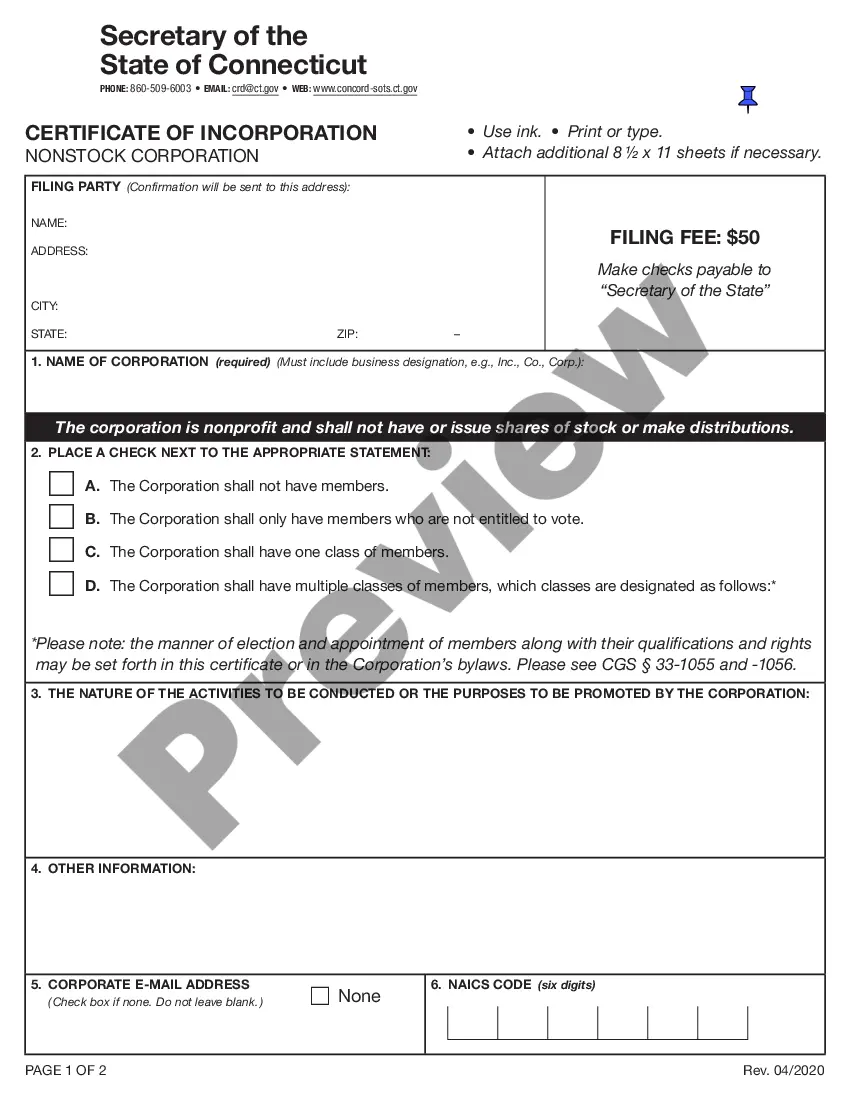

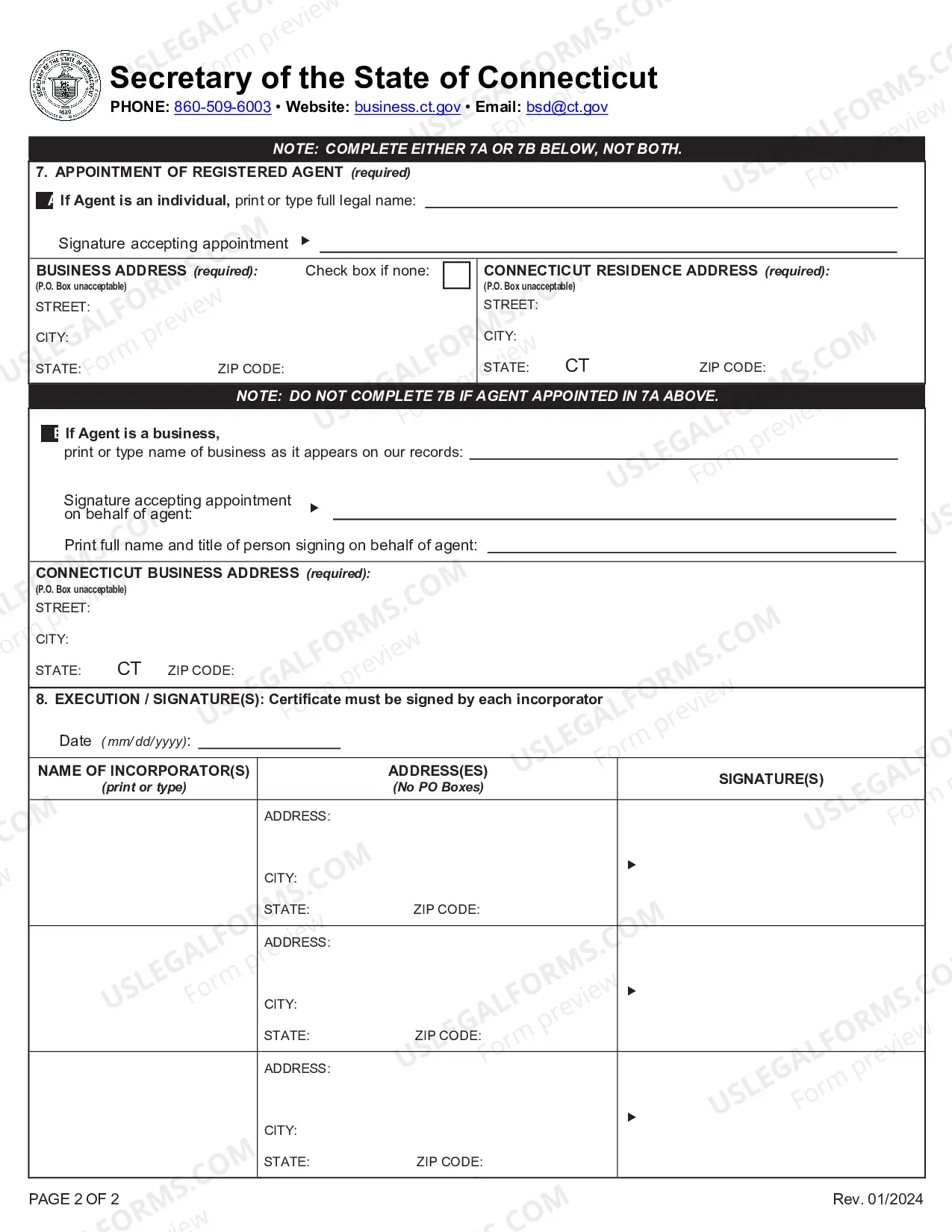

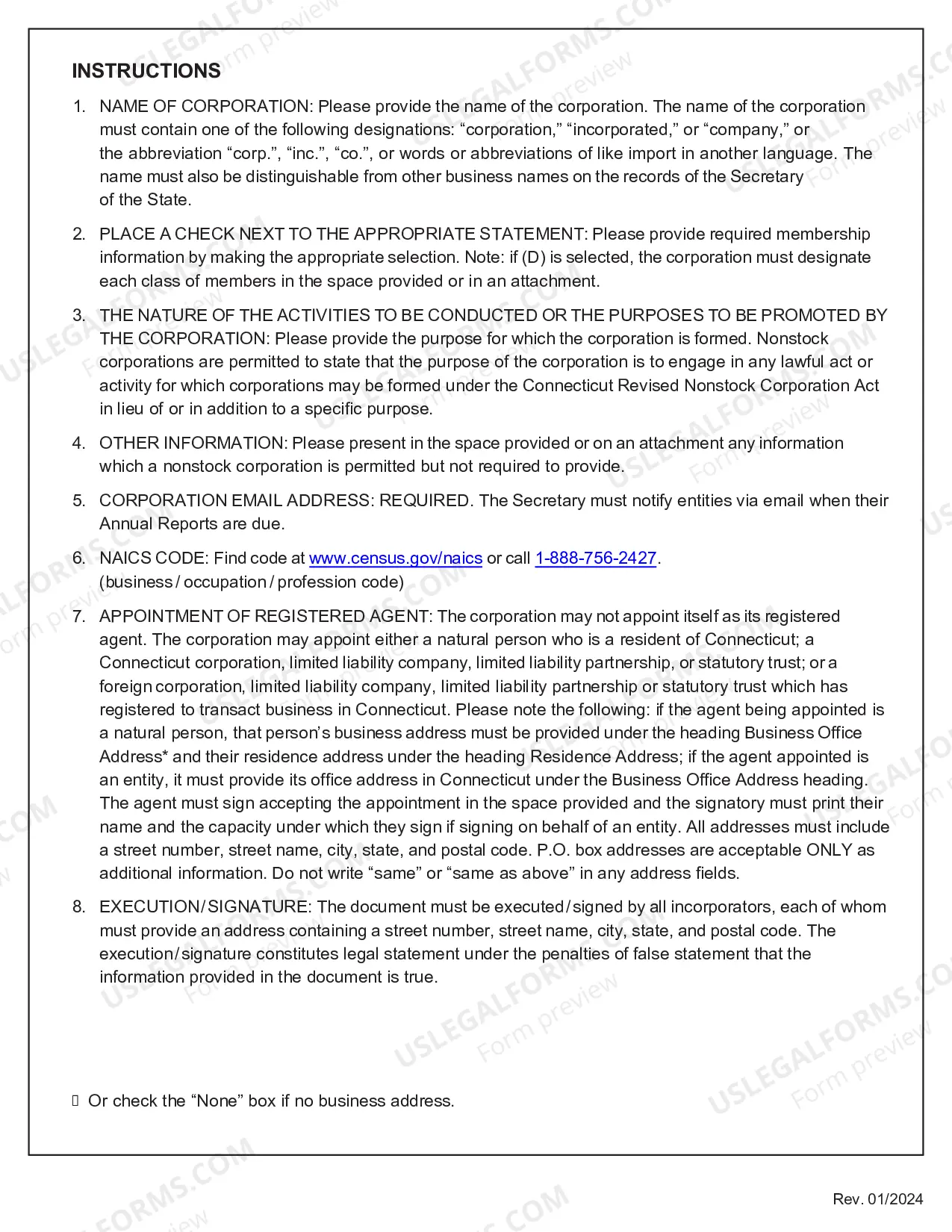

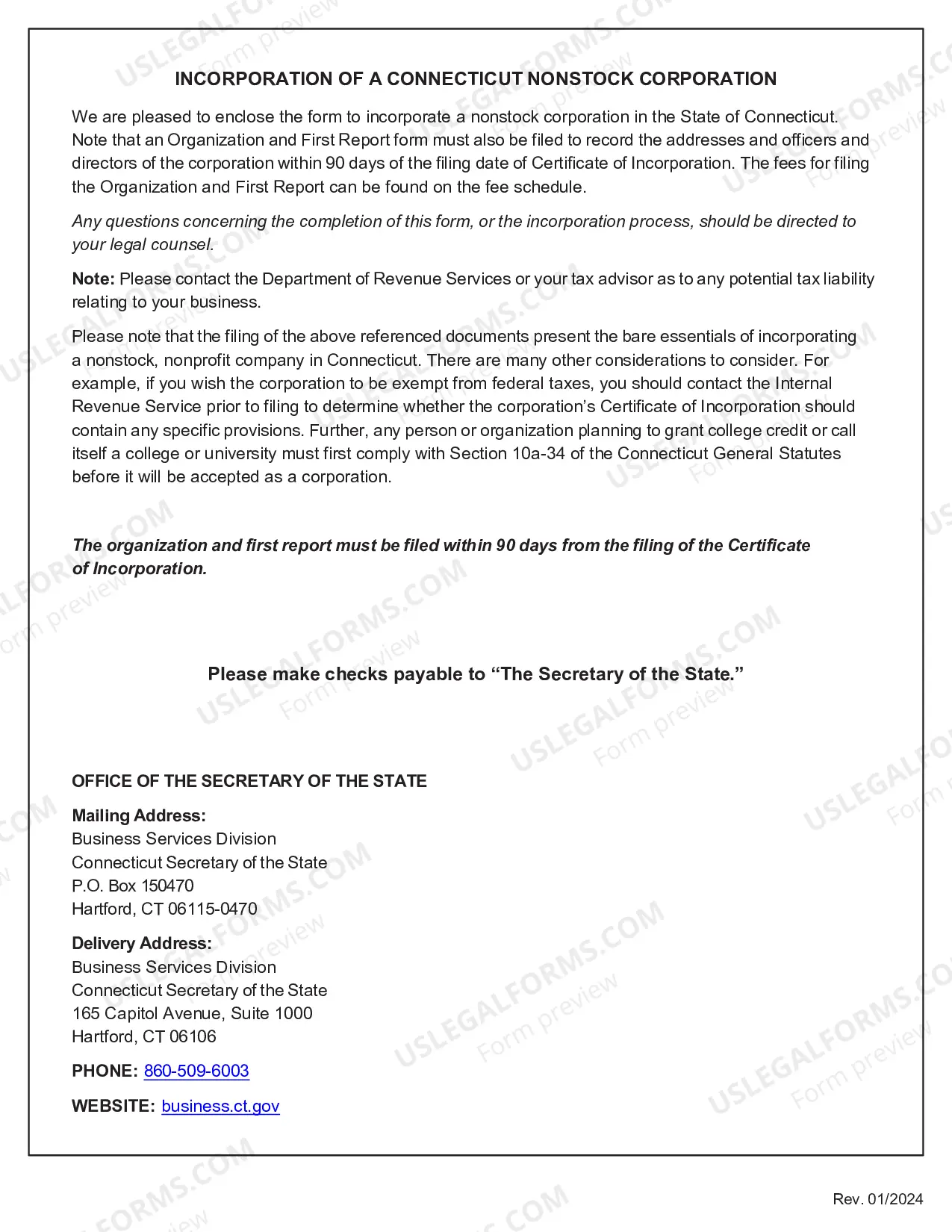

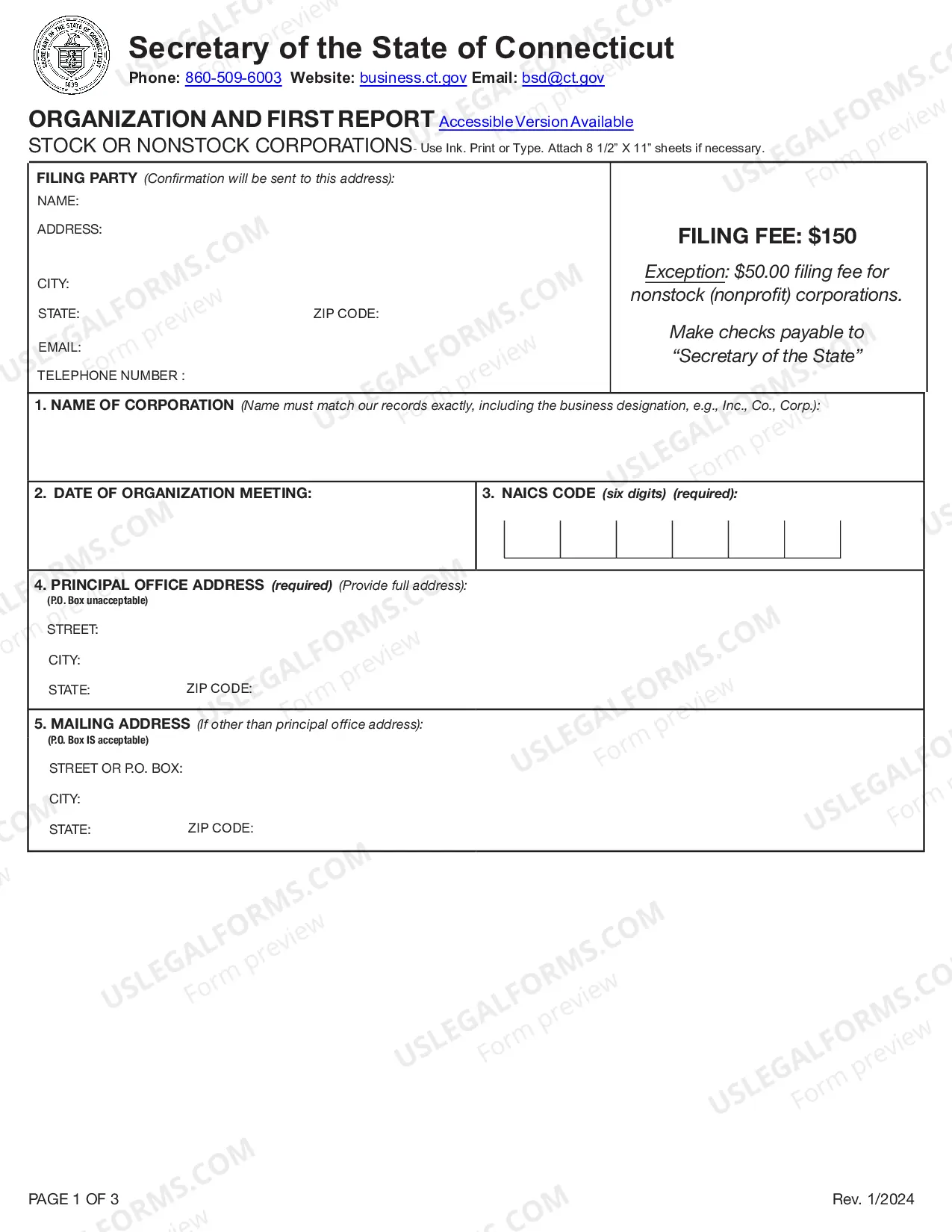

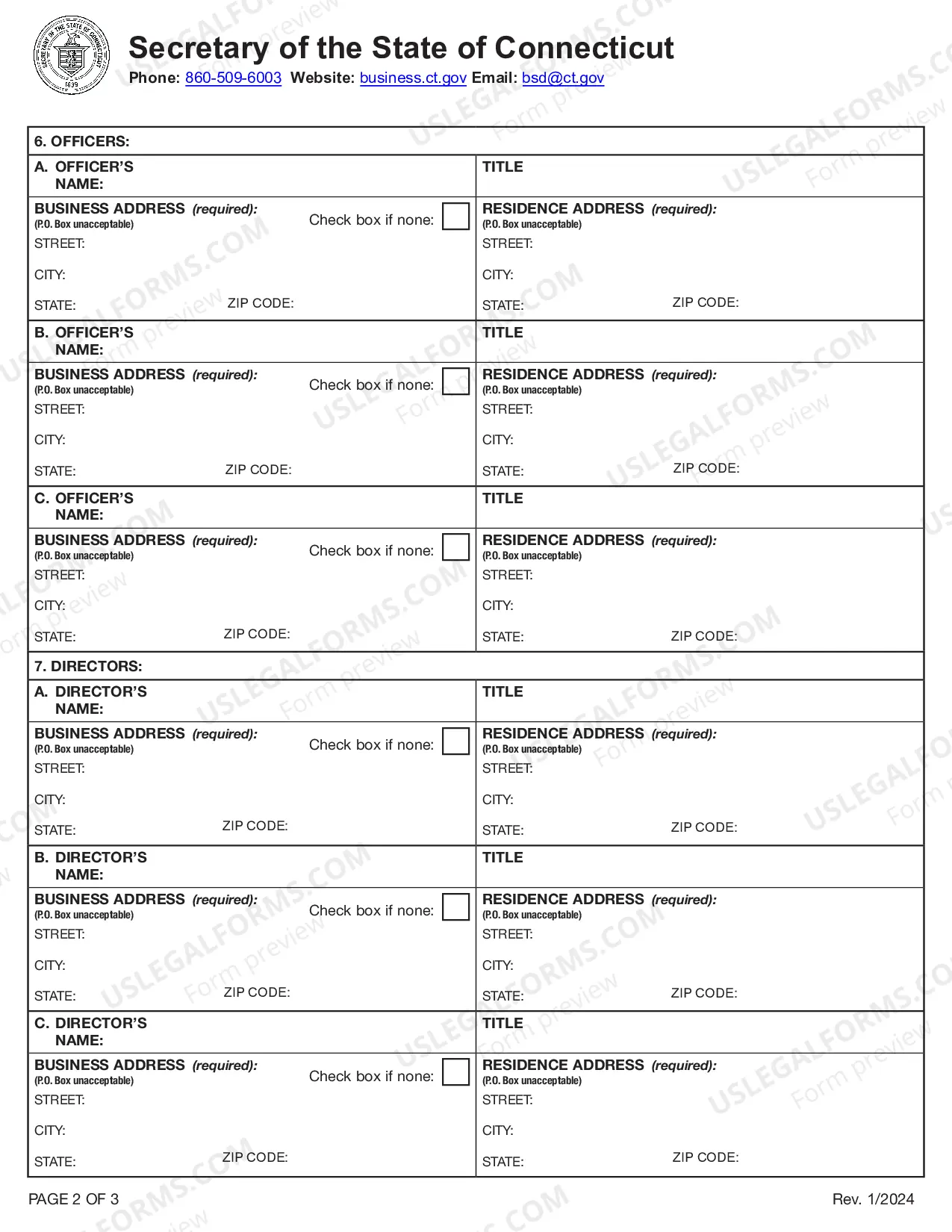

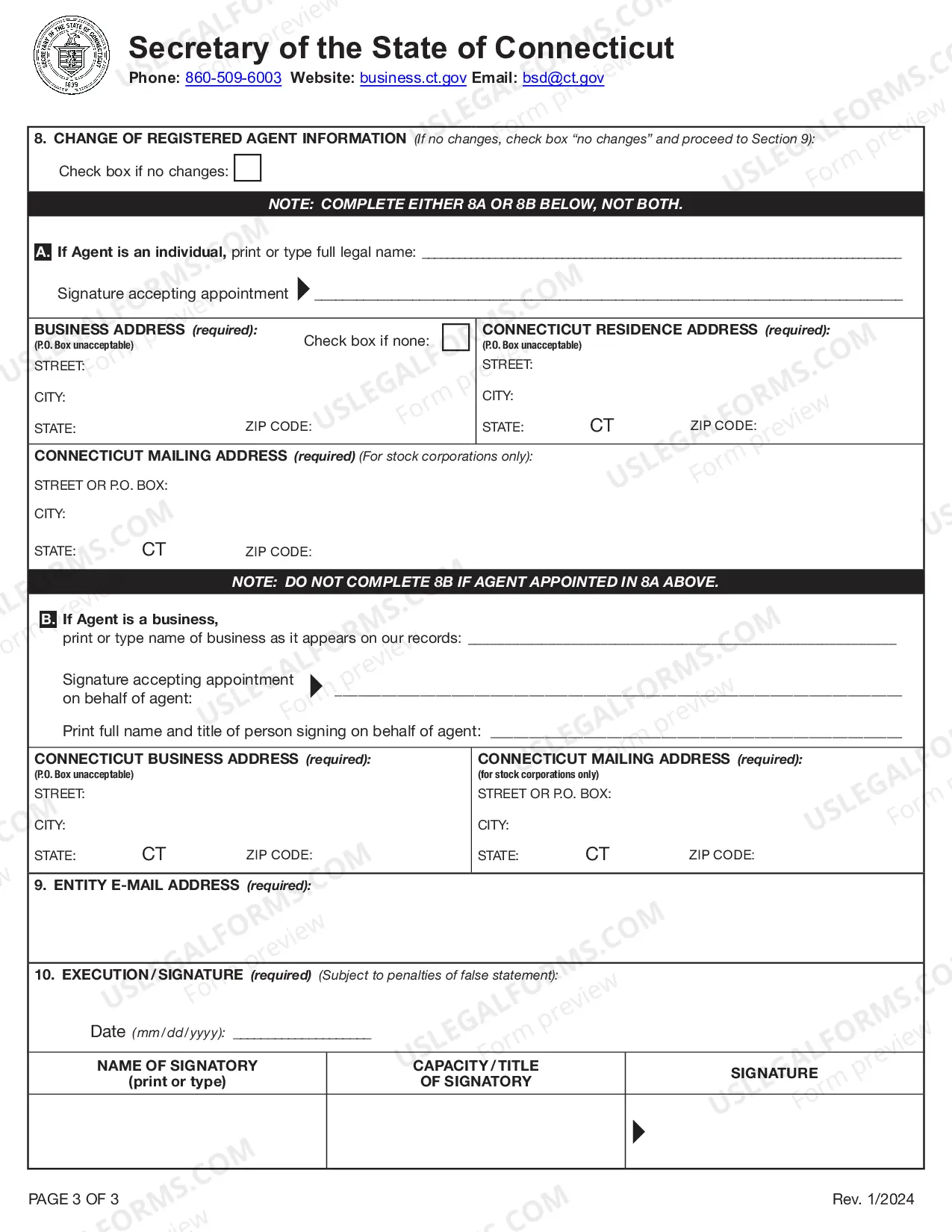

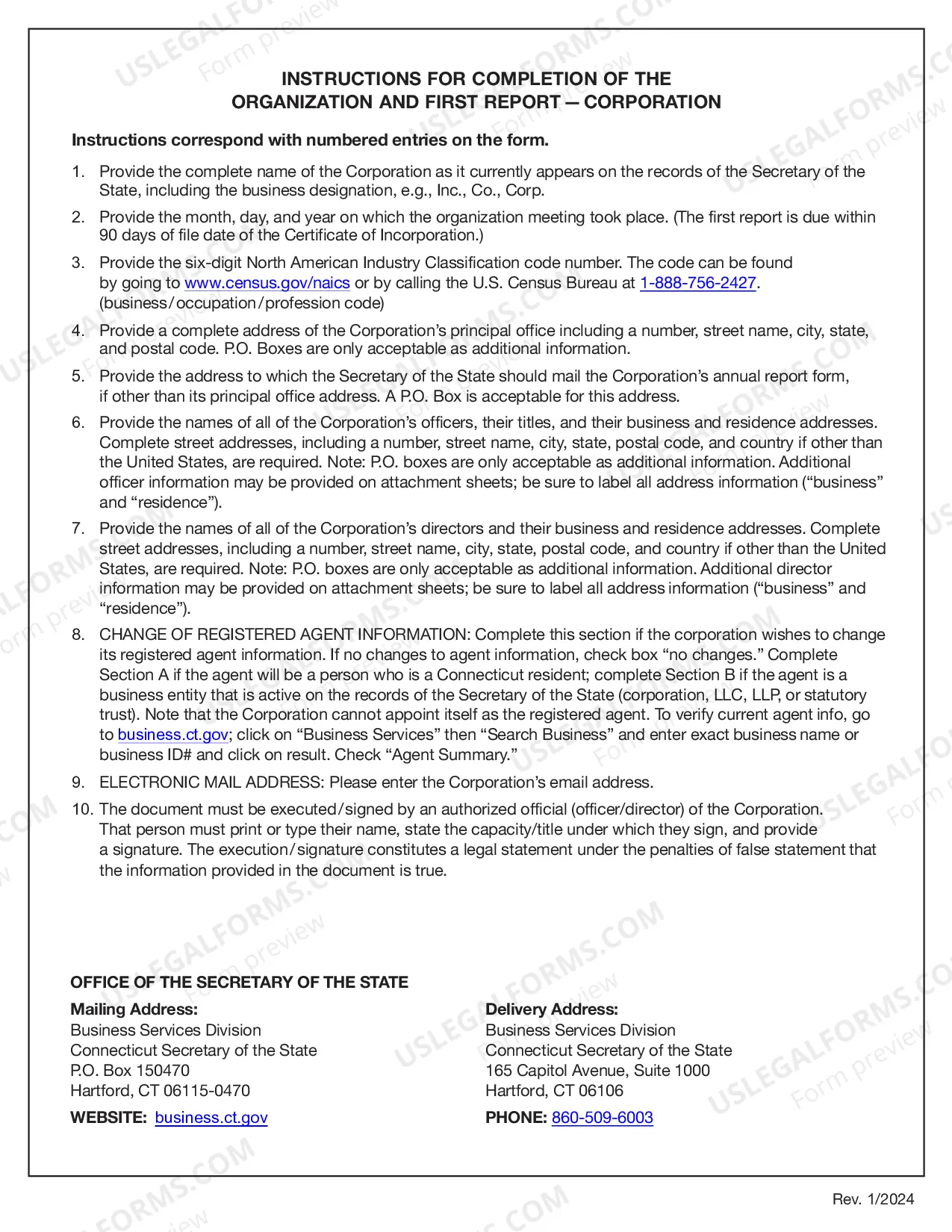

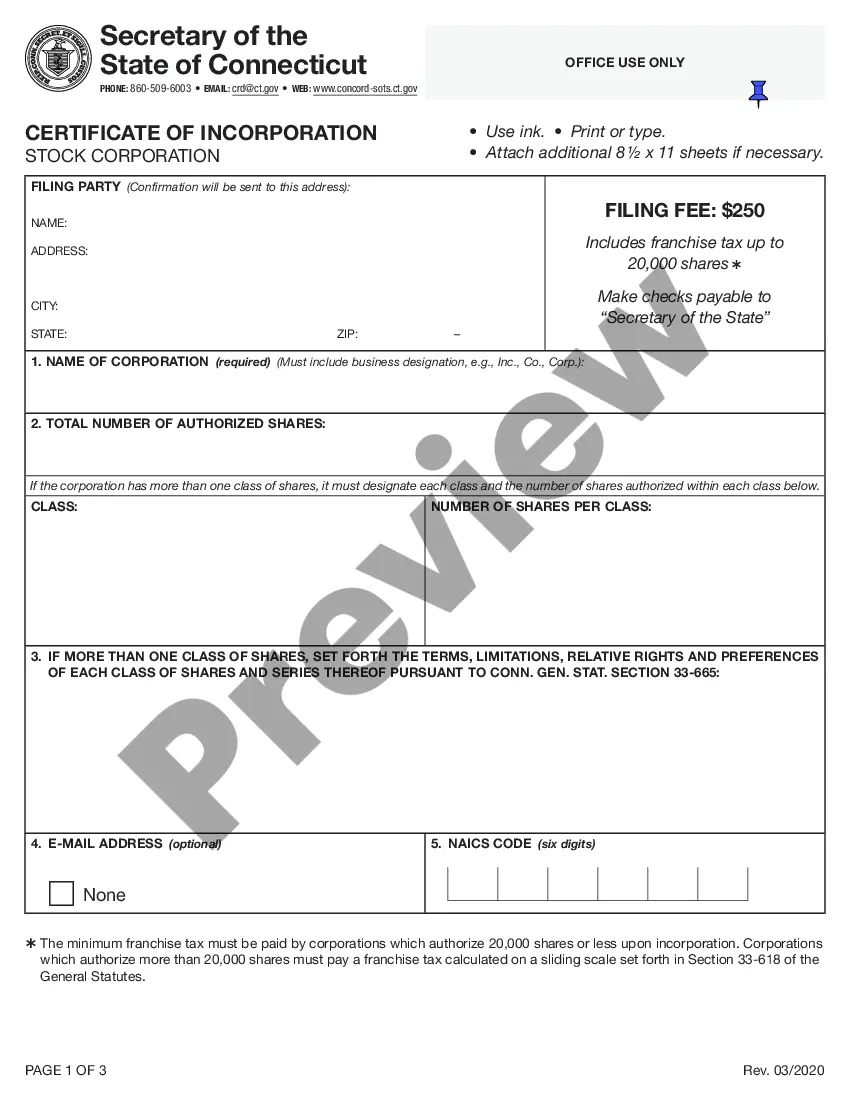

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation

Description

How to fill out Connecticut Articles Of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation?

The greater the number of documents you need to assemble - the more anxious you become.

You can discover a vast array of Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation templates online, however, you're uncertain about which ones to trust.

Eliminate the stress and simplify finding samples with US Legal Forms. Obtain professionally crafted documents that comply with state regulations.

Enter the required details to create your account and settle your order using PayPal or a debit/credit card. Select a suitable document format and download your template. Access all samples acquired through the My documents section. Go there to create a new version of your Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation. Even when filling out well-prepared forms, it remains crucial to consider having a local legal advisor review the completed sample to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you possess a subscription to US Legal Forms, Log In to your account, and you will see the Download option on the Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation’s page.

- If you haven’t utilized our website previously, complete the registration process by following these instructions.

- Verify if the Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation is applicable in your residing state.

- Review your choices by examining the description or using the Preview feature if available for the selected document.

- Click Buy Now to commence the registration process and choose a payment plan that meets your requirements.

Form popularity

FAQ

In Connecticut, the minimum tax for a corporation is typically set at $250. This applies to all Domestic Nonprofit Nonstock Corporations once they file their Connecticut Articles of Incorporation Certificate. Keep in mind that additional taxes may apply based on revenue and other factors, so it's wise to consult with a tax professional to understand your obligations.

Yes, you can start a corporation by yourself in Connecticut. When you file the Connecticut Articles of Incorporation Certificate for a Domestic Nonprofit Nonstock Corporation, you become the sole incorporator. However, it is important to understand that even if you are the only member, forming a corporation involves specific legal responsibilities and compliance with state regulations.

Yes, you must be incorporated to apply for 501(c)(3) status. First, you will need to obtain a Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation, which provides the legal foundation for your nonprofit. Once incorporated, you can then apply for the 501(c)(3) designation, allowing your organization to benefit from tax-exempt status. Ensuring you complete these steps correctly is crucial for your nonprofit’s success.

A purpose clause for a 501(c)(3) organization clearly outlines the mission and activities of the nonprofit. For instance, you could say, 'The organization is dedicated to promoting education and providing resources for underprivileged children.' This clause would align with the requirements for obtaining a Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation, as it defines the public benefit that the organization aims to provide.

No, articles of incorporation are not the same as a 501(c)(3) designation, although they are related. The Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation is the initial document filed to establish your nonprofit’s legal status. In contrast, 501(c)(3) refers to the tax-exempt status granted by the IRS after submitting a separate application. Both processes are essential for a nonprofit but serve different legal and tax purposes.

To write articles of incorporation for a nonprofit, begin by gathering the necessary information about your organization. You will need to include details such as the name, address, and purpose of the organization. Using a reliable resource like US Legal Forms can simplify the process, providing templates specifically designed for the Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation. Following the correct format ensures your nonprofit meets state requirements.

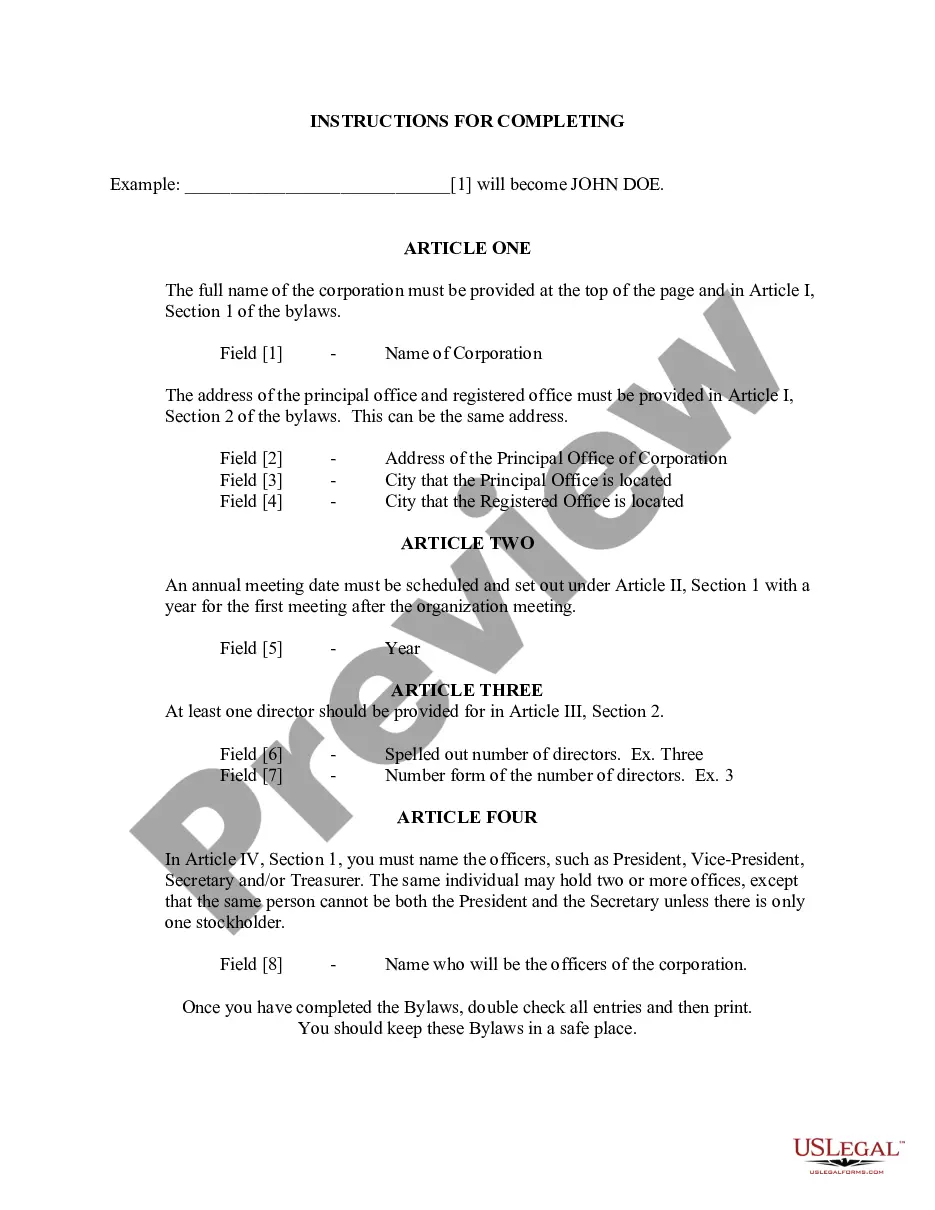

Bylaws and articles of incorporation serve distinct purposes for a nonprofit organization. While the Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation establishes the existence of the organization, bylaws outline the internal rules governing its operations. Typically, articles of incorporation include essential information like the nonprofit's name and mission, whereas bylaws detail the structure, roles, and responsibilities within the organization. Understanding these differences helps ensure that your nonprofit runs smoothly and adheres to legal requirements.

To start a non-profit in Connecticut, first, you need to file the Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation with the state. This document lays the foundation for your organization and sets forth its purpose and structure. After that, create your bylaws, select a board of directors, and hold an organizational meeting. Finally, apply for tax-exempt status with the IRS to enhance your non-profit's benefits.

To open a nonprofit in Connecticut, start by defining your mission and forming a board of directors. Next, complete the Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation to officially register your organization. After that, you may need to apply for tax-exempt status at the federal level. Using a service like uslegalforms can simplify the process by providing comprehensive guidance and the necessary forms to ensure compliance.

Yes, you can start a nonprofit by yourself, but it's beneficial to involve others as well. Forming a nonprofit usually requires a board of directors, which provides guidance and governance. You will also need to complete specific paperwork, including the Connecticut Articles of Incorporation Certificate - Domestic Nonprofit - Nonstock Corporation, to register your organization legally.