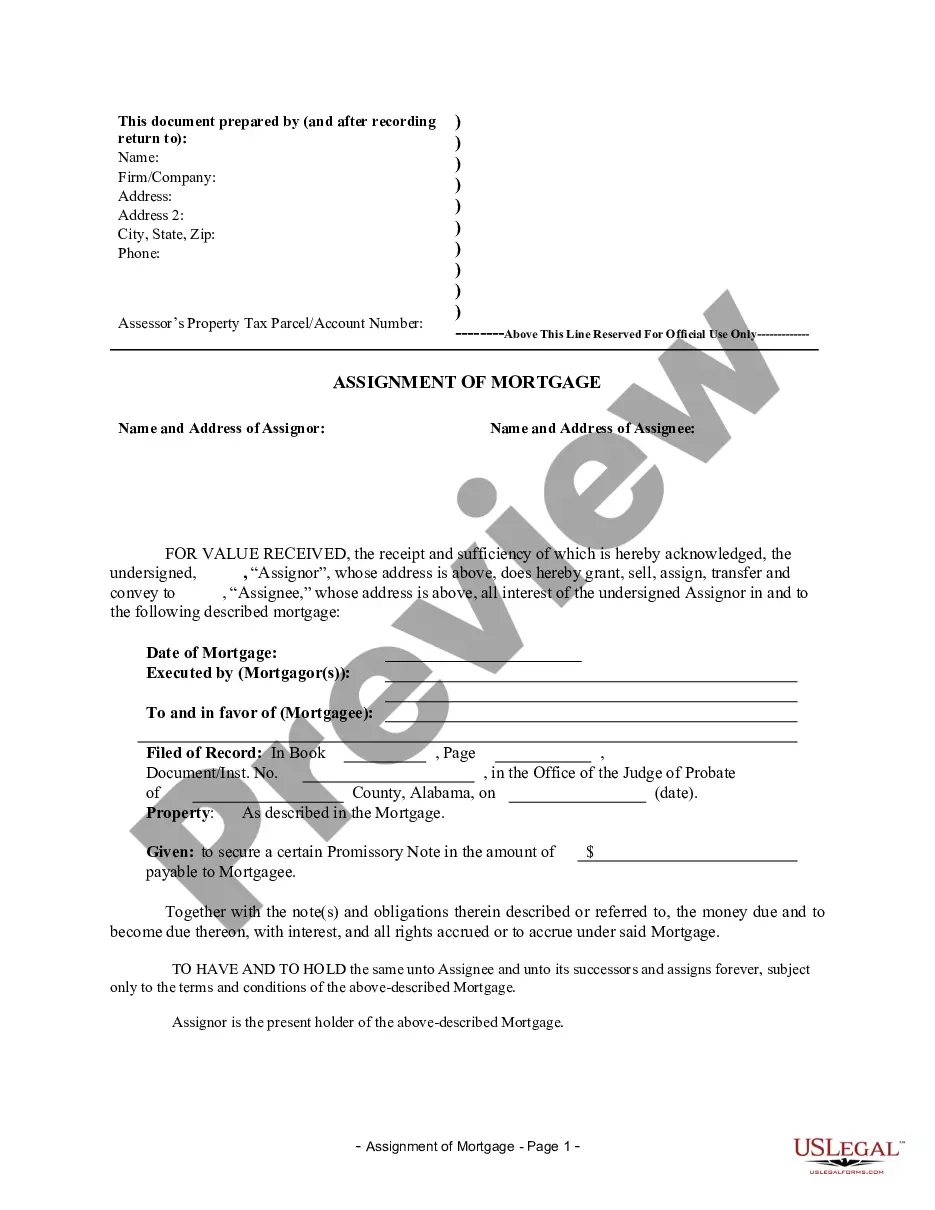

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Alabama Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Alabama Assignment Of Mortgage By Individual Mortgage Holder?

Employing Alabama Assignment of Mortgage by Individual Mortgage Holder examples crafted by skilled lawyers provides you the chance to evade stress while completing paperwork.

Simply download the example from our site, complete it, and ask a lawyer to verify it.

This can assist you in saving significantly more time and expenses than having an attorney draft a document from the beginning for you.

Use the Preview feature and examine the description (if accessible) to determine if you need this particular template and if so, click Buy Now. Locate another sample using the Search box if needed. Choose a subscription that meets your requirements. Start using your credit card or PayPal. Choose a file format and download your document. After you’ve completed all of the above steps, you will be able to fill out, print, and sign the Alabama Assignment of Mortgage by Individual Mortgage Holder example. Remember to verify all entered details for accuracy before submitting it or sending it out. Minimize the time you spend on document creation with US Legal Forms!

- If you’ve already obtained a US Legal Forms membership, just Log In to your profile and navigate back to the example webpage.

- Locate the Download button next to the template you are reviewing.

- After downloading a file, you will find all of your saved samples in the My documents section.

- If you don’t have a membership, that’s not a major issue.

- Simply follow the guidelines below to register for an online account, obtain, and complete your Alabama Assignment of Mortgage by Individual Mortgage Holder template.

- Double-check and ensure that you’re acquiring the appropriate state-specific form.

Form popularity

FAQ

To release an assignment of a mortgage, the original lender must execute a formal release document that states the mortgage obligation is fully satisfied. This release should be filed with the appropriate county office, where the mortgage was recorded, to ensure public records are accurate. In the process of handling an Alabama Assignment of Mortgage by Individual Mortgage Holder, confirming that all legal requirements are met can prevent future issues. Using US Legal Forms can help you find the correct documentation to facilitate this release efficiently.

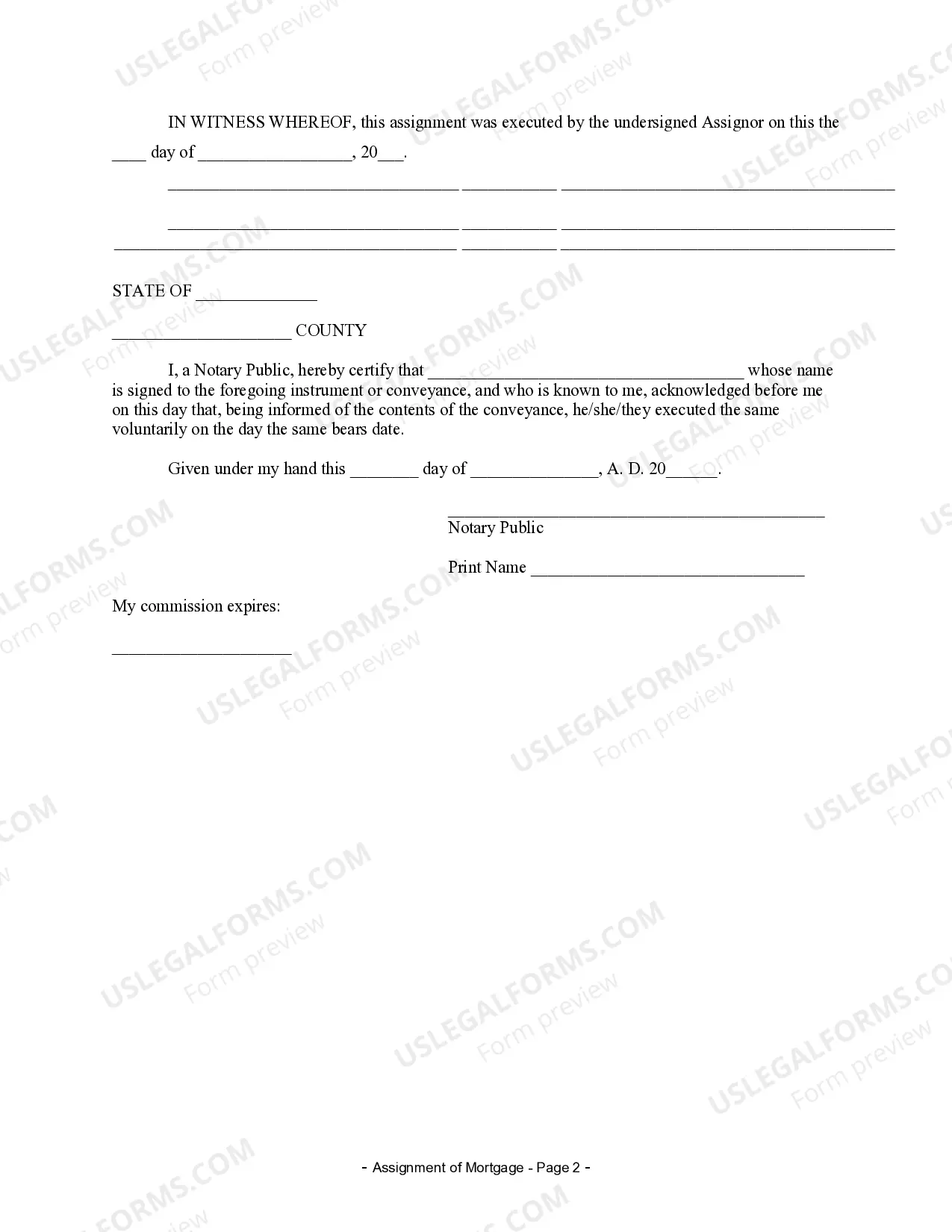

Typically, the assignment of a mortgage requires the signature of the current mortgage holder, who is transferring the mortgage rights. This may also include witnesses or a notary, depending on the specific requirements of Alabama law. When dealing with an Alabama Assignment of Mortgage by Individual Mortgage Holder, ensuring all parties' signatures are obtained is crucial for the assignment to be legally binding. Utilizing platforms like US Legal Forms can simplify this process by providing the necessary templates.

Assigning a mortgage involves transferring the mortgage rights from one party to another. In the case of the Alabama Assignment of Mortgage by Individual Mortgage Holder, this involves drafting an assignment document that details the transfer. It's crucial to engage a professional, like those at uslegalforms, to ensure that all legal requirements are met and the assignment is properly recorded.

This is a common question when it comes to financing options. The short answer is yes, you can assign a mortgage to someone, but it typically requires the lender's consent. In the context of the Alabama Assignment of Mortgage by Individual Mortgage Holder, you must follow specific legal procedures to ensure that the assignment is valid and binding.

Yes, you can transfer a mortgage to one person, but the process is not as straightforward as it may seem. When discussing the Alabama Assignment of Mortgage by Individual Mortgage Holder, it's essential to understand that both parties need to agree to the assignment terms. Additionally, the lender's approval is often required to ensure they are comfortable with the new mortgage holder's creditworthiness.

Transferring an existing mortgage to another person is possible through the Alabama Assignment of Mortgage by Individual Mortgage Holder. This process involves notifying your lender and obtaining their consent, as many mortgages contain clauses that restrict transferability. For a smooth transfer experience, it is advisable to use reliable resources like US Legal Forms, which can guide you through the necessary paperwork and legal requirements.

Yes, a mortgage can be assigned to another person under the process known as Alabama Assignment of Mortgage by Individual Mortgage Holder. This legal procedure allows the original mortgage holder to transfer their rights and obligations to someone else. However, it’s important that both parties understand the terms of the mortgage and follow any requirements outlined by the lender. For assistance, you can explore the services of a platform like US Legal Forms to ensure proper documentation.

To complete an assignment of mortgage, start by preparing an assignment document that includes details of the original mortgage and the parties involved. Ensure that all signatures are gathered and the document is notarized. Finally, record the assignment with the appropriate local authority to finalize the Alabama Assignment of Mortgage by Individual Mortgage Holder.

Yes, an assignment of mortgage should be recorded to ensure it has legal standing. While it may not be strictly required in every situation, recording protects the interests of the parties involved and helps avoid disputes in the future. This is especially important for the Alabama Assignment of Mortgage by Individual Mortgage Holder.

A recorded assignment of a mortgage is the formal process of documenting the transfer of mortgage rights in public records. This recording provides legal proof of the assignment and protects the new lender's interest. In the scope of Alabama Assignment of Mortgage by Individual Mortgage Holder, recording is essential for clarity and security.