Wisconsin Basic Will With Trust

Description

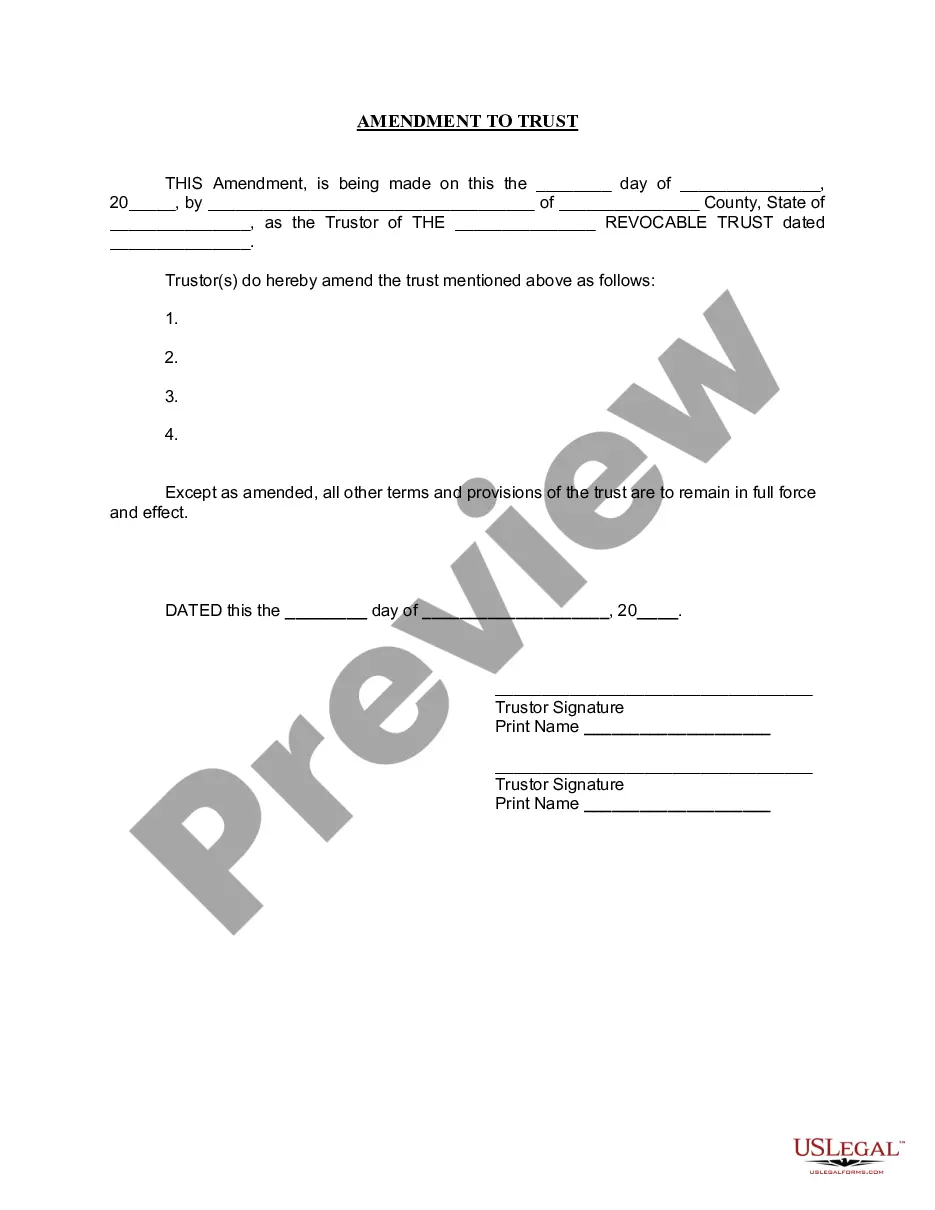

How to fill out Wisconsin Amendment To Living Trust?

Securing a reliable source for the most up-to-date and suitable legal templates is a significant part of navigating administrative procedures.

Acquiring the correct legal documents requires precision and mindfulness, which is why it's essential to obtain samples of the Wisconsin Basic Will With Trust exclusively from trustworthy outlets, such as US Legal Forms.

Eliminate the stress associated with your legal paperwork. Browse through the extensive US Legal Forms library to discover legal templates, evaluate their suitability for your circumstances, and download them instantly.

- Utilize the library navigation or search box to locate your template.

- Review the form’s description to confirm it meets the stipulations of your state and area.

- Examine the form preview, if available, to verify that the template is indeed the one you need.

- Return to the search and find the suitable template if the Wisconsin Basic Will With Trust does not meet your needs.

- If you are confident about the form’s applicability, download it.

- As an authorized client, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing plan that aligns with your needs.

- Continue to the registration to complete your transaction.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Wisconsin Basic Will With Trust.

- After obtaining the form on your device, you can edit it using the editor or print it out and complete it by hand.

Form popularity

FAQ

Having both a Wisconsin basic will with trust can be an effective way to manage your estate. A will allows you to specify how your assets will be distributed after your passing, while a trust can help you manage your assets during your lifetime and can reduce probate costs. By combining both, you ensure that your wishes are clearly stated and your estate is handled smoothly. Consider using the uslegalforms platform to create your Wisconsin basic will with trust efficiently.

To create a valid Wisconsin basic will with trust, you must be at least 18 years old and of sound mind. The will needs to be in writing, and you must sign it in front of two witnesses who are also present at the same time. It's essential that these witnesses do not stand to gain from the will. Following these straightforward steps ensures your Wisconsin basic will with trust meets legal requirements.

Filling out a Wisconsin basic will with trust involves a few key steps. First, gather essential information about your assets, beneficiaries, and any special requests regarding the distribution of your estate. Next, use a reliable platform like US Legal Forms to access customizable templates that guide you through the process smoothly. Finally, ensure you sign the document in front of witnesses to meet Wisconsin's legal requirements, making your will and trust valid and enforceable.

In estate planning, the choice between establishing a will or a trust first largely depends on your specific circumstances. Generally, you can create a Wisconsin basic will with trust simultaneously, as they serve complementary purposes. Having both documents allows for a more comprehensive approach to managing your estate and ensuring your wishes are honored.

Deciding between a trust or a will in Wisconsin revolves around your financial situation and goals. A Wisconsin basic will with trust may be beneficial if you wish to simplify the distribution process and avoid probate. However, if your estate is uncomplicated, a will might be adequate. Consulting with professionals, like those from USLegalForms, can help clarify which option best meets your needs.

A trust is often considered better than a will due to its ability to avoid probate, which can be a lengthy and costly process. A Wisconsin basic will with trust allows for more privacy, as trusts do not become public records. Moreover, trusts provide flexibility in managing your assets, ensuring your loved ones receive support without the complications that a will might entail.

Whether a trust is better than a will in Wisconsin depends on your unique situation. A Wisconsin basic will with trust offers benefits, such as avoiding probate and providing more control over asset distribution. However, if your estate is straightforward, a will may suffice. Evaluating your specific needs is crucial in determining the best option for you.

Creating a simple will in Wisconsin involves several steps. First, you need to outline your wishes regarding asset distribution and choose an executor to handle your estate. You can use online resources, such as USLegalForms, to guide you through the process, ensuring your Wisconsin basic will with trust is legally compliant and reflects your intentions.

A trust and a simple will serve different purposes in estate planning. A Wisconsin basic will with trust outlines how you want your assets distributed after your passing, while a trust allows you to manage your assets during your lifetime and distribute them according to specific terms after your death. Additionally, trusts can help avoid probate, whereas a will typically goes through this process, which can be time-consuming and costly.