District of Columbia Owner's Statement by Corporation

Understanding this form

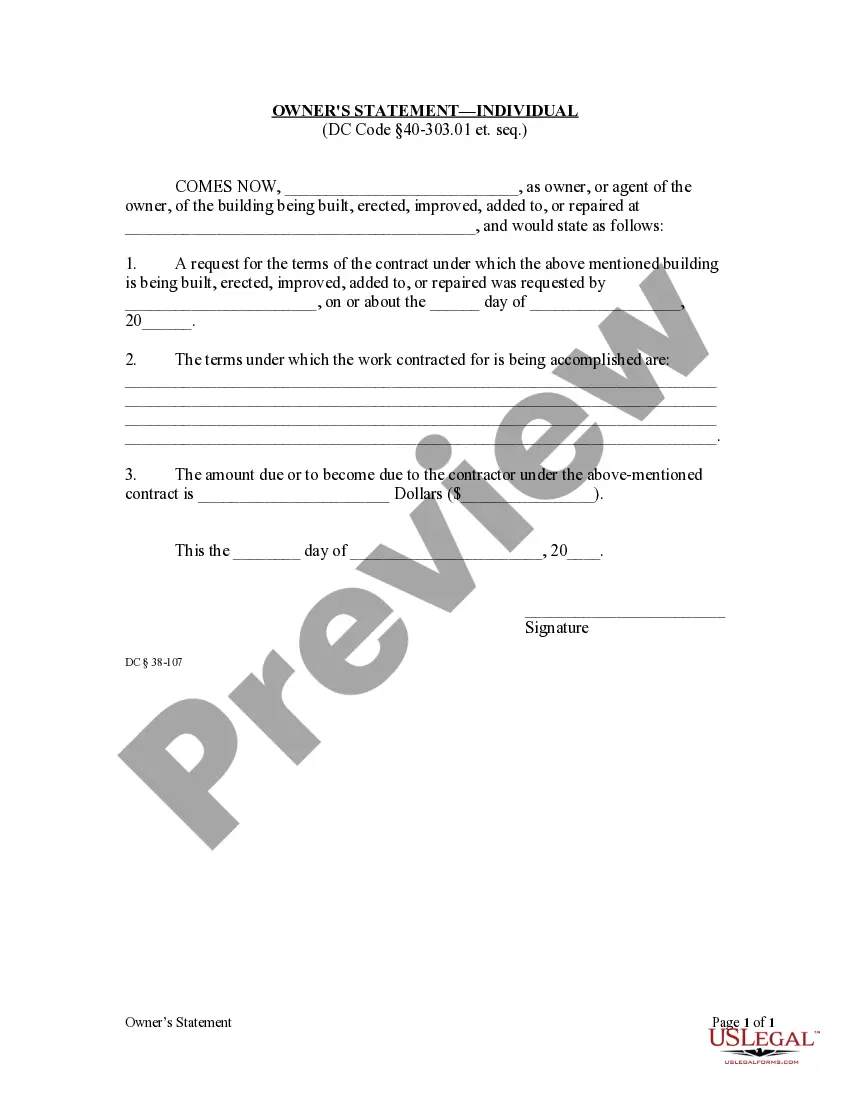

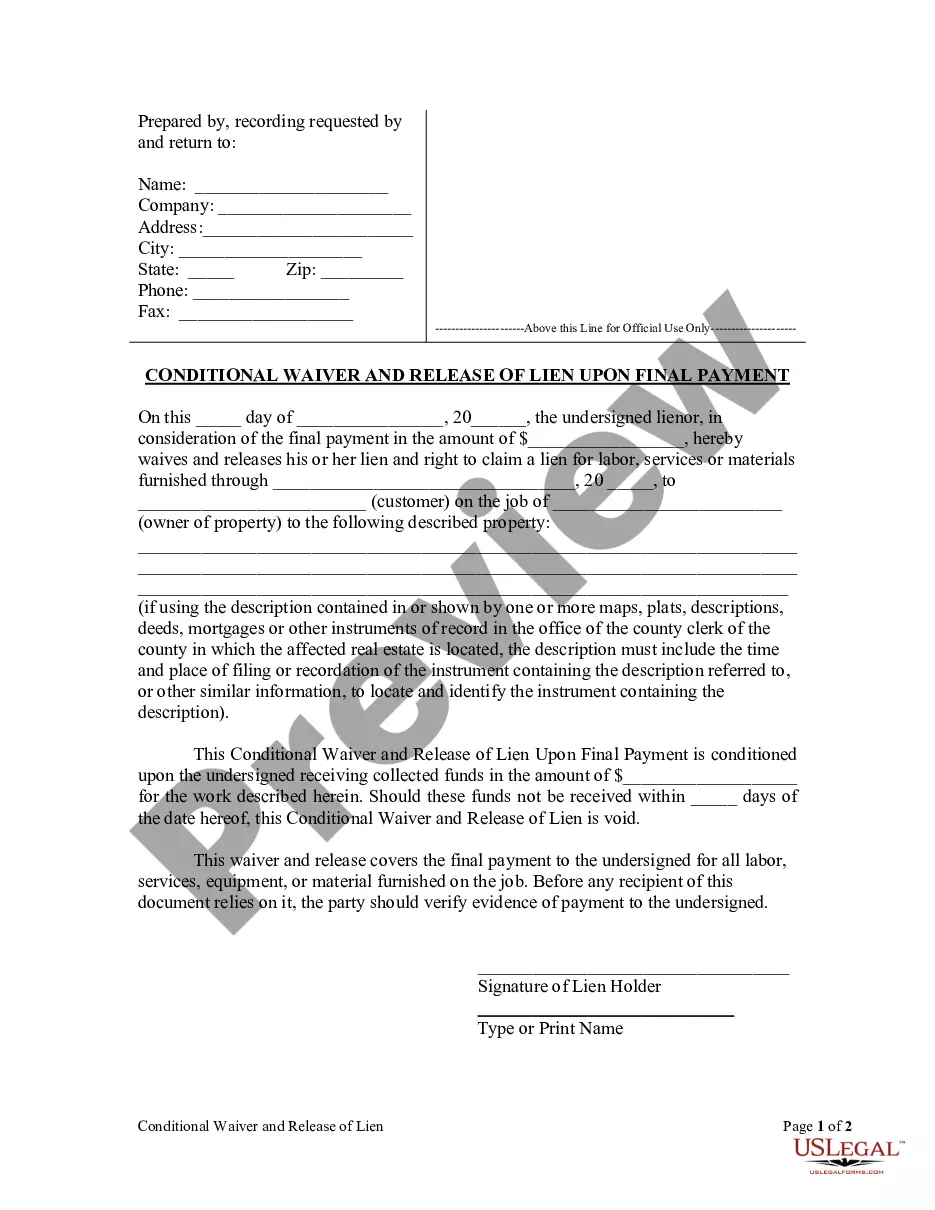

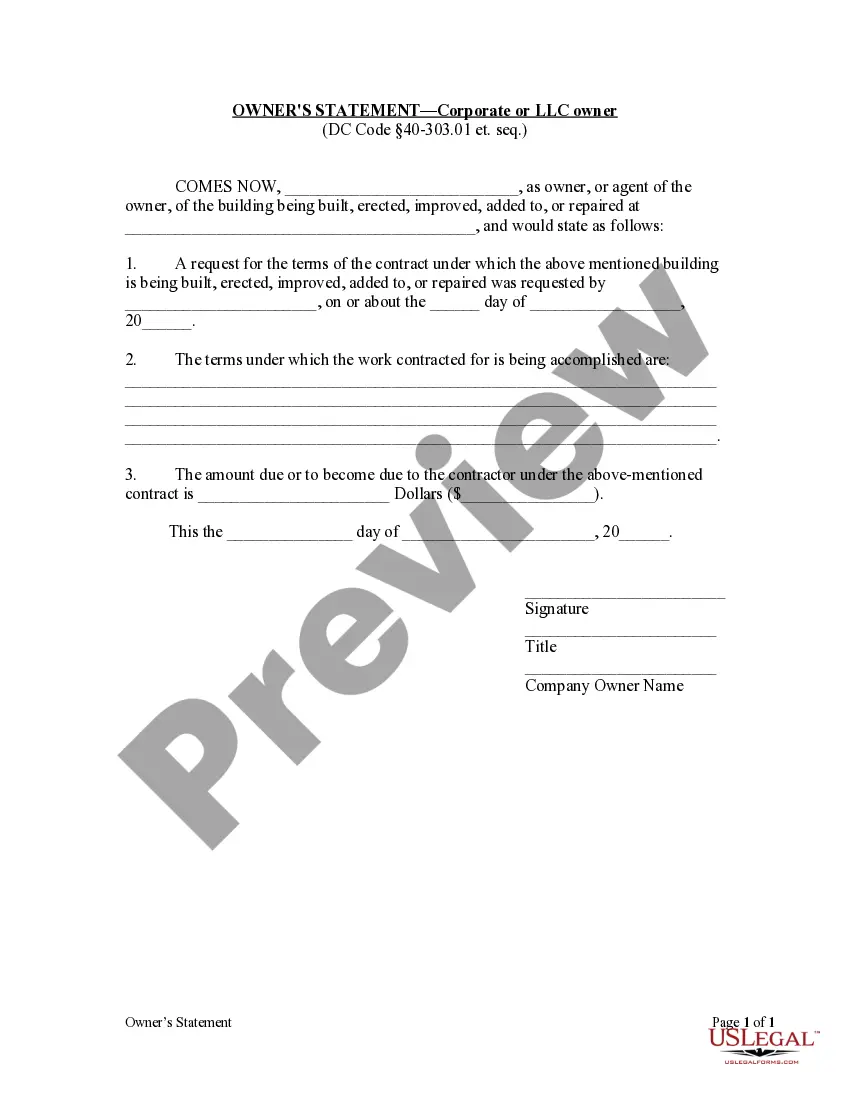

The Owner's Statement by Corporation is a legal document that allows a corporate owner to respond to a request from a subcontractor or other party concerning the terms of a contract related to construction work. This form differs from other contract-related forms by ensuring that the owner provides specific contractual details and payment amounts, adhering to the District of Columbia statutes.

Key parts of this document

- Owner or agent identification

- Address of the construction site

- Details of the request for the contract terms

- Contract terms clarification

- Payment amounts due to the contractor

- Signature and title of the owner

Situations where this form applies

This form should be used when a subcontractor or interested party requests the terms of a construction contract from the owner of a building project. It is important for compliance with local laws and for providing transparency regarding the contractual obligations in a construction setting.

Who this form is for

- Corporate property owners involved in construction projects

- Agents representing the owner of a construction project

- Subcontractors seeking contract information

- Legal representatives in construction-related transactions

Completing this form step by step

- Identify the corporation or agent acting on behalf of the owner.

- Fill in the address of the property where construction is taking place.

- Document the date of the request for the contract terms.

- Provide a clear statement of the contract terms under which the work is being performed.

- Indicate the total amount due or to become due to the contractor.

- Sign and date the form, including the title and name of the corporate owner.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to fill in the required information completely.

- Omitting the date of the request or contract execution.

- Providing unclear or vague contract terms.

- Not signing the form or including the title of the signatory.

Advantages of online completion

- Instant access to downloadable templates, saving time.

- Editable forms allow for easy customization to suit specific needs.

- Secure storage and retrieval options enhance document management.

Looking for another form?

Form popularity

FAQ

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

An LLC is very similar to a corporation, but while corporations are taxed separately from individual owners, LLCs let their income flow from the business directly to the individuals. In other words, if you have an LLC, you pay your personal income tax rate rather than a corporate income tax rate on your profits.

Unlike most business organizations, absent an agreement by all of the members of the LLC, ownership percentage has no real effect in terms of the governance and financial benefits. To increase the traditional benefits associated with ownership, control and financial return, you need to amend the operating agreement.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

The multi-member LLC is a Limited Liability Company with more than one owner. It is a separate legal entity from its owners, but not a separate tax entity. A business with multiple owners operates as a general partnership, by default, unless registered with the state as an LLC or corporation.

The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property. They may or may not manage the business and affairs. Initial members are admitted at the time of formation.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

Percentages of Ownership In return, each LLC member gets a percentage of ownership in the assets of the LLC. Members usually receive ownership percentages in proportion to their contributions of capital, but LLC members are free to divide up ownership in any way they wish.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.