Standard Term Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Standard Term Sheet?

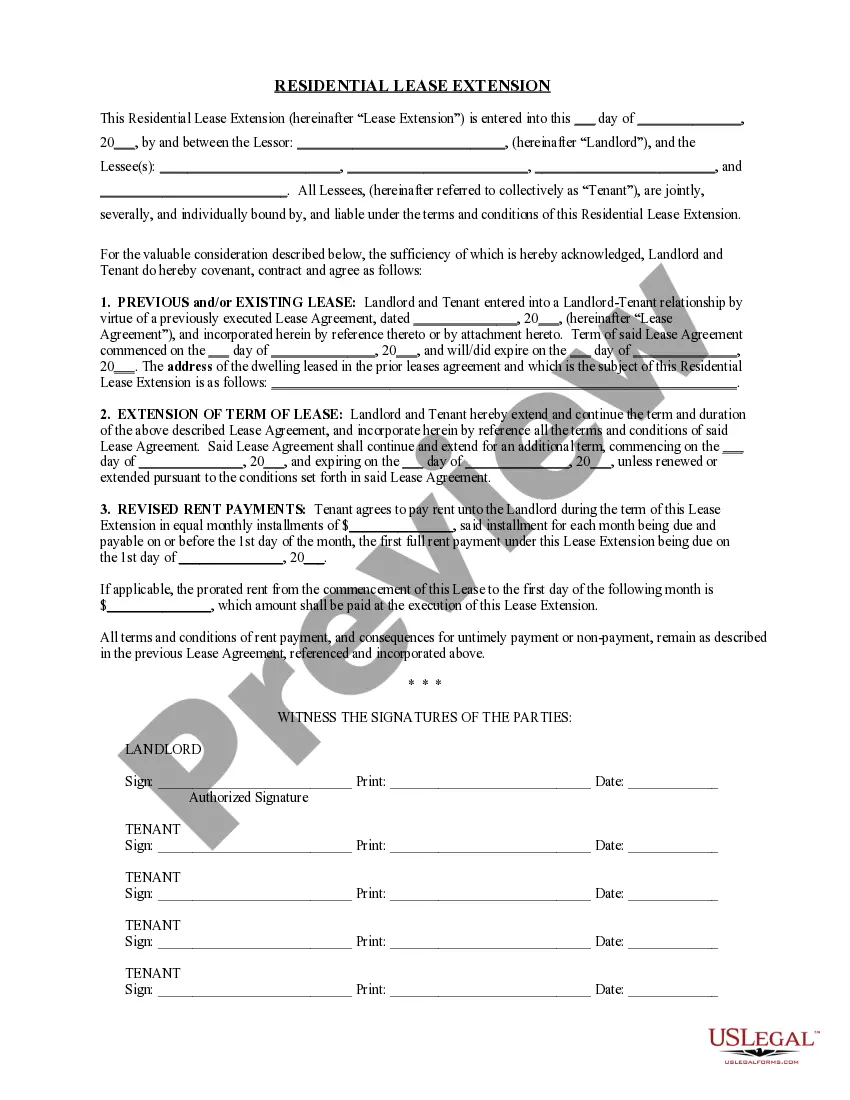

Use US Legal Forms to get a printable Standard Term Sheet. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most comprehensive Forms catalogue online and provides affordable and accurate samples for consumers and attorneys, and SMBs. The templates are grouped into state-based categories and some of them can be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to easily find and download Standard Term Sheet:

- Check to ensure that you get the proper template with regards to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Click Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search field if you need to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Standard Term Sheet. Above three million users already have utilized our service successfully. Select your subscription plan and get high-quality forms in a few clicks.

Form popularity

FAQ

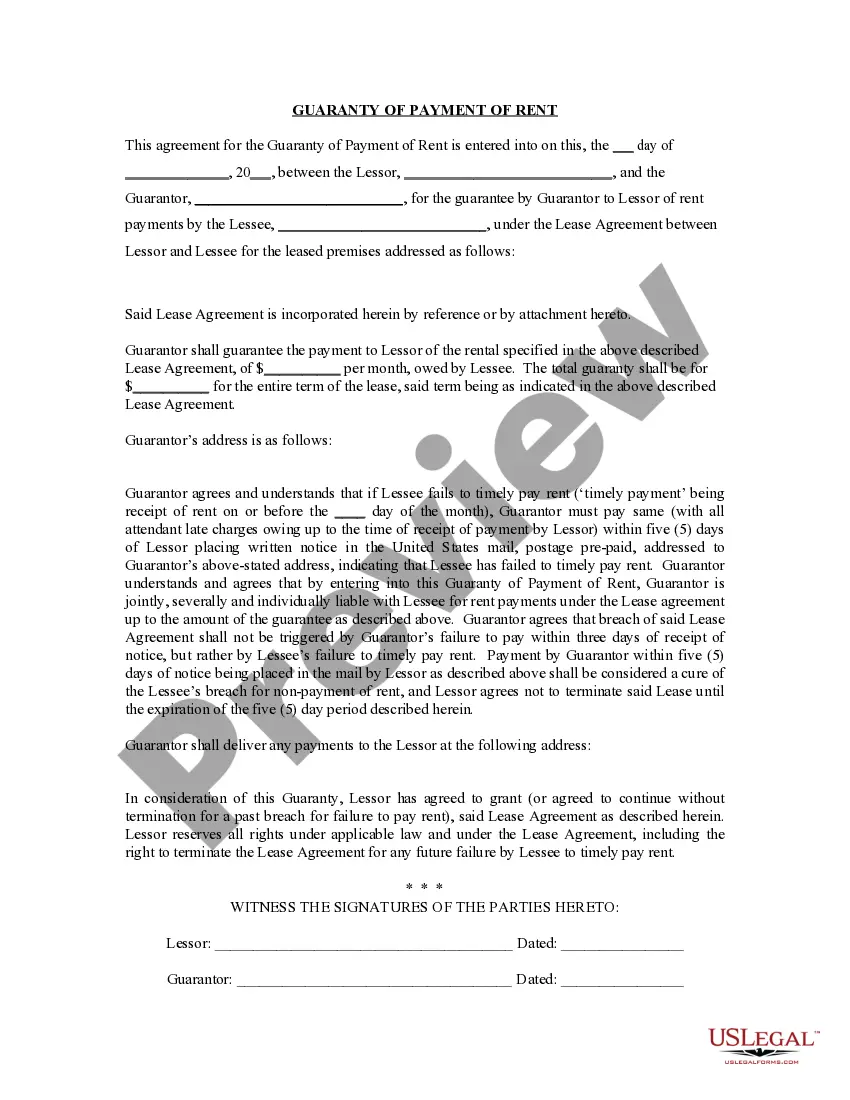

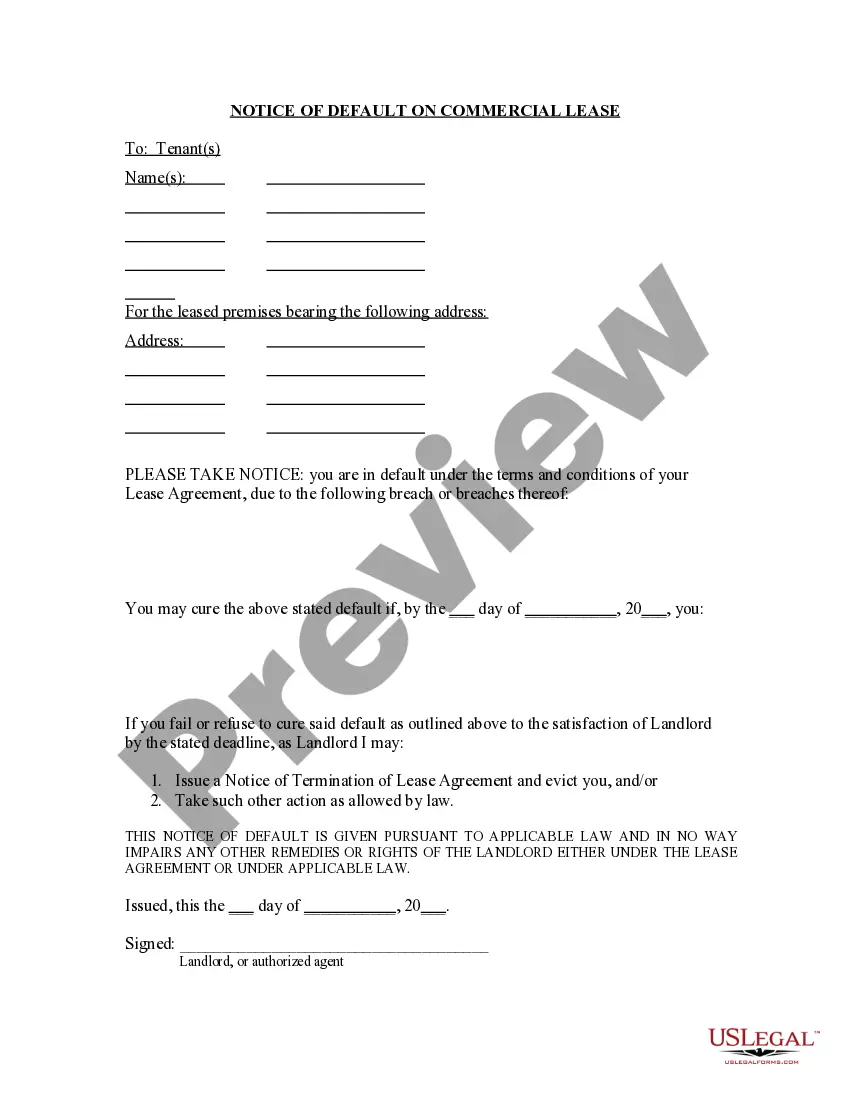

A term sheet usually has some provisions that are called out as being binding even though the rest of the term sheet is typically not binding. These binding provisions give the non-breaching party a right to sue for breach of those "binding" provisions.

Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

The approach to the final and binding agreement includes negotiating and signing the terms sheet, conducting due diligence, having legal counsel draft the final documents, and having a closing where all parties sign.

How much money is expected from the VC, or venture capitalist, to the founder of the startup, A detailed overview of the financial side of the investment, and. The power and controls given to the VCs.

A term sheet is a bullet-point document outlining the material terms and conditions of a potential business agreement, establishing the basis for future negotiations between a seller and buyer. It is usually the first documented evidence of possible acquisition. It may be either binding or non-binding.

Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.

Take the Time to Woo Multiple Investors. Do Your Due Diligence When Finding Investors. Negotiate A Term Sheet Better by Understanding the Terminology. Hire a Good Lawyer to Assist You. Prioritize the Non-Negotiables of Your Term Sheet. Be Prepared to Negotiate with Your Investor. Watch for Red Flags.