Wisconsin Trust Formation

Description

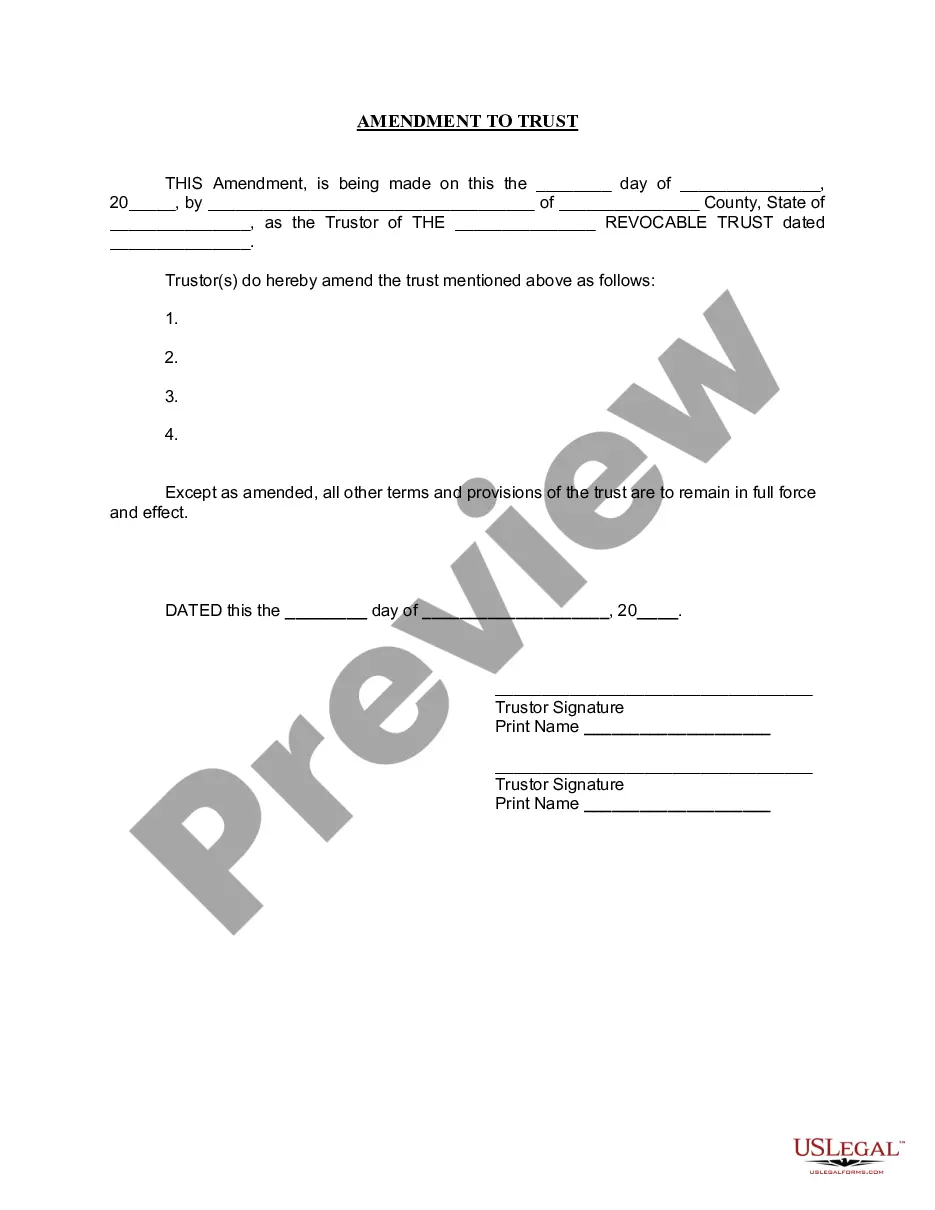

How to fill out Wisconsin Amendment To Living Trust?

Locating a reliable source for obtaining the most up-to-date and pertinent legal documents is a significant part of dealing with bureaucracy. Securing the correct legal paperwork demands precision and meticulousness, which is why it is vital to acquire Wisconsin Trust Formation samples exclusively from trustworthy providers, such as US Legal Forms. An incorrect template will consume your time and delay your circumstances. With US Legal Forms, you have little to fret about. You can access and review all details concerning the document’s applicability and significance for your situation in your state or locality.

Consider the following steps to complete your Wisconsin Trust Formation.

After obtaining the form on your device, you can modify it with the editor or print it out to complete it by hand. Eliminate the hassle associated with your legal documents. Explore the comprehensive US Legal Forms catalog to uncover legal samples, evaluate their relevance to your circumstances, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Examine the form’s details to ensure it meets the criteria of your state and area.

- Preview the form, if available, to confirm that the template is what you seek.

- Return to the search to find the correct template if the Wisconsin Trust Formation does not meet your requirements.

- Once you are confident about the form’s suitability, download it.

- If you are an authorized user, click Log in to verify your identity and access the selected forms in My documents.

- If you do not possess an account yet, click Buy now to obtain the template.

- Select the pricing package that fits your needs.

- Proceed to register to complete your transaction.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the format for downloading Wisconsin Trust Formation.

Form popularity

FAQ

Establishing a trust in Wisconsin requires a few key steps. First, determine the type of trust that fits your goals, whether it be a revocable or irrevocable trust. Next, you can utilize online services like US Legal Forms that offer templates specific to Wisconsin trust formation, making the process straightforward. Finally, be sure to fund your trust properly so that it can effectively manage your assets.

Yes, you can establish a trust without a lawyer through online platforms such as US Legal Forms that guide you through the Wisconsin trust formation process. By using user-friendly templates and resources, you can create a trust that meets your needs. However, consider consulting a legal expert if your situation is complex or involves significant assets. This can help ensure your trust meets state requirements and fulfills your intentions.

To form a trust in Wisconsin, you need to draft a trust document that specifies the trust's terms and beneficiaries. Start by deciding on the type of trust that aligns with your goals, and then consult professionals—like uslegalforms—to help with the paperwork. Once completed, be sure to transfer assets into the trust to activate it. Engaging in Wisconsin trust formation can provide significant benefits in wealth management.

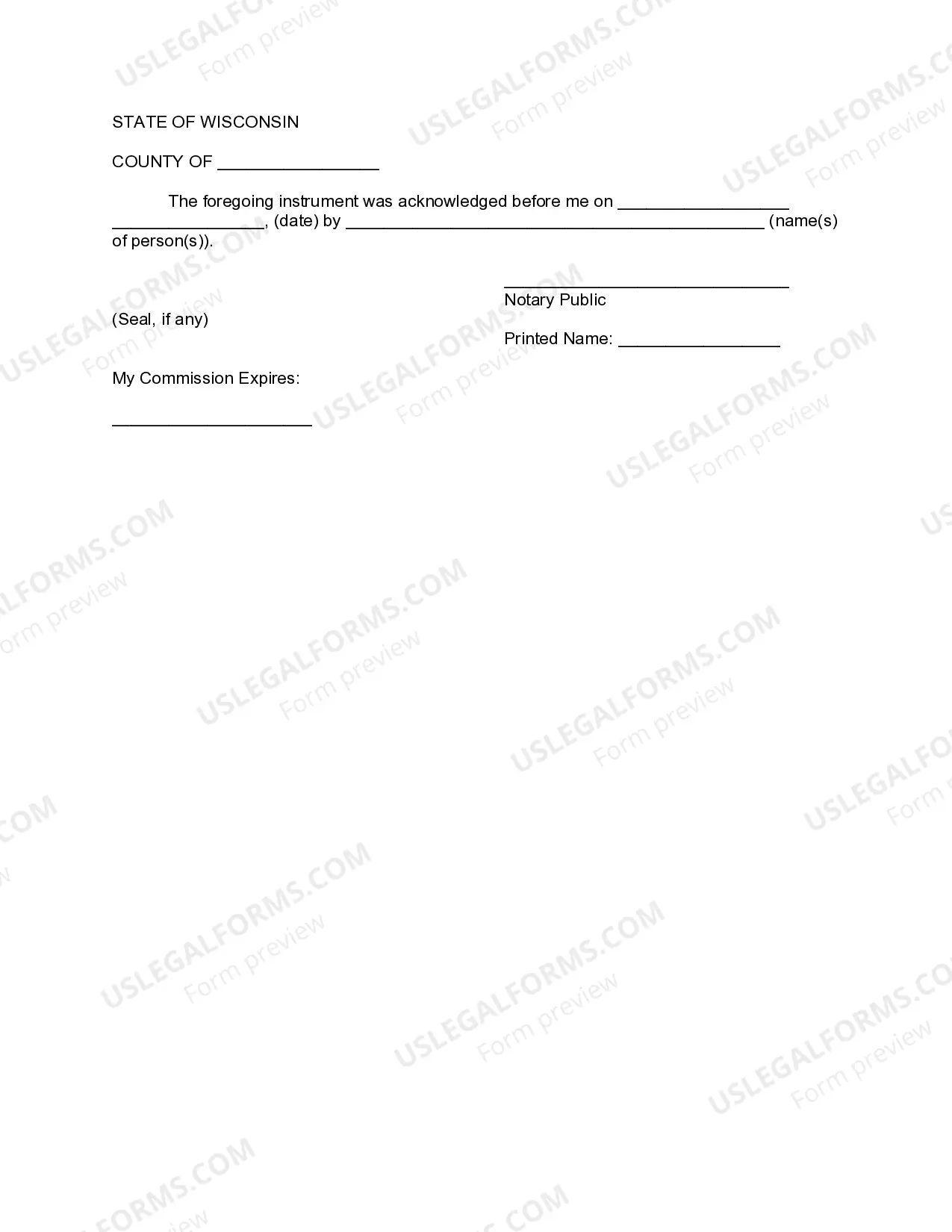

The trustee of the trust is responsible for filing the trust tax return. This person must ensure compliance with tax laws, especially in the context of Wisconsin trust formation. If there are multiple trustees, they need to coordinate to ensure that filing deadlines are met. Trusts often outline responsibilities within their governing documents.

A trust must file a tax return if it earns over $600 in gross income. This applies to all forms of trust as part of Wisconsin trust formation. Even if the income is below this threshold, it may still benefit your trust to file a return for various strategic reasons. Consulting a tax professional can offer clarity on your specific situation.

You should file a T3 trust return for any trust that has generated income during the tax year. In the case of Wisconsin trust formation, the return is typically due on March 31st of the following year. If your trust has a fiscal year-end, the due date can vary. Make sure to keep accurate records to determine the filing requirements.

Whether to choose a trust or a will in Wisconsin depends on your specific circumstances. A trust offers advantages such as avoiding probate and providing more control over asset distribution. In contrast, a will is generally simpler and less expensive to create. Consider your long-term goals and consult with experts to make an informed decision on Wisconsin trust formation.

Filling out a certification of trust form involves providing key information about the trust, including its name, date of creation, and details about the trustee. Make sure to include any specific powers granted to the trustee. It's crucial to follow the correct format to ensure the trust is legally recognized. For further help, the US Legal Forms platform offers user-friendly resources for effective Wisconsin trust formation.

The three primary types of trusts are revocable trusts, irrevocable trusts, and testamentary trusts. Revocable trusts allow you to maintain control over assets during your lifetime, while irrevocable trusts typically provide tax benefits and protection from creditors. Testamentary trusts come into effect after your death, distributing assets according to your wishes. Understanding these types can simplify your Wisconsin trust formation process.

To set up a trust in Wisconsin, start by deciding which type of trust best suits your needs. Next, you need to draft a trust document that outlines the terms and conditions, appointing a trustee to manage the assets. After your document is complete, fund the trust by transferring your assets into it. For assistance, consider using the US Legal Forms platform, which offers templates and guidance for smooth Wisconsin trust formation.