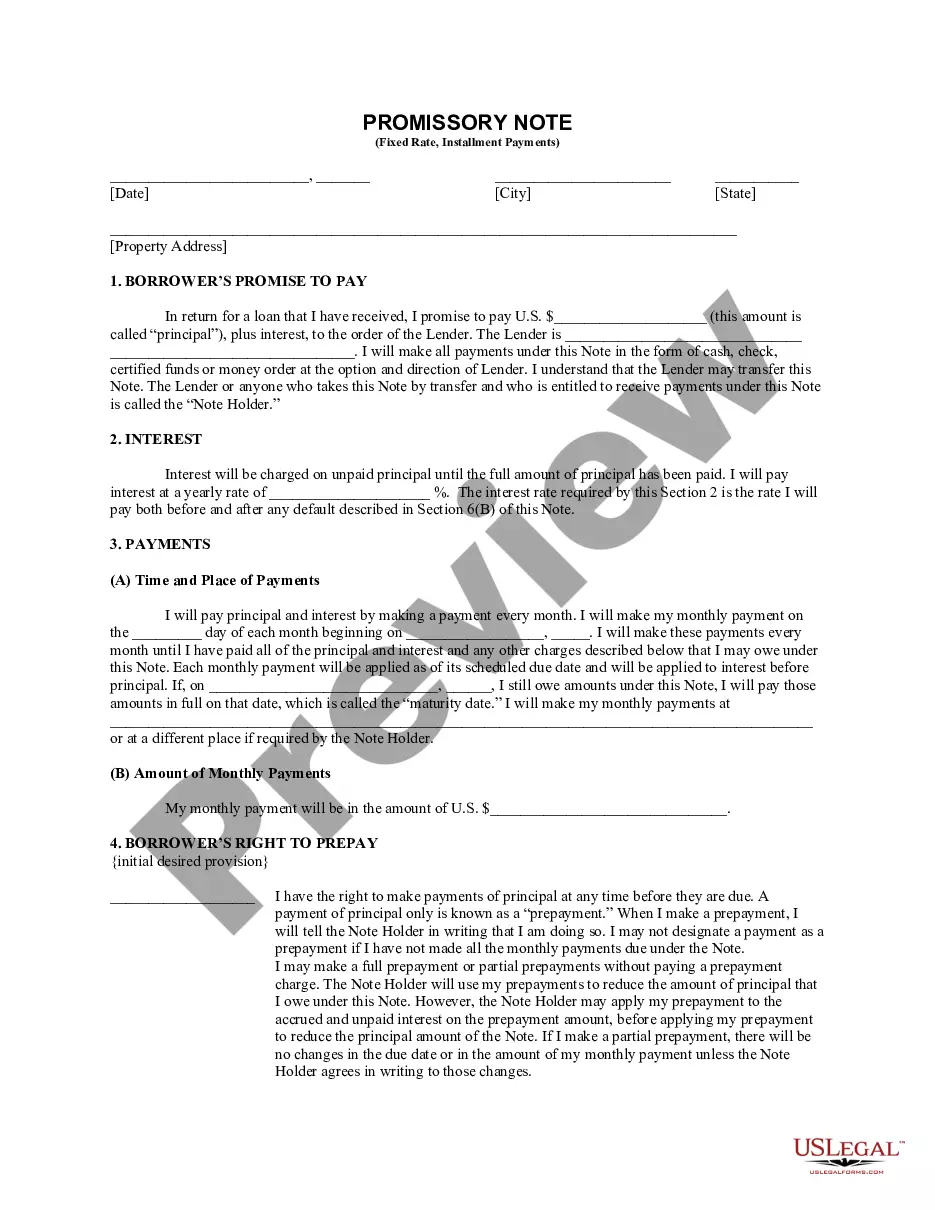

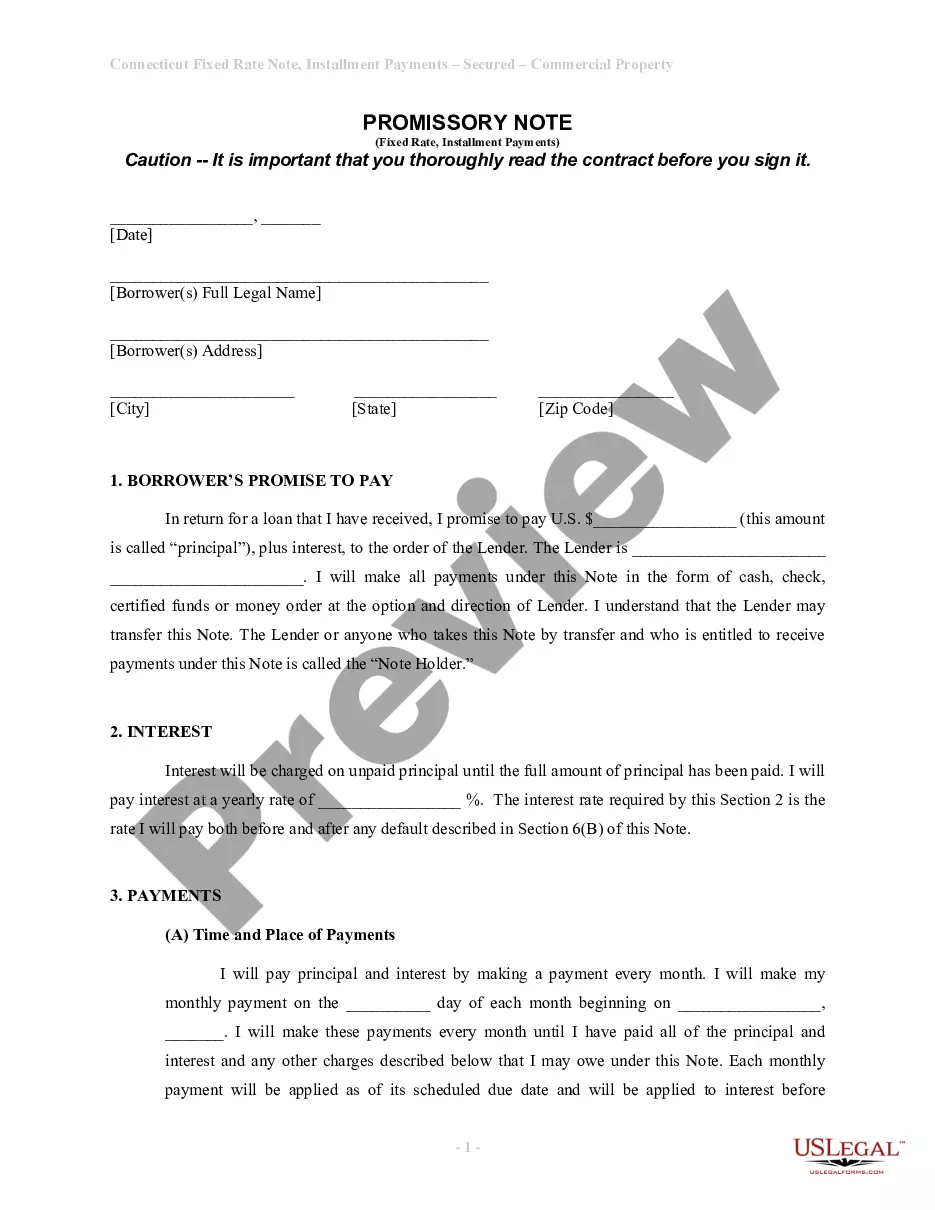

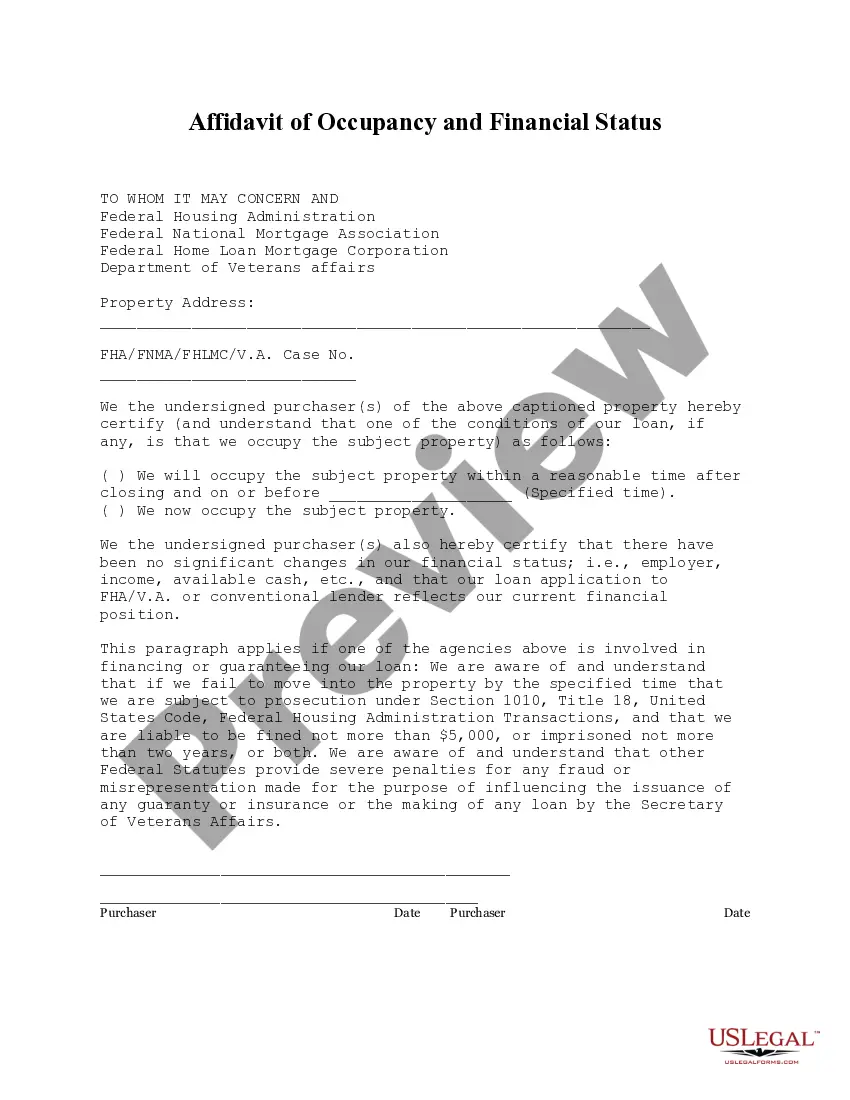

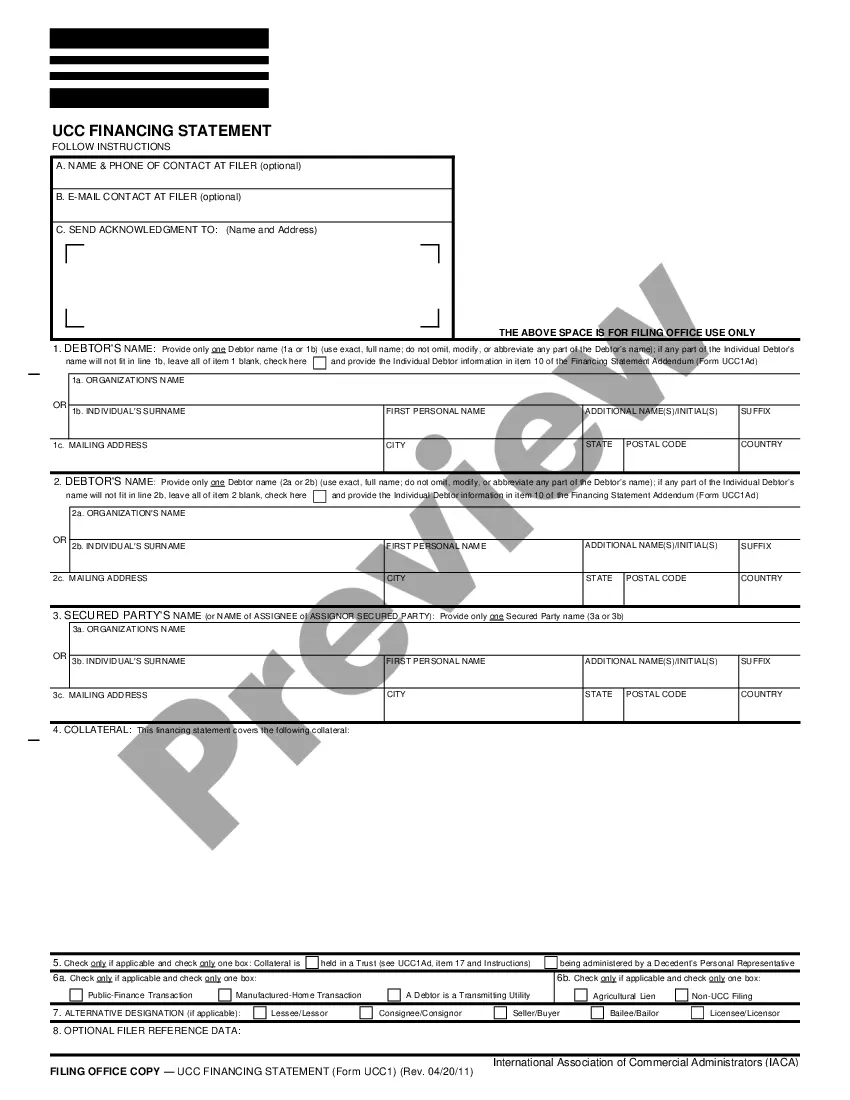

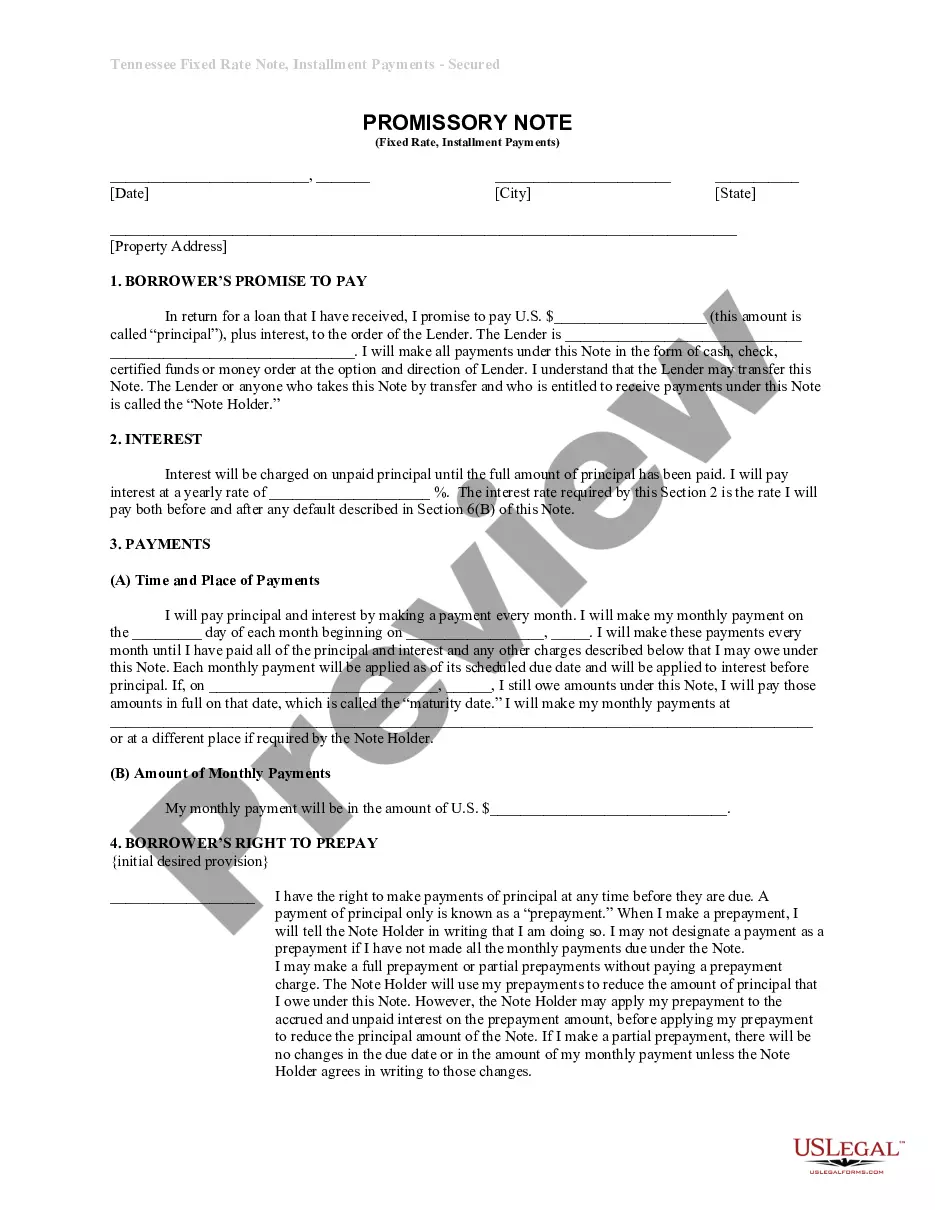

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

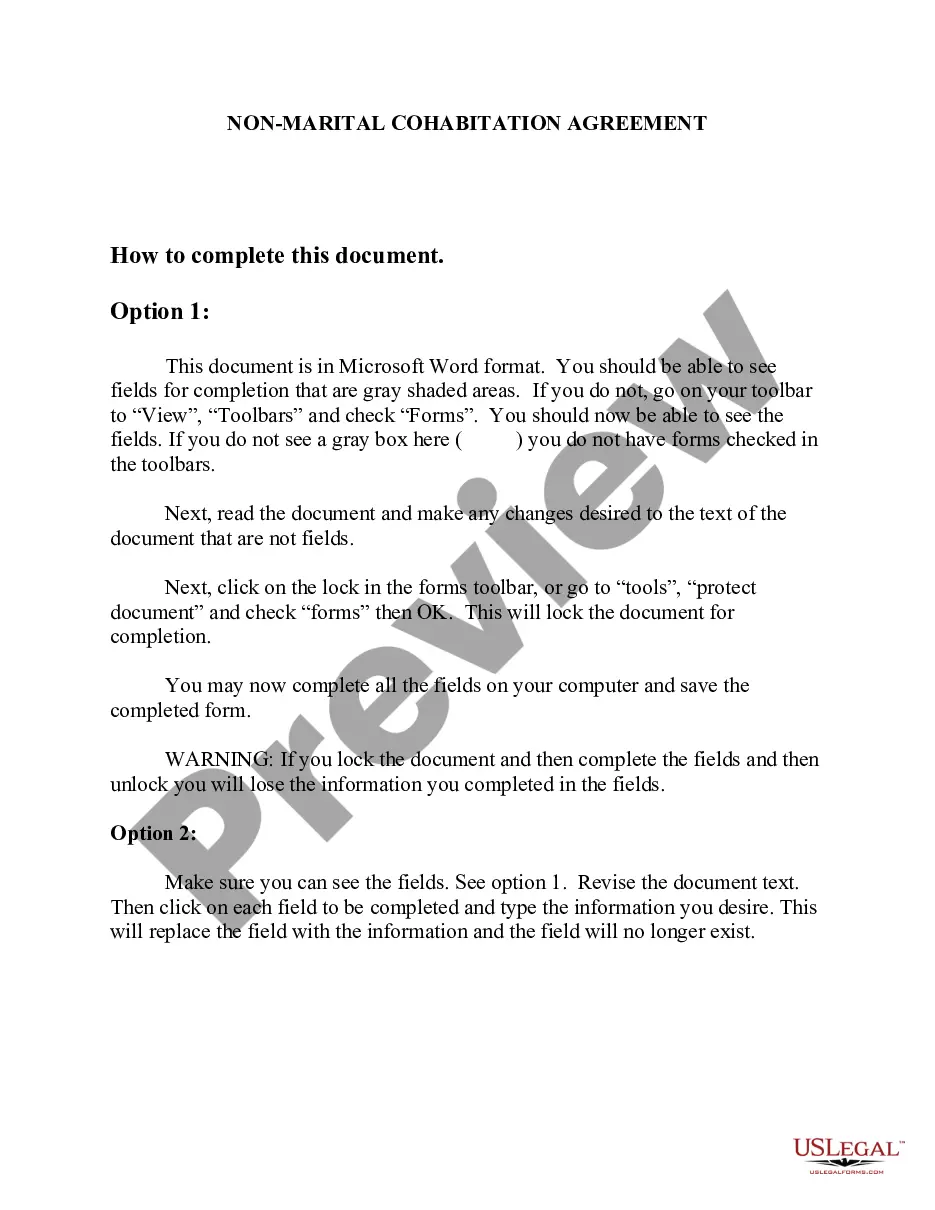

How to fill out Connecticut Installments Fixed Rate Promissory Note Secured By Personal Property?

The larger quantity of documents you are required to produce - the more anxious you become.

You can discover countless Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property samples on the web, however, you are unsure which of them to trust.

Eliminate the stress to make finding templates simpler by using US Legal Forms. Acquire expertly crafted documents designed to comply with state regulations.

Enter the requested information to set up your account and process the payment with your PayPal or credit card. Choose a suitable document format and download your sample. Access every file you receive in the My documents section. Simply navigate there to create a new version of your Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property. Although you are utilizing professionally created templates, it remains essential to consider consulting your local attorney to verify that the filled document is accurate. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you will find the Download button on the Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property’s page.

- If you have not used our service previously, follow the sign-up process with these steps.

- Verify if the Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property is applicable in your jurisdiction.

- Double-check your choice by reviewing the information or utilizing the Preview option if available for the chosen document.

- Press Buy Now to commence the registration process and choose a pricing plan that fits your needs.

Form popularity

FAQ

A security agreement serves as a document where personal property is used as security for a promissory note. In this context, the Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property details both the borrower's obligations and the lender's rights. By outlining specific personal property as collateral, this agreement provides clarity and security for both parties involved in the transaction.

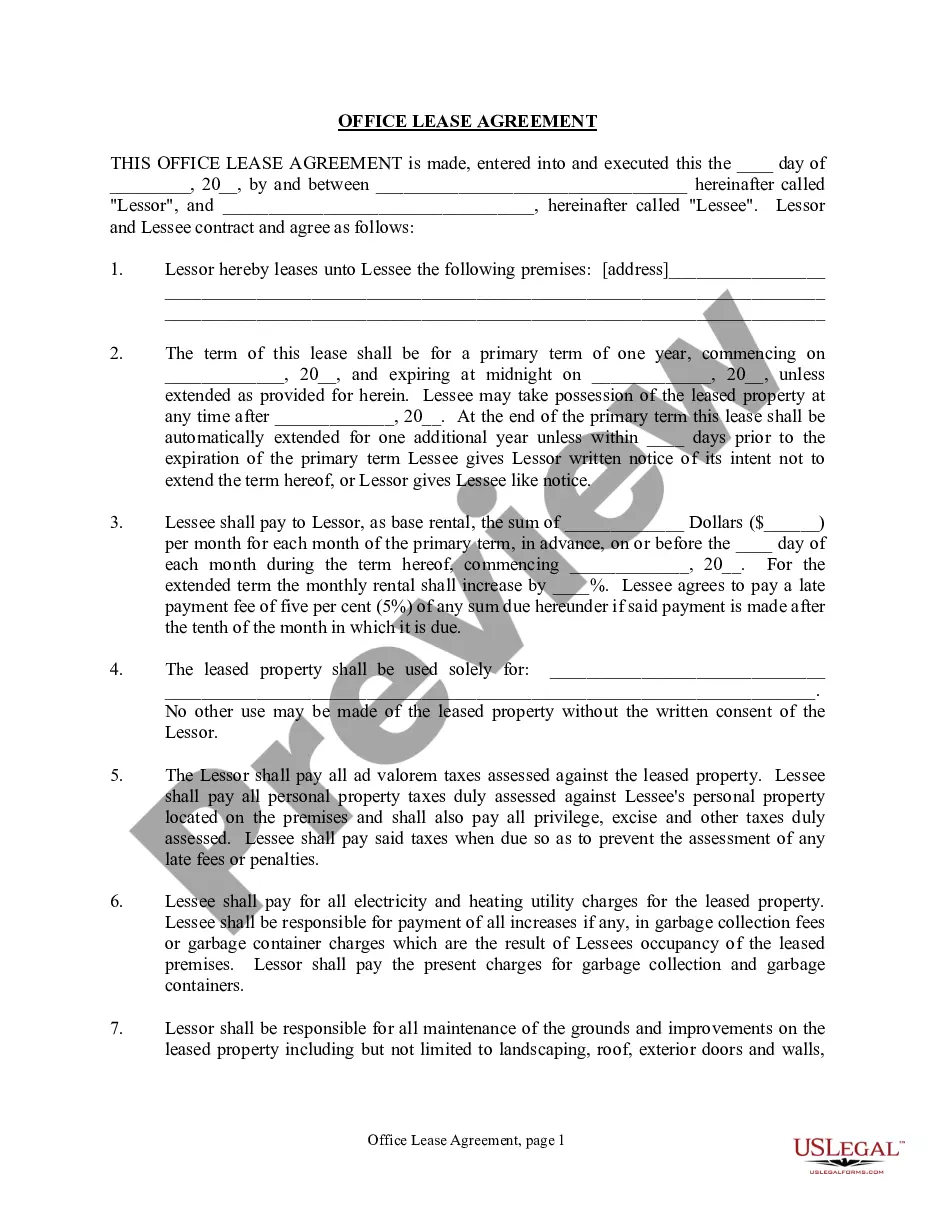

Yes, a promissory note can be secured by real property, but that typically involves real estate rather than personal property. For Connecticut Installments Fixed Rate Promissory Notes Secured by Personal Property, the focus is usually on tangible assets like vehicles or equipment. However, using real property as collateral offers different benefits and obligations, and understanding these differences is crucial for anyone entering such an agreement.

The document that creates a lien and acts as security for a promissory note is typically a security agreement. This agreement outlines the borrowing terms and specifies how a Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property is backed by the borrower’s assets. By signing this document, the borrower allows the lender to claim the specified personal property in case of default. It's essential to have this agreement properly drafted to protect both parties.

Yes, a well-drafted promissory note can hold up in court, especially if it follows state-specific guidelines. The Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property provides a clear structure that supports its validity. When disputes arise, courts often rely on the documentation of the note to enforce the obligations outlined in it.

Yes, promissory notes are generally enforceable in court when they meet certain legal requirements. A Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property is particularly strong because it outlines payment terms and collateral clearly. However, the enforceability may depend on factors such as proper signatures and the note's adherence to state laws.

Typically, a promissory note does not need to be filed with any government agency; however, it's advisable to keep it in a safe location. If your note is secured by real property, you should file the related mortgage or deed of trust with the local county recorder’s office. This filing protects your interest and makes the promissory note enforceable against third parties. For specifics, consider consulting the resources available through US Legal Forms.

To secure a promissory note with real property, the borrower must designate the real estate as collateral. This often involves drafting a mortgage or deed of trust that outlines the terms. The Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property will clearly state the property involved. If you need assistance, platforms like US Legal Forms offer templates to help you navigate this process easily.

Yes, promissory notes are generally legally enforceable as long as they meet specific requirements. For a Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property to be valid, it must clearly outline the terms agreed upon by both parties. Courts recognize these notes as valid contracts, provided they comply with state laws. This enforceability makes promissory notes, when completed correctly, a reliable method for securing loans and obligations.

An installment note and a promissory note are closely related, but they are not identical. An installment note, including the Connecticut Installments Fixed Rate Promissory Note Secured by Personal Property, specifies a payment schedule, often involving regular payments over time. In contrast, a promissory note can be a broader term that may not require structured payments. Understanding this distinction can help you choose the right financial instrument for your needs.