Arkansas Closing Statement

Overview of this form

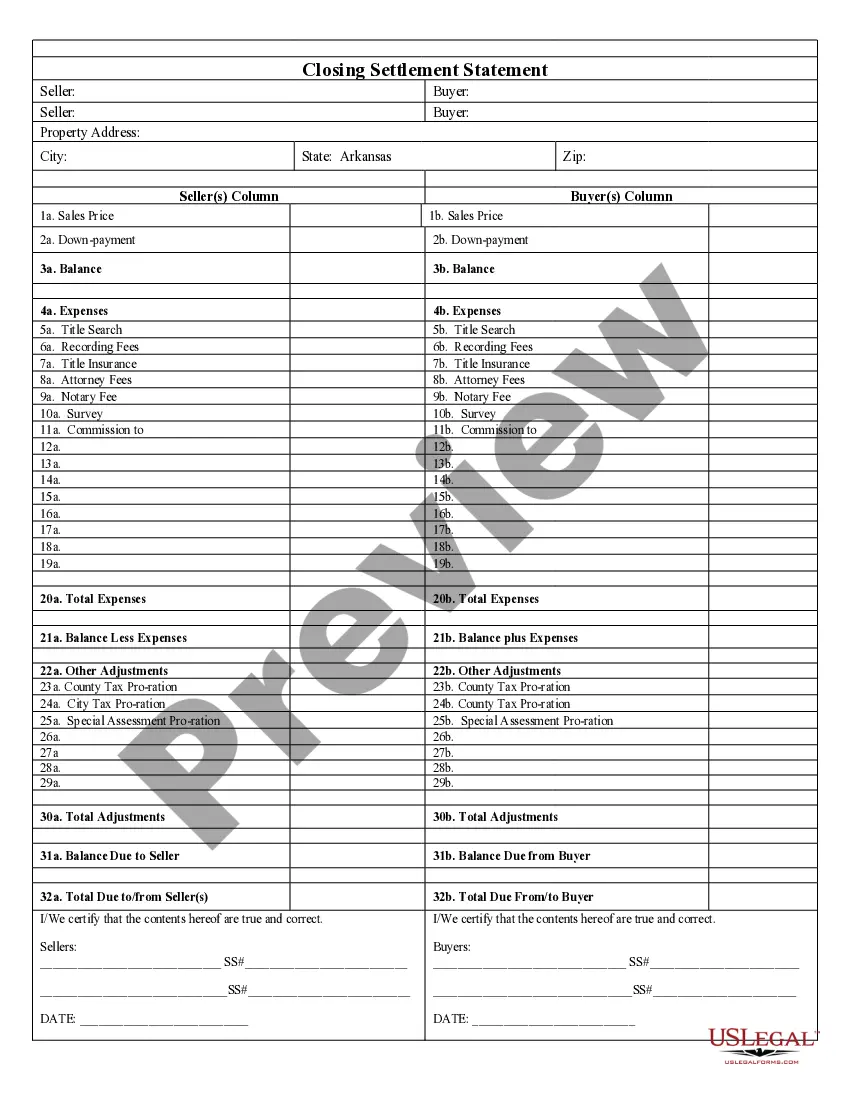

The Closing Statement is a crucial document in real estate transactions, particularly for cash sales or owner-financed deals. This form summarizes all financial details of the transaction, including expenses and final balances, and is verified and signed by both the seller and the buyer. Unlike other real estate forms, the Closing Statement specifically outlines the settlement process and provides a clear representation of the costs involved in the sale.

Key parts of this document

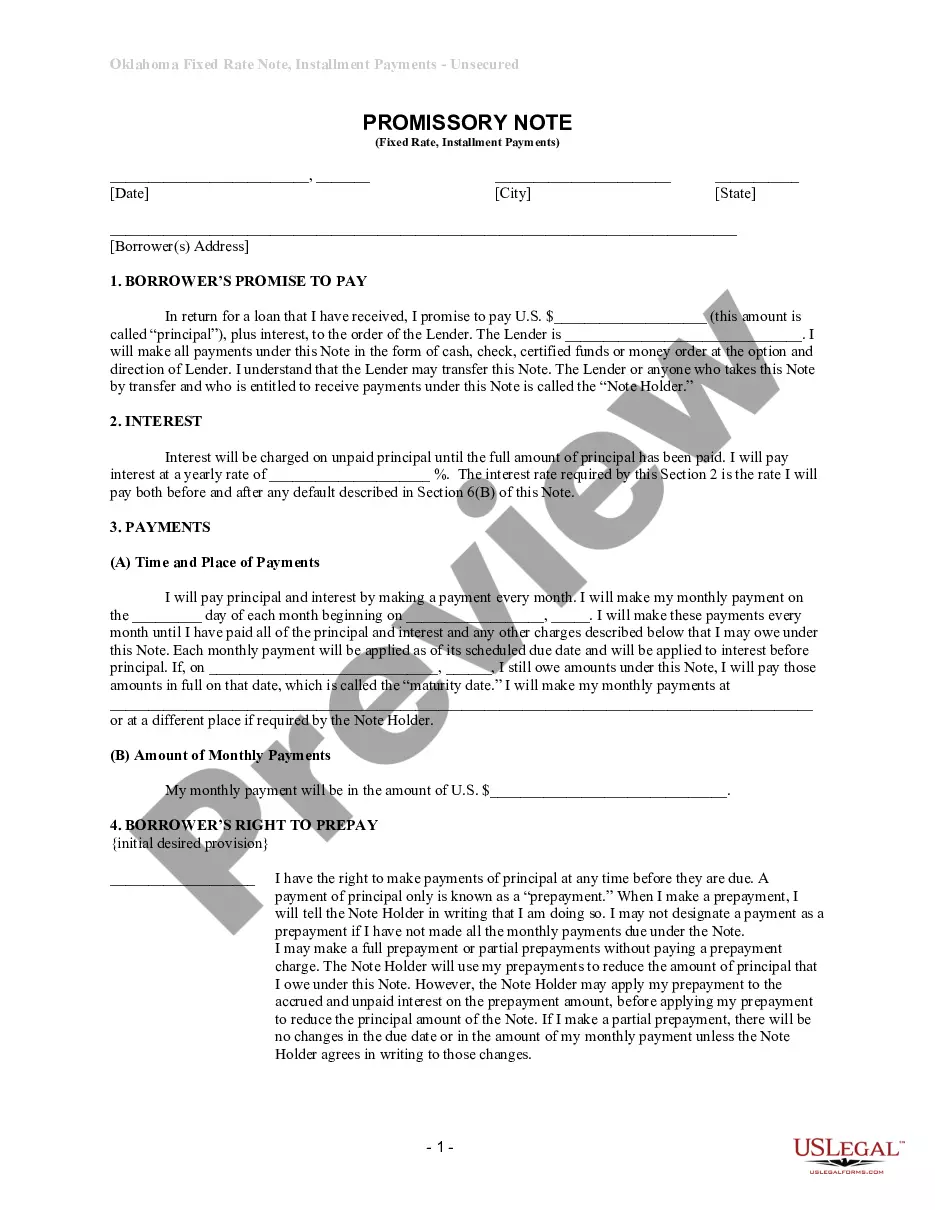

- Balance: Shows the final amounts due to or from each party.

- Expenses: Itemizes all costs associated with the transaction, including title search, recording fees, and attorney fees.

- Adjustments: Reflects other necessary financial adjustments, such as tax prorations.

- Signatures: Requires verification and certification by both seller and buyer to ensure accuracy.

- Total Due: Summarizes the final amounts payable between the parties.

When to use this document

The Closing Statement is used when finalizing a real estate purchase. It is essential in scenarios where the transaction does not involve traditional financing, such as cash sales or owner-financed deals. This form should be filled out during closing, summarizing all costs, credits, and debits, which ensures transparency for both parties involved in the transaction.

Who this form is for

This form is intended for:

- Real estate buyers and sellers engaged in cash transactions or owner financing.

- Real estate agents or brokers facilitating the closing process.

- Attorneys or legal representatives involved in the finalization of property sales.

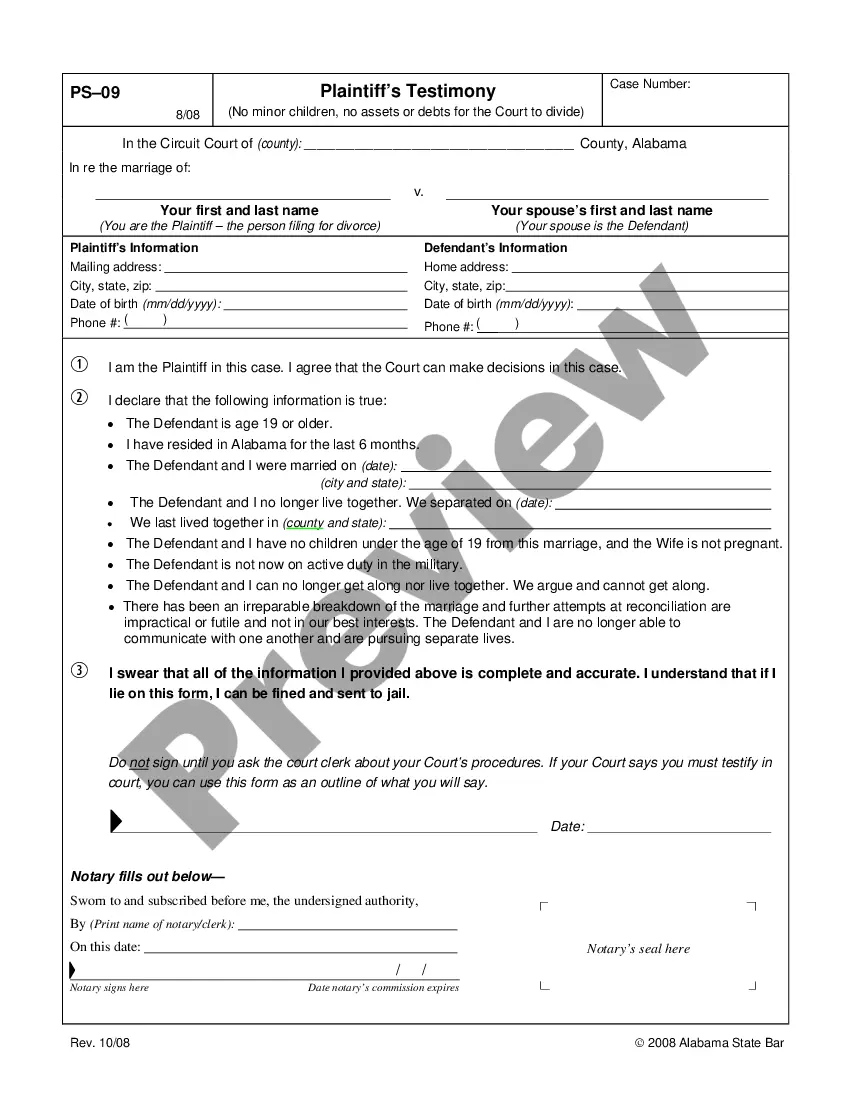

How to prepare this document

- Identify the parties: Enter the full names of the buyer and seller.

- Specify the property: Clearly describe the property being sold, including address and legal description.

- Detail the expenses: Populate the sections with all relevant expenses associated with the transaction.

- Include adjustments: Note any financial adjustments, such as tax prorations, that apply to the sale.

- Obtain signatures: Ensure both parties verify the information and sign the document, confirming its accuracy.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all expenses: Ensure no costs are overlooked in the statement.

- Incorrect information: Double-check all entries for accuracy before signatures.

- Not obtaining required signatures: Both parties must sign the document for it to be valid.

Advantages of online completion

- Convenience: Download and complete the form at your own pace without needing to visit a lawyer.

- Editability: Make changes easily if any details need adjustments before finalizing.

- Reliability: Use templates drafted by licensed attorneys to ensure compliance and accuracy.

Looking for another form?

Form popularity

FAQ

To close your LLC in Arkansas, you need to file a Certificate of Dissolution with the Secretary of State. Make sure to settle any outstanding debts and obtain a final Arkansas Closing Statement that reflects your company’s financial balance. After filing, keep a copy of all documents for your records, as it simplifies future business decisions or audits.

A good example of a closing statement includes clear sections for both the buyer and seller, itemized costs, and a concise summary of the transaction. In Arkansas, you'll see line items for things like financial adjustments and seller concessions. Services like UsLegalForms offer templates that can help you create a comprehensive closing statement tailored to your transaction.

A typical closing statement contains detailed itemizations of all costs associated with the transaction, including mortgage payoffs, title insurance, and closing costs. It also features the final amounts that both buyers and sellers need to address. In Arkansas, having a well-prepared closing statement ensures transparent communication and prevents surprises on closing day.

Closing your sales tax account in Arkansas involves submitting a final return to the Arkansas Department of Finance and Administration. You will need to report all sales and tax collected up to the date of closure. It's important to ensure that your Arkansas Closing Statement reflects any final sales tax amounts before you officially close your account.

To obtain your Arkansas Closing Statement, you typically need to contact your title company or closing attorney. They are responsible for preparing this document during the closing process of your real estate transaction. If you used a specific service or platform for your closing, such as UsLegalForms, you can access your closing statement directly through their portal.

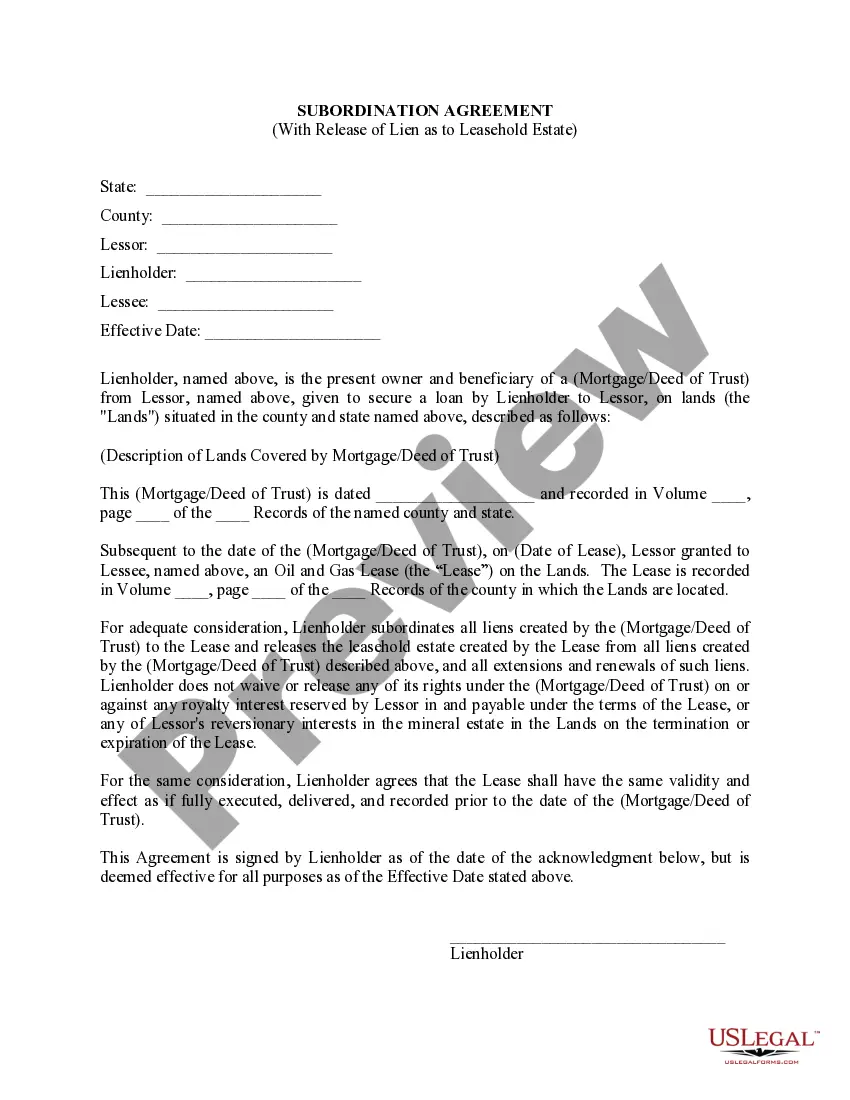

The attorney is responsible for preparing all necessary closing documents, scheduling the closing, explaining all necessary closing documents and having them properly executed and recorded. You will receive copies of most closing documents, including an itemized record of all money paid by you on your behalf.

A closing statement is a document that records the details of a financial transaction. A home buyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

Closing costs are all of the fees and expenses associated with the closing or settlement of a real estate transaction, and they can vary dramatically. The buyer typically pays the closing costs, while other costs are usually the responsibility of the seller.

Problems with a bank appraisal are a very common reason why a real estate closing can be delayed. The reasons issues that arise from a bank appraisal can delay a closing can vary from a home that under appraises and the buyer and seller cannot come to new terms or because of repairs that are required by the appraiser.

What is the seller's closing statement, aka settlement statement? The seller's closing statement is an itemized list of fees and credits that shows your net profits as the seller, and summarizes the finances of the entire transaction.