Alabama Notice of Default for Past Due Payments in connection with Contract for Deed

About this form

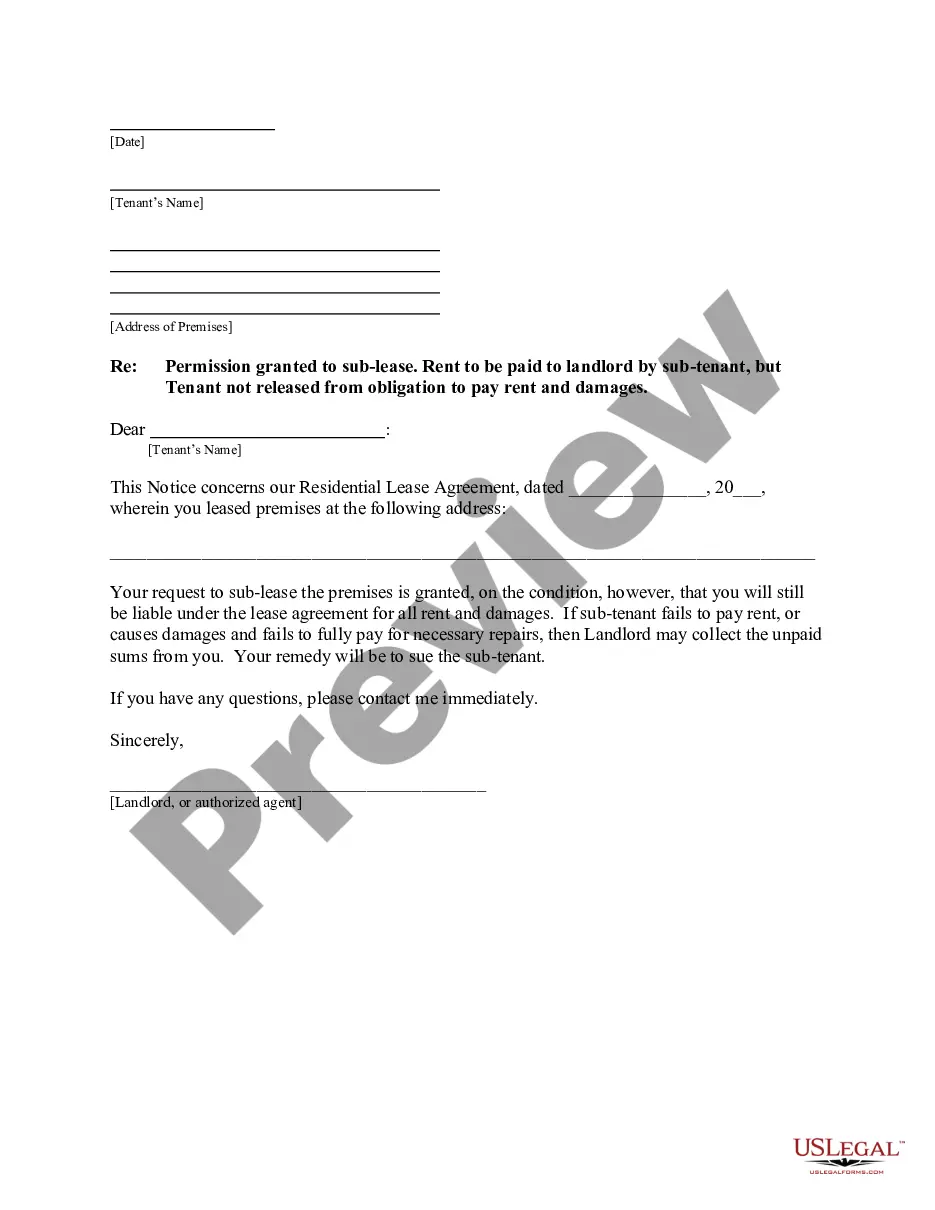

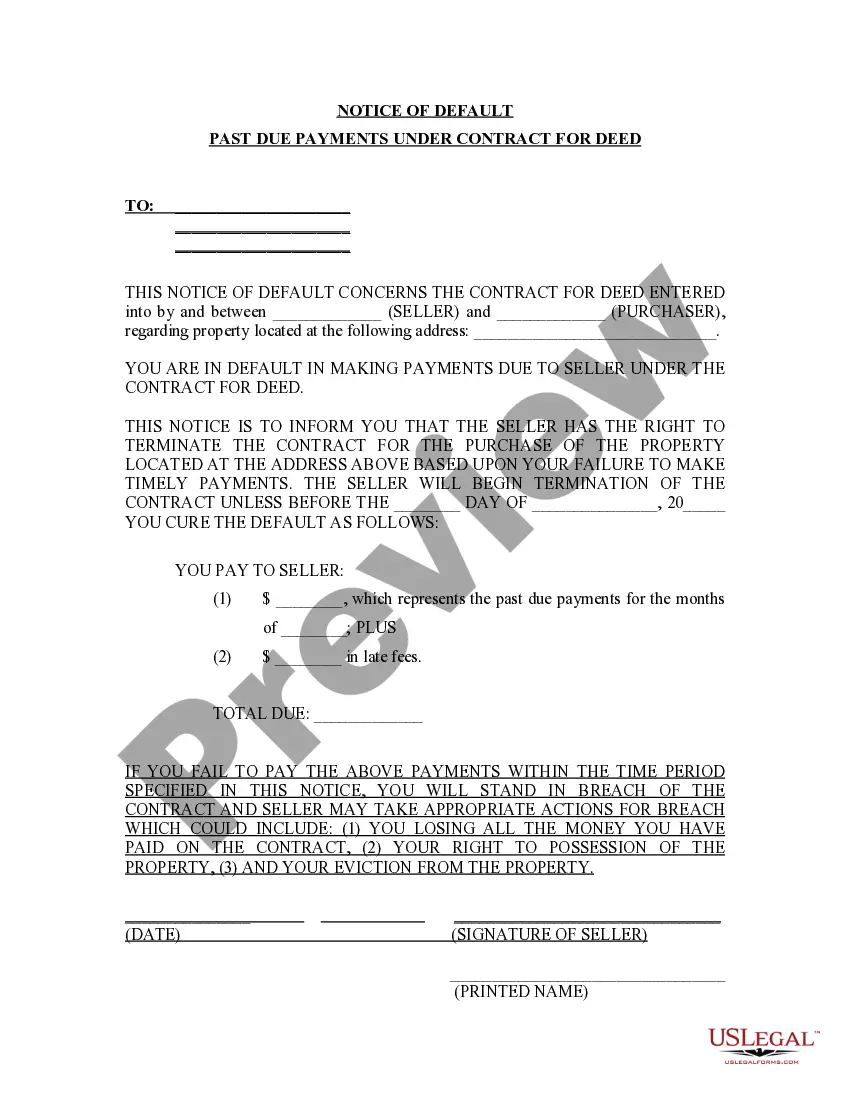

The Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that serves as the Seller's initial notification to the Purchaser regarding late payments related to a property sold under a contract for deed. This form is critical for informing the Purchaser that they have not met the payment terms outlined in the contract. By issuing this notice, the Seller indicates that failure to rectify the situation could lead to default of the contract, making it distinct from other payment reminder forms that may not carry legal implications.

Key parts of this document

- Identification of Seller and Purchaser: Clearly states the parties involved in the contract.

- Details of Past Due Payments: Specifies the amount and dates of payments that are overdue.

- Notice of Default: Official declaration of failure to comply with payment terms.

- Consequences of Default: Outlines potential repercussions if the Purchaser does not respond appropriately.

- Signature Section: Space for the Seller's signature to validate the notice.

When to use this document

This form should be used when a Seller needs to formally notify a Purchaser that they are behind on payments due under a contract for deed. It is appropriate to issue this notice if the Purchaser has not made timely payments as agreed, providing them with the opportunity to rectify the situation before any further action is taken, such as termination of the contract.

Who should use this form

- Contract for deed Sellers who have not received timely payments.

- Purchasers who are unsure about their payment status and need clarification from the Seller.

- Real estate professionals advising clients on managing payment defaults.

How to complete this form

- Identify the parties: Fill in the names and contact information of both the Seller and Purchaser.

- Specify payment details: Clearly list the amounts due and the dates of the missed payments.

- Include the notice of default: State that the Purchaser is in default due to non-payment.

- Outline consequences: Describe the actions that may result if the payment is not made promptly.

- Sign and date: Have the Seller sign the document and include the date of issuance.

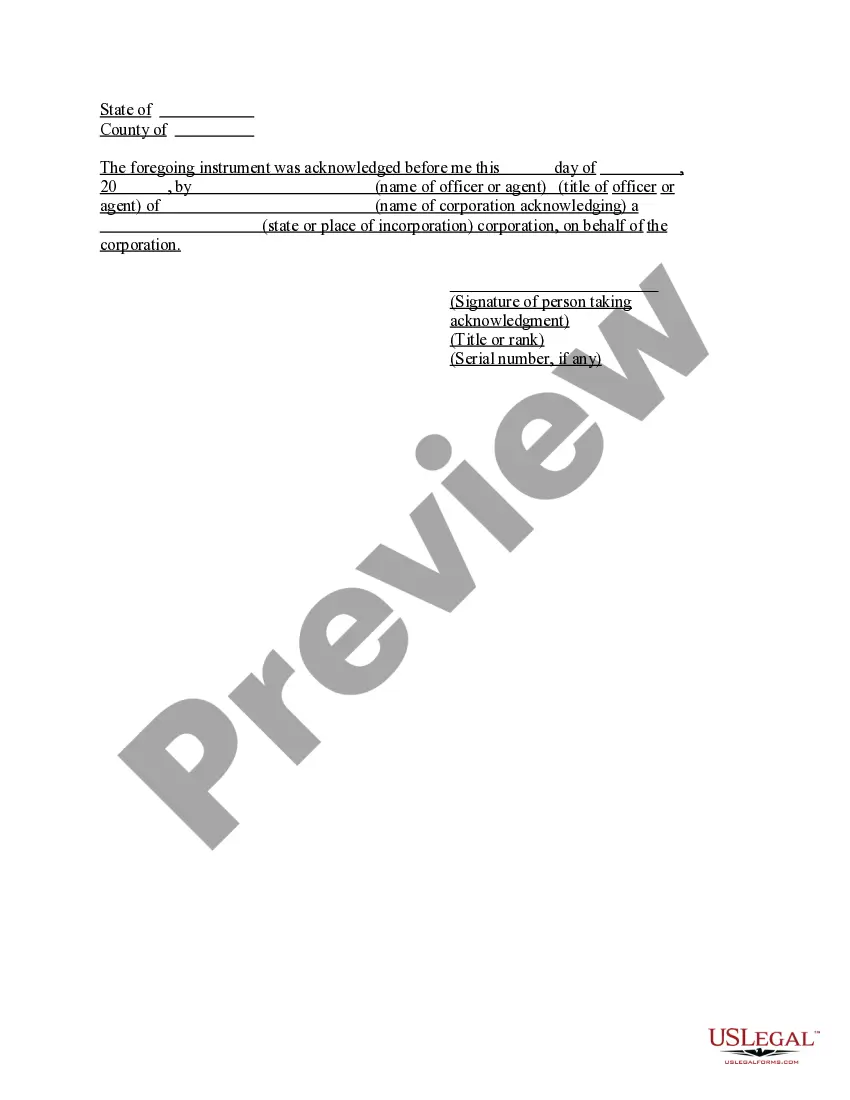

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide specific dates for missed payments.

- Not including the Seller's contact information.

- Neglecting to outline the consequences of default clearly.

- Omitting the signature or date, making the notice invalid.

Benefits of using this form online

- Convenience: Download and fill out the form at your own pace.

- Editability: Make necessary adjustments easily before finalizing the notice.

- Reliability: Use forms drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

What happens when you get a default notice? Your creditor will ask you to pay the full amount of the debt instead of paying the instalments you first agreed.Your creditor can also take further action after the account has defaulted, including: Passing the debt to a collection agency.

Breach: Everything You Need to Know. In contract law, a breach means the failure of a contracting party to perform their obligations according to the terms of the agreement.Default, according to the law of obligations and banking law, means to refuse to pay a debt when due.

In law, a default is the failure to do something required by law.

Once a default is recorded on your credit profile, you can't have it removed before the six years are up (unless it's an error). However, there are several things that can reduce its negative impact: Repayment. Try and pay off what you owe as soon as possible.

A default notice (sometimes referred to as a default letter or Notice of Default) is a formal letter sent to you by a creditor as a result of payments missed on a credit agreement between yourself and a credit provider.The notice will give you 14 days to pay any amount owed before issuing a default.

Generally, if a defendant fails to respond to a complaint you can get a default judgment after 45 days. However, the court system is very slow these days and it can take several months to get the court to issue the default judgment.

A default is a non-material breach of contract, whereby one party fails to perform a contractual obligation. What specifically constitutes a default will be set out in the contract terms, but generally, it can be defined as an omission or a failure to do what is expected or required.