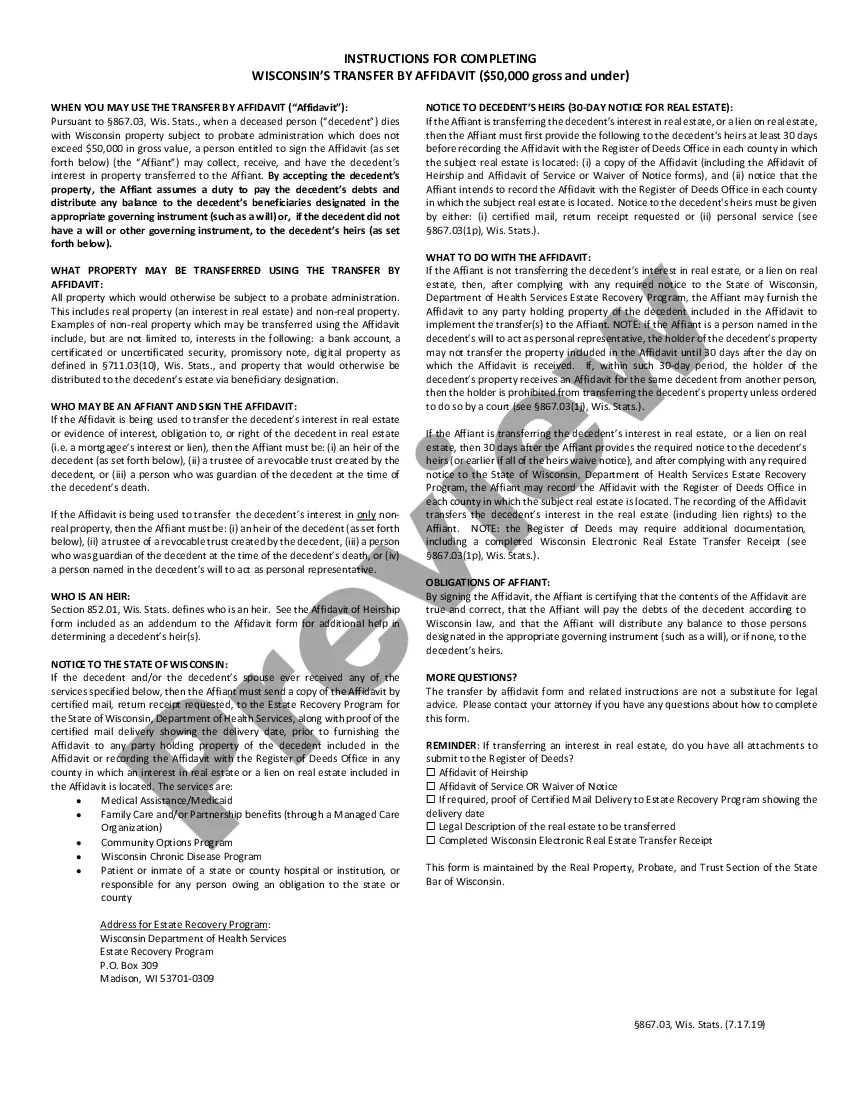

State Of Wisconsin Affidavit Of Under 50 000 For Estates

Description

How to fill out Wisconsin Transfer By Affidavit - And $50,000 And Under?

How to obtain professional legal documents that adhere to your state regulations and draft the State Of Wisconsin Affidavit Of Under 50,000 For Estates without hiring an attorney.

Numerous online services provide templates to address various legal situations and formalities. However, it can require time to assess which of the accessible samples meet both practical needs and legal standards for you.

US Legal Forms is a reliable platform that assists you in finding official documents created in accordance with the most recent state law updates and economizing on legal services.

If you don't have a US Legal Forms account, follow the steps below.

- US Legal Forms is not an ordinary web repository.

- It is a compilation of over 85k validated templates for diverse business and personal scenarios.

- All documents are organized by area and state to simplify your search process.

- Additionally, it integrates with powerful solutions for PDF editing and electronic signature, allowing users with a Premium subscription to quickly complete their documents online.

- It requires minimal time and effort to obtain the necessary forms.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the State Of Wisconsin Affidavit Of Under 50,000 For Estates using the appropriate button next to the filename.

Form popularity

FAQ

In Wisconsin, Small Estate Affidavits are commonly referred to as Transfer Affidavits. If you are dealing with someone's estate after they have passed, and there is $50,000 or less in probate assets, a transfer affidavit may be a good way to avoid probate, save time, and make the whole process easier for you.

How do I record the affidavit? If the non-probate assets include an interest in real estate, it must be recorded in the register of deeds in each Wisconsin county that the real estate is located in. The transfer affidavit must be signed and notarized.

How to File (5 steps)Step 1 Gather Information.Step 2 Prepare Affidavit(s)Step 3 Notify Department of Health Services.Step 4 Get All Forms Notarized.Step 5 Collect the Assets.

In order to qualify for the simplified small estate process in Wisconsin, the value of the estate must be worth $50,000 or less after mortgages and encumbrances are subtracted, and the decedent must be survived by a spouse or minor children.

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).