California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship

Form popularity

FAQ

Disadvantages of community property with right of survivorship include a lack of control for the deceased spouse over asset distribution. This arrangement may prevent individuals from leaving specific assets to heirs or other beneficiaries outside the marriage. Furthermore, understanding the California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship can help couples navigate these challenges and make informed decisions about asset management.

In California, community property with right of survivorship refers to assets acquired during a marriage, which pass to the surviving spouse upon the other spouse's death. This legal arrangement simplifies asset transfer and avoids lengthy probate proceedings. Utilizing the California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship allows for a straightforward process, ensuring quick access to shared property.

One downside of community property with right of survivorship is that it can lead to unintended consequences if one spouse has children from a previous relationship. In such cases, the surviving spouse automatically inherits all community property, potentially excluding the deceased spouse's children from inheritance. Therefore, careful planning and use of the California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship is essential to prevent complications.

Yes, the right of survivorship generally overrides a will when it comes to community property. If one spouse dies, the surviving spouse automatically inherits the deceased spouse's portion of the property through the right of survivorship. This process occurs outside of probate, making it crucial for couples in California to understand their rights under the California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship.

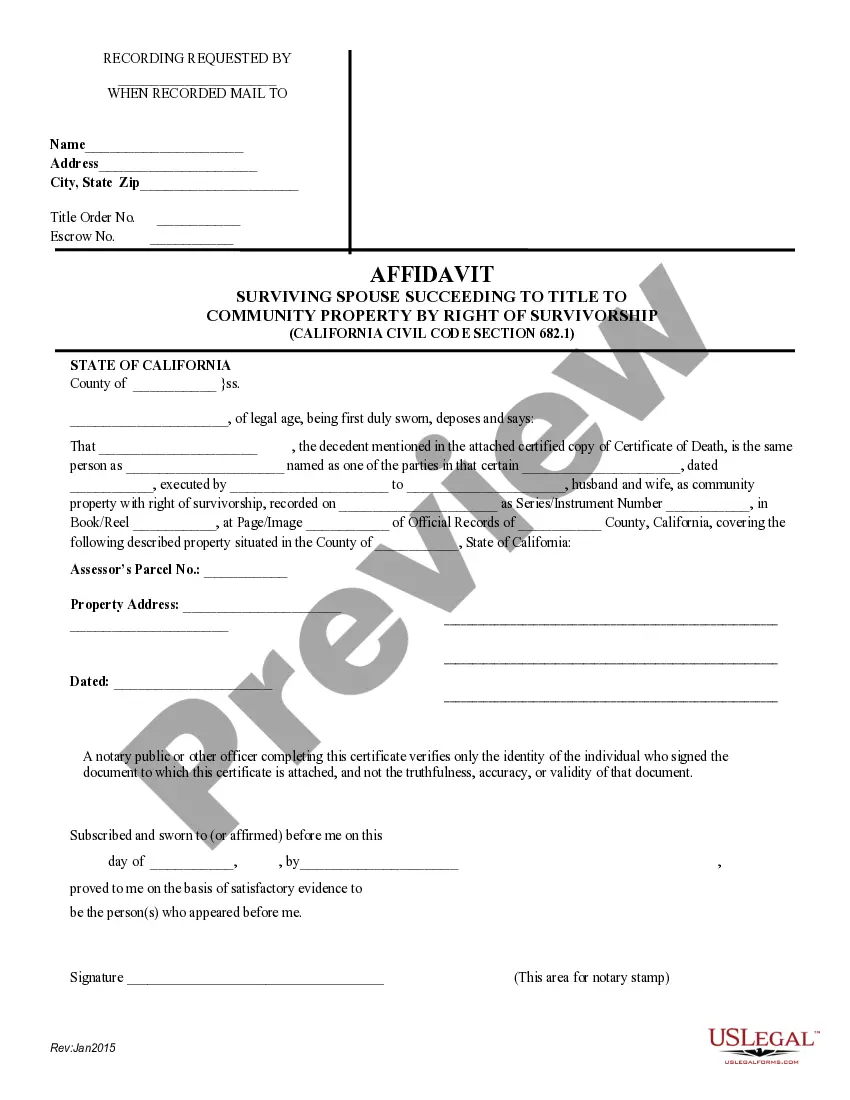

The California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship is a legal document used when one spouse passes away. This affidavit allows the surviving spouse to claim the deceased spouse's share of community property without going through probate. It simplifies the transfer process, ensuring that the surviving spouse retains ownership of shared assets quickly and efficiently.

Filling out an affidavit of death and heirship involves providing personal details about the deceased, their heirs, and the relationship between them. Be sure to include any relevant property details that the heirs will inherit. The completed affidavit should be signed before a notary public to ensure legal validity. To make this process easier, consider using the California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship from USLegalForms, which guides you through the necessary steps.

To complete an affidavit of death of a joint tenant in California, you must first gather necessary information, including details about the deceased joint tenant. The completed form must be signed in front of a notary public to validate the affidavit. After notarization, file this document with the county recorder’s office. This process can be streamlined using a California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship available on USLegalForms.

In California, when a spouse dies, community property typically transfers to the surviving spouse by right of survivorship. This means that the surviving spouse becomes the sole owner of the community property without the need for probate. To ensure this property transfer is handled correctly, the surviving spouse may need to complete a California Affidavit- Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship. Using a reliable platform like USLegalForms can simplify this process.

In California, community property is divided equally between spouses upon the death of one spouse. The surviving spouse retains their half and may inherit the deceased spouse's half, particularly if there is no will. This division ensures that both spouses' contributions during the marriage are recognized. To address these matters efficiently, a California Affidavit - Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship can be an effective tool.

When one owner of a jointly owned property dies in California, the property usually transfers to the surviving owner through the right of survivorship. This means the surviving owner gains full ownership without needing probate. If no right of survivorship exists, the deceased’s share may go to their heirs according to state laws. You may want to file a California Affidavit - Surviving Spouse Succeeding to Title to Community Property by Right of Survivorship to confirm this transfer.