- US Legal Forms

-

Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed...

Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Understanding this form

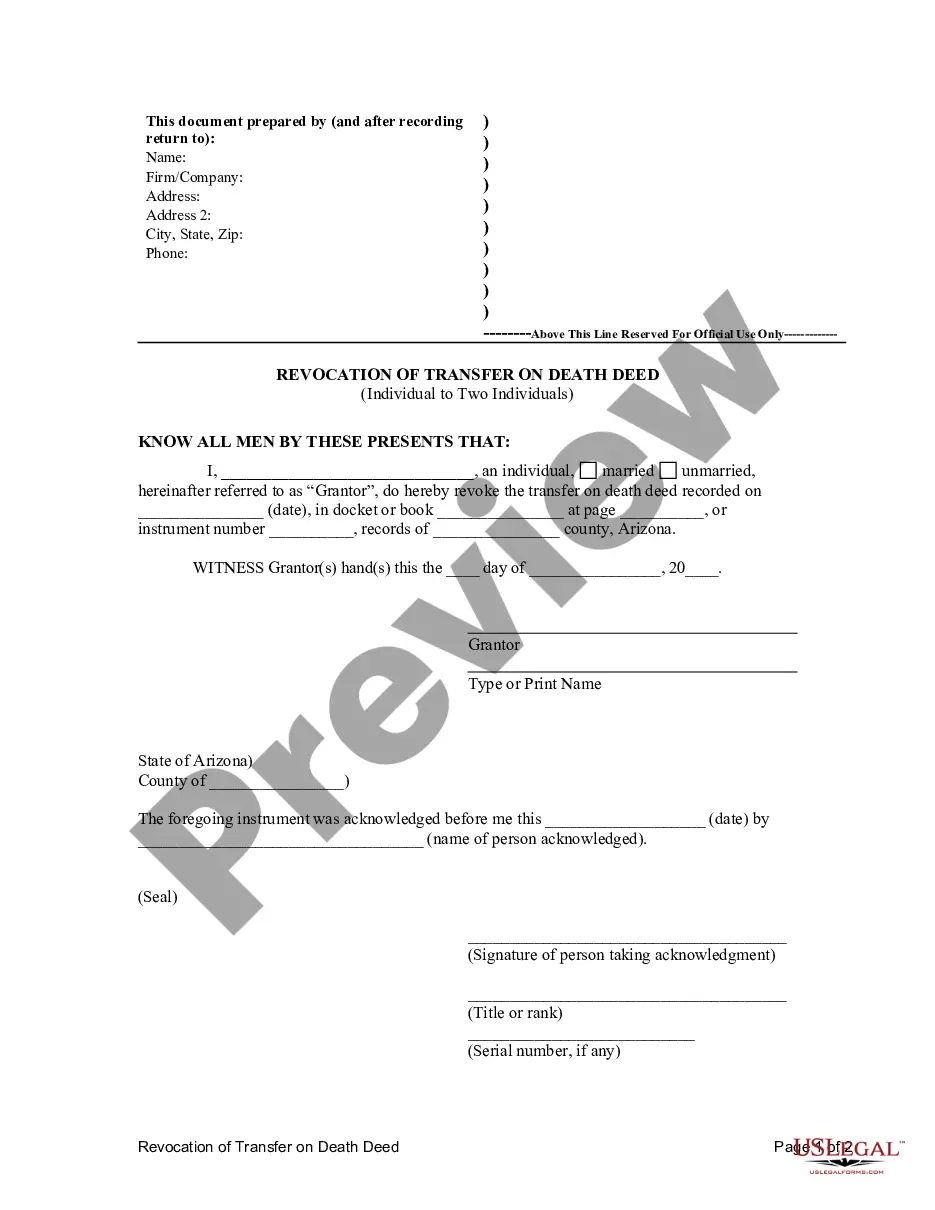

The Revocation of Transfer on Death Deed, also known as a TOD or Beneficiary Deed, allows you to revoke a previously executed transfer on death deed. This form is essential for property owners who want to change their designated beneficiaries for real estate after a transfer on death deed has been recorded. Unlike other forms of property transfer, a TOD deed enables owners to retain complete control over their property while they are alive, and it cannot be altered by a will.

Main sections of this form

- Grantor's signature - the person revoking the deed.

- Date of revocation - the date when the revocation is executed.

- Acknowledgment by a notary public - required for legal validity.

- Identification of the property - description of the real property being revoked.

- County recorder's information - where the revocation must be filed.

Related forms

Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals

Deed of Gift of Real Property

Owner's - Seller's - Affidavit

Partial Release of Deed of Trust

Basic Beneficiary Deed

When to use this document

You should use the Revocation of Transfer on Death Deed when you wish to cancel a previously recorded beneficiary deed for real property. Common scenarios include changes in personal circumstances, such as divorce or the death of a beneficiary, or simply if you have decided to designate a different beneficiary. It is essential to ensure that this revocation is filed before the death of the grantor for it to be effective.

Who needs this form

- Property owners in Arizona looking to revoke a previously executed transfer on death deed.

- Individuals who have changed beneficiaries due to personal circumstances.

- Anyone wanting to modify their estate planning concerning real estate holdings.

Completing this form step by step

- Identify the grantor (the individual revoking the deed) and provide their signature.

- Specify the date of the revocation on the designated line.

- Complete the property description section to identify the real property involved.

- Have the grantor sign the form in front of a notary public.

- Submit the completed and signed revocation to the county recorder's office for recording.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Related legal definitions

Mistakes to watch out for

- Failing to file the revocation before the grantor's death.

- Not having the form notarized, which could lead to legal challenges.

- Incorrectly describing the property, causing confusion during the recording process.

Benefits of using this form online

- Convenient access and immediate download of the legal form.

- Editability allows you to customize the form to your specific needs.

- Reliability, as the form is drafted by licensed attorneys to ensure legal compliance.

Quick recap

- The Revocation of Transfer on Death Deed allows for the change of beneficiaries on a property.

- It must be executed before the grantor's death and properly recorded with the county recorder.

- Notarization is a requirement for the revocation to be valid.

Looking for another form?

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Guam

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Puerto Rico

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virgin Islands

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Viewed forms

Form popularity

FAQ

The most effective way to transfer property title between family members is to utilize a properly executed deed, such as a Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. This method allows for seamless transfer upon one party's death without the hassles of probate. It’s essential to ensure that the deed is recorded and in compliance with Arizona law to protect all parties' interests.

When a property owner dies without a will in Arizona, their estate enters intestate succession. The state law determines how the property is distributed among surviving relatives. This can complicate matters compared to using a Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, which allows for easier transfer of property upon death, avoiding lengthy probate processes.

Transferring a property deed from a deceased relative in Arizona typically requires addressing the estate through probate. It's essential to gather documentation, such as the death certificate and the will, if available. Once the probate process is complete, you can file the appropriate deed, including a revocation of any Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, to legally transfer the property title to the heirs.

In Arizona, a deed must be recorded to provide public notice and establish its validity against third parties. Without recording, the deed may still be valid between the parties involved, but it may not protect the interests of those heirs or third parties. Recording the deed is especially important for the Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, as it ensures that the intended transfer of property is legally recognized.

To transfer property after your parent passes away in Arizona, first check if a Transfer on Death Deed (TOD) was recorded. If there was a TOD, the property will automatically transfer to the designated beneficiary without going through probate. If no TOD exists, you may need to initiate probate proceedings. For assistance, consider using US Legal Forms, which offers resources on the Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual to guide you through the process.

To remove someone from a property deed in Arizona, you will need to create a new deed that omits the individual you wish to remove. This process often involves drafting a quitclaim deed, which can facilitate a change in ownership. It's important to have the new deed signed and notarized before recording it at the County Recorder's Office. Using a platform like uslegalforms can simplify this process and ensure compliance with legal requirements.

Revoking a beneficiary deed in Arizona requires you to draft a revocation deed that clearly indicates your intent to revoke the prior deed. You must sign and notarize this new document and then record it at the County Recorder's Office. By doing so, you ensure that your property will not transfer as originally intended, allowing you greater control over your estate plan.

After a property owner's death in Arizona, the beneficiary deed serves as a key document for the property transfer. The named beneficiary should file a certified copy of the death certificate along with the beneficiary deed at the County Recorder's Office. This action initiates the transfer process, allowing the property to bypass probate. By following these steps, the beneficiary can directly take possession of the property.

To revoke a beneficiary deed in Arizona, you must create a new document that expressly revokes the previous deed. This new deed should be signed and notarized, similar to the original beneficiary deed process. After you prepare the revocation, you must record it at the County Recorder's Office. This step is crucial to ensure that your intentions regarding property transfer are legally honored.

Recording a beneficiary deed in Arizona is straightforward. First, prepare the beneficiary deed form, ensuring all required information is accurate. Next, sign the deed in front of a notary public. Finally, take the signed deed to your local County Recorder's Office and submit it for recording. This action ensures your property will pass to your designated beneficiaries without probate.

Arizona Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual Related Searches

-

Arizona transfer on death deed form

-

Beneficiary deed Arizona tax implications

-

Transfer on death deed Arizona pdf

-

Arizona beneficiary deed statute

-

AZ beneficiary deed

-

Can a beneficiary deed be contested

-

arizona - maricopa county beneficiary deed form

-

How much does a beneficiary deed cost

Explore more forms

Consent to Magistrate Judge

Consent to Proceed Before a Magistrate Judge in a Misdemeanor Case

Civil Subpoena - Hearing

Civil Subpoena - Deposition

Subpoena to Produce Documents, Information, or Objects or to Permit Inspection of Premises in a Civil Action

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Arizona

-

Alabama

-

Arkansas

-

Colorado

-

Connecticut

-

Delaware

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Louisiana

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Mexico

-

North Dakota

-

Pennsylvania

-

Rhode Island

-

South Dakota

-

Tennessee

-

Utah

-

Washington

-

Wisconsin

-

Wyoming

Contract for Deed - General - Arizona

Related Arizona Legal Forms

TITLE 33 PROPERTY

CHAPTER 4 CONVEYANCES AND DEEDS

ARTICLE 1. FORMAL REQUIREMENTS AND MODEL FORMS

33-405. Beneficiary deeds; recording; definitions

A. A deed that conveys an interest in real property, including any debt secured by a lien on real property, to a grantee beneficiary designated by the owner and that expressly states that the deed is effective on the death of the owner transfers the interest to the designated grantee beneficiary effective on the death of the owner subject to all conveyances, assignments, contracts, mortgages, deeds of trust, liens, security pledges and other encumbrances made by the owner or to which the owner was subject during the owner’s lifetime.

B. A beneficiary deed may designate multiple grantees who take title as joint tenants with right of survivorship, tenants in common, a husband and wife as community property or as community property with right of survivorship, or any other tenancy that is valid under the laws of this state.

C. A beneficiary deed may designate a successor grantee beneficiary. If the beneficiary deed designates a successor grantee beneficiary, the deed shall state the condition on which the interest of the successor grantee beneficiary would vest.

D. If real property is owned as joint tenants with the right of survivorship or as community property with the right of survivorship, a deed that conveys an interest in the real property to a grantee beneficiary designated by all of the then surviving owners and that expressly states that the deed is effective on the death of the last surviving owner transfers the interest to the designated grantee beneficiary effective on the death of the last surviving owner. If a beneficiary deed is executed by fewer than all of the owners of real property owned as joint tenants with right of survivorship or community property with right of survivorship, the beneficiary deed is valid if the last surviving owner is one of the persons who executes the beneficiary deed. If the last surviving owner did not execute the beneficiary deed, the transfer shall lapse and the deed is void. An estate in joint tenancy with right of survivorship or community property with right of survivorship is not affected by the execution of a beneficiary deed that is executed by fewer than all of the owners of the real property, and the rights of a surviving joint tenant with right of survivorship or a surviving spouse in community property with right of survivorship shall prevail over a grantee beneficiary named in a beneficiary deed.

E. A beneficiary deed is valid only if the deed is executed and recorded as provided by law in the office of the county recorder of the county in which the property is located before the death of the owner or the last surviving owner. A beneficiary deed may be used to transfer an interest in real property to the trustee of a trust even if the trust is revocable.

F. A beneficiary deed may be revoked at any time by the owner or, if there is more than one owner, by any of the owners who executed the beneficiary deed. To be effective, the revocation must be executed and recorded as provided by law in the office of the county recorder of the county in which the real property is located before the death of the owner who executes the revocation. If the real property is owned as joint tenants with right of survivorship or community property with right of survivorship and if the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner.

G. If an owner executes and records more than one beneficiary deed concerning the same real property, the last beneficiary deed that is recorded before the owner’s death is the effective beneficiary deed.

H. This section does not prohibit other methods of conveying property that are permitted by law and that have the effect of postponing enjoyment of an interest in real property until the death of the owner. This section does not invalidate any deed otherwise effective by law to convey title to the interests and estates provided in the deed that is not recorded until after the death of the owner.

I. The signature, consent or agreement of or notice to a grantee beneficiary of a beneficiary deed is not required for any purpose during the lifetime of the owner.

J. A beneficiary deed that is executed, acknowledged and recorded in accordance with this section is not revoked by the provisions of a will.

K. A beneficiary deed is sufficient if it complies with other applicable laws and if it is in substantially the following form:

Beneficiary Deed

I (we) _________________________ (owner) hereby convey to ___________________________ (grantee beneficiary) effective on my (our) death the following described real property:

(Legal description)

If a grantee beneficiary predeceases the owner, the conveyance to that grantee beneficiary shall either (choose one):

[] Become null and void.

[] Become part of the estate of the grantee beneficiary.

_________________________

(Signature of grantor(s))

(acknowledgment).

L. The instrument of revocation shall be sufficient if it complies with other applicable laws and is in substantially the following form:

Revocation of Beneficiary Deed

The undersigned hereby revokes the beneficiary deed recorded on ___________ (date), in docket or book ______________ at page ________, or instrument number ____________, records of ________________ county, Arizona.

Dated: _______________________

______________________________

Signature

(acknowledgment).

M. For the purposes of this section:

1. “Beneficiary deed” means a deed authorized under this section.

2. “Owner” means any person who executes a beneficiary deed as provided in this section.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-741. Definitions

In this article, unless the context otherwise requires:

1. “Account servicing agent” means a joint agent of seller and purchaser, appointed under the contract or under a separate agreement executed by the seller and the purchaser, to hold documents and collect monies due under the contract, who does business under the laws of this state as a bank, trust company, escrow agent, savings and loan association, insurance company or real estate broker, or who is licensed, chartered or regulated by the federal deposit insurance corporation or the comptroller of the currency, or who is a member of the state bar of Arizona.

2. “Contract” means a contract for conveyance of real property, a contract for deed, a contract to convey, an agreement for sale or any similar contract through which a seller has conveyed to a purchaser equitable title in property and under which the seller is obligated to convey to the purchaser the remainder of the seller’s title in the property, whether legal or equitable, on payment in full of all monies due under the contract. This article does not apply to purchase contracts and receipts, escrow instructions or similar executory contracts which are intended to control the rights and obligations of the parties to executory contracts pending the closing of a sale or purchase transaction.

3. “Monies due under the contract” means:

(a) Any principal and interest payments which are currently due and payable to the seller.

(b) Any principal and interest payments which are currently due and payable to other persons who hold existing liens and encumbrances on the property, the unpaid principal portion of which constitutes a portion of the purchase price, as stated in the contract, if the principal and interest payments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(c) Any delinquent taxes and assessments, including interest and penalty, due and payable to any governmental entity authorized to impose liens on the property which are the purchaser’s obligations under the contract, if the taxes and assessments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(d) Any unpaid premiums for any policy or policies of insurance which are the obligation of the purchaser to maintain under the contract, if the premiums were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

4. “Payoff deed” means the deed that the seller is obligated to deliver to the purchaser on payment in full of all monies due under the contract to convey to the purchaser the remainder of the seller’s title in the property, whether legal or equitable, as prescribed by the terms of the contract.

5. “Property” means the real property described in the contract and any personal property included under the contract.

6. “Purchaser” means the person or any successor in interest to the person who has contracted to purchase the seller’s title to the property which is the subject of the contract.

7. “Seller” means the person or any successor in interest to the person who has contracted to convey his title to the property which is the subject of the contract.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-742. Forfeiture of interest of purchaser in default under contract

A. If a purchaser is in default by failing to pay monies due under the contract, a seller may, after expiration of the applicable period stated in subsection D of this section and after serving the notice of election to forfeit stated in section 33-743, complete the forfeiture of the purchaser’s interest in the property in the manner provided by section 33-744 or 33-745. If the contract provides that the seller may elect to accelerate the principal balance due under the contract to the seller on the purchaser’s failure to pay the monies due, the seller may accelerate the principal balance due to the seller at any time after the purchaser has failed to pay the monies due under the contract. The acceleration may occur before or after the expiration of the applicable period stated in subsection D of this section and without serving the notice of election to forfeit stated in section 33-743. If the seller elects to accelerate the principal balance due to the seller, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748. If a purchaser is in default under the contract for reasons other than failing to pay monies due under the contract, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748.

B. The interest of a purchaser in any personal property included in a contract is subject to forfeiture or foreclosure in the same manner as the real property, except that forfeiture or foreclosure does not affect or impair the rights of a holder of a security interest whose interest in the personal property is not subordinate to that of the seller.

C. If a contract provides that time is of the essence, a waiver of that provision occurs only if the seller has accepted monies due under the contract in an amount which is less than the total monies due under the contract at the time of the acceptance. Receipt of any monies due under the contract by an account servicing agency does not constitute acceptance by the seller. A seller’s delay in exercising any remedy granted either by the contract or by law does not constitute a waiver of a time is of the essence provision. If the time of the essence provision has been waived, the seller may reinstate the provision by serving a written notice on the purchaser and the account servicing agent, if one has been appointed, requiring strict performance of the purchaser’s obligations to pay monies due under the contract. The notice shall be served, either by delivery in person or deposit in the United States mail, first class, postage prepaid, at least twenty days prior to the date on which the seller will require the purchaser to pay the monies due under the contract. A copy of the notice need not be recorded in the county in which the real property is located or served on any person other than the purchaser and the account servicing agent, if one has been appointed.

D. Forfeiture of the interest of a purchaser in the property for failure to pay monies due under the contract may be enforced only after expiration of the following periods after the date such monies were due:

1. If there has been paid less than twenty per cent of the purchase price, thirty days.

2. If there has been paid twenty per cent, or more, but less than thirty per cent of the purchase price, sixty days.

3. If there has been paid thirty per cent, or more, but less than fifty per cent of the purchase price, one hundred and twenty days.

4. If there has been paid fifty per cent, or more, of the purchase price, nine months.

E. For the purpose of computing the percentage of the purchase price paid under subsection D of this section, the total of only the following constitutes payments on the purchase price:

1. Down payments paid to the seller.

2. Principal payments paid to the seller on the contract.

3. Principal payments paid to other persons who hold liens or encumbrances on the property, the principal portion of which constitutes a portion of the purchase price, as stated under the contract.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-743. Notice of election to forfeit and reinstatement of purchaser’s interest

A. If the seller elects to forfeit the purchaser’s interest in the property, the seller and the account servicing agent, if one has been appointed, shall record a notice of election to forfeit with the county recorder of the county in which the real property is located. A notice of election to forfeit is ineffective unless recorded after expiration of the applicable period prescribed in section 33-742, subsection D. A copy of the notice shall be served, either by delivery in person or by deposit in the United States mail, first class, postage prepaid, at least twenty days prior to the effective date of the forfeiture, on the purchaser and on persons who, at the time of recordation of the notice of election to forfeit, appear on the records of the county recorder of the county in which the real property is located as having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, or who have requested a copy of such notice in the manner provided by section 33-746. If mailed, the notice shall be addressed to the last mailing address filed in writing with the seller or with the account servicing agent or as designated on the request for copy of notice of election to forfeit. If no address has been filed with the seller or the account servicing agent, a copy of the notice may be mailed in care of the person to whom any recorded document evidencing an interest in or a lien or encumbrance on the property was directed to be mailed at the time of its recording.

B. The notice of election to forfeit shall be substantially in the following form:

“Notice of Election to Forfeit

The undersigned hereby gives notice that the purchaser under that certain contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

has failed to pay monies due under the contract for a period of time in excess of that provided by Arizona Revised Statutes section 33-742, subsection D and is now subject to having his interest under the contract forfeited. The monies due under the contract which are required to be paid to reinstate such contract are as follows:

If the monies due under the contract are not received by five o’clock p.m. on the __________ day of _______________, 19____, being at least twenty days after the serving of this notice, at _______________, Arizona, the interest of the purchaser and all persons who have an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, shall be forfeited.

Dated _______________, 19____.

______________________________________

signature of seller, and

______________________________________

signature of account servicing agent

(if any)

(acknowledgments)”

C. A person need not be served with a copy of the notice of election to forfeit unless the person, at the time of recordation of the notice, appeared on the records of the county recorder of the county in which the real property is located as having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, or requested a copy of the notice in the manner provided for in section 33-746.

D. Failure to serve a copy of the notice of election to forfeit on each person as stated in subsection A of this section does not invalidate the service of the notice of election to forfeit as to persons served but extends the effective date of the forfeiture until at least twenty days after the persons not previously served have been served with a copy of the notice.

E. A purchaser who has failed to pay monies due under the contract or any other person may, at any time prior to expiration of the period provided for in the notice of election to forfeit, avoid the forfeiture by complying with the terms of the notice.

F. If the purchaser or any other person timely complies with the terms of the notice of election to forfeit, the seller or the account servicing agent shall record a notice of reinstatement with the county recorder of the county in which the real property is located. The notice of reinstatement shall be substantially in the following form:

“Notice of Reinstatement

The undersigned hereby gives notice that the notice of election to forfeit, dated _______________, 19____, pertaining to a contract which covers real property described as follows:

and including personal property described as follows:

which notice was recorded on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, is cancelled.

dated _______________, 19____.

______________________________________

signature of seller, or signature of

account servicing agent (if any)

(acknowledgment)”

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-744. Completion of forfeiture by judicial process

At any time after expiration of the period provided for in the notice of election to forfeit, the seller may complete the forfeiture of the interest of the purchaser and persons having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, by filing an action in the superior court in the county in which the real property is located to declare that the interest of the persons has been forfeited and to quiet title to the property in the seller. In the action, the seller shall name as defendants the purchaser and each person who, at the expiration of the period provided for in the notice of election to forfeit, had an interest in or a lien or encumbrance on the property, the priority of which was subordinate to that of the seller.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-745. Completion of forfeiture by notice

A. If an account servicing agent has been appointed to hold documents and collect monies due under the contract and the agent has recorded and served the notice of election to forfeit, as provided in section 33-743, the seller and account servicing agent may complete the forfeiture of the interest of the purchaser and persons having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, by recordation of an affidavit of completion of forfeiture with the county recorder of the county in which the real property is located. The county recorder shall index the affidavit of completion of forfeiture under the classification in which conveyances of real property are indexed.

B. Recordation of an affidavit of completion of forfeiture terminates without right of redemption all right, title and interest of the purchaser and all persons having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, including the interest of any persons acquiring an interest in or a lien or encumbrance on the property subsequent to recordation of the notice of election to forfeit. On recordation of the affidavit, the property reverts to the seller clear of all interests, liens and encumbrances, the priority of which was subordinate to that the seller. The recordation of the affidavit of completion of forfeiture also raises the presumption of compliance with all requirements of this article and constitutes conclusive evidence of the meeting of the requirements in favor of purchasers or encumbrancers for value and without actual notice.

C. The affidavit of completion of forfeiture shall be substantially in the following form:

“Affidavit of Completion of Forfeiture

The undersigned, being duly sworn, deposes and says that the purchaser under that certain contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

failed to pay amounts due under the contract; that on the date the monies were due, any provision of the contract which made time of the essence had not been waived or had been reinstated in the manner provided for in Arizona Revised Statutes section 33-742, subsection C; that the applicable period stated in Arizona Revised Statutes section 33-742, subsection D had expired after the date the monies were due; that a notice of election to forfeit was recorded with the county recorder of the county in which the real property is located; that a copy of the notice was served upon the purchaser and all persons who, at the time of recordation of the notice of election to forfeit, appeared on the records of the county recorder of the county in which the real property was located, as having an interest in or a lien or encumbrance on the property, the priority of which was subordinate to that of the seller, or who had requested a copy of the notice in the manner provided for in Arizona Revised Statutes section 33-746; that the terms of the notice of election to forfeit were not complied with prior to expiration of the period provided for in the notice; and that all right, title and interest of the purchaser and all persons having an interest in or a lien or encumbrance on the property, the priority of which was subordinate to that of the seller, are by this affidavit declared to be forfeited and to revert to the seller in accordance with the terms of the contract and the laws of the state of Arizona.

______________________________________

signature of seller,

______________________________________

signature of account servicing agent

(jurats)”

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-746. Request for copy of notice of election to forfeit

A. Any person, including, without limitation, a person in possession of the property or having an interest in or a lien or encumbrance on the property, which is not disclosed by a document recorded with the county recorder of the county in which the real property is located, who desires a copy of a notice of election to forfeit under a contract shall, prior to recording of a notice of election to forfeit, record with the county recorder of the county in which the real property is located a request for a copy of any notice of election to forfeit.

B. A request for a copy of any notice of election to forfeit under a contract shall be substantially in the following form:

“Request for Notice of Election to Forfeit

Request is hereby made that a copy of any notice of election to forfeit under the contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

be mailed to: _________________________________________________________, at _____________________________________________________________________.

Dated this __________ day of _______________, 19____.

______________________________________

signature

(acknowledgment)”

C. The existence and contents of a recorded request do not affect the title to the property or provide notice to any person that a person requesting a copy of the notice has an interest in or a lien or encumbrance on the property.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-747. Appointment of successor account servicing agent

A. If a person appointed as account servicing agent fails to qualify or is unwilling or unable to serve, the seller may appoint a successor account servicing agent, and the appointment constitutes a substitution of account servicing agent.

B. The seller may at any time remove an account servicing agent for any reason and appoint a successor account servicing agent, and the appointment constitutes a substitution of account servicing agent.

C. A substitution of an account servicing agent shall be made by written notice, personally delivered or mailed in the United States mail, first class, postage prepaid, to the purchaser, the account servicing agent and the successor account servicing agent and by recording a copy of the notice with the county recorder of the county in which the real property is located.

D. A notice of substitution of account servicing agent shall be substantially in the following form:

“Notice of Substitution of Account Servicing Agent

The undersigned seller hereby appoints:

_________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ successor account servicing agent under that certain contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

Dated this _______________ day of _______________, 19____.

______________________________________

signature of seller

(acknowledgment)”

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-748. Seller’s right to foreclose

A. If a contract provides that the seller may elect to accelerate the unpaid principal balance due to seller on the purchaser’s failure to pay the monies due under the contract, the seller may only enforce the acceleration by foreclosing the contract in the manner provided by law for foreclosure of mortgages upon real property. If a purchaser is in default under the contract for reasons other than failing to pay amounts due under the contract, the seller may only foreclose the contract as a mortgage in the manner provided by law for foreclosure of mortgages upon real property.

B. If an action to foreclose a contract has been filed, a forfeiture, by judicial process as provided by section 33-744 or by notice as provided by section 33-745, shall not thereafter be completed unless the foreclosure action is first dismissed and a notice of election to forfeit is served in the manner and on the persons provided for in section 33-743.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-749. Other remedies

A. The seller may maintain an action against any person, including the purchaser, for a claim for relief if damages or injury occurs, or may occur, to the property, including without limitation, an action for damages, or to prevent any of the following:

1. Physical abuse to or distribution of the property.

2. Waste.

3. Impairment of security provided by the contract.

B. An action for recovery of damages under subsection A of this section may be maintained:

1. At any time before the seller elects to forfeit or foreclose the purchaser’s interest in the property.

2. Within ninety days after completion of a forfeiture of the purchaser’s interest in the property as provided by section 33-745.

3. In conjunction with completion of a forfeiture of the purchaser’s interest in the property as provided by section 33-744.

4. In conjunction with the seller foreclosing the contract as a mortgage as provided for in section 33-748.

C. The remedies provided by this article are in addition to and do not preclude any other remedy granted either by the contract or by law which is not inconsistent with this article.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-750. Conveyance by seller; payment in full; payoff deed

A. A seller who is entitled to payment and who receives full payment of all monies due under the contract shall deliver to the person who made full payment a payoff deed that conveys to the purchaser the real property described in the contract. The deed shall be entitled “payoff deed”, shall state that it is being delivered to consummate a contract and shall include the docket and page number or recording number of the contract.

B. For a contract that provides for a purchase price obligation of one million dollars or less exclusive of interest, if a seller does not deliver a payoff deed pursuant to subsection A within sixty days of payment in full of all monies due under the contract, a title insurer as defined in section 20-1562 may prepare, execute and record a payoff deed. At least thirty days before issuing and recording a payoff deed pursuant to this subsection, the title insurer shall mail notice of its intention to record the payoff deed and a copy of the payoff deed by certified mail with postage prepaid and return receipt requested to all of the following:

1. The seller of record and the seller’s respective successors in interest of record at their last known addresses shown of record.

2. The account servicing agent if known.

3. Any person who received payment in full of the monies due under the contract according to the records of the title insurer at the address shown in the title insurer’s records.

C. The payoff deed prescribed by subsection B of this section shall set forth all of the following:

1. The name of the original seller and the seller’s successors in interest of record.

2. The name of the original account servicing agent and the successors in interest of the account servicing agent if of record or if known to the title insurer.

3. The name of the original purchaser and any successors in interest of record of that purchaser.

4. The date of recording and docket and page number or recording number of the contract.

5. The date and amount of payment.

6. A statement that the title insurer has actual knowledge that the monies due under the contract have been paid in full.

D. The title insurer or a duly appointed attorney-in-fact of the title insurer shall execute the payoff deed. Any delegation pursuant to this subsection does not relieve the title insurer from any liability pursuant to this section.

E. A payoff deed issued pursuant to subsection B of this section is entitled to recordation and, when recorded, constitutes a payoff deed issued pursuant to subsection A of this section.

F. In addition to any other remedy provided by law, a title insurer preparing or recording the payoff deed pursuant to subsection B of this section is liable to any party for actual damage, including attorney fees, that any person may sustain by reason of the issuance and recording of the payoff deed.

G. The title insurer shall not record a payoff deed if the title insurer receives notice before the expiration of the thirty day period prescribed by subsection B of this section from the seller or account servicing agent that the monies due under the contract have not been paid in full.

H. The title insurer may charge a reasonable fee to the owner of the land or any other person who requests a payoff deed including a fee for performing a title search, document preparation and mailing services and in addition may collect recording or other official fees.

Arizona Case Law

Arizona courts ruled that “although the law disfavors forfeitures, when it clearly appears from the terms of the contract that the parties have agreed to a contract that will result in forfeiture, the courts will enforce it.” Mohave County v. Mohave-Kingman Estates, Inc. 586 P.2d 978 (1978)

The Arizona court agreed that Ariz. Rev. Stat. 33-741 does not operate to extend a grace period to a defaulting purchaser in a cash real estate purchase contract. Brigham and Glickman v. First National Bank of Arizona, 629 P.2d 996

Contract for Deed - General - Arizona

Related Arizona Legal Forms

TITLE 33 PROPERTY

CHAPTER 4 CONVEYANCES AND DEEDS

ARTICLE 1. FORMAL REQUIREMENTS AND MODEL FORMS

33-405. Beneficiary deeds; recording; definitions

A. A deed that conveys an interest in real property, including any debt secured by a lien on real property, to a grantee beneficiary designated by the owner and that expressly states that the deed is effective on the death of the owner transfers the interest to the designated grantee beneficiary effective on the death of the owner subject to all conveyances, assignments, contracts, mortgages, deeds of trust, liens, security pledges and other encumbrances made by the owner or to which the owner was subject during the owner’s lifetime.

B. A beneficiary deed may designate multiple grantees who take title as joint tenants with right of survivorship, tenants in common, a husband and wife as community property or as community property with right of survivorship, or any other tenancy that is valid under the laws of this state.

C. A beneficiary deed may designate a successor grantee beneficiary. If the beneficiary deed designates a successor grantee beneficiary, the deed shall state the condition on which the interest of the successor grantee beneficiary would vest.

D. If real property is owned as joint tenants with the right of survivorship or as community property with the right of survivorship, a deed that conveys an interest in the real property to a grantee beneficiary designated by all of the then surviving owners and that expressly states that the deed is effective on the death of the last surviving owner transfers the interest to the designated grantee beneficiary effective on the death of the last surviving owner. If a beneficiary deed is executed by fewer than all of the owners of real property owned as joint tenants with right of survivorship or community property with right of survivorship, the beneficiary deed is valid if the last surviving owner is one of the persons who executes the beneficiary deed. If the last surviving owner did not execute the beneficiary deed, the transfer shall lapse and the deed is void. An estate in joint tenancy with right of survivorship or community property with right of survivorship is not affected by the execution of a beneficiary deed that is executed by fewer than all of the owners of the real property, and the rights of a surviving joint tenant with right of survivorship or a surviving spouse in community property with right of survivorship shall prevail over a grantee beneficiary named in a beneficiary deed.

E. A beneficiary deed is valid only if the deed is executed and recorded as provided by law in the office of the county recorder of the county in which the property is located before the death of the owner or the last surviving owner. A beneficiary deed may be used to transfer an interest in real property to the trustee of a trust even if the trust is revocable.

F. A beneficiary deed may be revoked at any time by the owner or, if there is more than one owner, by any of the owners who executed the beneficiary deed. To be effective, the revocation must be executed and recorded as provided by law in the office of the county recorder of the county in which the real property is located before the death of the owner who executes the revocation. If the real property is owned as joint tenants with right of survivorship or community property with right of survivorship and if the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner.

G. If an owner executes and records more than one beneficiary deed concerning the same real property, the last beneficiary deed that is recorded before the owner’s death is the effective beneficiary deed.

H. This section does not prohibit other methods of conveying property that are permitted by law and that have the effect of postponing enjoyment of an interest in real property until the death of the owner. This section does not invalidate any deed otherwise effective by law to convey title to the interests and estates provided in the deed that is not recorded until after the death of the owner.

I. The signature, consent or agreement of or notice to a grantee beneficiary of a beneficiary deed is not required for any purpose during the lifetime of the owner.

J. A beneficiary deed that is executed, acknowledged and recorded in accordance with this section is not revoked by the provisions of a will.

K. A beneficiary deed is sufficient if it complies with other applicable laws and if it is in substantially the following form:

Beneficiary Deed

I (we) _________________________ (owner) hereby convey to ___________________________ (grantee beneficiary) effective on my (our) death the following described real property:

(Legal description)

If a grantee beneficiary predeceases the owner, the conveyance to that grantee beneficiary shall either (choose one):

[] Become null and void.

[] Become part of the estate of the grantee beneficiary.

_________________________

(Signature of grantor(s))

(acknowledgment).

L. The instrument of revocation shall be sufficient if it complies with other applicable laws and is in substantially the following form:

Revocation of Beneficiary Deed

The undersigned hereby revokes the beneficiary deed recorded on ___________ (date), in docket or book ______________ at page ________, or instrument number ____________, records of ________________ county, Arizona.

Dated: _______________________

______________________________

Signature

(acknowledgment).

M. For the purposes of this section:

1. “Beneficiary deed” means a deed authorized under this section.

2. “Owner” means any person who executes a beneficiary deed as provided in this section.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-741. Definitions

In this article, unless the context otherwise requires:

1. “Account servicing agent” means a joint agent of seller and purchaser, appointed under the contract or under a separate agreement executed by the seller and the purchaser, to hold documents and collect monies due under the contract, who does business under the laws of this state as a bank, trust company, escrow agent, savings and loan association, insurance company or real estate broker, or who is licensed, chartered or regulated by the federal deposit insurance corporation or the comptroller of the currency, or who is a member of the state bar of Arizona.

2. “Contract” means a contract for conveyance of real property, a contract for deed, a contract to convey, an agreement for sale or any similar contract through which a seller has conveyed to a purchaser equitable title in property and under which the seller is obligated to convey to the purchaser the remainder of the seller’s title in the property, whether legal or equitable, on payment in full of all monies due under the contract. This article does not apply to purchase contracts and receipts, escrow instructions or similar executory contracts which are intended to control the rights and obligations of the parties to executory contracts pending the closing of a sale or purchase transaction.

3. “Monies due under the contract” means:

(a) Any principal and interest payments which are currently due and payable to the seller.

(b) Any principal and interest payments which are currently due and payable to other persons who hold existing liens and encumbrances on the property, the unpaid principal portion of which constitutes a portion of the purchase price, as stated in the contract, if the principal and interest payments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(c) Any delinquent taxes and assessments, including interest and penalty, due and payable to any governmental entity authorized to impose liens on the property which are the purchaser’s obligations under the contract, if the taxes and assessments were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

(d) Any unpaid premiums for any policy or policies of insurance which are the obligation of the purchaser to maintain under the contract, if the premiums were paid by the seller pursuant to the terms of the contract and to protect his interest in the property.

4. “Payoff deed” means the deed that the seller is obligated to deliver to the purchaser on payment in full of all monies due under the contract to convey to the purchaser the remainder of the seller’s title in the property, whether legal or equitable, as prescribed by the terms of the contract.

5. “Property” means the real property described in the contract and any personal property included under the contract.

6. “Purchaser” means the person or any successor in interest to the person who has contracted to purchase the seller’s title to the property which is the subject of the contract.

7. “Seller” means the person or any successor in interest to the person who has contracted to convey his title to the property which is the subject of the contract.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-742. Forfeiture of interest of purchaser in default under contract

A. If a purchaser is in default by failing to pay monies due under the contract, a seller may, after expiration of the applicable period stated in subsection D of this section and after serving the notice of election to forfeit stated in section 33-743, complete the forfeiture of the purchaser’s interest in the property in the manner provided by section 33-744 or 33-745. If the contract provides that the seller may elect to accelerate the principal balance due under the contract to the seller on the purchaser’s failure to pay the monies due, the seller may accelerate the principal balance due to the seller at any time after the purchaser has failed to pay the monies due under the contract. The acceleration may occur before or after the expiration of the applicable period stated in subsection D of this section and without serving the notice of election to forfeit stated in section 33-743. If the seller elects to accelerate the principal balance due to the seller, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748. If a purchaser is in default under the contract for reasons other than failing to pay monies due under the contract, the seller may only foreclose the contract as a mortgage in the manner provided by section 33-748.

B. The interest of a purchaser in any personal property included in a contract is subject to forfeiture or foreclosure in the same manner as the real property, except that forfeiture or foreclosure does not affect or impair the rights of a holder of a security interest whose interest in the personal property is not subordinate to that of the seller.

C. If a contract provides that time is of the essence, a waiver of that provision occurs only if the seller has accepted monies due under the contract in an amount which is less than the total monies due under the contract at the time of the acceptance. Receipt of any monies due under the contract by an account servicing agency does not constitute acceptance by the seller. A seller’s delay in exercising any remedy granted either by the contract or by law does not constitute a waiver of a time is of the essence provision. If the time of the essence provision has been waived, the seller may reinstate the provision by serving a written notice on the purchaser and the account servicing agent, if one has been appointed, requiring strict performance of the purchaser’s obligations to pay monies due under the contract. The notice shall be served, either by delivery in person or deposit in the United States mail, first class, postage prepaid, at least twenty days prior to the date on which the seller will require the purchaser to pay the monies due under the contract. A copy of the notice need not be recorded in the county in which the real property is located or served on any person other than the purchaser and the account servicing agent, if one has been appointed.

D. Forfeiture of the interest of a purchaser in the property for failure to pay monies due under the contract may be enforced only after expiration of the following periods after the date such monies were due:

1. If there has been paid less than twenty per cent of the purchase price, thirty days.

2. If there has been paid twenty per cent, or more, but less than thirty per cent of the purchase price, sixty days.

3. If there has been paid thirty per cent, or more, but less than fifty per cent of the purchase price, one hundred and twenty days.

4. If there has been paid fifty per cent, or more, of the purchase price, nine months.

E. For the purpose of computing the percentage of the purchase price paid under subsection D of this section, the total of only the following constitutes payments on the purchase price:

1. Down payments paid to the seller.

2. Principal payments paid to the seller on the contract.

3. Principal payments paid to other persons who hold liens or encumbrances on the property, the principal portion of which constitutes a portion of the purchase price, as stated under the contract.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-743. Notice of election to forfeit and reinstatement of purchaser’s interest

A. If the seller elects to forfeit the purchaser’s interest in the property, the seller and the account servicing agent, if one has been appointed, shall record a notice of election to forfeit with the county recorder of the county in which the real property is located. A notice of election to forfeit is ineffective unless recorded after expiration of the applicable period prescribed in section 33-742, subsection D. A copy of the notice shall be served, either by delivery in person or by deposit in the United States mail, first class, postage prepaid, at least twenty days prior to the effective date of the forfeiture, on the purchaser and on persons who, at the time of recordation of the notice of election to forfeit, appear on the records of the county recorder of the county in which the real property is located as having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, or who have requested a copy of such notice in the manner provided by section 33-746. If mailed, the notice shall be addressed to the last mailing address filed in writing with the seller or with the account servicing agent or as designated on the request for copy of notice of election to forfeit. If no address has been filed with the seller or the account servicing agent, a copy of the notice may be mailed in care of the person to whom any recorded document evidencing an interest in or a lien or encumbrance on the property was directed to be mailed at the time of its recording.

B. The notice of election to forfeit shall be substantially in the following form:

“Notice of Election to Forfeit

The undersigned hereby gives notice that the purchaser under that certain contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

has failed to pay monies due under the contract for a period of time in excess of that provided by Arizona Revised Statutes section 33-742, subsection D and is now subject to having his interest under the contract forfeited. The monies due under the contract which are required to be paid to reinstate such contract are as follows:

If the monies due under the contract are not received by five o’clock p.m. on the __________ day of _______________, 19____, being at least twenty days after the serving of this notice, at _______________, Arizona, the interest of the purchaser and all persons who have an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, shall be forfeited.

Dated _______________, 19____.

______________________________________

signature of seller, and

______________________________________

signature of account servicing agent

(if any)

(acknowledgments)”

C. A person need not be served with a copy of the notice of election to forfeit unless the person, at the time of recordation of the notice, appeared on the records of the county recorder of the county in which the real property is located as having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, or requested a copy of the notice in the manner provided for in section 33-746.

D. Failure to serve a copy of the notice of election to forfeit on each person as stated in subsection A of this section does not invalidate the service of the notice of election to forfeit as to persons served but extends the effective date of the forfeiture until at least twenty days after the persons not previously served have been served with a copy of the notice.

E. A purchaser who has failed to pay monies due under the contract or any other person may, at any time prior to expiration of the period provided for in the notice of election to forfeit, avoid the forfeiture by complying with the terms of the notice.

F. If the purchaser or any other person timely complies with the terms of the notice of election to forfeit, the seller or the account servicing agent shall record a notice of reinstatement with the county recorder of the county in which the real property is located. The notice of reinstatement shall be substantially in the following form:

“Notice of Reinstatement

The undersigned hereby gives notice that the notice of election to forfeit, dated _______________, 19____, pertaining to a contract which covers real property described as follows:

and including personal property described as follows:

which notice was recorded on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, is cancelled.

dated _______________, 19____.

______________________________________

signature of seller, or signature of

account servicing agent (if any)

(acknowledgment)”

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-744. Completion of forfeiture by judicial process

At any time after expiration of the period provided for in the notice of election to forfeit, the seller may complete the forfeiture of the interest of the purchaser and persons having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, by filing an action in the superior court in the county in which the real property is located to declare that the interest of the persons has been forfeited and to quiet title to the property in the seller. In the action, the seller shall name as defendants the purchaser and each person who, at the expiration of the period provided for in the notice of election to forfeit, had an interest in or a lien or encumbrance on the property, the priority of which was subordinate to that of the seller.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-745. Completion of forfeiture by notice

A. If an account servicing agent has been appointed to hold documents and collect monies due under the contract and the agent has recorded and served the notice of election to forfeit, as provided in section 33-743, the seller and account servicing agent may complete the forfeiture of the interest of the purchaser and persons having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, by recordation of an affidavit of completion of forfeiture with the county recorder of the county in which the real property is located. The county recorder shall index the affidavit of completion of forfeiture under the classification in which conveyances of real property are indexed.

B. Recordation of an affidavit of completion of forfeiture terminates without right of redemption all right, title and interest of the purchaser and all persons having an interest in or a lien or encumbrance on the property, the priority of which is subordinate to that of the seller, including the interest of any persons acquiring an interest in or a lien or encumbrance on the property subsequent to recordation of the notice of election to forfeit. On recordation of the affidavit, the property reverts to the seller clear of all interests, liens and encumbrances, the priority of which was subordinate to that the seller. The recordation of the affidavit of completion of forfeiture also raises the presumption of compliance with all requirements of this article and constitutes conclusive evidence of the meeting of the requirements in favor of purchasers or encumbrancers for value and without actual notice.

C. The affidavit of completion of forfeiture shall be substantially in the following form:

“Affidavit of Completion of Forfeiture

The undersigned, being duly sworn, deposes and says that the purchaser under that certain contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

failed to pay amounts due under the contract; that on the date the monies were due, any provision of the contract which made time of the essence had not been waived or had been reinstated in the manner provided for in Arizona Revised Statutes section 33-742, subsection C; that the applicable period stated in Arizona Revised Statutes section 33-742, subsection D had expired after the date the monies were due; that a notice of election to forfeit was recorded with the county recorder of the county in which the real property is located; that a copy of the notice was served upon the purchaser and all persons who, at the time of recordation of the notice of election to forfeit, appeared on the records of the county recorder of the county in which the real property was located, as having an interest in or a lien or encumbrance on the property, the priority of which was subordinate to that of the seller, or who had requested a copy of the notice in the manner provided for in Arizona Revised Statutes section 33-746; that the terms of the notice of election to forfeit were not complied with prior to expiration of the period provided for in the notice; and that all right, title and interest of the purchaser and all persons having an interest in or a lien or encumbrance on the property, the priority of which was subordinate to that of the seller, are by this affidavit declared to be forfeited and to revert to the seller in accordance with the terms of the contract and the laws of the state of Arizona.

______________________________________

signature of seller,

______________________________________

signature of account servicing agent

(jurats)”

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-746. Request for copy of notice of election to forfeit

A. Any person, including, without limitation, a person in possession of the property or having an interest in or a lien or encumbrance on the property, which is not disclosed by a document recorded with the county recorder of the county in which the real property is located, who desires a copy of a notice of election to forfeit under a contract shall, prior to recording of a notice of election to forfeit, record with the county recorder of the county in which the real property is located a request for a copy of any notice of election to forfeit.

B. A request for a copy of any notice of election to forfeit under a contract shall be substantially in the following form:

“Request for Notice of Election to Forfeit

Request is hereby made that a copy of any notice of election to forfeit under the contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

be mailed to: _________________________________________________________, at _____________________________________________________________________.

Dated this __________ day of _______________, 19____.

______________________________________

signature

(acknowledgment)”

C. The existence and contents of a recorded request do not affect the title to the property or provide notice to any person that a person requesting a copy of the notice has an interest in or a lien or encumbrance on the property.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-747. Appointment of successor account servicing agent

A. If a person appointed as account servicing agent fails to qualify or is unwilling or unable to serve, the seller may appoint a successor account servicing agent, and the appointment constitutes a substitution of account servicing agent.

B. The seller may at any time remove an account servicing agent for any reason and appoint a successor account servicing agent, and the appointment constitutes a substitution of account servicing agent.

C. A substitution of an account servicing agent shall be made by written notice, personally delivered or mailed in the United States mail, first class, postage prepaid, to the purchaser, the account servicing agent and the successor account servicing agent and by recording a copy of the notice with the county recorder of the county in which the real property is located.

D. A notice of substitution of account servicing agent shall be substantially in the following form:

“Notice of Substitution of Account Servicing Agent

The undersigned seller hereby appoints:

_________________________________________________________________________ _________________________________________________________________________ _________________________________________________________________________ successor account servicing agent under that certain contract, by and between _______________, as seller, and _______________, as purchaser, dated _______________, 19____, and recorded (if recorded) on _______________, 19____, in docket __________, at page __________, records of _______________ county, Arizona, covering real property described as follows:

and including personal property described as follows:

Dated this _______________ day of _______________, 19____.

______________________________________

signature of seller

(acknowledgment)”

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-748. Seller’s right to foreclose

A. If a contract provides that the seller may elect to accelerate the unpaid principal balance due to seller on the purchaser’s failure to pay the monies due under the contract, the seller may only enforce the acceleration by foreclosing the contract in the manner provided by law for foreclosure of mortgages upon real property. If a purchaser is in default under the contract for reasons other than failing to pay amounts due under the contract, the seller may only foreclose the contract as a mortgage in the manner provided by law for foreclosure of mortgages upon real property.

B. If an action to foreclose a contract has been filed, a forfeiture, by judicial process as provided by section 33-744 or by notice as provided by section 33-745, shall not thereafter be completed unless the foreclosure action is first dismissed and a notice of election to forfeit is served in the manner and on the persons provided for in section 33-743.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-749. Other remedies

A. The seller may maintain an action against any person, including the purchaser, for a claim for relief if damages or injury occurs, or may occur, to the property, including without limitation, an action for damages, or to prevent any of the following:

1. Physical abuse to or distribution of the property.

2. Waste.

3. Impairment of security provided by the contract.

B. An action for recovery of damages under subsection A of this section may be maintained:

1. At any time before the seller elects to forfeit or foreclose the purchaser’s interest in the property.

2. Within ninety days after completion of a forfeiture of the purchaser’s interest in the property as provided by section 33-745.

3. In conjunction with completion of a forfeiture of the purchaser’s interest in the property as provided by section 33-744.

4. In conjunction with the seller foreclosing the contract as a mortgage as provided for in section 33-748.

C. The remedies provided by this article are in addition to and do not preclude any other remedy granted either by the contract or by law which is not inconsistent with this article.

TITLE 33 PROPERTY

CHAPTER 6 MORTGAGES

ARTICLE 3. FORFEITURE AND REINSTATEMENT OF PURCHASER’S INTEREST

UNDER CONTRACT FOR CONVEYANCE OF REAL PROPERTY

33-750. Conveyance by seller; payment in full; payoff deed

A. A seller who is entitled to payment and who receives full payment of all monies due under the contract shall deliver to the person who made full payment a payoff deed that conveys to the purchaser the real property described in the contract. The deed shall be entitled “payoff deed”, shall state that it is being delivered to consummate a contract and shall include the docket and page number or recording number of the contract.