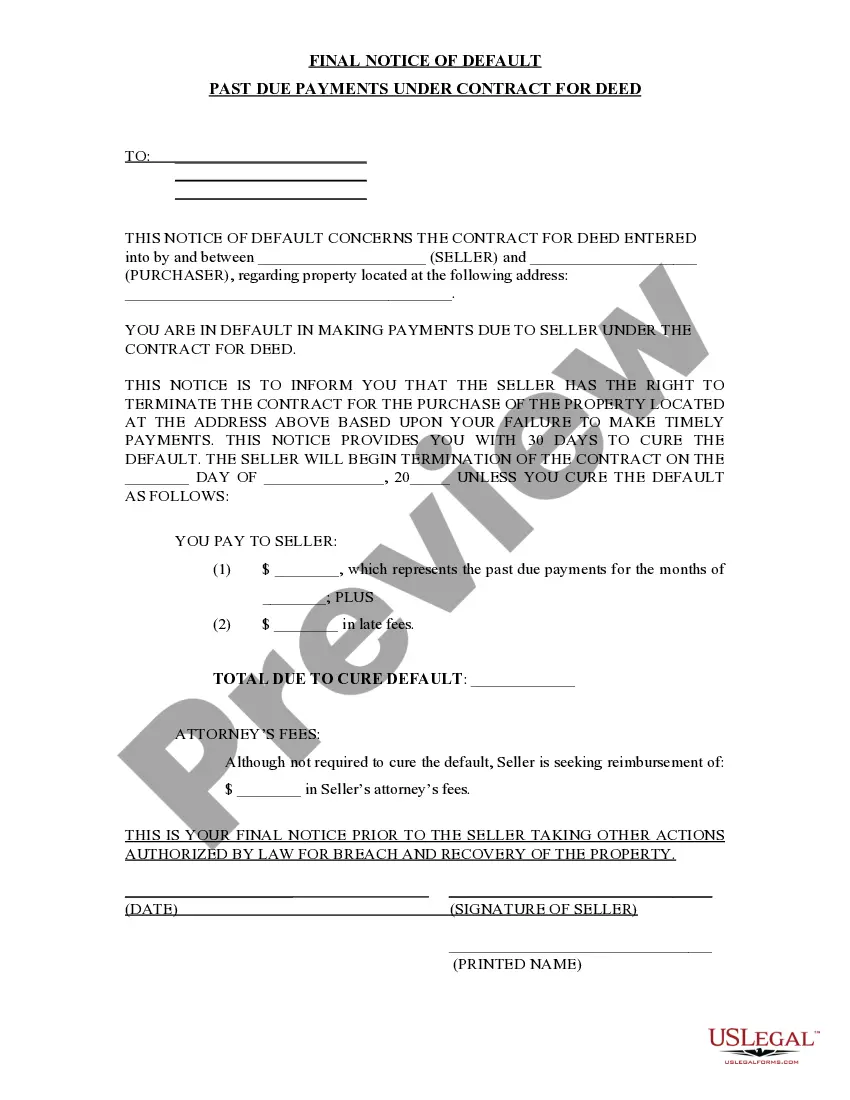

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

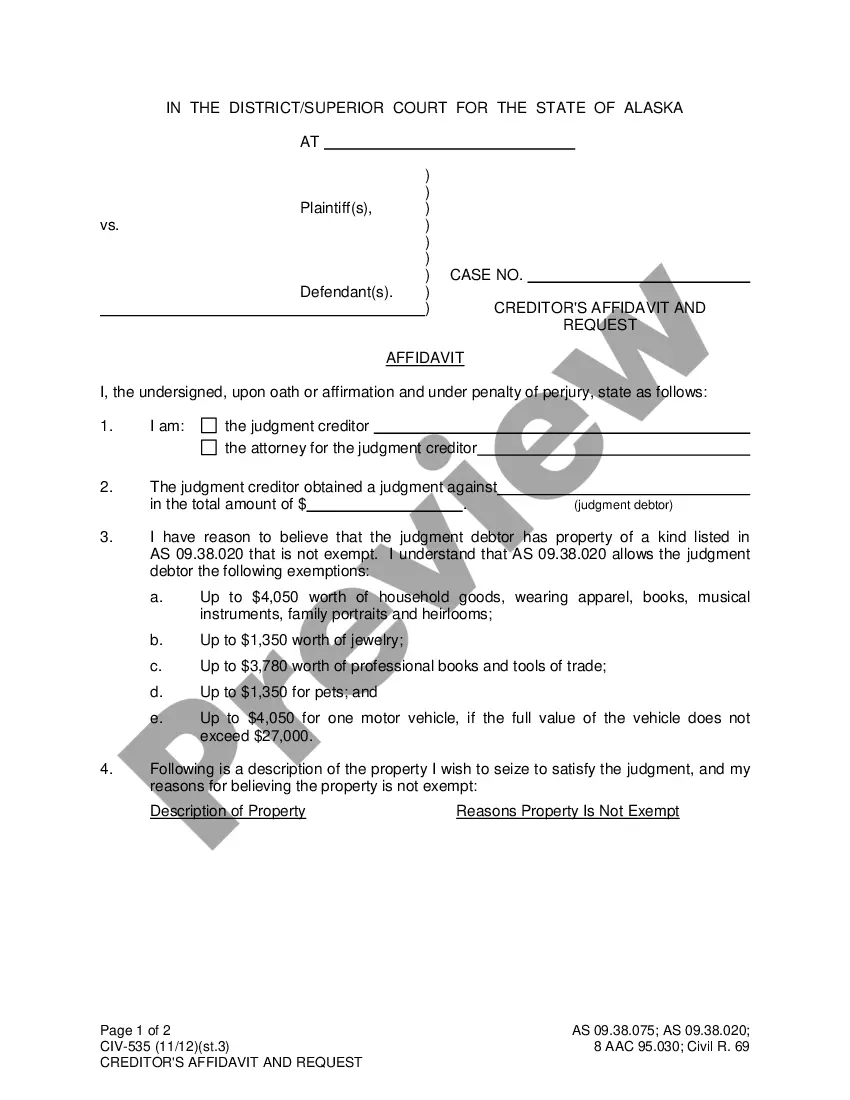

How to fill out Iowa Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to acquire a printable Iowa Final Notice of Default for Unpaid Payments related to Contract for Deed. Our legal forms, acceptable in court, are crafted and frequently revised by experienced lawyers.

Our collection is the most extensive Forms catalog available online and provides economical and precise templates for clients, legal experts, and small to medium-sized businesses.

The documents are categorized by state, and some can be previewed before downloading.

US Legal Forms provides a vast array of legal and tax templates and packages for both business and individual requirements, including Iowa Final Notice of Default for Unpaid Payments in relation to Contract for Deed. Over three million users have successfully utilized our service. Choose your subscription plan and access high-quality forms in just a few clicks.

- To download samples, users must possess a subscription and Log In to their account.

- Click Download next to any template you require and locate it in My documents.

- For those without a subscription, follow these instructions to swiftly find and download Iowa Final Notice of Default for Unpaid Payments related to Contract for Deed.

- Verify that you have the correct template pertinent to the required state.

- Examine the document by reviewing the description and using the Preview feature.

- Click Buy Now if this is the document you need.

- Establish your account and pay via PayPal or credit/debit card.

- Download the template to your device and feel free to reuse it multiple times.

Form popularity

FAQ

The primary risk for the buyer or borrower in a contract for deed involves potentially losing the property upon receiving an Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed. If the buyer fails to make timely payments, the seller may initiate foreclosure proceedings, which can lead to the loss of not only the property but also any equity built during the contract period. This situation highlights the importance of understanding the terms of the contract and maintaining consistent payment habits. Utilizing resources from uslegalforms can help clarify these terms and equip you with vital information to mitigate risks.

In Iowa, a borrower may typically face foreclosure after missing three consecutive payments. However, every lender may have different policies regarding this. The Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed signals that immediate action is essential to avoid foreclosure. Seeking guidance from resources like uslegalforms can provide critical insights and help you strategize your next steps.

A legal notice of default is a document that informs a borrower they have fallen behind on their payments. This notice serves as an alert of potential foreclosure proceedings if the situation is not resolved. When you encounter an Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, it indicates urgency. Tools provided by uslegalforms can assist you in understanding your legal obligations and possible remedies.

In Iowa, the foreclosure process can last anywhere from six months to over a year. This time can be influenced by various elements such as legal proceedings and the nature of the mortgage. If you receive an Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, it’s critical to take immediate action. Utilizing services like uslegalforms can guide you in understanding your position and potential next steps.

The time frame for a bank to foreclose on a house varies, often taking between three to twelve months. The timeline can fluctuate based on factors such as state laws and the borrower's situation. With the Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding these timelines can help you formulate an effective strategy. Consider using resources like uslegalforms to gain clarity on your rights and options.

The foreclosure process in Iowa typically takes anywhere from several months to over a year. This duration depends on various factors, including court schedules and the complexity of the case. When facing the Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, it is essential to act promptly. Engaging with a legal professional can help you navigate this process efficiently.

When you receive a notice of default, it signals that you have fallen behind on your payments. This document, specifically the Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, sets off a chain reaction that can lead to foreclosure if not addressed. Reviewing your financial situation and reaching out to your lender can help you formulate a plan to remedy the default.

A default notice is a serious warning regarding your financial obligations. It indicates that you are at risk of foreclosure if corrective action is not taken promptly. The Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed emphasizes the urgency of addressing your payments before you lose your property.

Once a house is in default, the lender typically initiates the foreclosure process. You may receive the Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, which outlines your obligations and options moving forward. Engaging with your lender at this stage may offer ways to amend the situation before it escalates.

Yes, it is possible to halt a sheriff sale in Iowa, particularly if you take action quickly. You may need to negotiate with your lender or seek a court order to stop the sale. Addressing the Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed early on can provide you with options to avoid foreclosure.