Arkansas Partial Release of Property From Mortgage by Individual Holder

Overview of this form

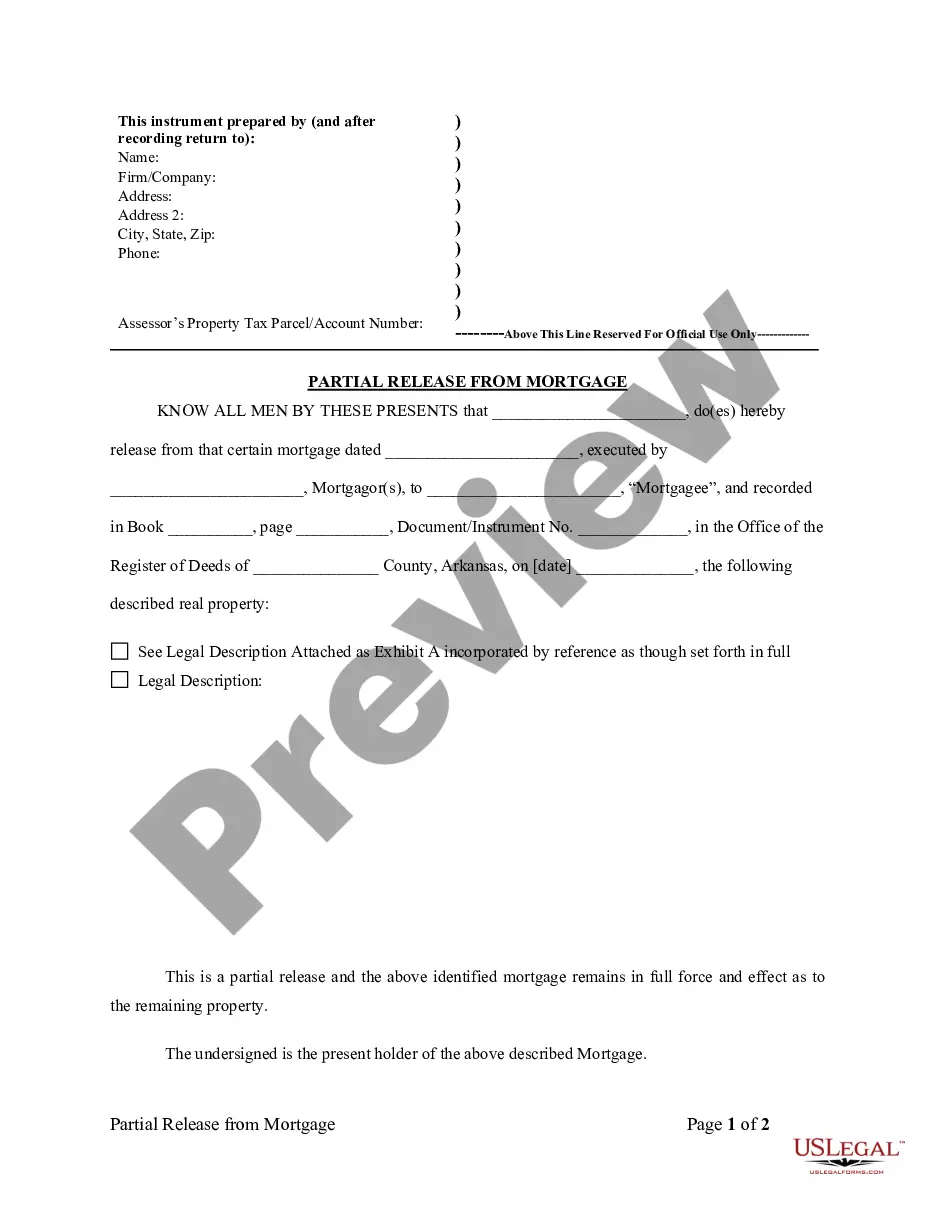

The Partial Release of Property From Mortgage by Individual Holder is a legal document that allows the holder of a mortgage or deed of trust to release a specified portion of real property from the mortgage. This form ensures that the remaining property under the mortgage continues to be secured as before. This is particularly useful when a homeowner sells a part of their property or refinances only a section, while still obligating themselves to the remaining mortgage obligations.

Main sections of this form

- Identification of the mortgage holder and property description.

- Acknowledgment of the assignment and its recording details.

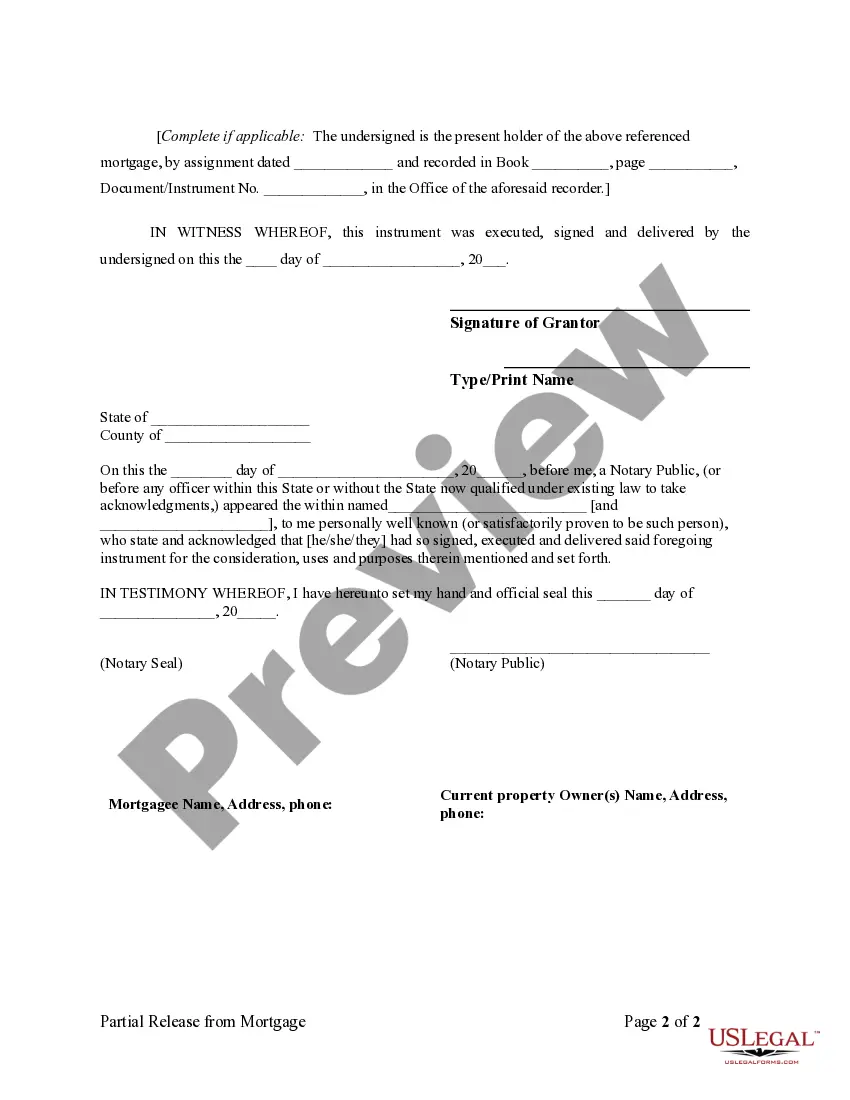

- Notary public section for verification of signatures.

- Signature line for the mortgage holder.

- Date of execution for legal validation.

When this form is needed

This form is commonly used in situations where an individual property owner wants to sell or refinance part of their property that is encumbered by a mortgage or deed of trust. It is necessary when the mortgage holder agrees to release only a portion of the secured property while ensuring that the remaining property remains under the original mortgage terms.

Who needs this form

- Property owners looking to release part of their mortgaged property.

- Mortgage holders or lenders who need to formalize the release of a portion of the property.

- Real estate attorneys assisting clients in property transactions involving partial releases.

Steps to complete this form

- Identify the parties involved, including the mortgage holder and property details.

- Complete the section regarding the assignment of the mortgage, including recording details.

- Fill in the date and ensure all parties are present for the signing.

- Have the signatures of the mortgage holder and the notary public verified.

- Ensure all information is accurate and legible before submission.

Is notarization required?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to accurately identify the property being released.

- Not providing complete recording details for the mortgage assignment.

- Overlooking the requirement for notarization.

- Signing the document without the presence of a notary public.

Advantages of online completion

- Convenient access to legal forms at any time without visiting an office.

- Editable templates allow customization to meet unique property situations.

- Reliable and professionally drafted documents to ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

A partial release clause typically appears in a mortgage agreement and specifies the conditions under which a portion of the property may be released from the mortgage obligation. This clause details the process for obtaining a release, often involving payment of a specified amount to the lender. For property owners looking to understand how to navigate the Arkansas Partial Release of Property From Mortgage by Individual Holder, this clause is crucial. Utilizing programs like US Legal Forms can simplify the legal documentation needed for a smooth release process.

A partial release of collateral letter is a formal document that allows for the release of a portion of the property secured by a mortgage. In the context of Arkansas, this letter details the specific assets being released from the mortgage obligation, tailored for the Arkansas Partial Release of Property From Mortgage by Individual Holder. This document is important for ensuring clarity between the borrower and lender. You can find templates and guidance for this process on the USLegalForms platform.

The duration for an Arkansas Partial Release of Property From Mortgage by Individual Holder can vary. Generally, it takes a few weeks to complete the process once all required documents are submitted. Factors such as the lender’s processing speed and the complexity of the situation can influence the timeline. It’s always a good idea to communicate with your lender for a more specific timeframe.

A partial payment mortgage allows the borrower to make smaller payments for a specific period, often before returning to the regular payment schedule. This arrangement can provide temporary financial relief, making it easier to manage your mortgage responsibilities. If you're navigating an Arkansas Partial Release of Property From Mortgage by Individual Holder, consider how a partial payment structure might fit into your overall financial plan.

The process of a partial release involves submitting a written request to the mortgage holder, specifying the property portions you wish to release. After the mortgage holder processes your request, they issue a document confirming the partial release. This process is crucial for property owners in Arkansas hoping to manage their mortgages effectively and utilize aspects like the Arkansas Partial Release of Property From Mortgage by Individual Holder.

A part and part mortgage allows you to release part of the property from the mortgage while retaining the mortgage on the remaining portion. This could be beneficial if you want to sell a portion of your property or minimize your financial exposure. However, evaluate the implications carefully, especially in relation to the Arkansas Partial Release of Property From Mortgage by Individual Holder, to ensure it aligns with your financial goals.

Partial redemption of a mortgage occurs when a borrower pays off a percentage of their mortgage balance, reducing the outstanding debt while keeping the mortgage in effect. This can help borrowers lower their monthly payments and improve their financial standing. Engaging with an understanding of the Arkansas Partial Release of Property From Mortgage by Individual Holder can guide you through the complexities of redemption situations.

The partial release of a mortgage is a legal action that allows a borrower to remove part of a mortgaged property's lien while keeping the remaining property under the mortgage. This is often used during sales or refinances to allow homeowners more flexibility with their real estate assets. It is essential to ensure that proper documentation is filed to avoid complications. Utilizing services related to the Arkansas Partial Release of Property From Mortgage by Individual Holder can simplify this process.

Partially released refers to a situation where only a portion of the property, secured by a mortgage, is released from the mortgage agreement. The remaining part still retains the mortgage obligation, allowing the borrower to keep some equity while discarding part of the lien. This could be beneficial in certain transactions, especially sales or partial refinances. For further clarity on this, consider exploring the Arkansas Partial Release of Property From Mortgage by Individual Holder.

A partial discharge of a mortgage occurs when a lender agrees to remove a portion of the collateral from the mortgage agreement. This usually happens when the borrower pays off a specific amount or when the property is sold. It allows the homeowner to retain some property while relieving the mortgage burden. Furthermore, knowing about the Arkansas Partial Release of Property From Mortgage by Individual Holder can be essential in this process.