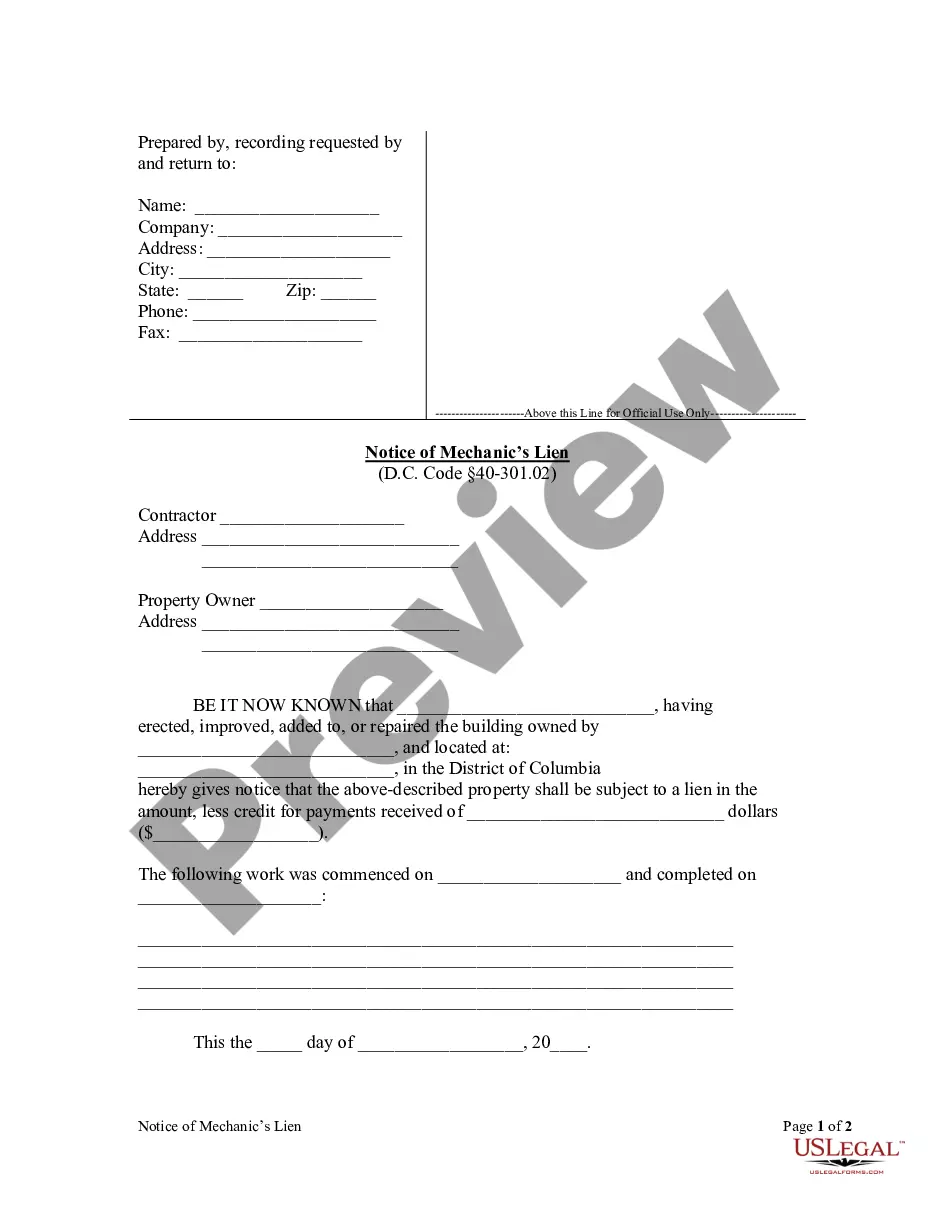

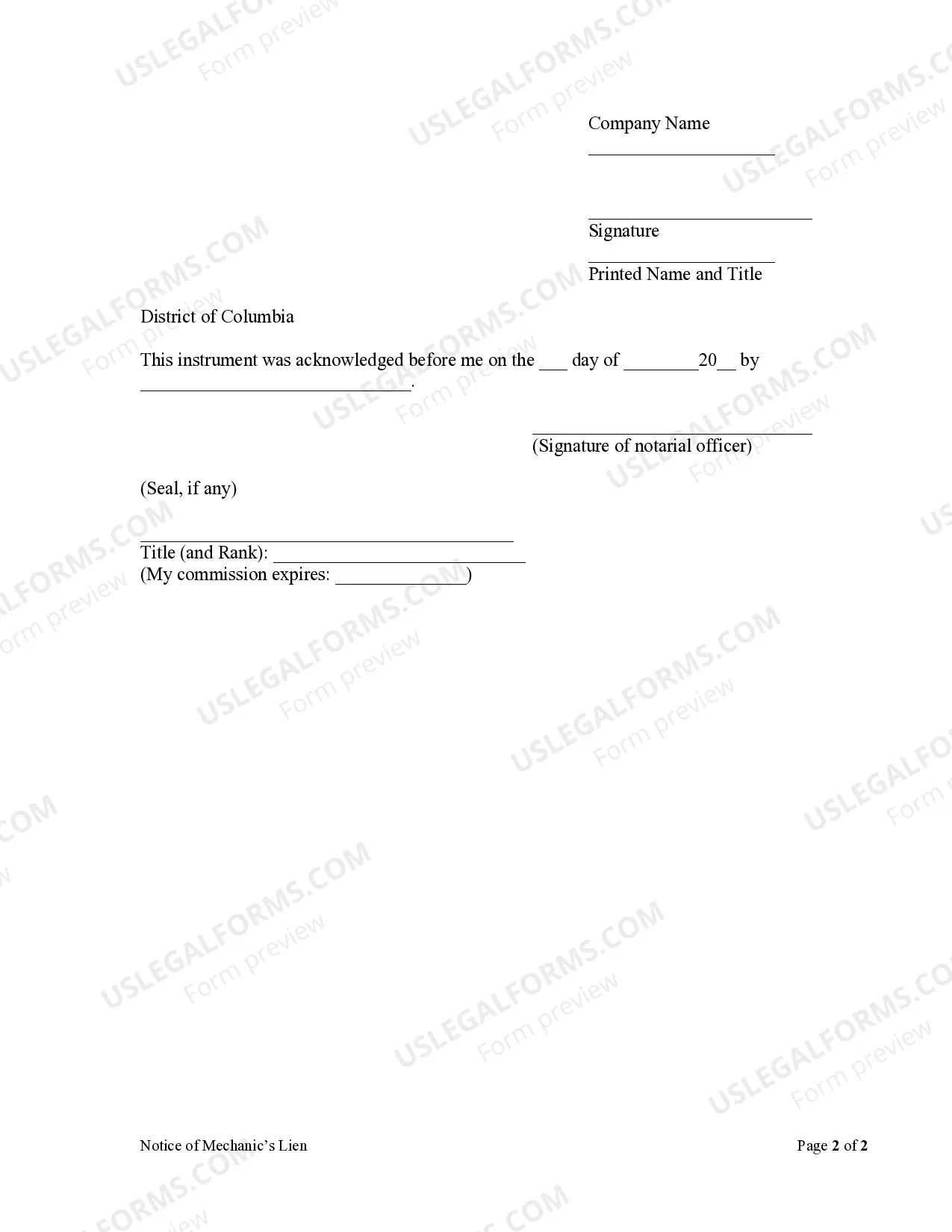

District of Columbia statutes require that any party who supplies labor and materials for the erection, improvement, addition to, or repair of a building and desires to claim a lien must file a Notice of Claim with the Recorder of Deeds within three (3) months of completion of work.

District of Columbia Notice of Claim of Lien by Corporation

Description

How to fill out District Of Columbia Notice Of Claim Of Lien By Corporation?

The larger quantity of documentation you need to prepare - the more anxious you become.

You can find numerous District of Columbia Notice of Claim of Lien by Corporation or LLC forms online, but you are unsure which ones to trust.

Eliminate the complications of obtaining samples by using US Legal Forms.

Enter the required information to create your profile and complete your order payment using PayPal or a credit card.

- If you currently possess a US Legal Forms subscription, Log In to your account and look for the Download option on the District of Columbia Notice of Claim of Lien by Corporation or LLC’s page.

- If this is your first time using our website, follow these steps to complete the registration process.

- Ensure the District of Columbia Notice of Claim of Lien by Corporation or LLC is accepted in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if it is available for the selected document.

- Click Buy Now to start the sign-up process and select a pricing plan that fits your needs.

Form popularity

FAQ

A lien filing notice is a formal document that a corporation files to claim a right to property as a guarantee for a debt. Specifically, a District of Columbia Notice of Claim of Lien by Corporation notifies relevant parties that the corporation has a legal interest in the property. This notice is important for protecting the corporation's financial interests and ensuring that they can pursue the debt. By understanding and utilizing this process, you can effectively navigate the legal landscape and secure your rights.

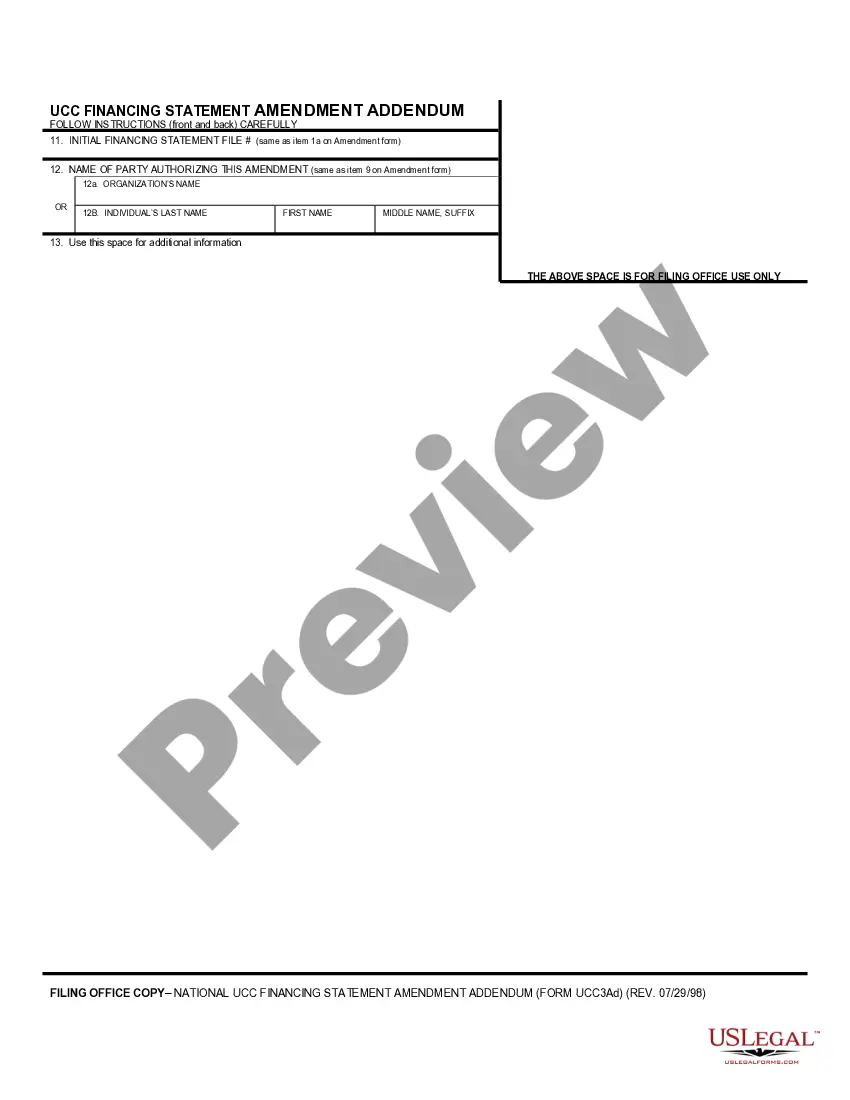

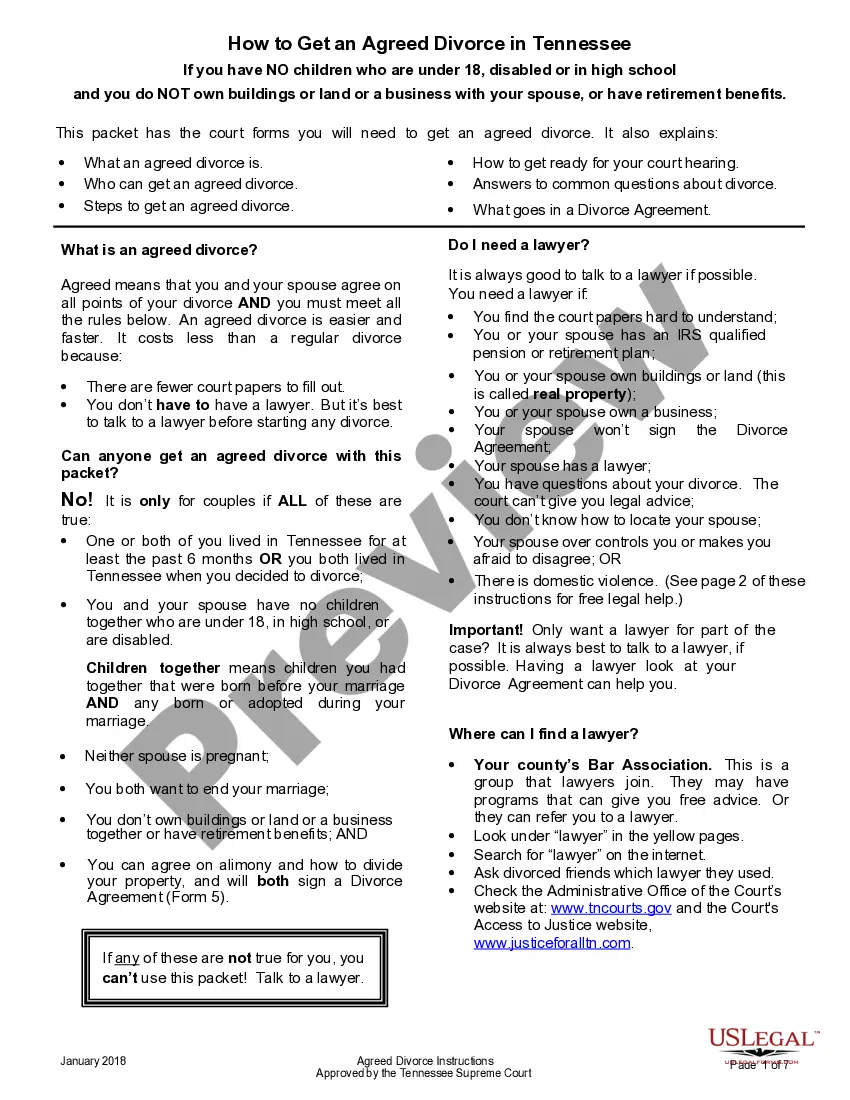

The conditions for a lien typically include a valid debt owed and a legal claim to property. In the context of a District of Columbia Notice of Claim of Lien by Corporation, the creditor must follow specific legal procedures. These procedures generally include notifying the property owner and filing the necessary documentation. Understanding these conditions helps in navigating lien-related issues effectively.

Yes, you can put a lien on something you own, such as your home or vehicle. A District of Columbia Notice of Claim of Lien by Corporation may arise when you fail to fulfill a financial obligation. However, it's important to understand the legal implications before proceeding. Consulting with a qualified attorney can guide you through the process safely.

In the District of Columbia, there is no strict minimum amount required to file a lien on a property. However, the debts that lead to a District of Columbia Notice of Claim of Lien by Corporation should typically relate to significant unpaid obligations. Keep in mind that even small debts can result in liens if they are unresolved. Therefore, timely payments are essential to avoid liens.

A notice of a lien filing acts as a major red flag because it indicates that a creditor claims a legal right to your property due to unpaid debts. With a District of Columbia Notice of Claim of Lien by Corporation, the consequences can escalate quickly if not addressed. This situation can affect your credit and your ability to sell the property. Therefore, recognizing the seriousness of a lien notice is crucial.

If you receive a lien notice, it is crucial to respond promptly. Start by reviewing the notice to understand the specifics of the District of Columbia Notice of Claim of Lien by Corporation. Next, consult a legal professional to discuss your options. Addressing the lien quickly can prevent further legal complications.

To put a lien on a property in DC, you must file a District of Columbia Notice of Claim of Lien by Corporation with the appropriate government agency. This process involves preparing the necessary documentation and ensuring that all legal requirements are met. A properly filed lien allows you to secure a claim for any debt owed. If you're unsure about the procedure, platforms like uslegalforms can provide step-by-step assistance.

Yes, DC is considered a tax lien state, which means that the government can place a lien on properties for unpaid taxes. If taxes remain unpaid, property owners may face significant legal consequences, including eventual foreclosure. It's essential for property owners to be proactively aware of their tax obligations to prevent a lien situation. Understanding the implications of a District of Columbia Notice of Claim of Lien by Corporation is critical in this context.

A federal tax lien is serious as it impacts your credit and can make it difficult to sell or refinance your property. Upon a federal tax lien's placement, it secures the government's interest in your property until the tax debt is settled. Furthermore, a tax lien can escalate to seizure of your assets, which underscores the importance of addressing tax issues promptly. You should always be aware of any District of Columbia Notice of Claim of Lien by Corporation in relation to federal claims.

A recorded lien release document is an official record confirming that a lien, such as a District of Columbia Notice of Claim of Lien by Corporation, has been satisfied. This document is crucial for clearing a property title. Once recorded, it ensures that no further claims can be made against the property regarding that specific lien. It provides peace of mind to current or prospective property owners.