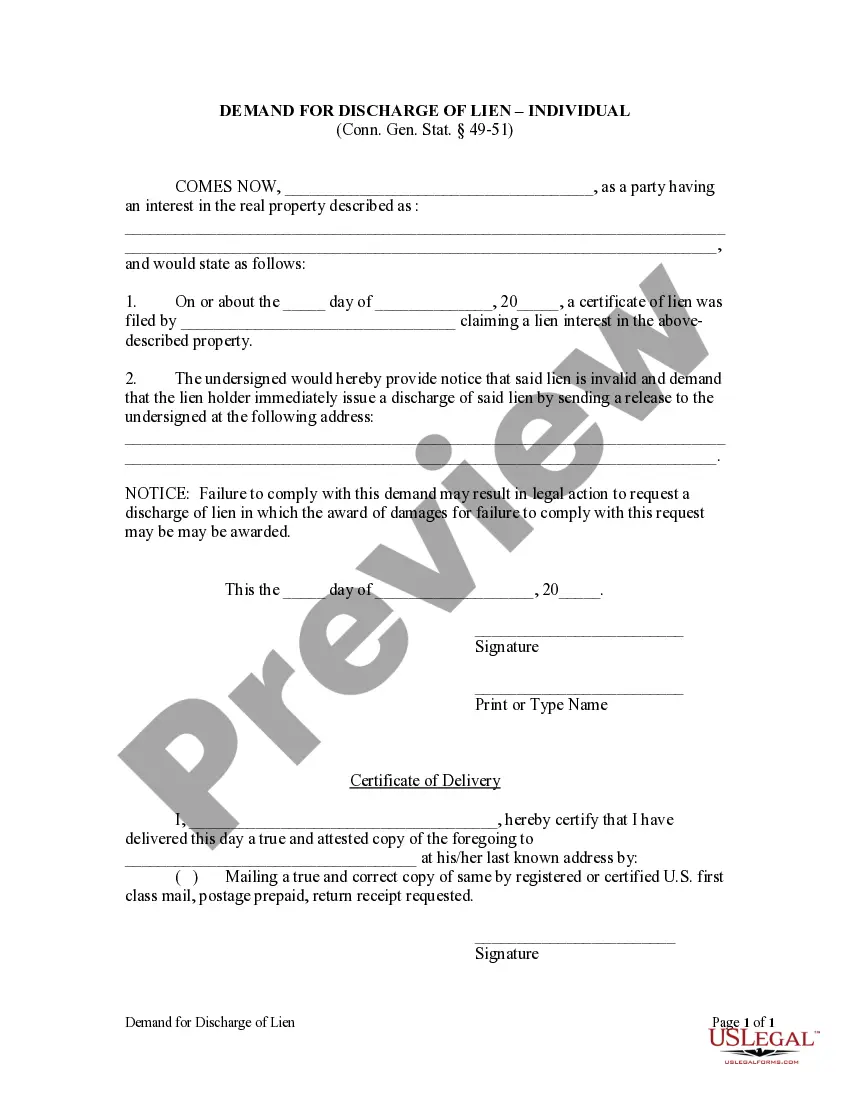

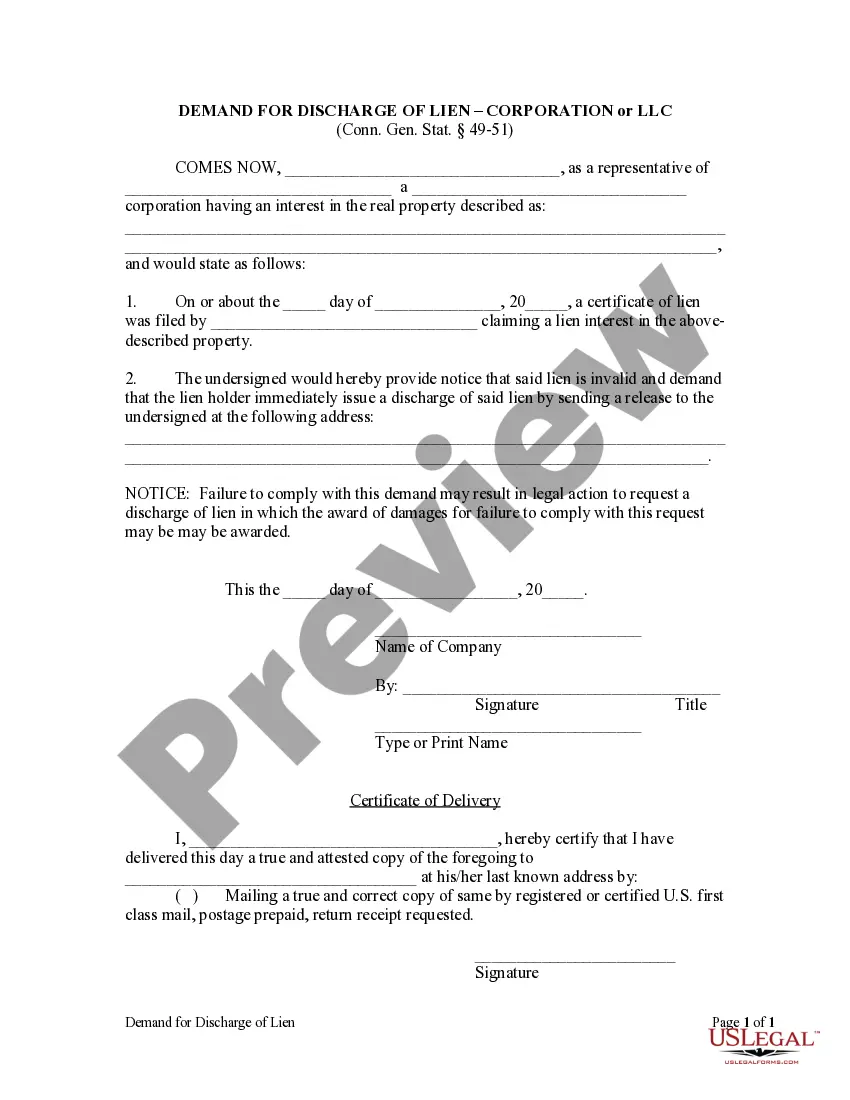

Any person having an interest in any real property described in a certificate of lien, when said lien is invalid but not discharged, may give written notice to the lienor sent to him at his last known address by registered mail or by certified mail. Upon receipt of such a demand for discharge, the lien holder is required to provide a release to the party requesting the discharge. If the lien is not discharged within thirty (30) days of receipt of the demand for discharge, the person with an interest in the property may apply to the Superior Court for a discharge, with the possibility that the Court may award the plaintiff party damages as a result of the lien holder's refusal to comply.

Connecticut Demand for Discharge by Corporation or LLC

Description

How to fill out Connecticut Demand For Discharge By Corporation Or LLC?

The larger quantity of documents you should produce - the more anxious you feel.

You can find thousands of Connecticut Demand for Discharge by Corporation or LLC forms available online, yet you remain uncertain about which ones to rely on.

Eliminate the stress to streamline acquiring templates by using US Legal Forms.

Access all templates you acquire in the My documents section. Simply navigate there to create a new version of the Connecticut Demand for Discharge by Corporation or LLC. Even when using well-prepared templates, it's still advisable to consult your local attorney to verify that your document is correctly completed. Achieve more for less with US Legal Forms!

- Ensure the Connecticut Demand for Discharge by Corporation or LLC is accepted in your state.

- Double-check your selection by reviewing the description or by utilizing the Preview feature if available for the chosen file.

- Press Buy Now to initiate the sign-up process and select a pricing plan that fits your needs.

- Fill in the required information to establish your account and settle your payment using PayPal or credit card.

- Select a suitable file format and download your copy.

Form popularity

FAQ

There are several reasons a corporation may choose to dissolve, but two common ones are financial distress and strategic business changes. Companies facing financial challenges may opt to dissolve to minimize further losses. Alternatively, a corporation might dissolve if it decides to sell assets or merge with another entity. Understanding these scenarios can help when preparing for a Connecticut Demand for Discharge by Corporation or LLC, and resources from US Legal Forms can guide you through these considerations.

Notifying the IRS about your corporation's dissolution involves completing IRS Form 966, which is a corporate dissolution or liquidation form. This form must be filed within 30 days of the dissolution. Additionally, you need to ensure final tax returns are submitted, along with any required tax payments. Managing these notifications is essential when handling a Connecticut Demand for Discharge by Corporation or LLC, and using US Legal Forms can streamline this process for you.

There are generally two methods to dissolve a corporation: voluntary dissolution, which is initiated by the corporation’s directors and shareholders, and administrative dissolution, which occurs when the state forces dissolution due to non-compliance with business regulations. Each method requires different paperwork and may have various implications. Understanding these processes can ease the filing of a Connecticut Demand for Discharge by Corporation or LLC. US Legal Forms can assist you with the necessary forms and instructions.

Dissolving a corporation in Connecticut starts with a decision by the board of directors and, if required, approval from the shareholders. Once approved, you need to file a Certificate of Dissolution with the state, detailing the corporation’s information and the reason for dissolution. This step, along with settling all debts and obligations, ensures a proper end to your corporation. To navigate this process efficiently, check out the resources available at US Legal Forms for guidance on the Connecticut Demand for Discharge by Corporation or LLC.

To dissolve a corporation in Connecticut, you must file a Certificate of Dissolution with the Secretary of State. This involves completing the appropriate form and ensuring all taxes and obligations are settled beforehand. Following this process ensures compliance with state laws, making it smoother for the Connecticut Demand for Discharge by Corporation or LLC. Consider using US Legal Forms to simplify filing and ensure accuracy.

In Connecticut, an operating agreement is not legally required for an LLC, but it is highly recommended. This document outlines the ownership structure and operating procedures of the LLC. Having a clear operating agreement can help avoid future disputes among members and is crucial for management decisions. Additionally, it may serve as a supportive document when addressing the Connecticut Demand for Discharge by Corporation or LLC.

The state of incorporation influences taxation, legal protections, and regulatory requirements that can significantly affect your business. Choosing the right state can provide advantages in terms of liability protection and flexibility. For businesses in Connecticut, being aware of the Connecticut Demand for Discharge by Corporation or LLC helps navigate these elements effectively.

Yes, Connecticut offers many resources for startups, including support from local organizations and access to skilled talent. The state's strategic location also provides a gateway to major markets in the Northeast. With a solid understanding of the legal requirements, including the Connecticut Demand for Discharge by Corporation or LLC, you can establish a thriving business here.

Companies incorporate in Connecticut to take advantage of its robust economy and skilled workforce. The state provides a business-friendly environment, including access to venture capital and networking opportunities. Furthermore, understanding processes like the Connecticut Demand for Discharge by Corporation or LLC can ensure a smooth operational framework.

Connecticut is known for its strong finance, insurance, and healthcare sectors. Additionally, businesses focusing on technology and innovative solutions thrive here. By leveraging the local market and understanding regulations, such as the Connecticut Demand for Discharge by Corporation or LLC, you can position your business for success.