Arkansas Replacement Beneficiary Deed

Description

Individual and the Grantee is an Individual.

Definition and meaning

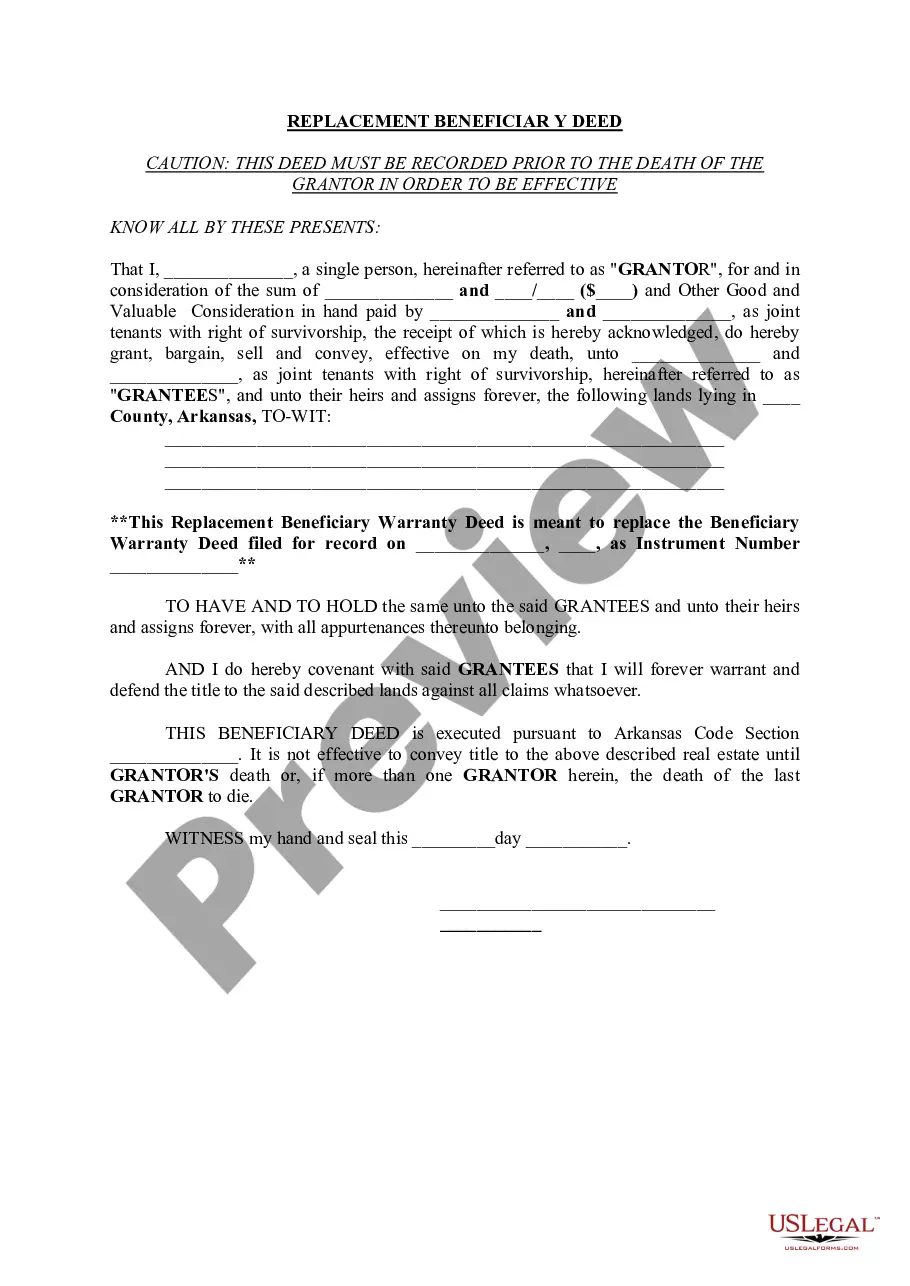

The Arkansas Replacement Beneficiary Deed is a legal document that allows property owners to designate new beneficiaries for their real estate upon their death. This deed acts as a replacement for a previously filed Beneficiary Deed, ensuring that the specified beneficiaries receive the property without going through probate.

How to complete a form

Completing the Arkansas Replacement Beneficiary Deed involves several key steps:

- Identify the Grantor: The person transferring the property, also known as the Grantor, must fill in their full name.

- Detail the Consideration: Indicate the monetary amount and/or any other valuable considerations for the transfer.

- Name the Grantees: List the names of individuals who will receive the property as joint tenants with the right of survivorship.

- Describe the Property: Provide a detailed description of the property, including the county and any property identification numbers.

- Sign the Deed: The Grantor must sign and date the deed in the presence of a notary public.

Who should use this form

The Arkansas Replacement Beneficiary Deed is suitable for homeowners in Arkansas who wish to designate new beneficiaries for their property in the event of their death. This form is particularly useful for individuals looking to amend previously established beneficiary designations or to simplify the transfer of property upon death, avoiding probate proceedings.

Legal use and context

This form is governed by state law under the Arkansas Code. It is essential to understand that the Replacement Beneficiary Deed must be recorded before the death of the Grantor to be effective. The deed ensures a smooth transition of property ownership, protecting the interests of the designated beneficiaries.

State-specific requirements

In Arkansas, specific legal requirements must be met for the Replacement Beneficiary Deed to be valid:

- The deed must be signed by the Grantor.

- A notary public must acknowledge the signature.

- The deed must be recorded in the appropriate county where the property is located.

- It should clearly indicate the names of both the Grantor and Grantees.

Benefits of using this form online

Using the Arkansas Replacement Beneficiary Deed online offers several advantages:

- Convenience: Users can complete the form at their own pace and from the comfort of their home.

- Accuracy: Online forms often include guidance to help ensure all necessary information is provided accurately.

- Immediate access: Users can download and print the form immediately upon completion, facilitating faster processing.

How to fill out Arkansas Replacement Beneficiary Deed?

Utilizing Arkansas Replacement Beneficiary Deed examples crafted by skilled lawyers allows you to sidestep complications when filing paperwork.

Simply obtain the form from our site, complete it, and request a lawyer to review it. Doing this will save you significantly more time and expenses than seeking an attorney to draft a document from scratch for you.

If you’ve previously purchased a US Legal Forms membership, just sign in to your account and return to the sample section. Look for the Download button adjacent to the template you are reviewing. Once you download a template, you can locate all your stored samples in the My documents tab.

After you’ve completed all the above steps, you will be able to finish, print, and sign the Arkansas Replacement Beneficiary Deed template. Remember to double-check all entered information for accuracy before submitting or sending it out. Reduce the time spent on document preparation with US Legal Forms!

- Confirm and ensure you are obtaining the correct state-specific document.

- Use the Preview feature and read the description (if present) to determine if you need this specific sample and if so, just click Buy Now.

- Search for another template using the Search bar if needed.

- Select a subscription that fits your needs.

- Begin with your credit card or PayPal.

- Choose a file type and download your document.

Form popularity

FAQ

To obtain a replacement deed in Arkansas, you should contact the county clerk's office where the original deed was recorded. They will guide you through the steps needed to access or replace your Arkansas Replacement Beneficiary Deed. Additionally, using platforms like US Legal Forms can simplify the process with easy access to the correct forms.

You can acquire a beneficiary deed in Arkansas through local legal forms websites, law offices, or directly from the county clerk's office. Many online services also offer downloadable templates for the Arkansas Replacement Beneficiary Deed, allowing you to fill them out at your convenience. Ensure you understand the requirements before proceeding.

Obtaining a quick deed in Arkansas involves efficiently preparing and filing the necessary paperwork with the local clerk's office. Using available online resources can save you time, and platforms like US Legal Forms provide ready-to-use templates for creating Arkansas Replacement Beneficiary Deeds. This approach often speeds up the process significantly.

To get a copy of your deed in Arkansas, you can visit your local county clerk's office where the property is located. Alternatively, you can request a copy online or through mail, depending on the county's services. Make sure to have relevant details, such as your name and property description, ready to assist in locating your Arkansas Replacement Beneficiary Deed.

To obtain a beneficiary deed in Arkansas, you must fill out the appropriate form that specifies your property and the designated beneficiary. It is crucial to ensure the deed is correctly executed and filed with the county clerk's office. For convenience, consider using platforms like US Legal Forms to access templates for the Arkansas Replacement Beneficiary Deed.

Yes, a beneficiary deed can help avoid probate in Arkansas. By designating a beneficiary in your deed, the property will transfer directly to them upon your passing without going through the lengthy probate process. This makes the Arkansas Replacement Beneficiary Deed an efficient tool for estate planning.

Generally, the process to obtain a land deed in Arkansas can take several weeks. After submitting your application, it is important to allow time for processing and recording by the county clerk. If you need a quicker turnaround, consider exploring options like the Arkansas Replacement Beneficiary Deed for streamlined procedures.

If there is no will, property can still transfer after death using the Arkansas Replacement Beneficiary Deed. This deed allows property owners to designate beneficiaries during their lifetime. Consequently, upon their passing, the property transfers directly to these beneficiaries, bypassing the complications of intestacy laws and probate.

Transferring title after death in Arkansas can be handled efficiently using an Arkansas Replacement Beneficiary Deed. This legal document allows the title to transfer automatically to the named beneficiaries upon the owner's death. By using this approach, you can avoid the lengthy probate process and ensure a smoother transition of ownership.

To transfer land after the death of the owner in Arkansas, you can utilize an Arkansas Replacement Beneficiary Deed. This deed simplifies the transfer process, allowing property to pass directly to the designated beneficiaries without going through probate. It’s essential to ensure the deed is correctly executed during the owner's lifetime to facilitate this transfer effectively.