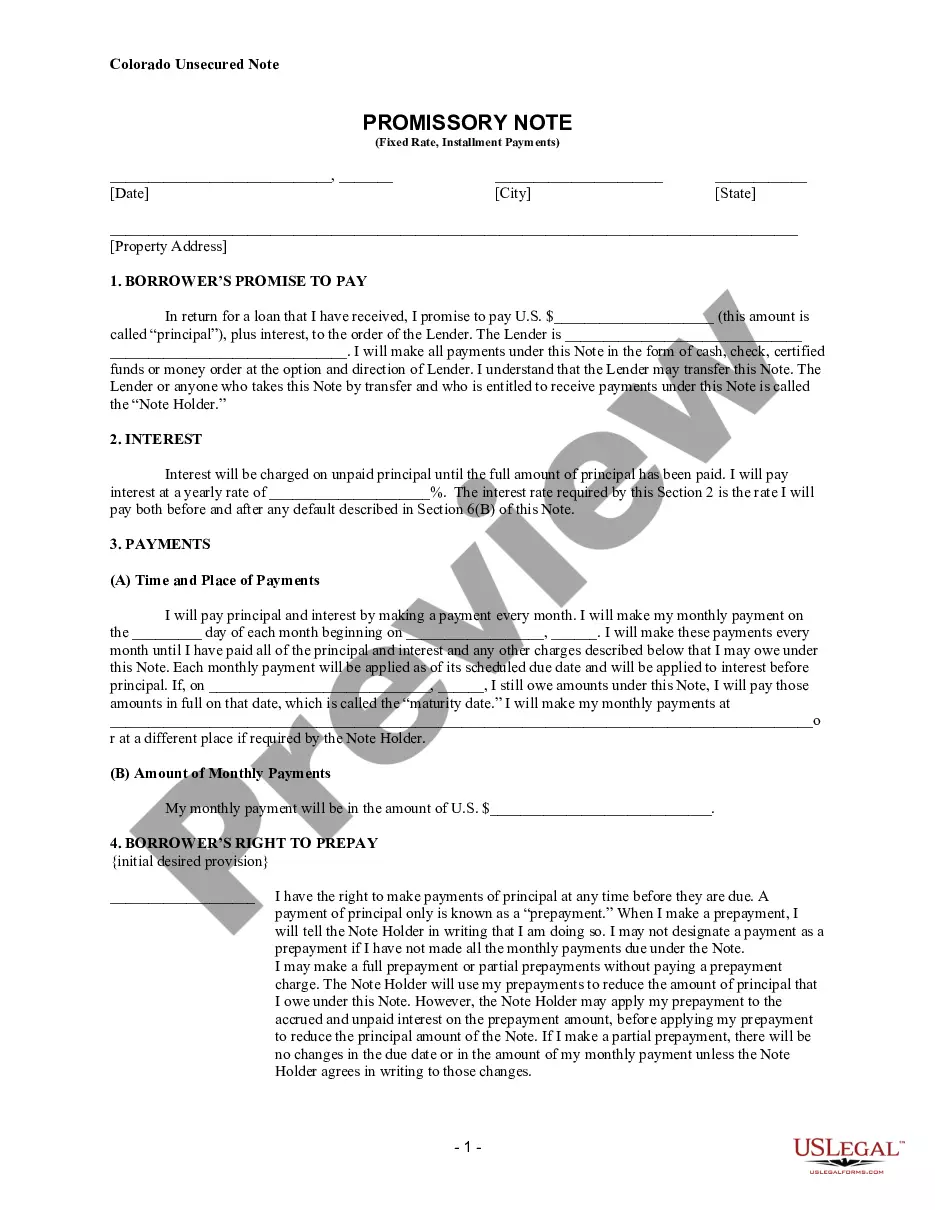

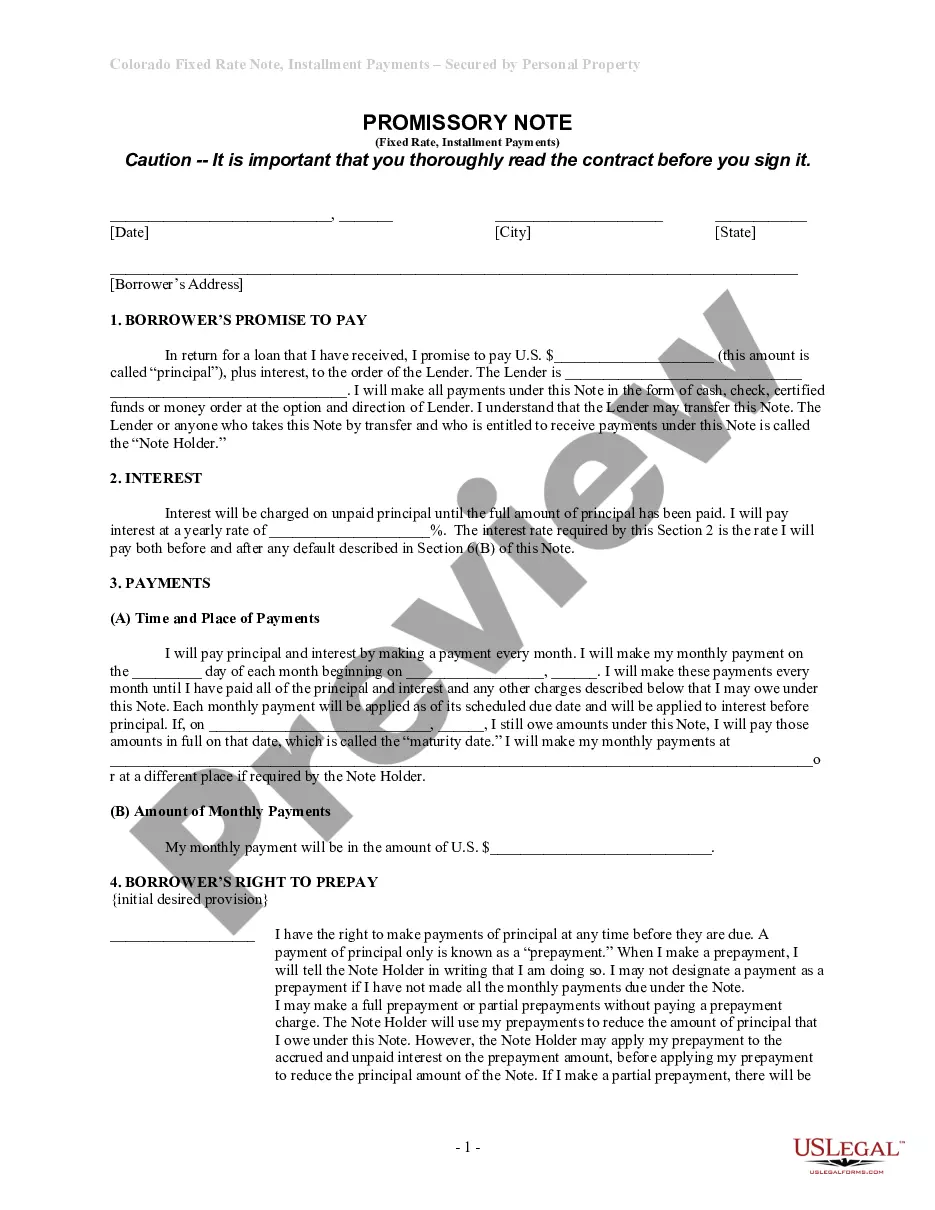

Colorado Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Colorado Unsecured Installment Payment Promissory Note For Fixed Rate?

The greater number of documents you are required to produce - the more anxious you feel.

You can discover countless Colorado Unsecured Installment Payment Promissory Note for Fixed Rate templates available online; however, you may be unsure which ones to trust.

Eliminate the frustration to simplify your search for samples using US Legal Forms.

Do more for less with US Legal Forms! Even with properly drafted templates, it is still important to consult a local attorney to double-check your filled-out sample to ensure that your document is correctly completed.

- Obtain accurately prepared forms that are tailored to meet the state regulations.

- If you're already a US Legal Forms subscriber, Log In to your account, and you will see the Download button on the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate’s page.

- If you haven’t used our platform previously, follow these steps to complete the registration process.

- Ensure that the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is legitimate in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if available for the chosen document.

Form popularity

FAQ

Filling out a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate involves several key steps. Start by including the names and addresses of both parties—borrower and lender. Clearly state the amount being borrowed, the interest rate, and the repayment schedule. Finally, both parties should sign and date the document to validate the agreement.

A note generally refers to any written document acknowledging a debt, while a promissory note specifically includes a borrower's commitment to repay that debt under certain conditions. Thus, all promissory notes are notes, but not all notes are promissory notes. The Colorado Unsecured Installment Payment Promissory Note for Fixed Rate stands out as a dedicated document that outlines specific repayment terms, aiding borrowers in organizing their finances.

An installment note typically involves a series of scheduled payments and outlines terms such as interest rates and payment intervals. On the other hand, a promissory note is broader and can exist without specifying any payment schedule. Thus, the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is a specific form of a promissory note that incorporates installment payment features, making it easier to manage loans.

Legal requirements for a promissory note in Colorado include the necessity for the note to be written, signed by the borrower, and to clearly state the payment terms. The document should reflect that it is a debt obligation, and ideally, it should be clear and straightforward to avoid ambiguity. Using a structured Colorado Unsecured Installment Payment Promissory Note for Fixed Rate can assist in fulfilling these legal requirements effectively.

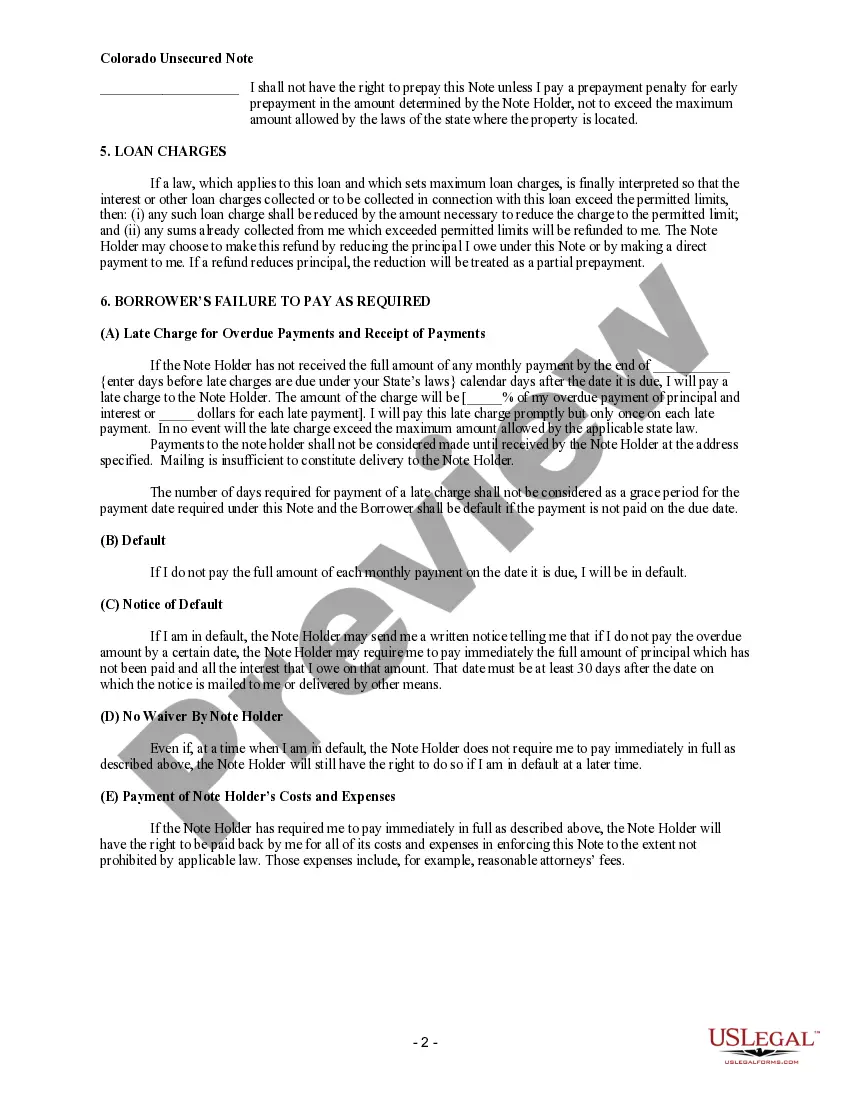

A comprehensive Colorado Unsecured Installment Payment Promissory Note for Fixed Rate should contain clear information such as the names of the parties involved, the amount being borrowed, the interest rate, and the repayment timeline. Furthermore, it should detail any penalties for late payments and the resolution process in case of default. Including these components ensures clarity and mutual understanding for all involved.

In Colorado, notarization of a promissory note is not specifically required for it to be valid. However, having a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate notarized may enhance its credibility and may be necessary for certain lenders. It serves to confirm the identity of the signer and can help in avoiding disputes in the future.

A promissory note can be deemed invalid for several reasons, such as missing critical information, lack of signatures, or if it contains illegal terms. Additionally, if the document does not meet Colorado's legal requirements, it could be challenged in court. To avoid these pitfalls, consider using a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate that complies with all necessary regulations.

Yes, a promissory note can be unsecured, meaning it does not require collateral from the borrower. This type of note relies heavily on the trust between the lender and borrower. For those exploring this option, a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate can provide a structured approach to managing payments while minimizing risk.

To obtain a copy of a promissory note, you should contact the lender or institution that issued the note. If the note is part of a larger agreement, it may also be filed with the county recorder's office. Utilizing the right templates, like the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate, can simplify the process of keeping accurate records for future reference.

In Colorado, a promissory note must contain specific elements to be legally valid. It should clearly state the amount being borrowed, the interest rate, and the payment schedule. Additionally, it must outline the borrower's obligations and include both signatures. Using a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate can help ensure all of these details are accurately included.