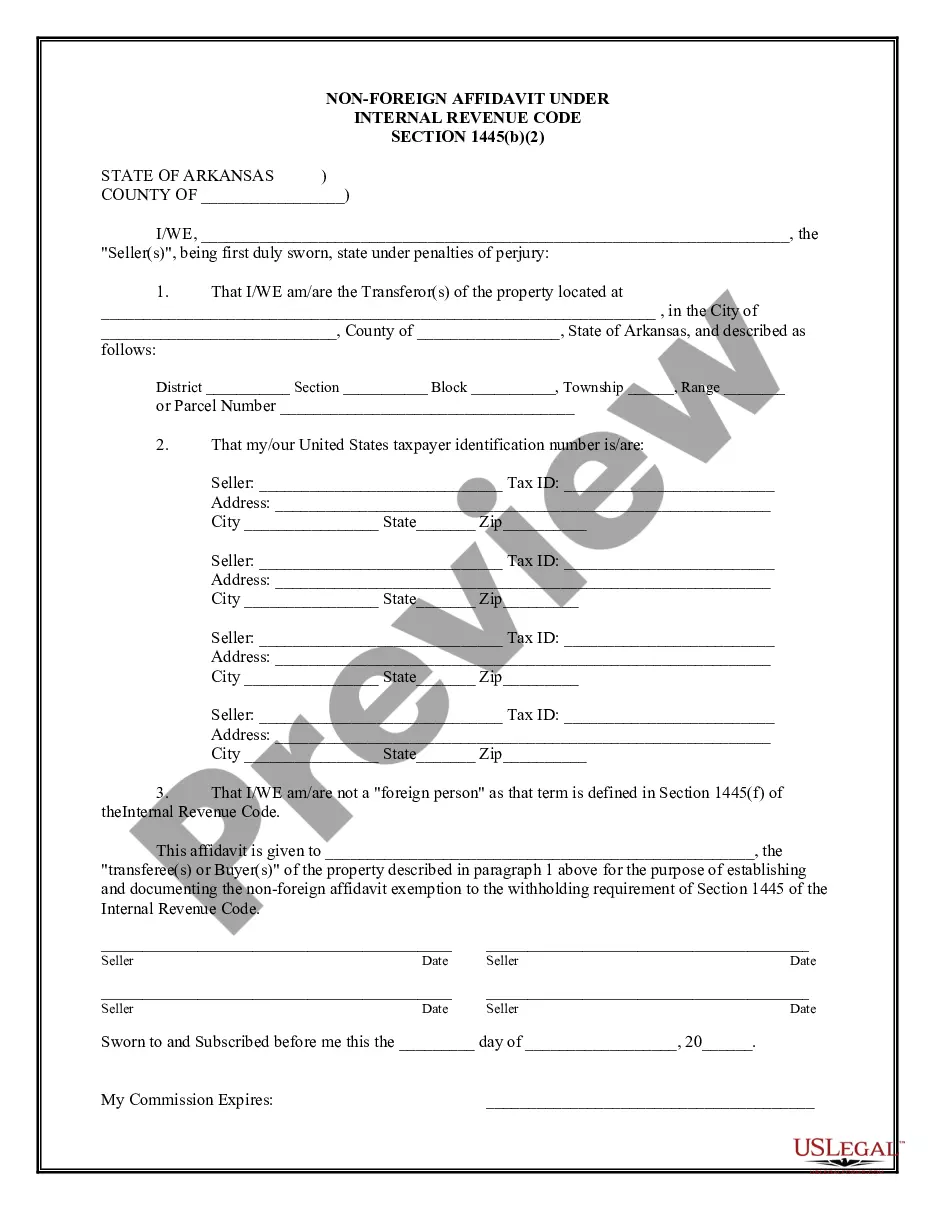

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Arkansas Non-Foreign Affidavit Under IRC 1445

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Non-Foreign Affidavit Under IRC 1445?

Utilizing Arkansas Non-Foreign Affidavit Under IRC 1445 examples crafted by knowledgeable attorneys provides you the chance to avert difficulties when submitting paperwork.

Simply obtain the template from our site, complete it, and request an attorney to validate it.

This approach can save you significantly more time and expenses compared to having an attorney draft a file from scratch to match your specifications.

Ensure that you double-check all entered information for accuracy before submitting or mailing out your document. Streamline the process of creating paperwork with US Legal Forms!

- If you currently possess a US Legal Forms subscription, just Log In to your account and navigate back to the sample webpage.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a document, you will find all of your saved examples in the My documents section.

- If you lack a subscription, it’s not a major issue.

- Simply adhere to the instructions below to register for your online account, obtain, and finalize your Arkansas Non-Foreign Affidavit Under IRC 1445 template.

Form popularity

FAQ

The responsibility for preparing FIRPTA documents typically lies with the seller or their real estate agent. However, a qualified attorney can also assist in preparing an Arkansas Non-Foreign Affidavit Under IRC 1445. This support ensures all documentation is accurate and compliant with federal tax requirements.

An Affidavit of non-foreign status is a legal declaration that a seller is not a foreign entity for tax purposes. This affidavit is integral in the context of FIRPTA, particularly when utilizing an Arkansas Non-Foreign Affidavit Under IRC 1445. By submitting this affidavit, sellers help mitigate any tax withholding issues during real estate transactions.

There are legitimate ways to avoid FIRPTA withholding, such as ensuring the seller qualifies as a non-foreign person using an Arkansas Non-Foreign Affidavit Under IRC 1445. Consulting a tax professional or attorney can provide guidance tailored to your specific situation. Careful planning and proper documentation play vital roles in navigating FIRPTA effectively.

The seller of the property is responsible for signing the FIRPTA Affidavit. They affirm their non-foreign status by completing an Arkansas Non-Foreign Affidavit Under IRC 1445. This signature serves to protect the buyer from any tax implications tied to foreign sellers.

To complete a FIRPTA Affidavit for real estate, the seller must provide their taxpayer identification number and information verifying their non-foreign status. This may include an Arkansas Non-Foreign Affidavit Under IRC 1445. Proper documentation is crucial to ensure compliance and facilitate a smooth property transaction.

A 1445 certificate, known formally as a FIRPTA certificate, is a document that confirms the non-foreign status of a seller. The seller must fill out an Arkansas Non-Foreign Affidavit Under IRC 1445 to eliminate the need for tax withholding at the time of the sale. This simplifies the transaction for both the buyer and the seller.

A FIRPTA certificate is typically provided by the seller of the property or their attorney. In the case of a non-foreign seller, they must complete an Arkansas Non-Foreign Affidavit Under IRC 1445 to affirm their status. This certificate ensures that the buyer does not withhold taxes required under the Foreign Investment in Real Property Tax Act.

A FIRPTA statement is a formal declaration related to the sale of U.S. real estate by foreign sellers. This document indicates whether the seller is foreign and the implications for tax withholding. Having an Arkansas Non-Foreign Affidavit Under IRC 1445 ensures that all parties involved understand their responsibilities, preventing potential tax issues in the future. You can rely on the uslegalforms platform to easily access and complete necessary documentation.

Certain individuals and entities are exempt from FIRPTA withholding. Typically, this includes U.S. citizens, resident aliens, and certain domestic entities that meet specific criteria. It is important to confirm your eligibility for exemption to avoid unnecessary tax withholding. Obtaining the Arkansas Non-Foreign Affidavit Under IRC 1445 can help clarify your status and ensure compliance.

A section 1445 Affidavit is a declaration provided by sellers under the Foreign Investment in Real Property Tax Act (FIRPTA). This affidavit affirms that the seller is not a foreign person, thus exempting the buyer from withholding taxes on the sale. By submitting the Arkansas Non-Foreign Affidavit Under IRC 1445, sellers help facilitate a smoother transaction and avoid potential issues with the IRS.