Wisconsin Transfer Valued Forest

Description

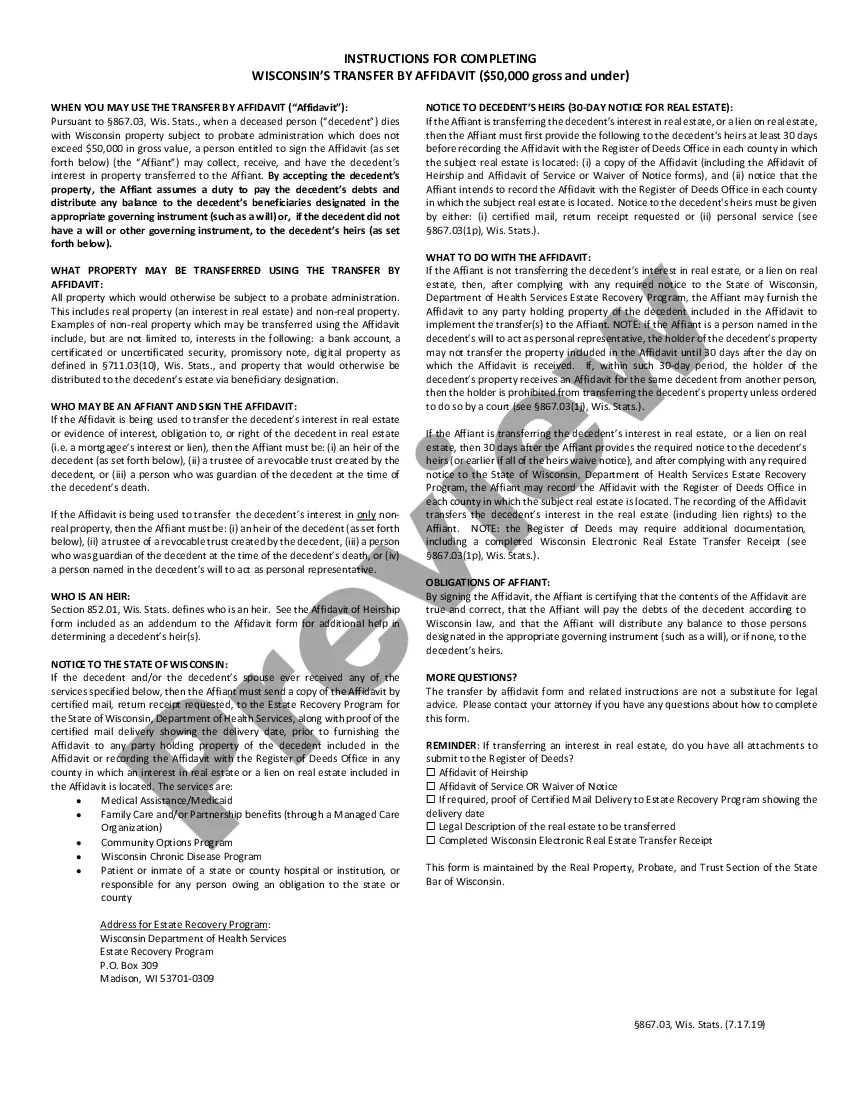

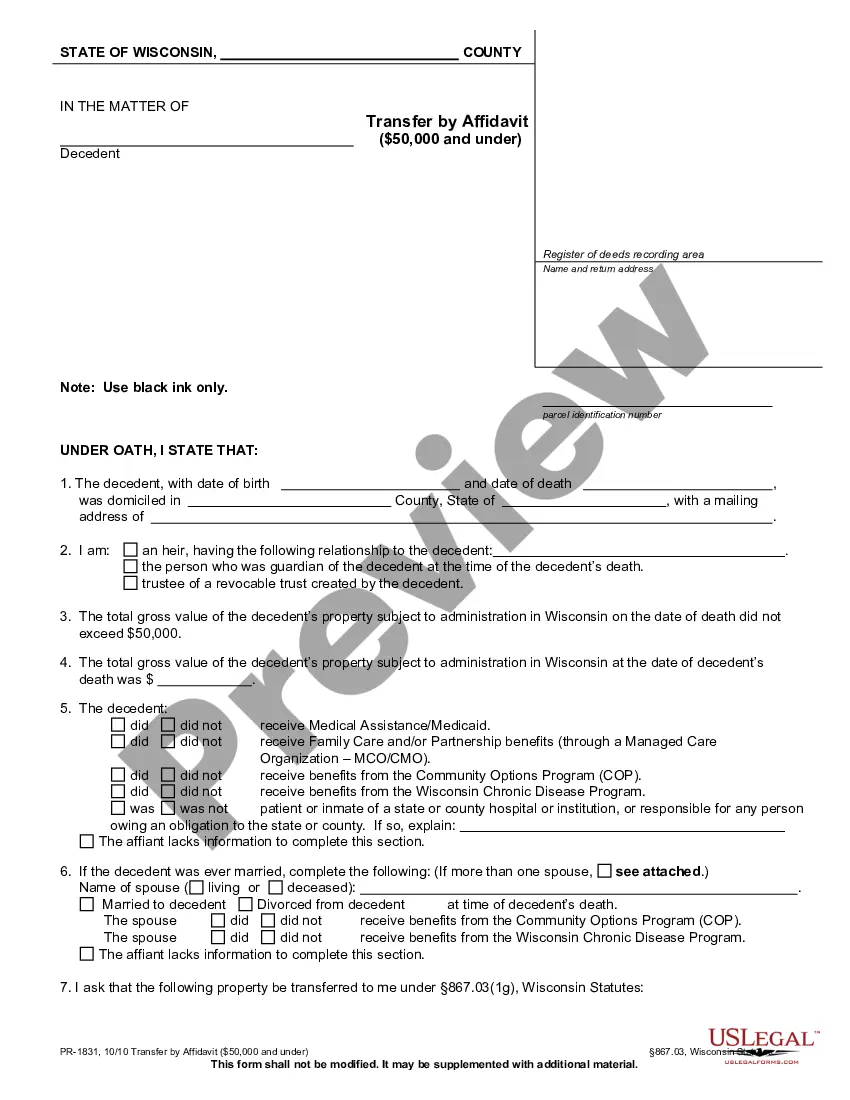

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Creating legal documents from the beginning can frequently be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you seek a more direct and cost-effective method for preparing Wisconsin Transfer Valued Forest or any other forms without dealing with unnecessary complications, US Legal Forms is always accessible.

Our online collection of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs.

Examine the document preview and descriptions to confirm that you have located the document you need. Ensure that the template you select meets the regulations of your state and county. Choose the most suitable subscription option to obtain the Wisconsin Transfer Valued Forest. Download the file, then complete, verify, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make form completion a simple and efficient process!

- With just a few clicks, you can promptly access templates tailored to your state and county, meticulously created by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services to easily find and obtain the Wisconsin Transfer Valued Forest.

- If you’re familiar with our services and have previously established an account, simply Log In to your account, select the template, and download it or retrieve it anytime from the My documents section.

- Not registered yet? No issue. It only takes a few minutes to set up and browse the catalog.

- However, before proceeding to download Wisconsin Transfer Valued Forest, adhere to these suggestions.

Form popularity

FAQ

Complete the deed form on your computer or print it and complete it in all black ink. The Grantors (current owners) must sign the deed before a notary public. 2. Go to the Wisconsin Department of Revenue's E-Return website at and complete an E-Return (eRETR).

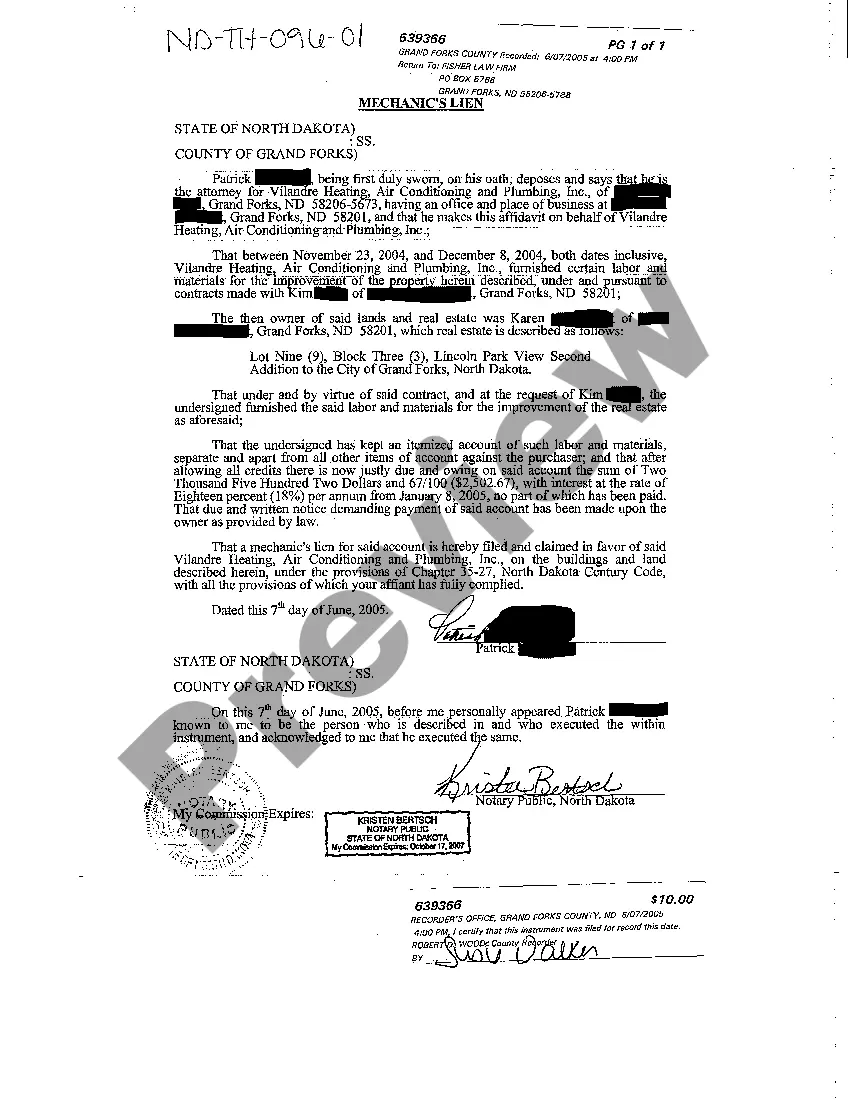

A deed filed for a partnership filing or canceling a statement of qualification is exempt from transfer fee under state law (sec. 77.25(6d), Wis. Stats.).

A deed and an Electronic Wisconsin Real Estate Transfer Return (eRETR) must be completed to convey title to real estate. If you need additional information in regards to your inquiry you will have to consult with a title company or an attorney. You can also contact the Register of Deeds at (608) 266-4141.

Transfer fee due The grantor of real estate must pay a real estate transfer fee at the rate of 30 cents for each $100 of value or fraction thereof on every conveyance not exempted or excluded under state law (sec. 77.22(1), Wis.

The deed transfer tax is $3.00 per $1000.00 or major fraction thereof of consideration. The seller customarily pays the deed transfer tax. Wisconsin does not have a mortgage, recordation or excise tax. Title insurance premium includes the search and examination fee.