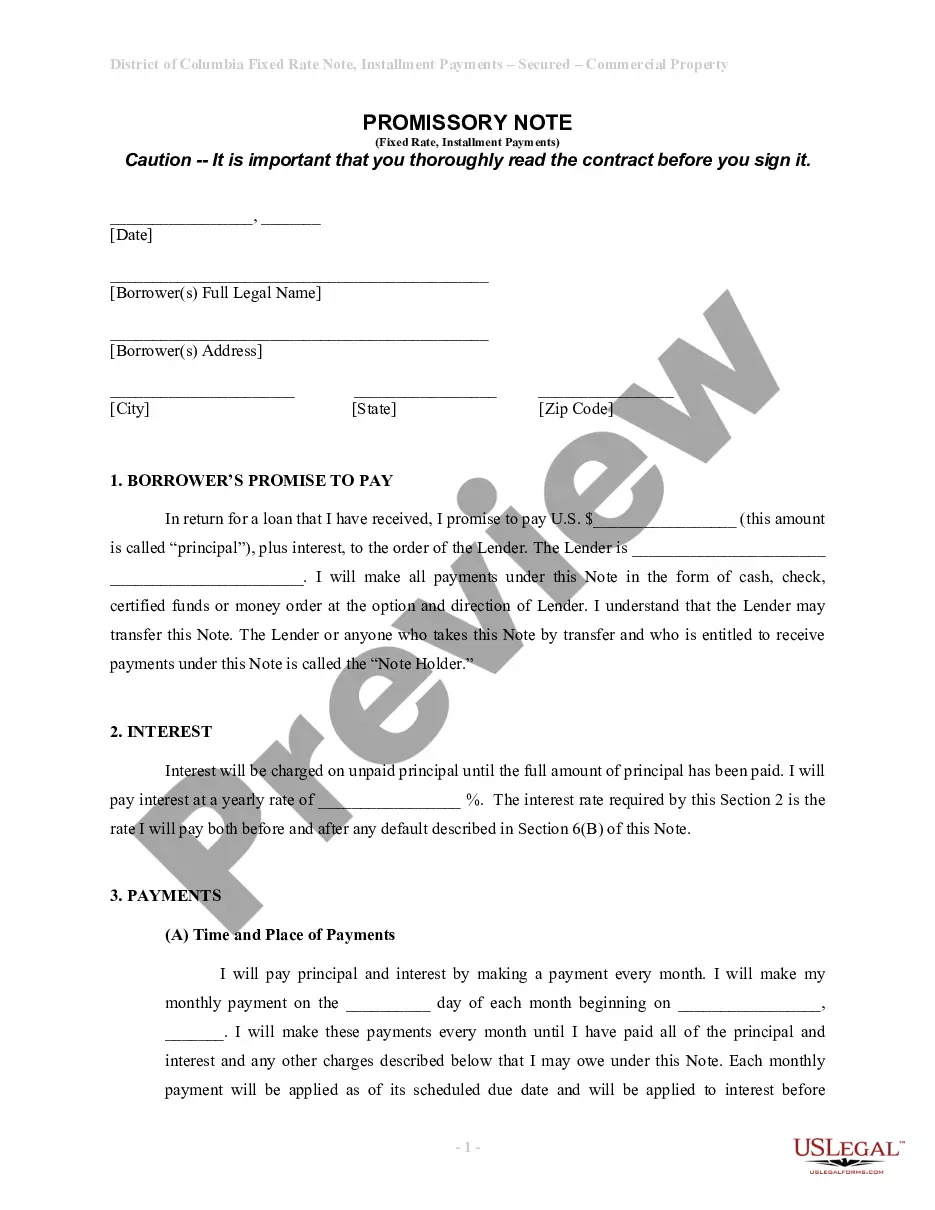

A promissory note should appear professional and straightforward, beginning with a title indicating it is a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate. Use clear sections for the lender and borrower details, the amount loaned, interest, and payment schedule. Visual clarity and organization are key to ensuring the document’s acceptance and understanding by all parties involved.

Filling out a promissory note involves entering specific information needed for the contract. You must include the date, names of the parties, principal amount, interest rate, and detailed payment terms. After providing this information, both parties should sign the note. This process creates a binding agreement, securing your commitment as needed in a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate.

The structure of a promissory note typically includes a title, parties involved, the principal amount, interest rate, payment terms, and a date for repayment. It's essential to layout these sections clearly to avoid misunderstandings. Adding signatures from both parties solidifies the document, enabling it to function as a District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate.

To obtain a promissory note, you can either request one from the lender or draft it yourself. If you choose to create your own, consider using the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate template available on US Legal Forms. This resource ensures your agreement complies with local laws and includes all necessary details.

Acquiring a promissory note is a straightforward process once you understand your needs. You can draft your own District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate using templates available online. Platforms like US Legal Forms provide customizable templates to simplify this process, ensuring your note meets all legal requirements.

To obtain a copy of your promissory note, you should check with the lender or financial institution that issued it. They often keep records of all agreements, including your District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate. If you cannot reach them, consider visiting your local courthouse or using resources like US Legal Forms to access the necessary documentation.

You do not typically record promissory notes in public registries; rather, you simply keep them for personal records. For added security, you might choose to have the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate notarized. This provides an additional layer of authenticity, which can be useful in case of disputes.

Filling out the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate involves including essential information such as the amount, interest rate, repayment schedule, and party details. Be clear and thorough in your entries. You can also utilize platforms like USLegalForms to access templates that simplify this process.

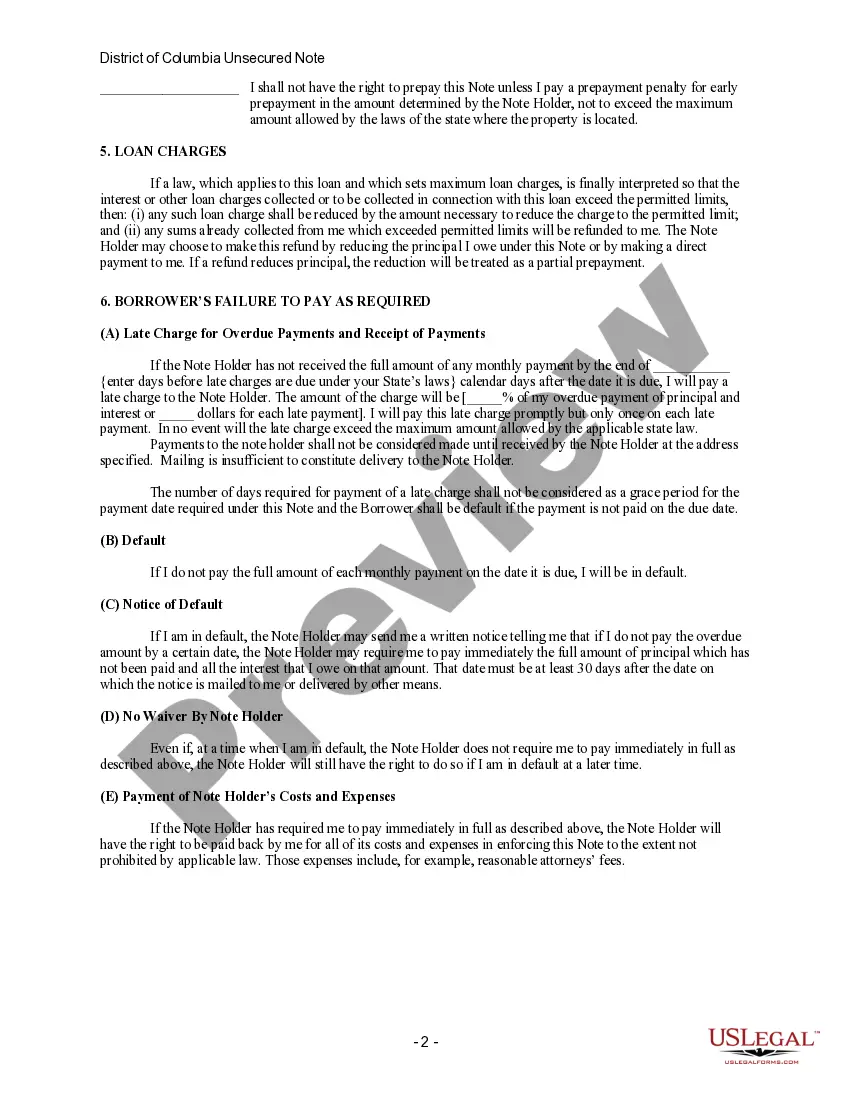

To enforce an unsecured promissory note, you generally must initiate legal action through the courts. If the borrower defaults on the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate, you may file a lawsuit to recover the owed amount. It is often useful to first send a demand letter before proceeding with legal actions.

When it comes to taxes, the interest earned on the District of Columbia Unsecured Installment Payment Promissory Note for Fixed Rate may be taxable income. You need to report this income on your tax return. Be sure to keep comprehensive records of all related transactions, as they will be useful during tax season.