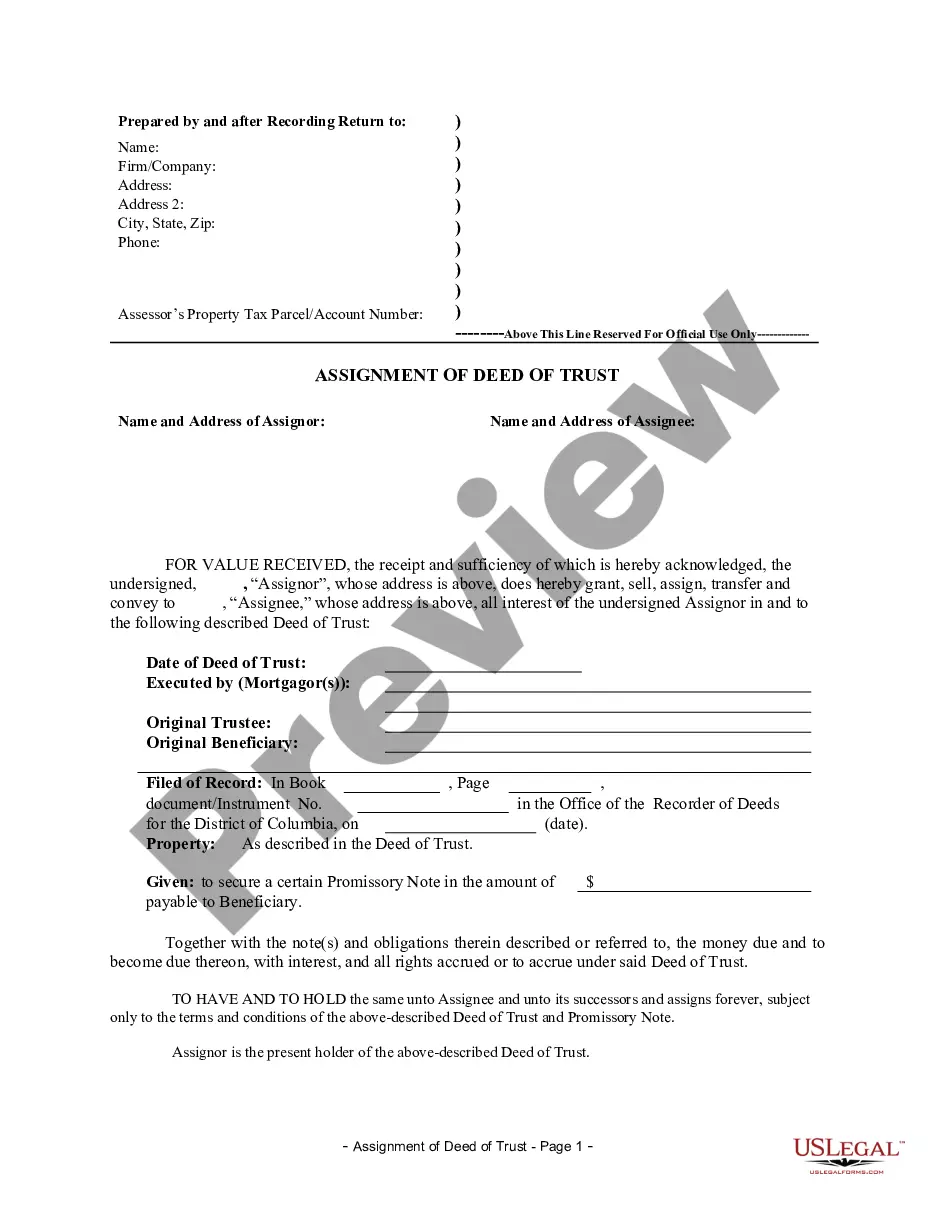

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out District Of Columbia Assignment Of Deed Of Trust By Corporate Mortgage Holder?

The larger volume of documentation you have to complete - the more anxious you feel.

You can obtain countless District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder templates online, but you may not know which ones to trust.

Eliminate the frustration to make obtaining samples much easier by utilizing US Legal Forms.

Enter the required information to establish your profile and settle your order with PayPal or a credit card. Select a suitable file format and obtain your sample. Access any document you acquire in the My documents menu. Simply go there to complete a new version of the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder. Even when creating expertly drafted forms, it's still wise to consult with your local attorney to verify that your document is properly filled out. Achieve more for less with US Legal Forms!

- If you already possess a subscription to US Legal Forms, Log In to your account, and you'll discover the Download option on the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder’s page.

- If you haven't utilized our service before, go through the registration process using these steps.

- Verify if the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder is applicable in your state.

- Double-check your selection by reviewing the description or by using the Preview function if available for the selected document.

- Click on Buy Now to initiate the registration process and choose a payment plan that suits your needs.

Form popularity

FAQ

A deed of Assignment of a mortgage is a legal document that transfers the rights and responsibilities of the mortgage from one lender to another. This process is often used by lenders when they sell the mortgage or assign it to another party. In the case of a District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder, this deed effectively updates the records to reflect the new holder of the mortgage. You can rely on USLegalForms to guide you through this process and provide the necessary documents.

To create a valid deed in Washington, D.C., you need to ensure that the document is in writing, signed by the grantor, and includes a description of the property. Additionally, it must be delivered and accepted to complete the transfer of ownership. For a District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder, it is essential to follow specific regulations set by local authorities. Utilizing a platform like USLegalForms can help you ensure all requirements are met accurately.

While Quizlet may offer educational content on corporate real estate transactions, conveying real estate through a deed involves legal steps that a corporation must follow. This includes preparation and execution of the deed, as well as compliance with state regulations. For those looking to understand the process, resources like the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder can provide helpful guidance.

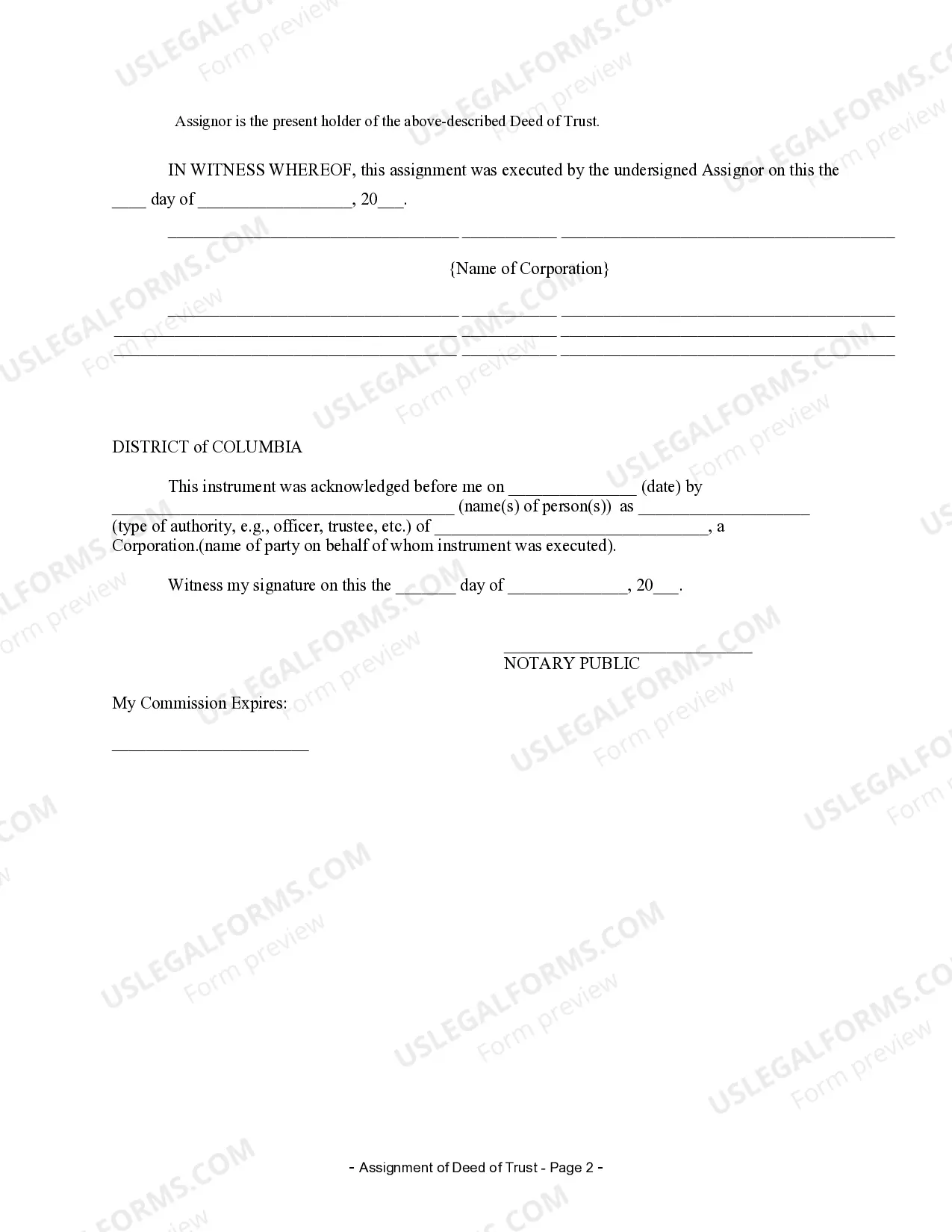

The Assignment of Deed of Trust must be signed by authorized representatives of the corporation, typically by an officer or director. It is crucial that the signatories are designated in accordance with the corporation's bylaws to ensure legitimacy. This process strengthens the legal enforceability of the arrangement under the framework of District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder.

The title on the deed should reflect the legal entity of the corporation, including its full name as registered with the state. Clarity in this title helps avoid future disputes regarding property ownership. When dealing with the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder, precise title representation is vital for upholding the rights of all involved parties.

When a corporation transfers ownership of property, the deed must be signed by authorized individuals on behalf of the corporation. This signature acts as verification of the transaction and ensures that all corporate policies have been followed. In the context of the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder, proper execution of the deed is crucial for it to be legally binding.

Yes, a corporation can convey real estate, provided it follows proper legal protocols. Corporations possess the legal capacity to own and transfer property like any individual. It is essential that the transfer complies with local laws, including the requirements for the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder.

A corporation conveys real estate through a deed by having its authorized representatives execute the document. The deed must clearly identify the corporation as the grantor and include relevant property details. In the District of Columbia, this process often involves the Assignment of Deed of Trust by Corporate Mortgage Holder to ensure legal compliance and protection of interests.

The purpose of a Deed of Trust is to provide security to lenders while facilitating real estate transactions. It ensures that the lender has a legal claim to the property until the borrower repays the debt fully. This structure helps protect both parties and enhances the overall stability of the real estate market. If you're looking to navigate the intricacies of real estate in D.C., consider utilizing the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder through platforms like uslegalforms.

One disadvantage of a Deed of Trust is that it can lead to foreclosure more quickly than a traditional mortgage. If a borrower defaults, the trustee may sell the property without going through a lengthy court process. This expedited procedure may leave borrowers with less time to remedy financial issues. Knowing this disadvantage can help borrowers prepare for responsible management of their property rights, particularly in relation to the District of Columbia Assignment of Deed of Trust by Corporate Mortgage Holder.