Arkansas Deed of Correction - Individual to Trust

About this form

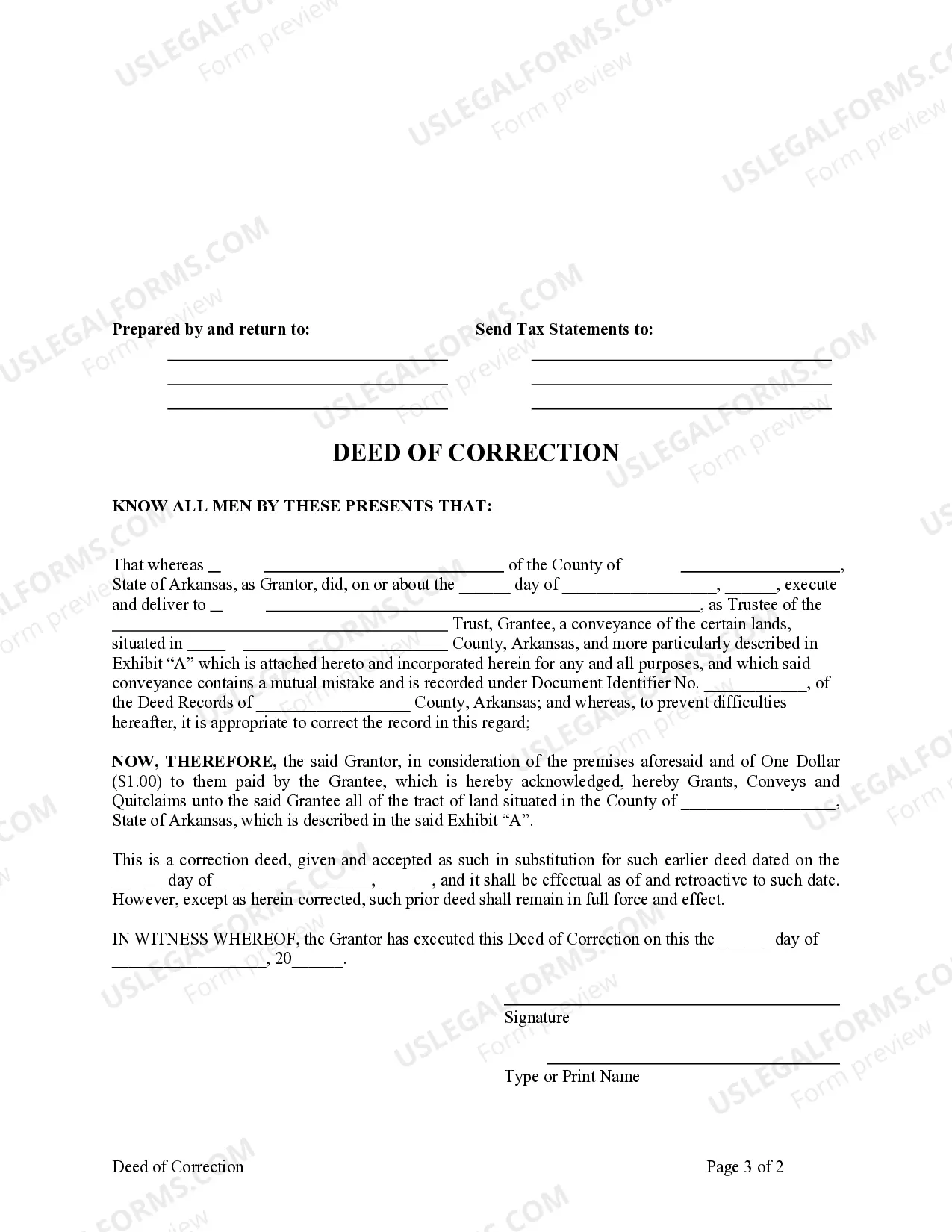

The Deed of Correction - Individual to Trust is a legal document used to rectify a mutual mistake in a property transfer where the Grantor is an individual and the Grantee is a trust. This form ensures that the Grantor conveys and warrants the specified property to the trust accurately. Unlike other deeds, this form specifically addresses corrections to previous property conveyances, making it essential for clear property title and legal ownership.

Form components explained

- Identification of the Grantor (individual) and Grantee (trust).

- Description of the property being conveyed, including physical address and parcel number.

- Statement of correction acknowledging the mistake made in the original deed.

- Consideration clause confirming the payment of one dollar.

- Signatures of the Grantor and acknowledgment by a notary public, if required.

Situations where this form applies

This form is necessary when a property deed contains erroneous information that needs to be corrected, such as incorrect names, descriptions, or other critical details that may affect the title. By filing a Deed of Correction, property owners ensure that the trust holds clear and marketable title to the property, preventing future disputes arising from the error.

Who needs this form

- Individuals who have previously transferred property to a trust with inaccuracies in the original deed.

- Property owners seeking to fix clerical errors or misunderstandings from past transactions.

- Trustees who need to correct the title of property mistakenly transferred under the trust's name.

Instructions for completing this form

- Identify the Grantor (the individual) and the Grantee (the trust) at the beginning of the form.

- Clearly describe the property being corrected, including necessary location details.

- State the mutual mistake explicitly to clarify the reason for the correction.

- Provide the consideration amount, typically one dollar, to validate the transaction.

- Signature of the Grantor is required, along with notarization if mandated by state law.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to accurately describe the property may lead to further disputes.

- Neglecting to sign the document can render it invalid.

- Omitting the acknowledgment by a notary public when required.

Advantages of online completion

- Convenience of completing the form digitally allows for quick adjustments and revision.

- Form fields are clearly marked, making it easy to fill out essential information correctly.

- Reliable access to templates developed by licensed attorneys ensures professional legal compliance.

Looking for another form?

Form popularity

FAQ

An amended deed of trust is a legal document that modifies the original deed of trust, allowing for changes in the terms without the need to create a completely new document. This can include updates on the beneficiary or the name of the trust. In the context of an Arkansas Deed of Correction - Individual to Trust, this process helps clarify ownership and facilitate smoother transactions. Using US Legal Forms, you can easily access templates and guidance to create an amended deed of trust that meets your specific needs.

In Arkansas, deeds do not have to be prepared by an attorney, but it is often recommended. Using an attorney can help ensure that your Arkansas Deed of Correction - Individual to Trust meets all necessary legal requirements. If you prefer to handle it yourself, platforms like uslegalforms provide user-friendly templates and guidance to assist you through the process.

Preparing a deed can fall under the definition of practicing law, especially if it requires legal interpretation or advice. However, individuals can draft their own documents as long as they do not seek to advise others. If you are unsure about the legal implications of your Arkansas Deed of Correction - Individual to Trust, it is wise to seek advice from a legal professional.

To obtain the deed to your property in Arkansas, start by contacting your local county clerk's office. You can typically request a copy of the deed online or in person. If you're working on an Arkansas Deed of Correction - Individual to Trust, it may be beneficial to use online platforms like uslegalforms to streamline the process and ensure you follow the correct procedures.

In Arkansas, anyone who has legal capacity can create a deed. This includes individuals, as well as entities like trusts. When creating an Arkansas Deed of Correction - Individual to Trust, it's important to ensure that you have the proper authority to make changes to the title. Always consider consulting with a professional to confirm your eligibility for creating a deed.

Writing a deed of trust requires specific information: the names of the parties involved, a clear description of the property, and the terms of the trust. Ensure that all essential details are accurately included to prevent future legal issues. For those unfamiliar with legal documents, relying on a service like US Legal Forms can help you draft an Arkansas Deed of Correction - Individual to Trust correctly and efficiently.

Yes, you can modify a deed of trust, but the process can be somewhat complex. Typically, you will need to create an amendment or a new deed that outlines the changes. If you are transferring the deed into a trust, using an Arkansas Deed of Correction - Individual to Trust may simplify this transition while ensuring compliance with Arkansas regulations.

In Arkansas, you are not required to have an attorney prepare a deed, but it is advisable if you want to ensure everything is done correctly. An attorney can help navigate the complexities of property law and verify that all necessary details are included in the deed. For those tackling it independently, the Arkansas Deed of Correction - Individual to Trust offers guidance but consulting with a professional is always a good option.

To transfer a property title to a family member in Arkansas, you need a properly executed deed, like a quitclaim or warranty deed. It’s essential to specify the family member's name and the property details clearly. Recording the deed with the local county clerk ensures the transfer is legally recognized. If the family member is establishing a trust, consider the Arkansas Deed of Correction - Individual to Trust for proper registration.

A trust is a legal arrangement where a person (the grantor) transfers property to a trustee for the benefit of beneficiaries. On the other hand, a beneficiary deed allows property to pass directly to a named beneficiary upon the owner's death without going through probate. When transferring to a trust, utilizing an Arkansas Deed of Correction - Individual to Trust can help manage the assets within the trust effectively.