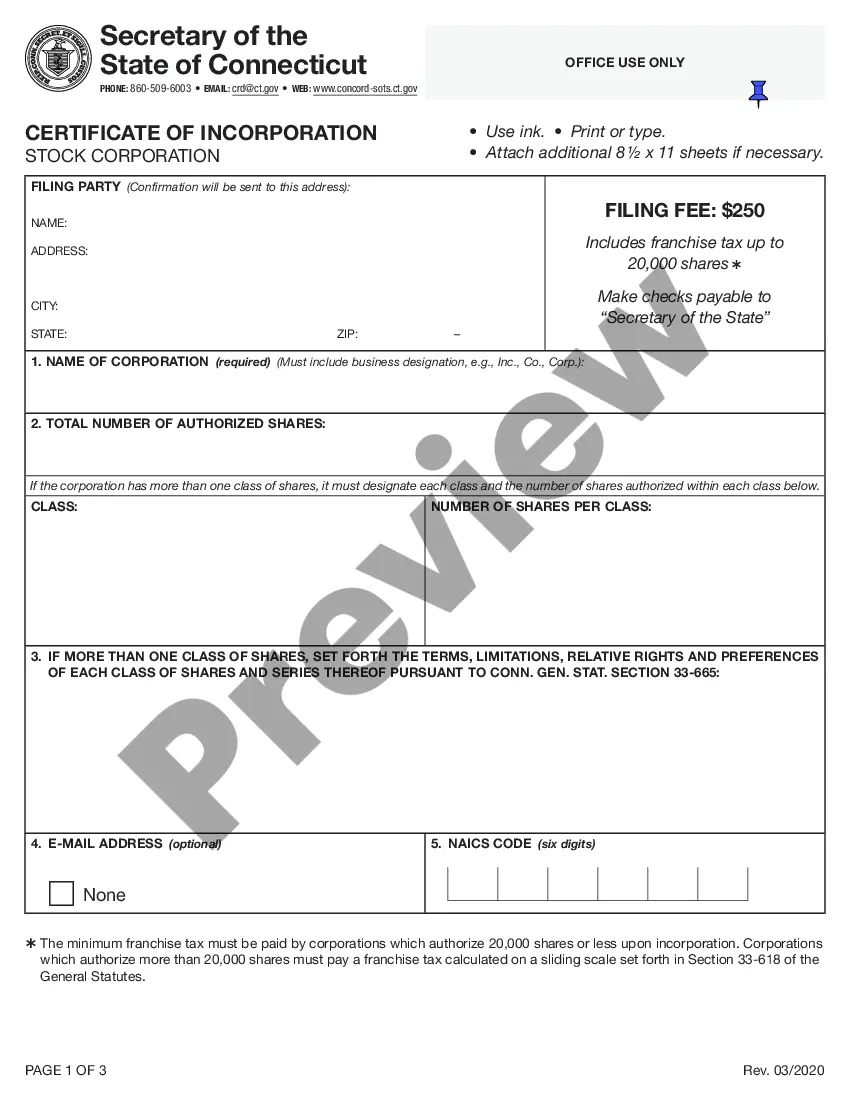

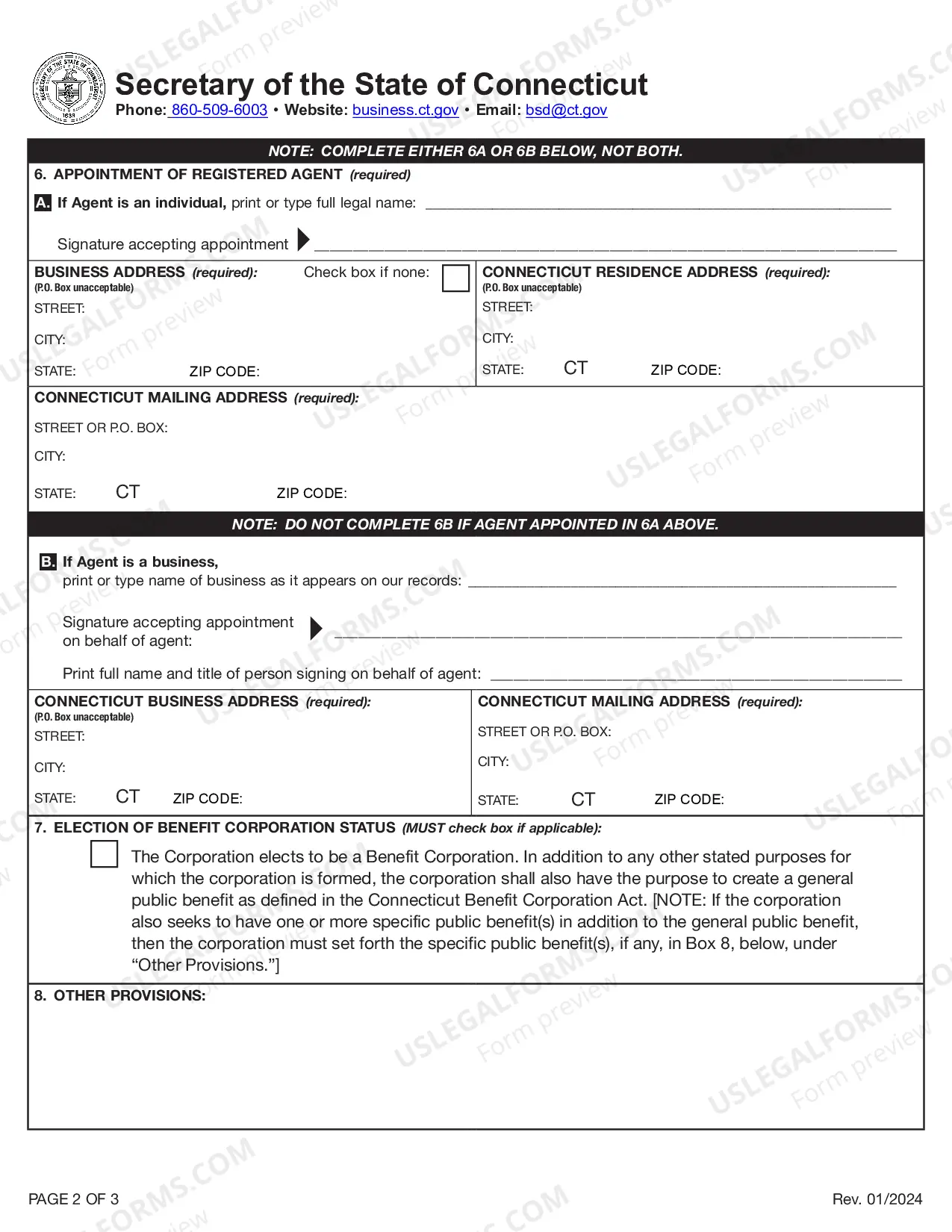

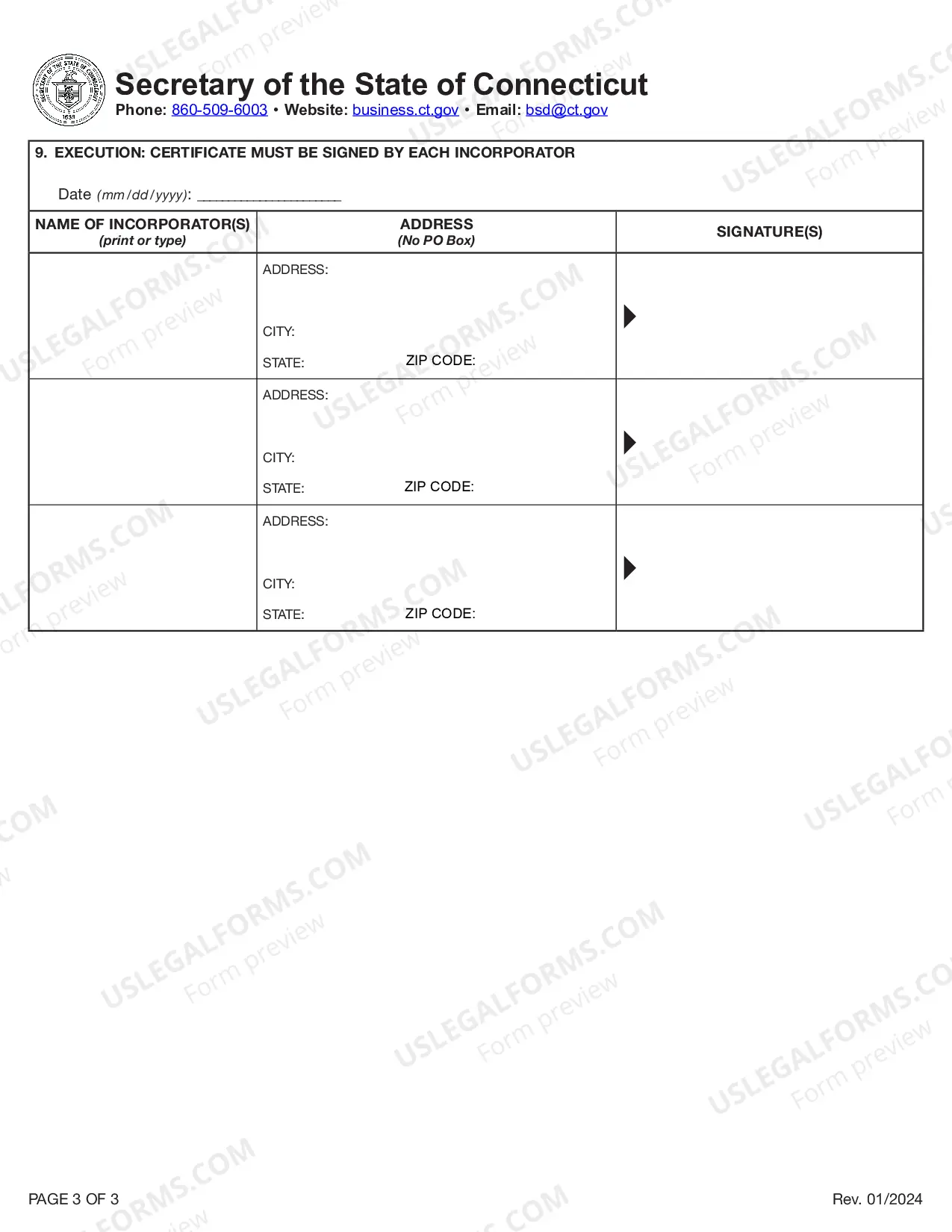

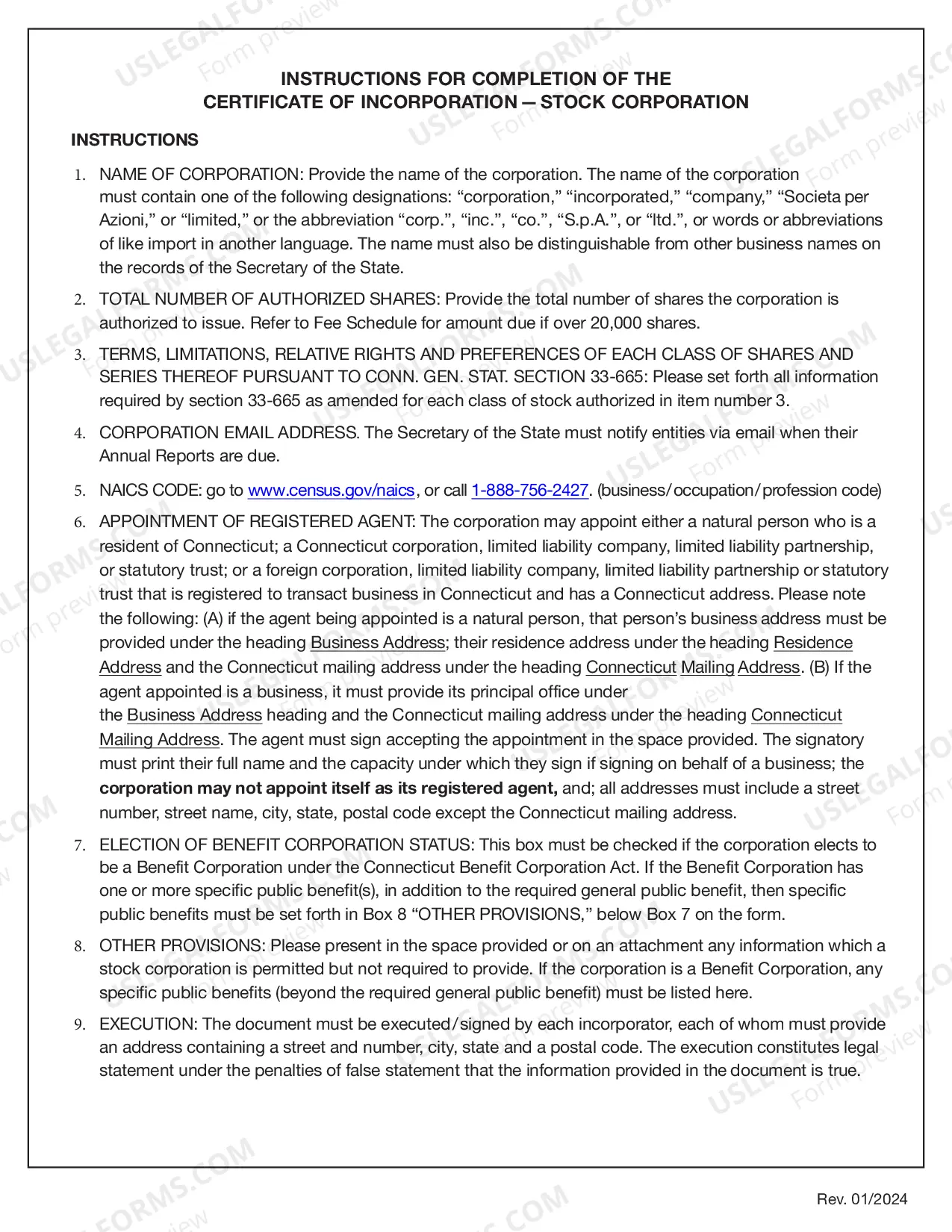

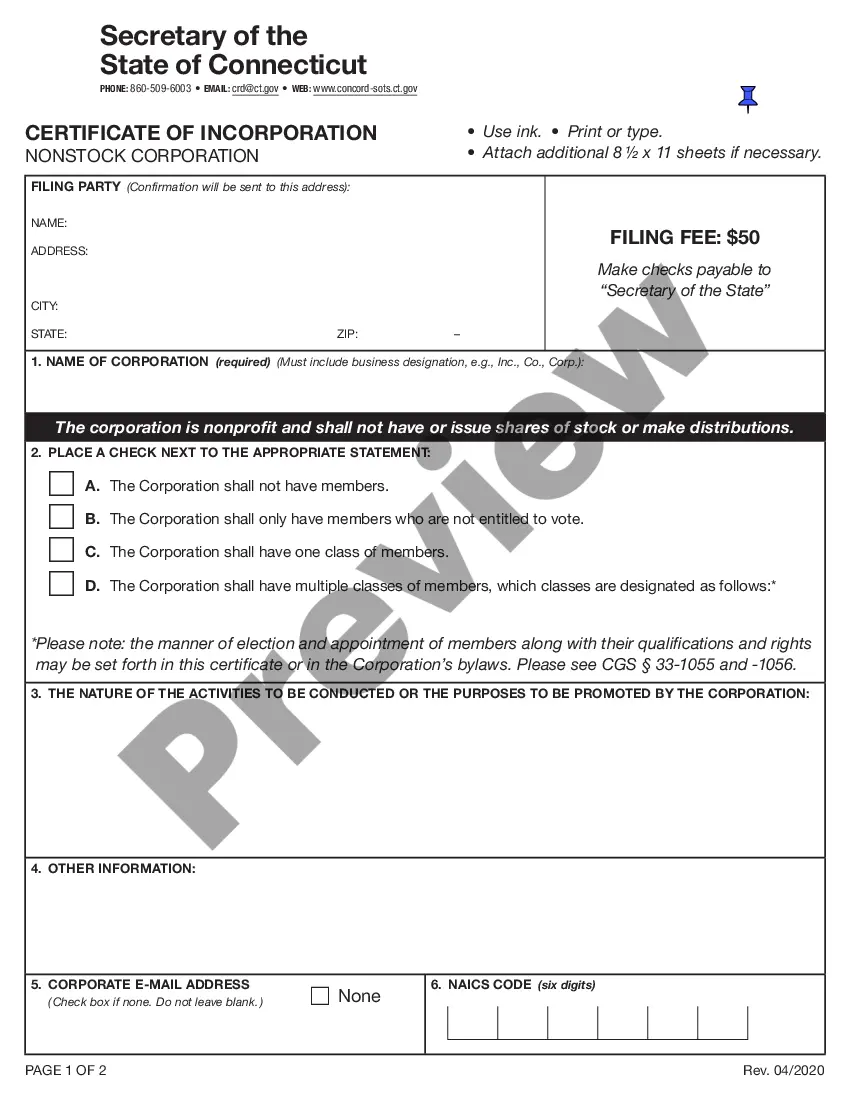

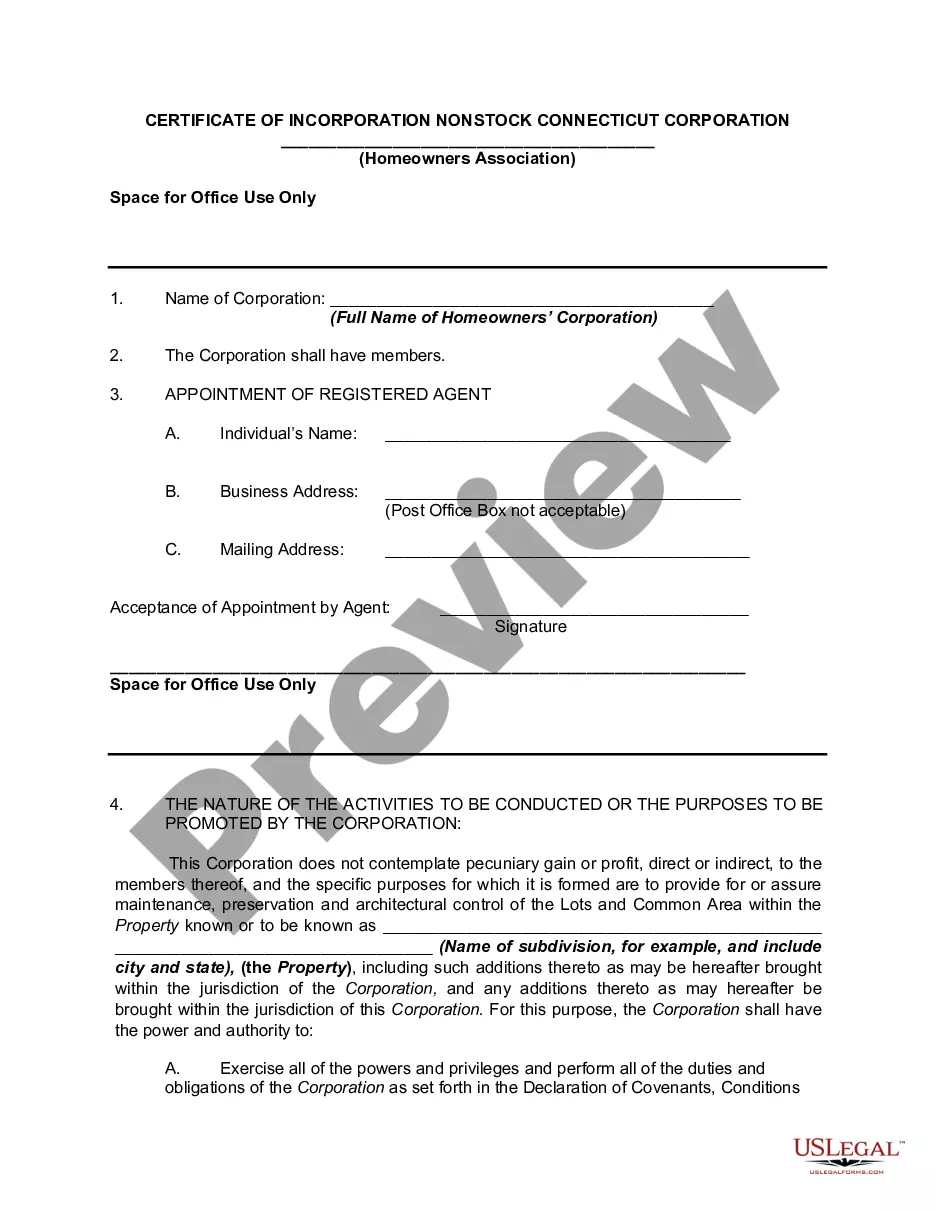

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation

Description

How to fill out Connecticut Articles Of Incorporation Certificate - Domestic For-Profit - Stock Corporation?

The greater the number of documents you need to produce - the more anxious you become.

You can find a vast array of Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation templates online, but you are uncertain about which to trust.

Eliminate the stress and simplify obtaining samples by using US Legal Forms. Acquire expertly crafted documents designed to meet state requirements.

Enter the requested information to set up your account and process your payment using either PayPal or credit card. Choose a preferred file format and download your sample. Access each sample you obtain in the My documents section. Simply visit there to generate a new version of the Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation. Even when utilizing professionally prepared templates, it’s still advisable to consult with a local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you have a US Legal Forms account, Log In to your account, and you will see the Download option on the Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation’s page.

- If you’re new to our site, complete the registration process with these steps.

- Confirm whether the Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation is applicable in your state.

- Double-check your selection by reviewing the description or utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that suits your requirements.

Form popularity

FAQ

The state of incorporation affects your company's legal obligations, tax rates, and business regulations. Each state has unique laws that can either facilitate or hinder growth. By choosing to file a Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation, you can ensure your business operates under state laws that align with your goals.

Yes, Connecticut boasts a strong workforce and various incentives for new businesses. The state has numerous resources available, including access to funding and support networks. By filing your Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation, you can tap into these resources and benefit from the local economy.

Some businesses incorporate in other states to take advantage of more favorable laws or tax rates. States like Delaware are well-known for their business-friendly environments and established legal precedents. However, if you're starting in Connecticut, the Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation offers a solid foundation for operations in the local market.

Connecticut does not require a company to make an S Corp election, but doing so can offer certain tax benefits. If your business's structure allows it, choosing S Corp status can help avoid double taxation on earnings. You will need to file the appropriate forms once you secure your Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation.

Companies often choose to incorporate in Connecticut due to its business-friendly laws and diverse economy. The state provides various support services for entrepreneurs and established businesses alike. Filing a Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation positions your company for growth in a thriving marketplace.

Starting an LLC in Connecticut offers several advantages, such as personal liability protection and tax flexibility. By forming an LLC, you can separate your personal assets from your business debts, which is crucial for financial security. The process requires filing a Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation, ensuring your business is legally recognized.

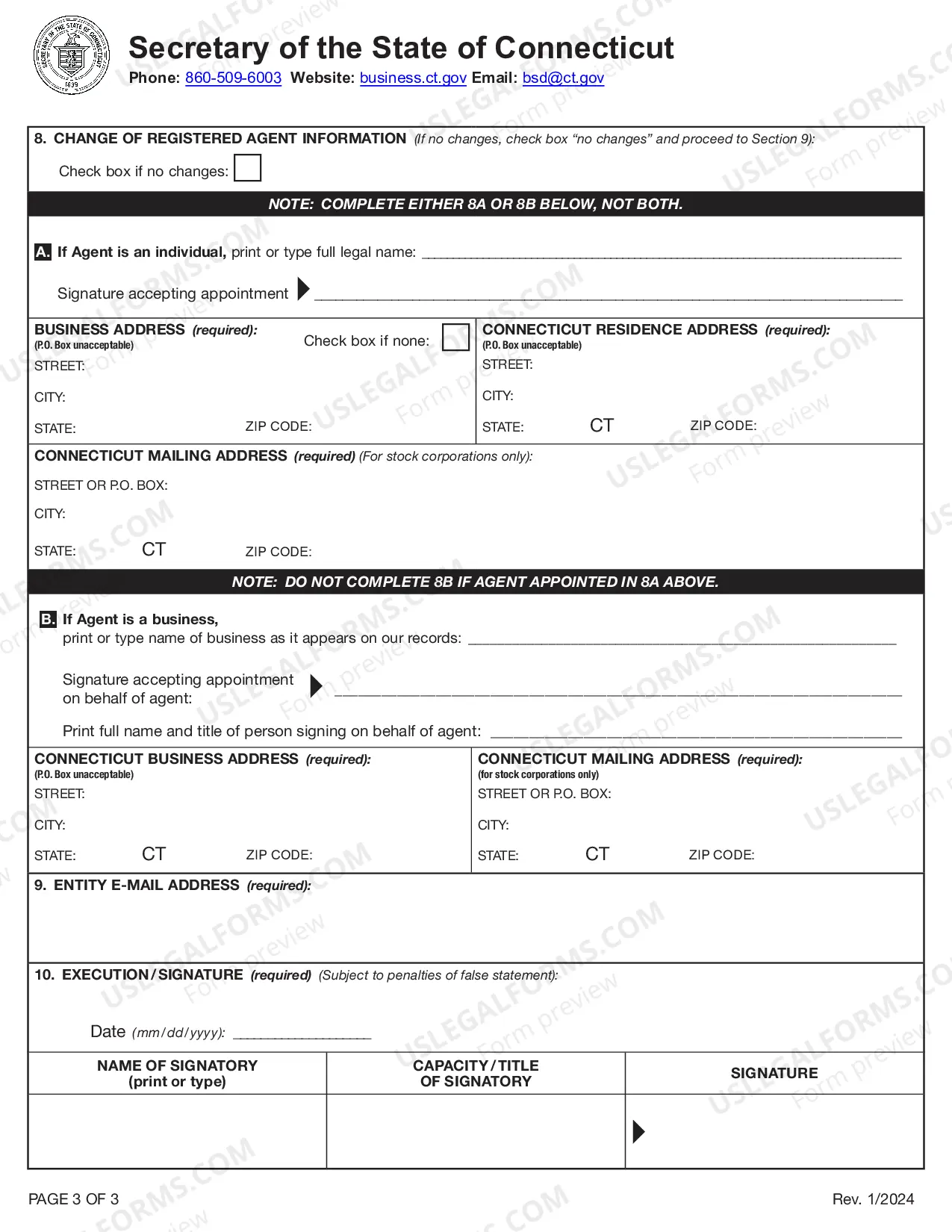

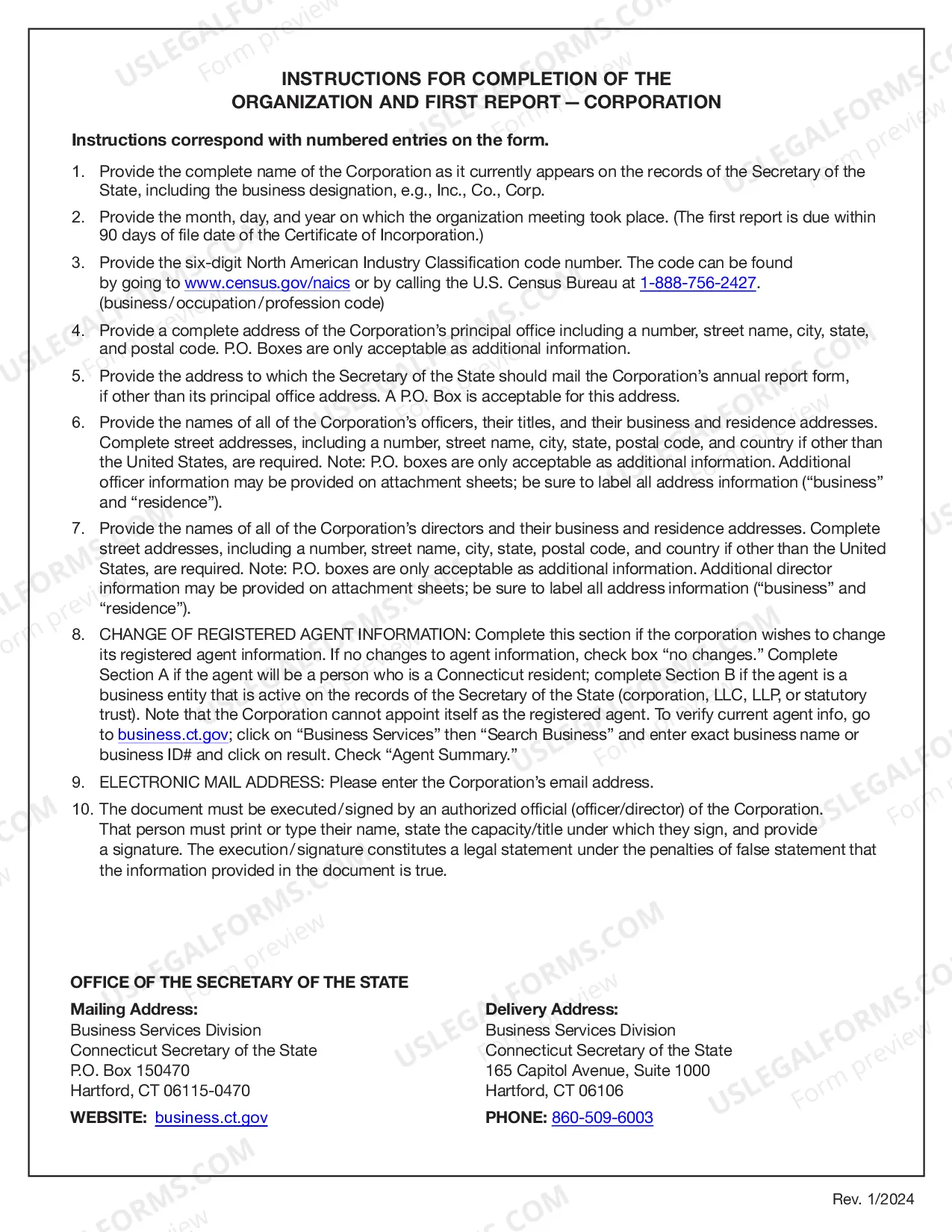

Filing an S Corp in Connecticut begins with completing the Connecticut Articles of Incorporation Certificate for a Domestic For-Profit Stock Corporation. This involves providing specified details about your corporation and selecting S Corporation status when filing your federal tax forms. Once your Articles of Incorporation are approved, you’ll need to comply with state regulations and keep your corporate records in order. Consider using US Legal Forms to help you with the documentation and ensure compliance throughout the process.

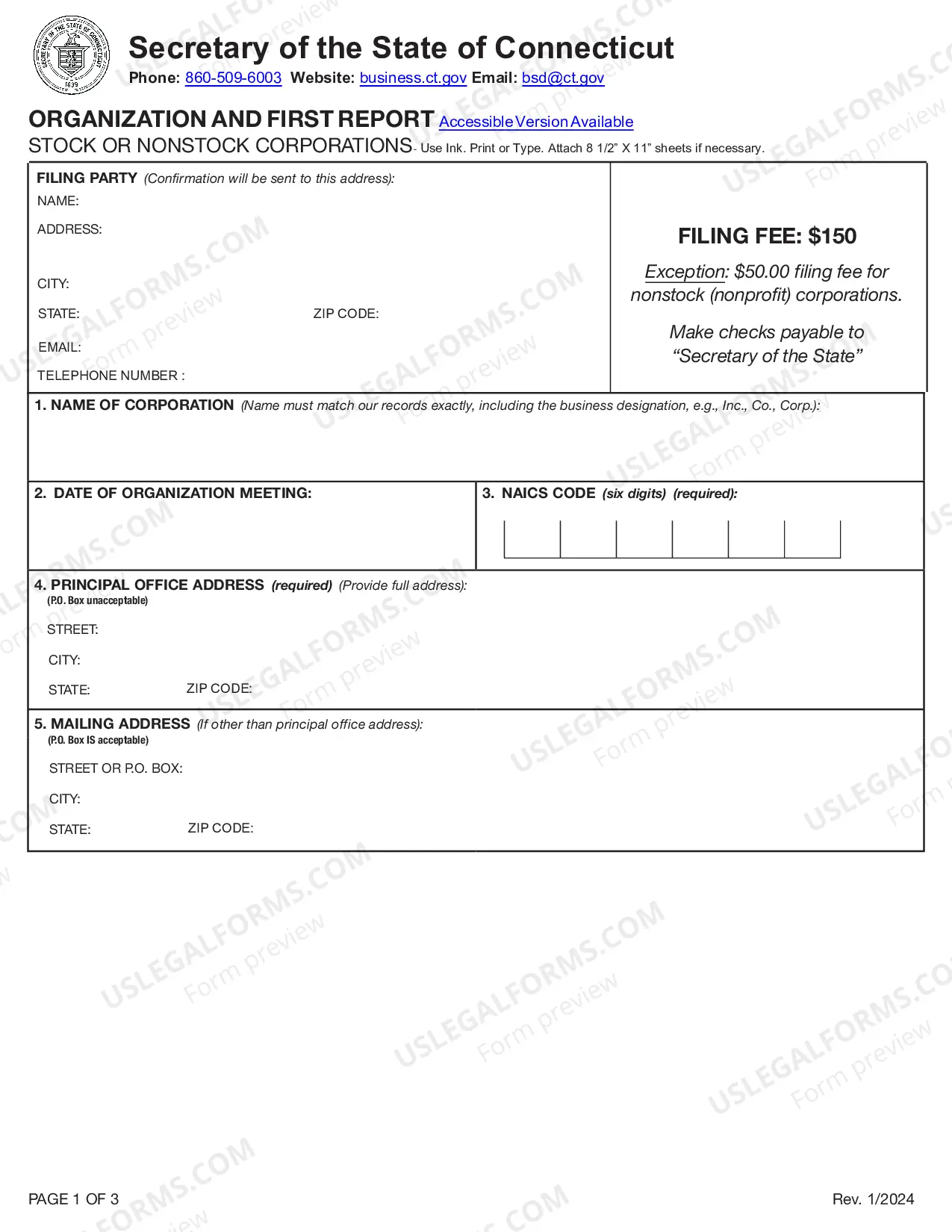

To incorporate your business in Connecticut, you need to prepare and file the Connecticut Articles of Incorporation Certificate for a Domestic For-Profit Stock Corporation. This process involves choosing a unique business name, designating a registered agent, and outlining the purpose of your corporation. You can submit these documents through the Connecticut Secretary of State's online portal or via mail. Utilizing platforms like US Legal Forms can simplify this process by providing templates and guidance tailored to Connecticut’s requirements.

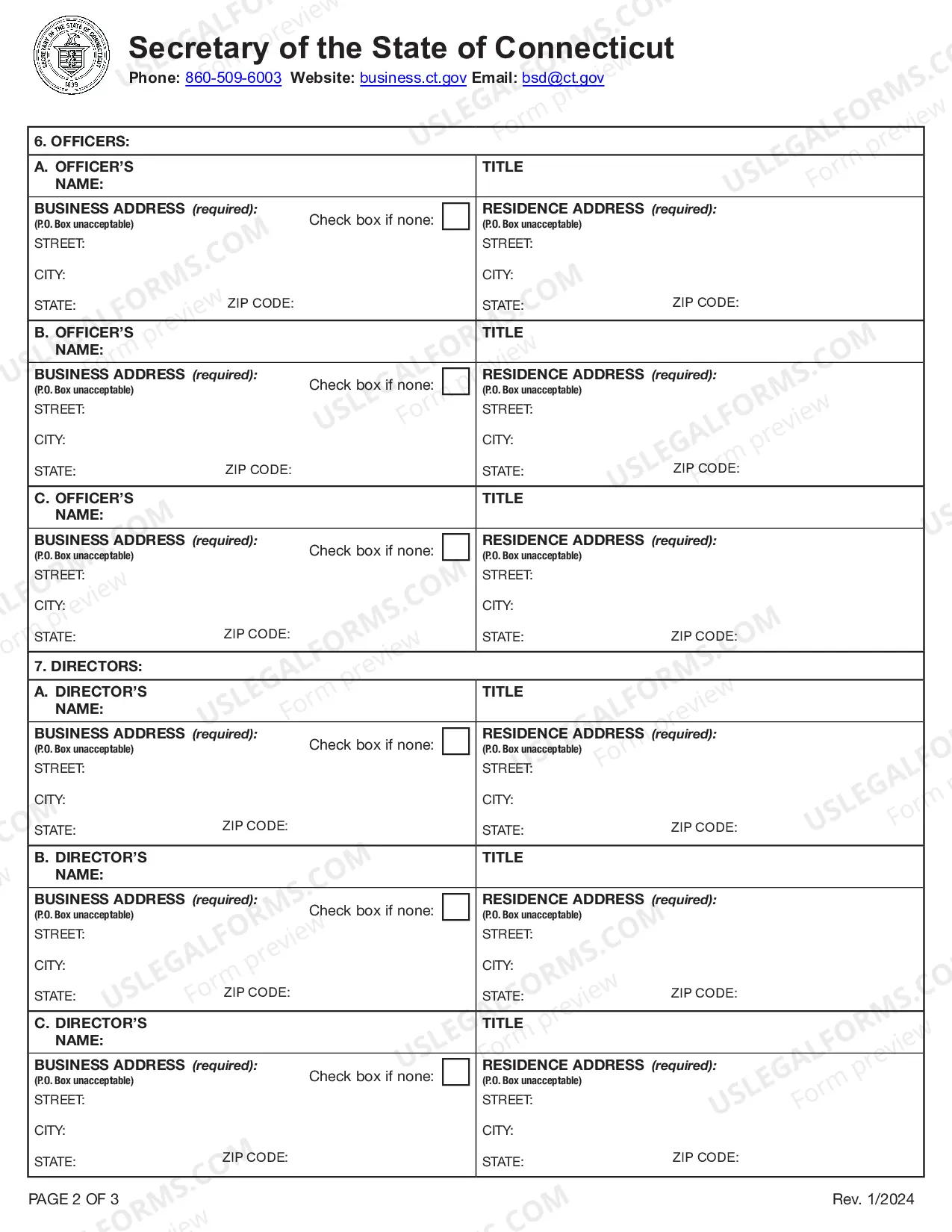

Articles of incorporation for an S Corp are essential documents that establish the existence of a corporation under Connecticut law. This certificate lays the legal groundwork for your business, identifying it as a Domestic For-Profit Stock Corporation. It details important information such as the corporation's name, purpose, and the address of its registered agent. Filing the Connecticut Articles of Incorporation Certificate is a crucial step in ensuring your business operates legally and effectively.

Filling out a share certificate involves noting essential information such as the company name, the shareholder's name, and the class and number of shares. It is important to ensure that this information matches what is outlined in your Connecticut Articles of Incorporation Certificate - Domestic For-Profit - Stock Corporation. If you want to simplify this process, consider using pre-designed templates available online or through platforms like USLegalForms, which make the task straightforward.