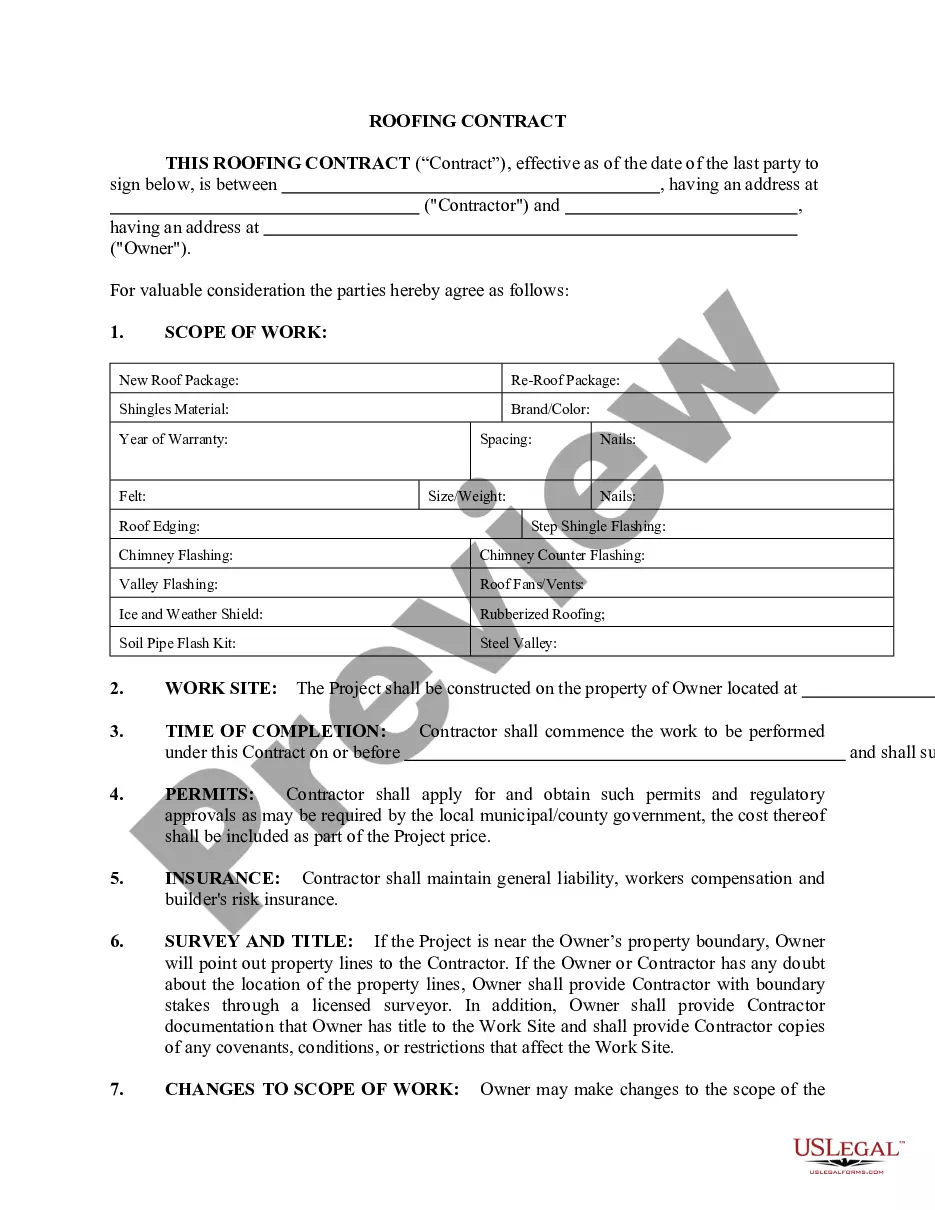

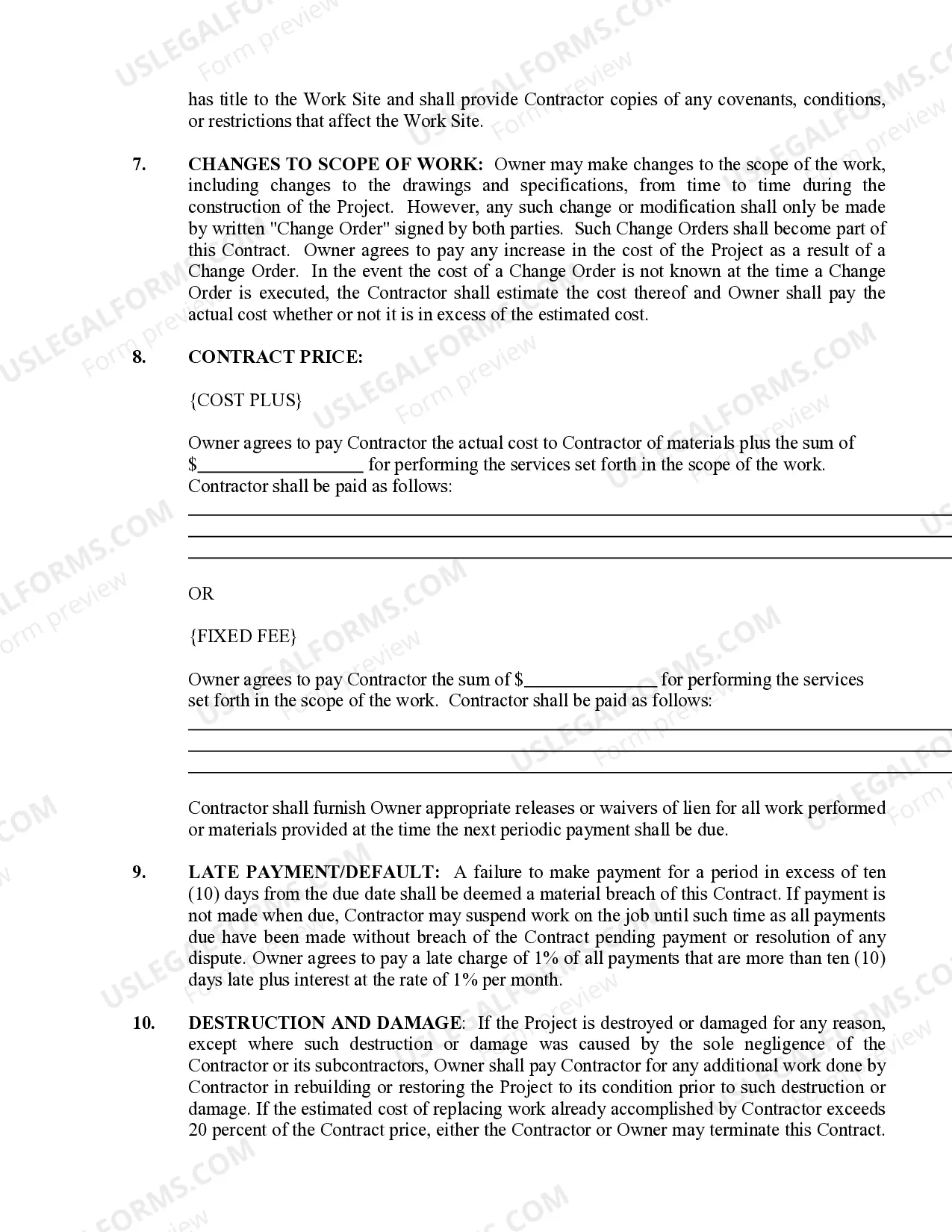

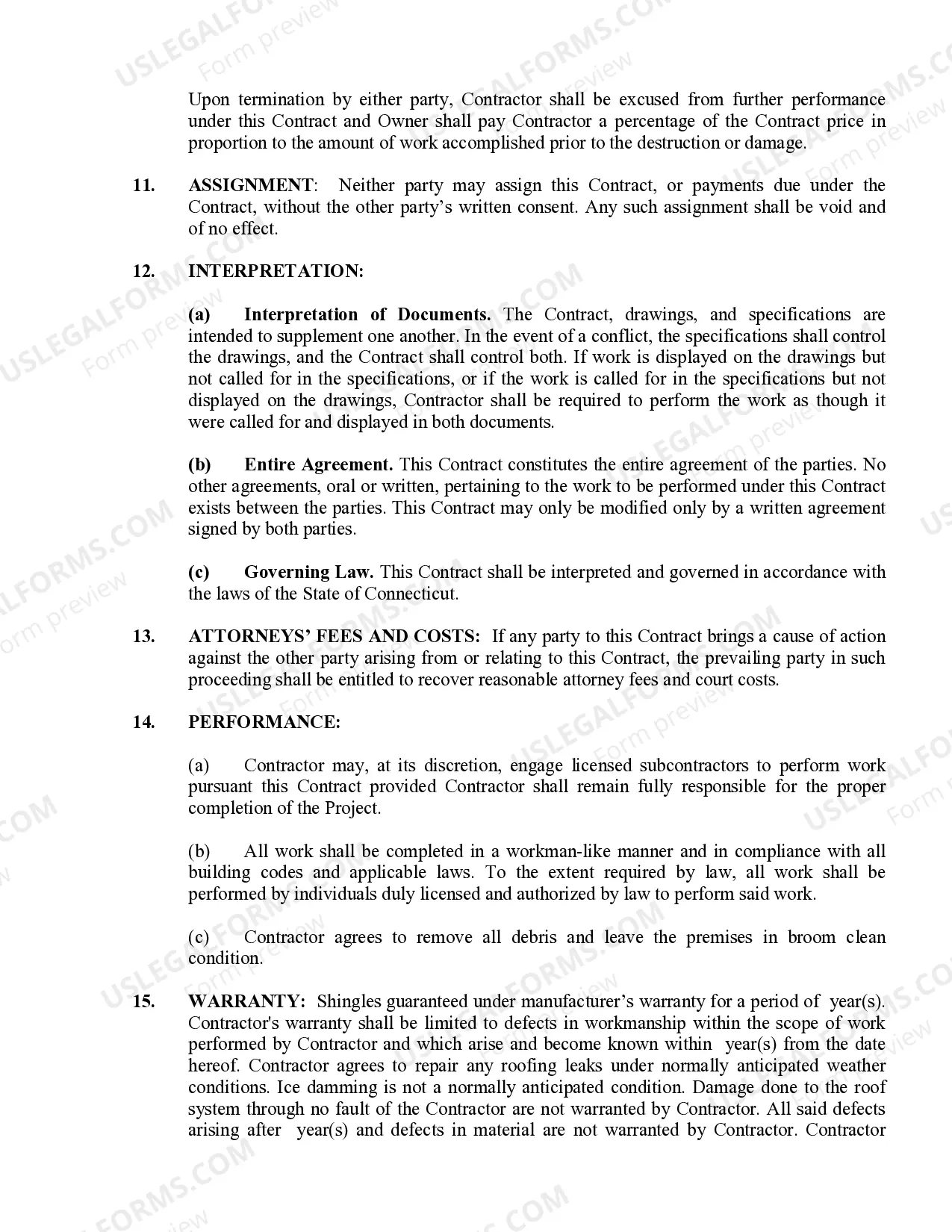

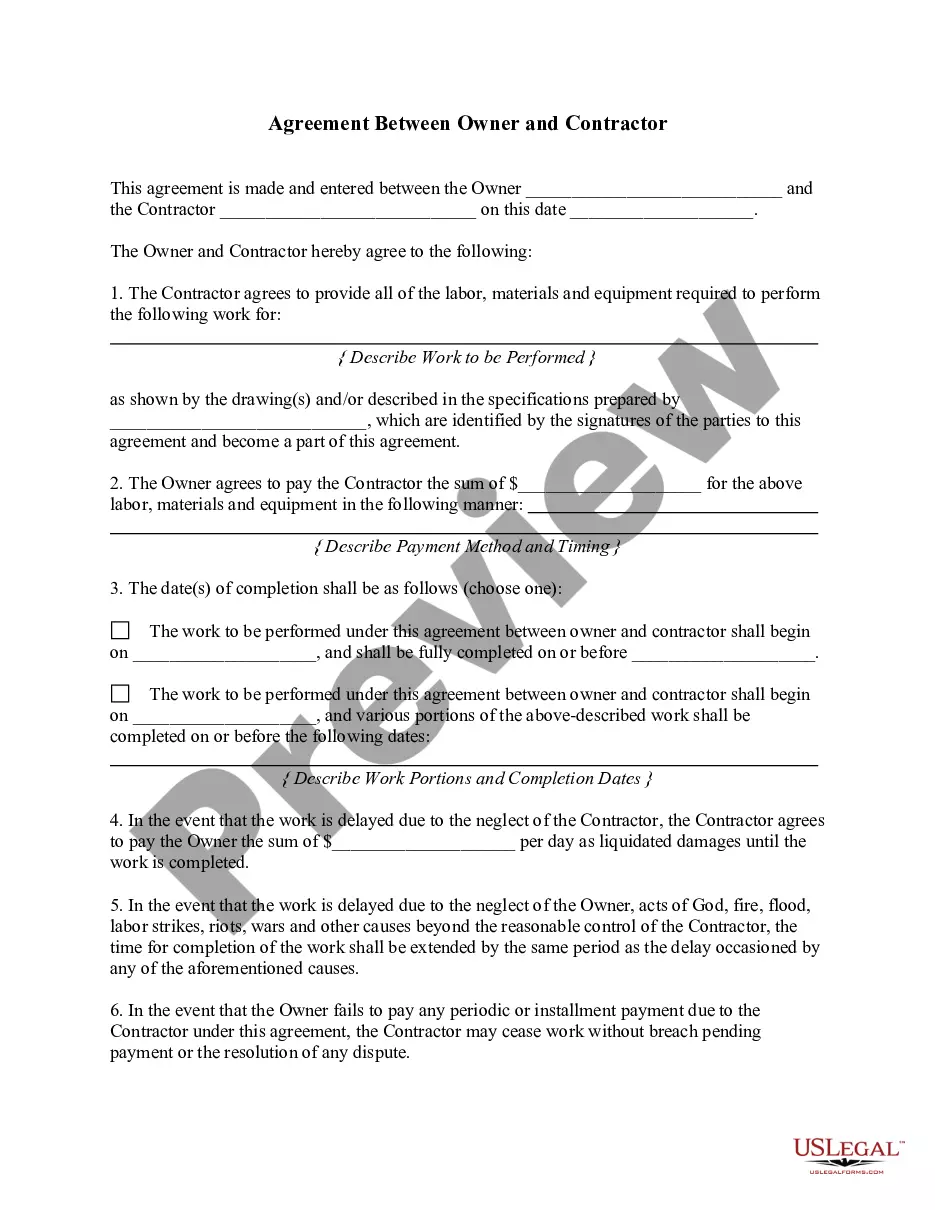

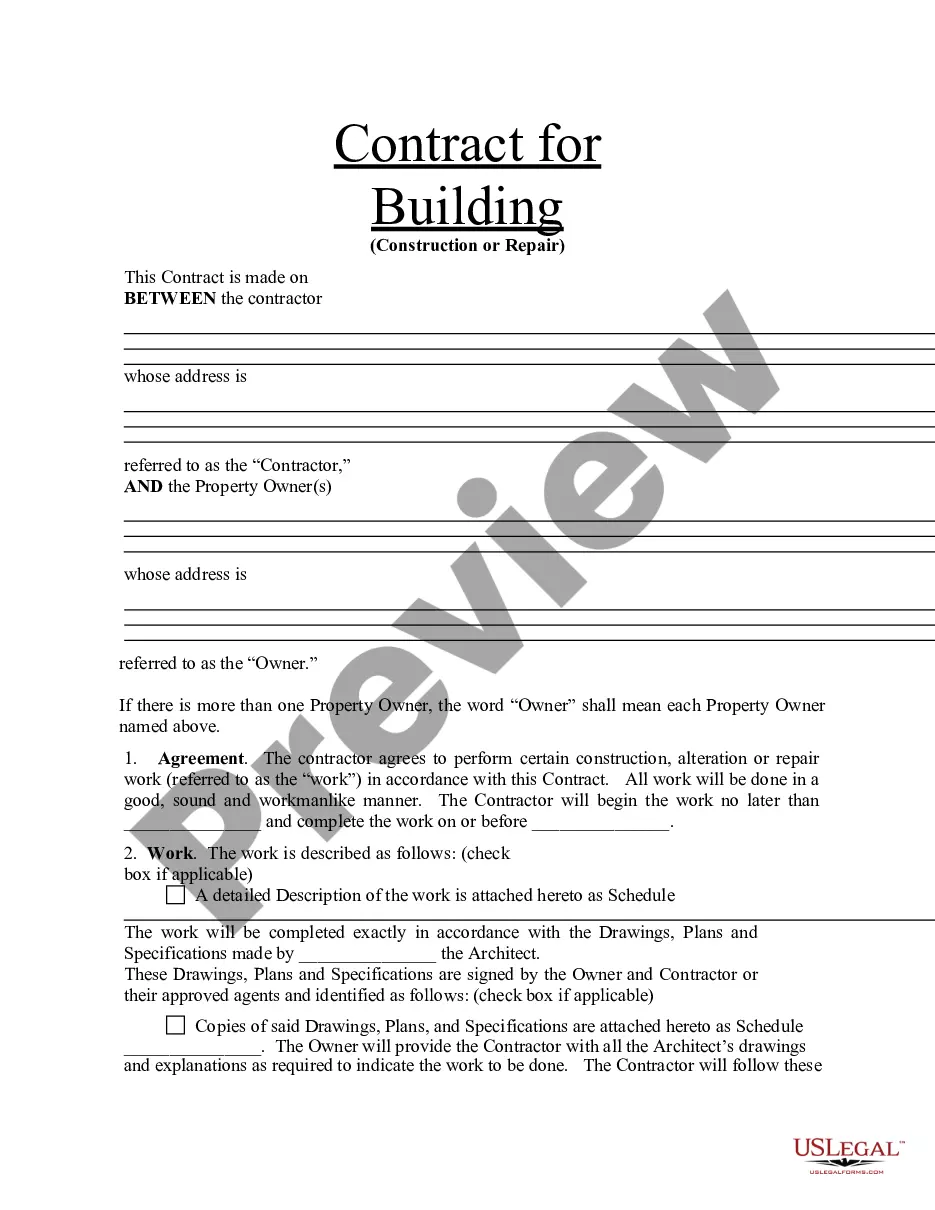

This form is designed for use between Roofing Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Connecticut.

Connecticut Roofing Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

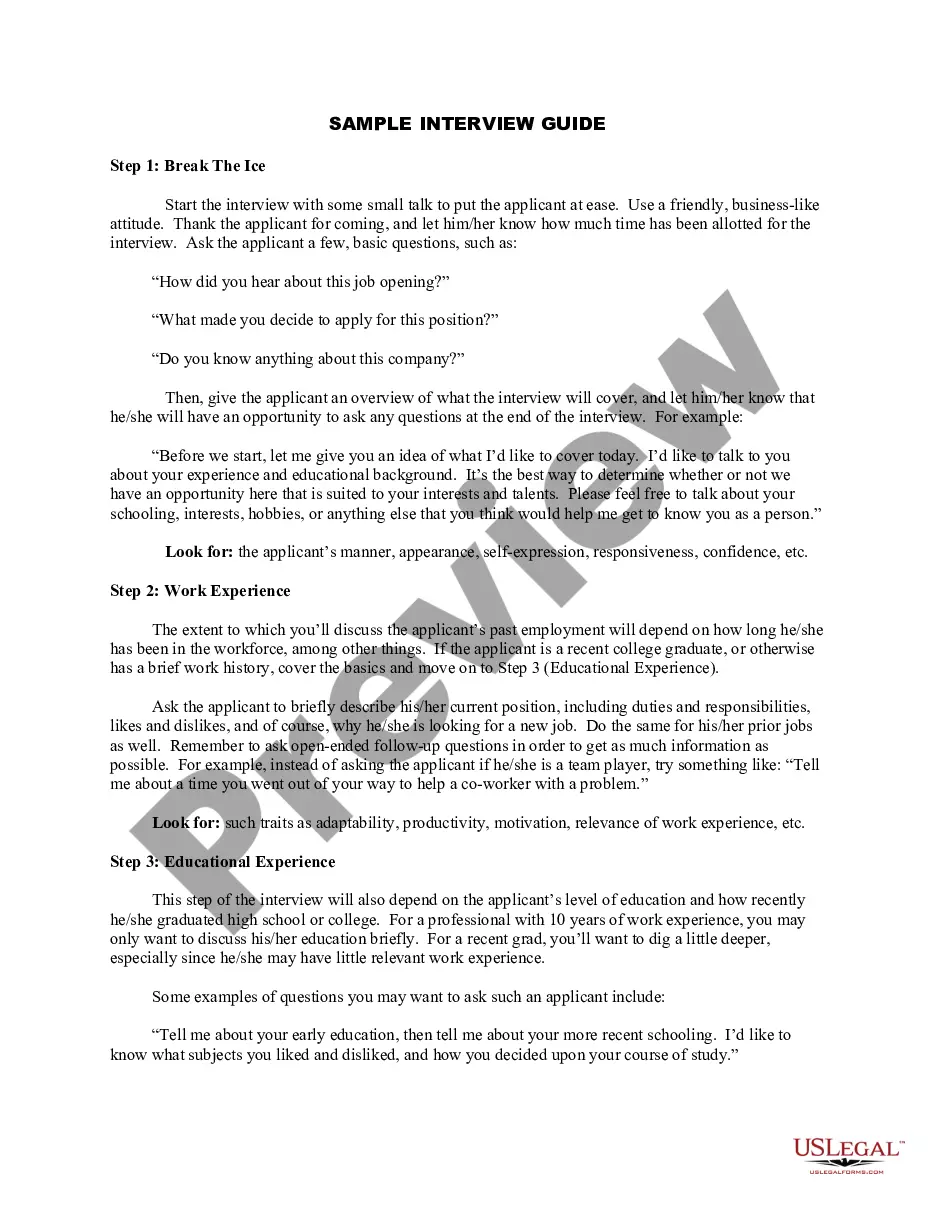

How to fill out Connecticut Roofing Contract For Contractor?

The greater the number of documents you must produce - the more anxious you become.

You can discover a vast array of Connecticut Roofing Agreement for Contractor templates on the internet, but you’re unsure which ones to trust.

Eliminate the inconvenience and simplify the process of obtaining samples with US Legal Forms. Acquire expertly crafted documents that comply with state requirements.

Input the necessary information to create your profile and settle the order using PayPal or a credit card. Select a suitable document format and receive your sample. Find all templates you acquire in the My documents section. Simply visit there to generate a new copy of your Connecticut Roofing Agreement for Contractor. Even with expertly crafted templates, it remains essential to consider consulting your local attorney to verify that your completed sample is accurately filled out. Achieve more for less with US Legal Forms!

- If you already possess a subscription to US Legal Forms, Log In to your account, and you’ll locate the Download key on the Connecticut Roofing Agreement for Contractor’s page.

- If you haven’t utilized our service previously, complete the registration process by following these steps.

- Verify that the Connecticut Roofing Agreement for Contractor is applicable in your state.

- Reassess your choice by reading the description or by using the Preview feature if it’s available for the chosen document.

- Click on Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

Connecticut's sales tax is assessed on goods and services, including labor.You pay sales tax on labor when it occurs as part of a taxable service. Taxable services include the work of building contractors, computer specialists, personal service providers and business service providers.

You can charge them for the lost opportunity. However, you will not be able to legally collect if they fail to pay. Moreover, you might lose them as a client. If they call you again, you need to agree that there will be a cancellation fee if they cancel upon less than 24 hours notice.

A contractor or subcontractor can abandon a contract upon breach by the owner or general contractor, but cannot terminate the contract.Termination for convenience allows the owner/general contractor to stop the work for just about any reason without having to pay for anticipated profit or unperformed work.

While home improvement and new home construction contractors must be registered to do business in Connecticut, certain types of skilled work requires the additional training, experience and education that professional licensing helps to ensure.

In other words, contractors pay sales and use tax on all their purchases as is the case in Connecticut. Typically, the gross receipts of contractors are not subject to sales or use tax.

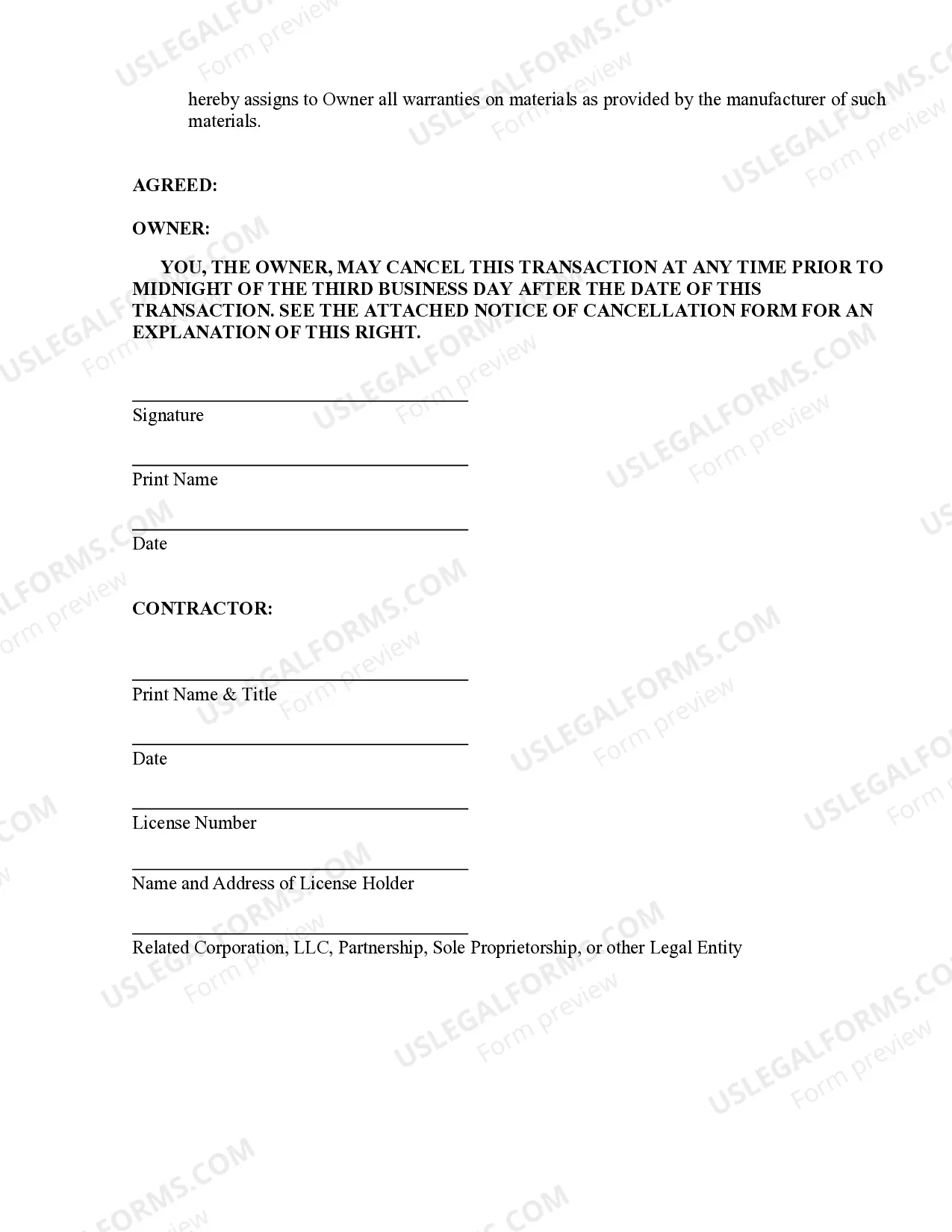

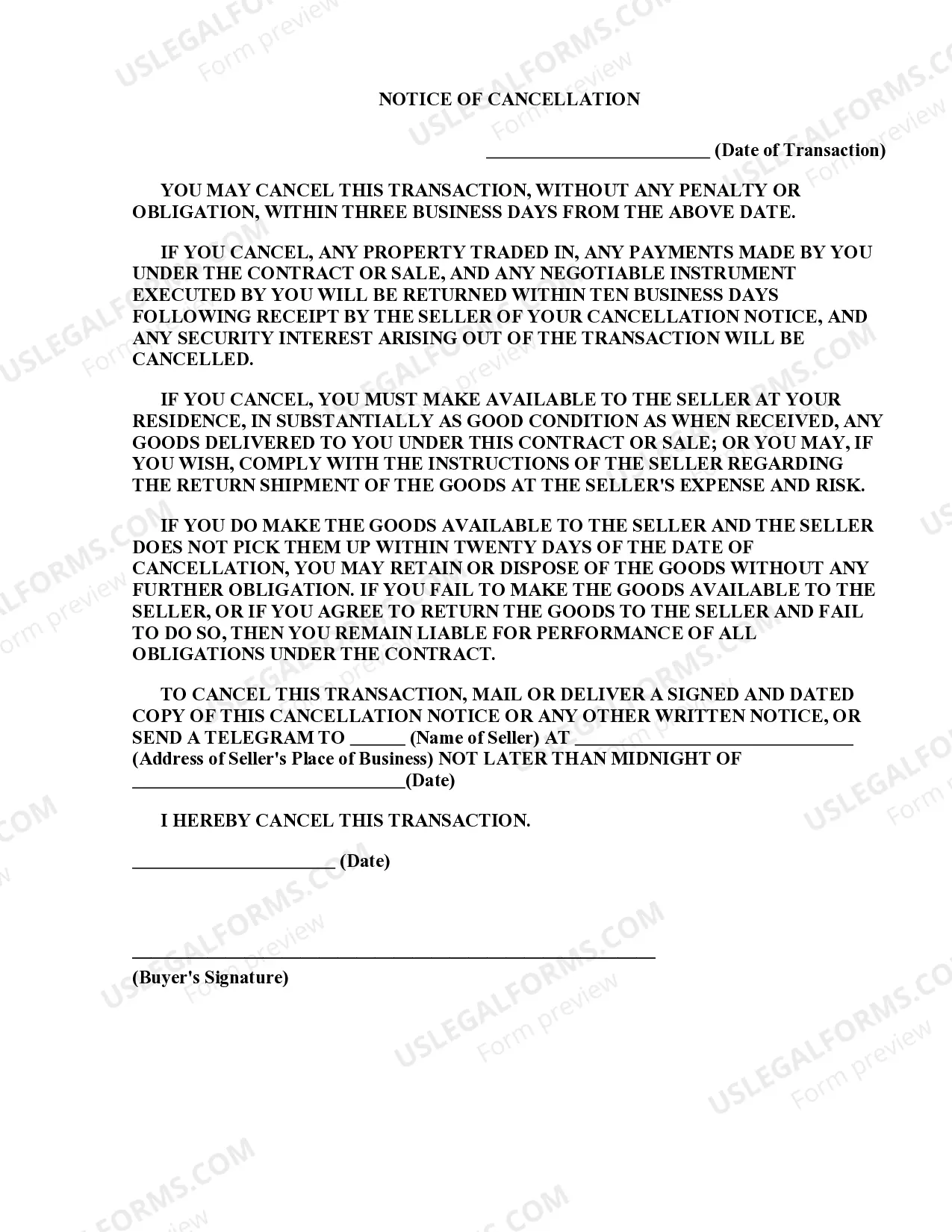

Homeowners who enter into contracts with contractors to improve, remodel or repair their homes almost always have a right to cancel the contract, without any penalty or obligation, within three business days after signing the contract.

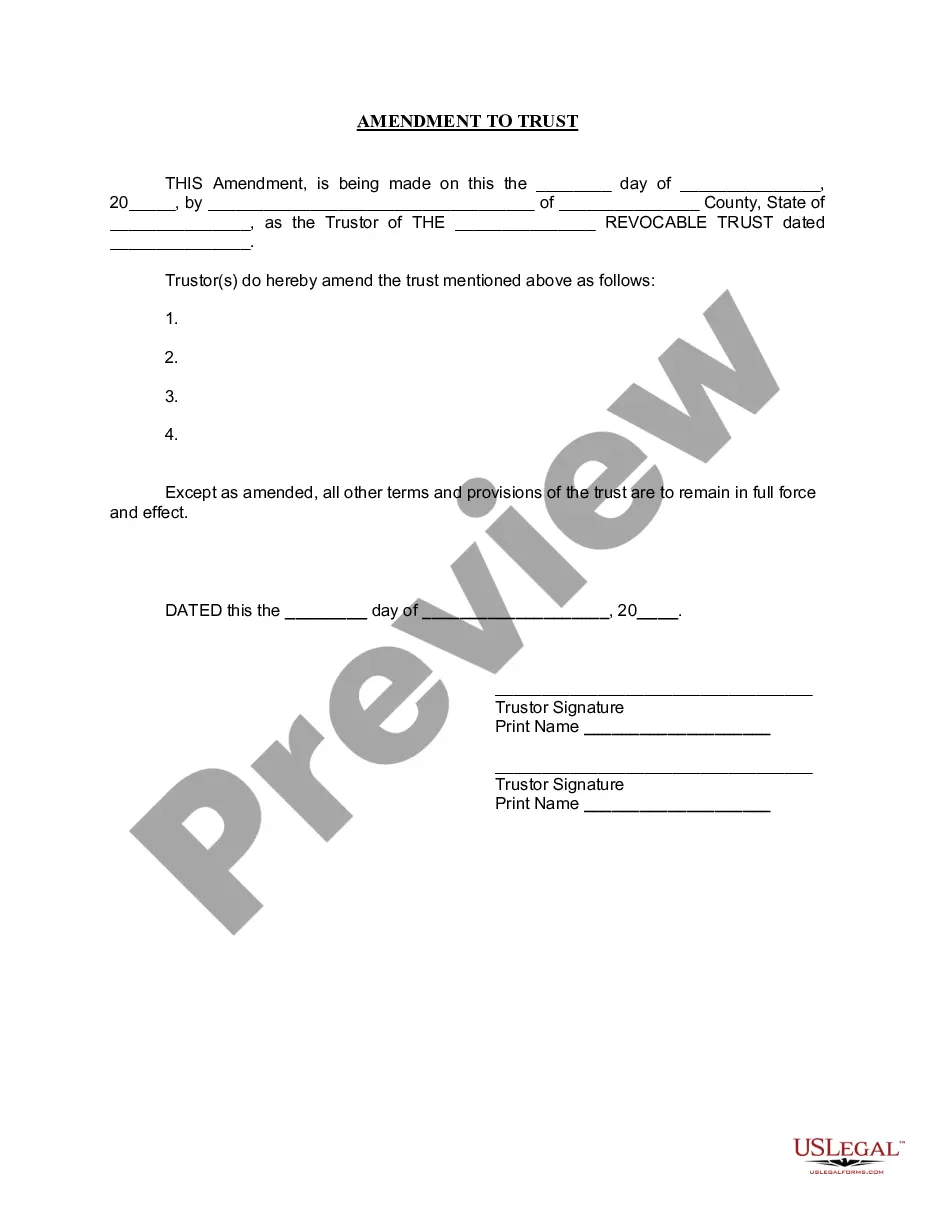

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

Connecticut's sales tax is assessed on goods and services, including labor.You pay sales tax on labor when it occurs as part of a taxable service. Taxable services include the work of building contractors, computer specialists, personal service providers and business service providers.

Always terminate the contractor in writing, rather than orally. Even if the contractor doesn't show up for work, you have to document the termination by sending a written notice specifying the reason for termination without defaming the contractor.