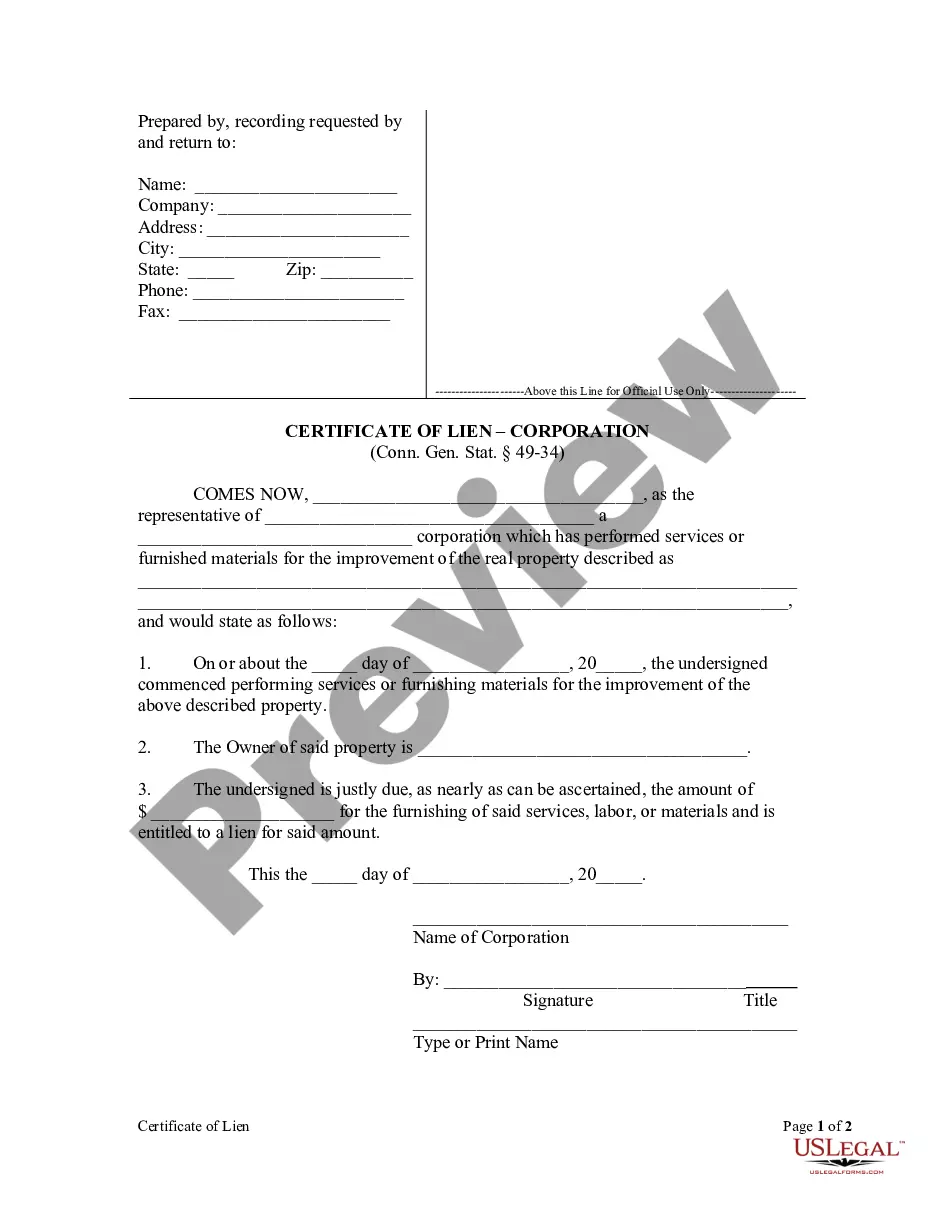

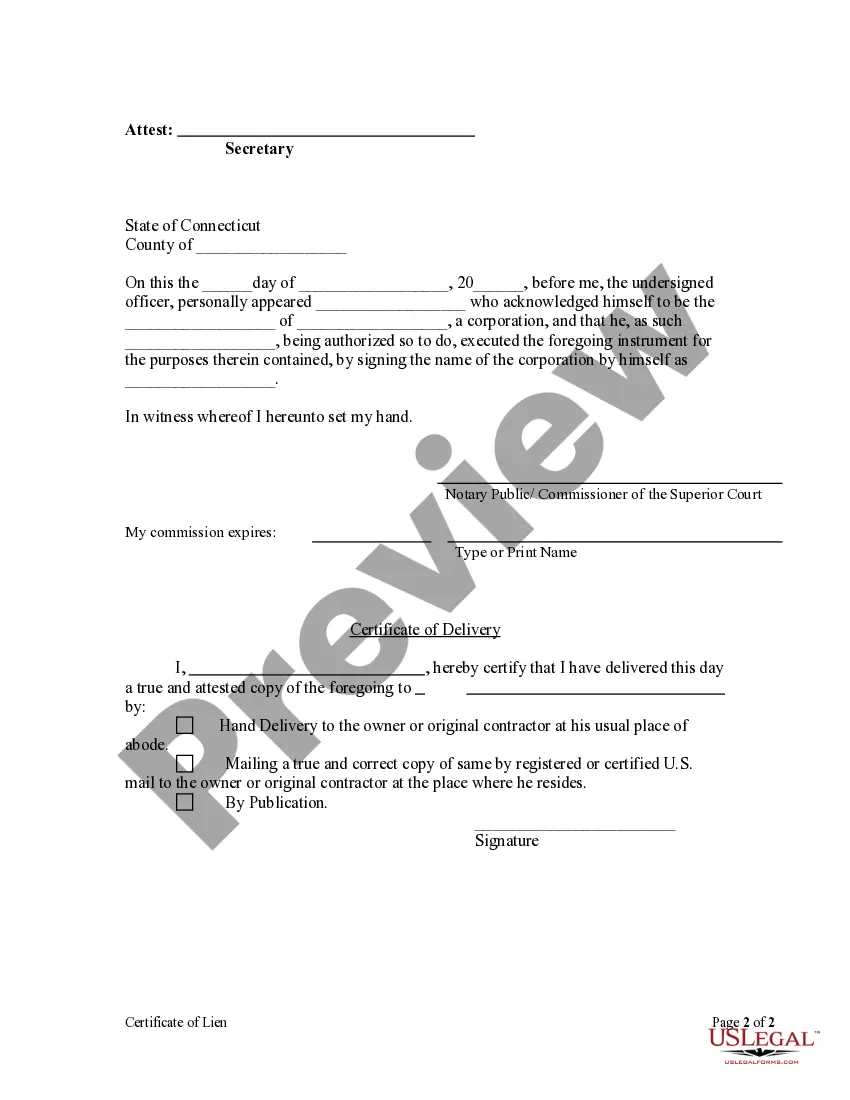

Conn. Gen. Stat. §49-34 states that a mechanic's lien is invalid without the filing of a certificate of lien within ninety (90) days after the cessation of work. The certificate must be recorded with the town clerk of the town in which the building, lot or plot is situated, and must be subscribed and sworn to by the lien claimant. The certificate must be served on the property owner, (a) within (90) days of the cessation of work, or (b) prior to the lodging of the certificate but not later than thirty (30) days after the lodging of the certificate. This form is for use by a corporation or limited liability company.

Connecticut Certificate of Lien by Corporation or LLC

Description

How to fill out Connecticut Certificate Of Lien By Corporation Or LLC?

The greater the paperwork you are required to complete - the more anxious you become.

You can discover numerous Connecticut Certificate of Lien by Corporation or LLC templates online, yet you aren't certain which ones to trust.

Eliminate the frustration to simplify the search for samples using US Legal Forms. Acquire expertly composed documents designed to meet state regulations.

Submit the required information to create your account and settle your order using your PayPal account or credit card. Choose a convenient document format and obtain your template. Access all templates you receive in the My documents section. Simply visit there to prepare a new version of your Connecticut Certificate of Lien by Corporation or LLC. Even when using professionally prepared forms, it remains important to consider consulting a local attorney to verify that your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you have a US Legal Forms membership, sign in to your account, and you will locate the Download button on the Connecticut Certificate of Lien by Corporation or LLC's page.

- If you haven’t utilized our service before, complete the registration process by following these guidelines.

- Ensure the Connecticut Certificate of Lien by Corporation or LLC is applicable in your state.

- Verify your selection by reviewing the description or utilizing the Preview feature if available for the selected file.

- Click on Buy Now to initiate the registration process and select a pricing plan that fits your needs.

Form popularity

FAQ

To change ownership of an LLC in Connecticut, you typically need to update the operating agreement to reflect the new ownership structure. Additionally, you may need to file specific documents with the Secretary of State, depending on the nature of the changes. Ensuring that all legal changes are properly documented helps maintain compliance. UsLegalForms can assist with the required paperwork, guiding you through the transition smoothly.

Filing a property lien in Connecticut requires you to prepare a Connecticut Certificate of Lien by Corporation or LLC. You must file this document with the town clerk in the town where the property is located. It is important to provide accurate information about the debtor and property to avoid complications. By utilizing UsLegalForms, you can access the necessary templates and guidance to streamline this process.

To form an LLC in Connecticut, you must file a Certificate of Organization with the Secretary of State. This document includes basic information about your LLC, such as its name and address. It is also necessary to create an operating agreement that defines the management structure and operating procedures. By using UsLegalForms, you can easily complete the required documentation, ensuring compliance while focusing on setting up your business.

To set up an LLC in Connecticut, start by choosing a unique name for your business that complies with state regulations. Next, file a Certificate of Organization with the Connecticut Secretary of the State, providing details about your LLC's structure and purpose. Once your LLC is registered, consider obtaining a Connecticut Certificate of Lien by Corporation or LLC for added protection against claims on your business assets. Finally, create an operating agreement to outline member roles, responsibilities, and procedures.

The Certificate of Organization is specifically for forming an LLC, while incorporation refers to the process of creating a corporation. Although both establish a company as a legal entity, they differ in structure and regulatory requirements. Understanding these differences is crucial when considering options for your Connecticut Certificate of Lien by Corporation or LLC.

To file a lien in Connecticut, you need to complete a lien statement that includes pertinent information about the debt and the debtor. The next step is to file this statement with the appropriate town clerk's office. Utilizing a service like uslegalforms can simplify this process, ensuring you correctly file your Connecticut Certificate of Lien by Corporation or LLC without any oversight.

In Connecticut, a Certificate of Organization is a document filed with the Secretary of State to formally create a limited liability company or corporation. This certificate includes vital information, such as the business name and registered agent. It plays a significant role in the establishment of your business and in any subsequent proceedings, including the filing of a Connecticut Certificate of Lien by Corporation or LLC.

A Certificate of Organization is not the same as a business license; rather, it serves as the initial step to create your business legally in Connecticut. While the Certificate establishes your entity, a business license permits you to conduct specific activities as regulated by the state. It's essential to understand these distinctions when starting your venture.

Yes, you can put a lien on a corporation, including an LLC, to secure a debt. This legal claim allows creditors to protect their interests in the business's assets. Obtaining a Connecticut Certificate of Lien by Corporation or LLC can formalize this process and ensure your rights as a creditor are recognized.

An organizational certificate is a formal document that outlines the details of a corporation or LLC, such as its name and business purpose. This documentation is crucial for complying with state regulations in Connecticut. The Connecticut Certificate of Lien by Corporation or LLC may utilize this information to secure financial interests in the business.