Wyoming Llc Operating Agreement With Profits Interest

Description

How to fill out Wyoming Limited Liability Company LLC Operating Agreement?

There is no longer a necessity to invest hours seeking legal documents to meet your local state obligations. US Legal Forms has gathered all of them in one location and improved their accessibility.

Our platform provides more than 85,000 templates for various business and personal legal situations categorized by state and purpose. All forms are thoroughly drafted and verified for legality, so you can confidently obtain an up-to-date Wyoming LLC Operating Agreement With Profits Interest.

If you are acquainted with our service and have an existing account, ensure your subscription is active before accessing any templates. Sign in to your account, select the document, and click Download. You can also return to all previously obtained documents at any time by accessing the My documents section in your profile.

Print your form to fill it out manually or upload the sample if you wish to do it in an online editor. Creating formal documentation under federal and state laws and regulations is swift and simple with our collection. Explore US Legal Forms today to maintain your paperwork organized!

- If you haven't utilized our platform before, the process will involve a few additional steps. Here’s how new users can locate the Wyoming LLC Operating Agreement With Profits Interest in our catalog.

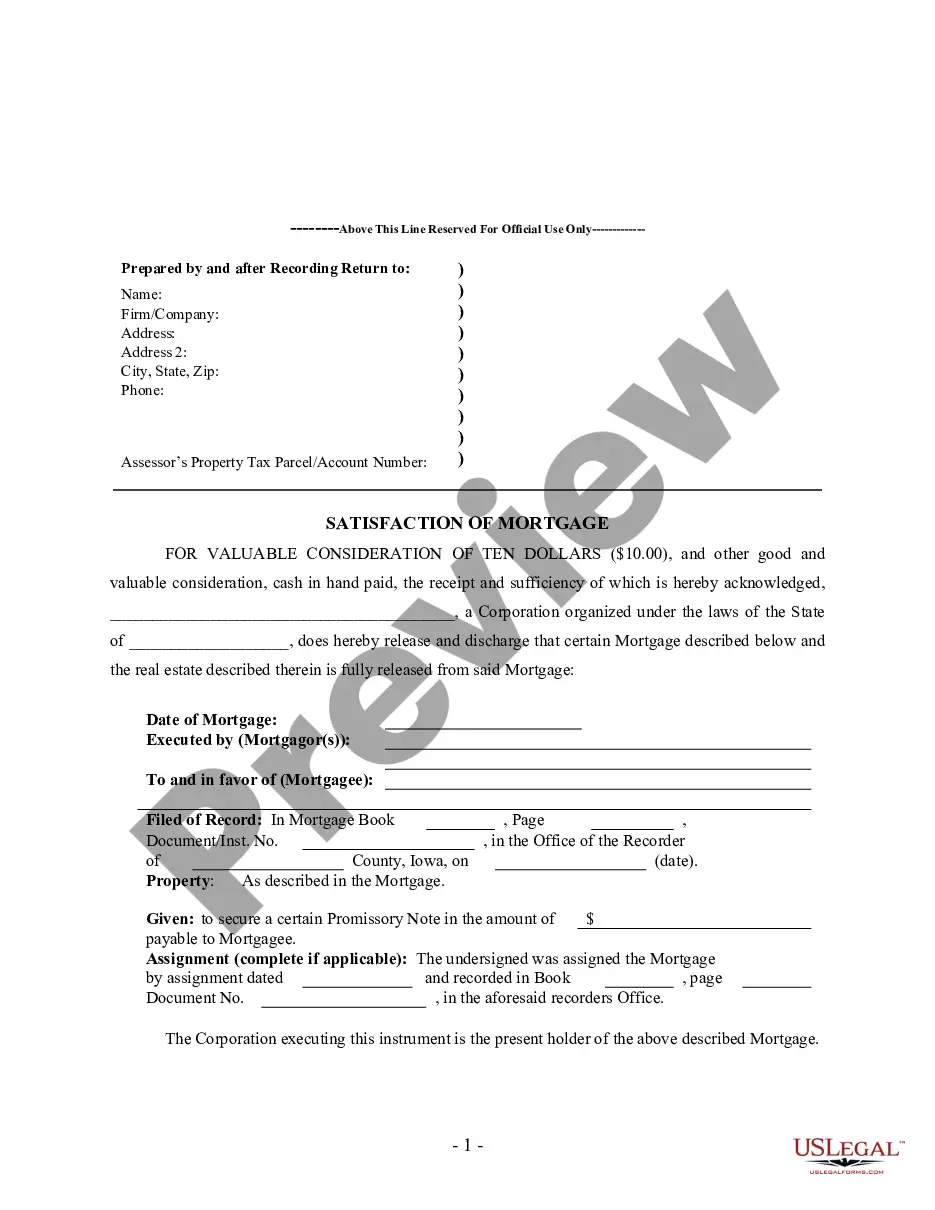

- Carefully read the page content to ensure it includes the sample you need.

- Use the form description and preview options if available for this.

- Leverage the Search field above to look for another sample if the previous one was not suitable for you.

- Click Buy Now next to the template title upon locating the correct one.

- Select the most appropriate pricing plan and create an account or Log In.

- Process your payment for the subscription using a credit card or through PayPal.

- Choose the file format for your Wyoming LLC Operating Agreement With Profits Interest and download it to your device.

Form popularity

FAQ

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

How to Start an LLC in WyomingChoose a Name for Your LLC.Appoint a Registered Agent.File Articles of Organization.Prepare an Operating Agreement.Comply With Tax and Regulatory Requirements.Annual Report.

Is an LLC Operating Agreement required in Wyoming? No. An Operating Agreement is not required in Wyoming. Although it is not required, the SBA recommends that all LLCs in every state have a clear and detailed Operating Agreement.

From a tax perspective, an LLC is known as a pass-through entity. That means that rather than being taxed on the income it makes, this income passes through to its members, who are then taxed on this income individually. Unless it elects to be taxed as a corporation, a multi-member LLC is treated as a partnership.