Transfer Affidavit Valued Without Probate California

Description

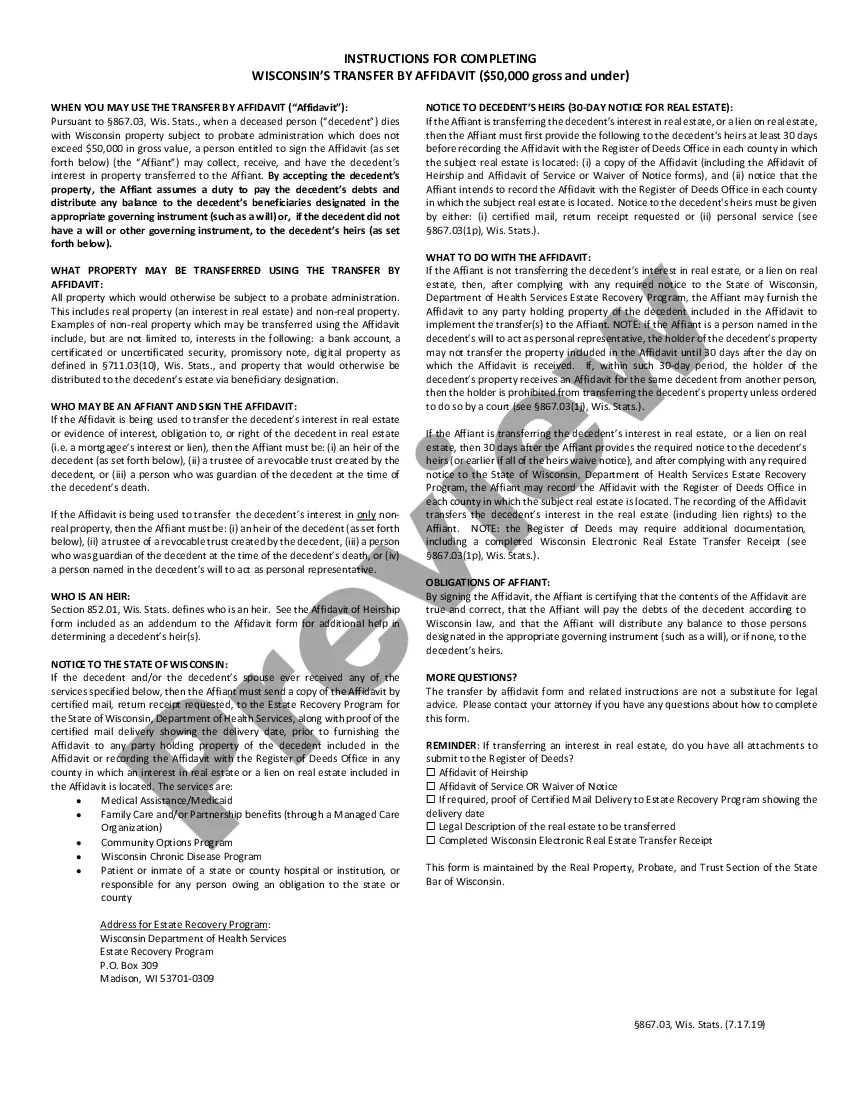

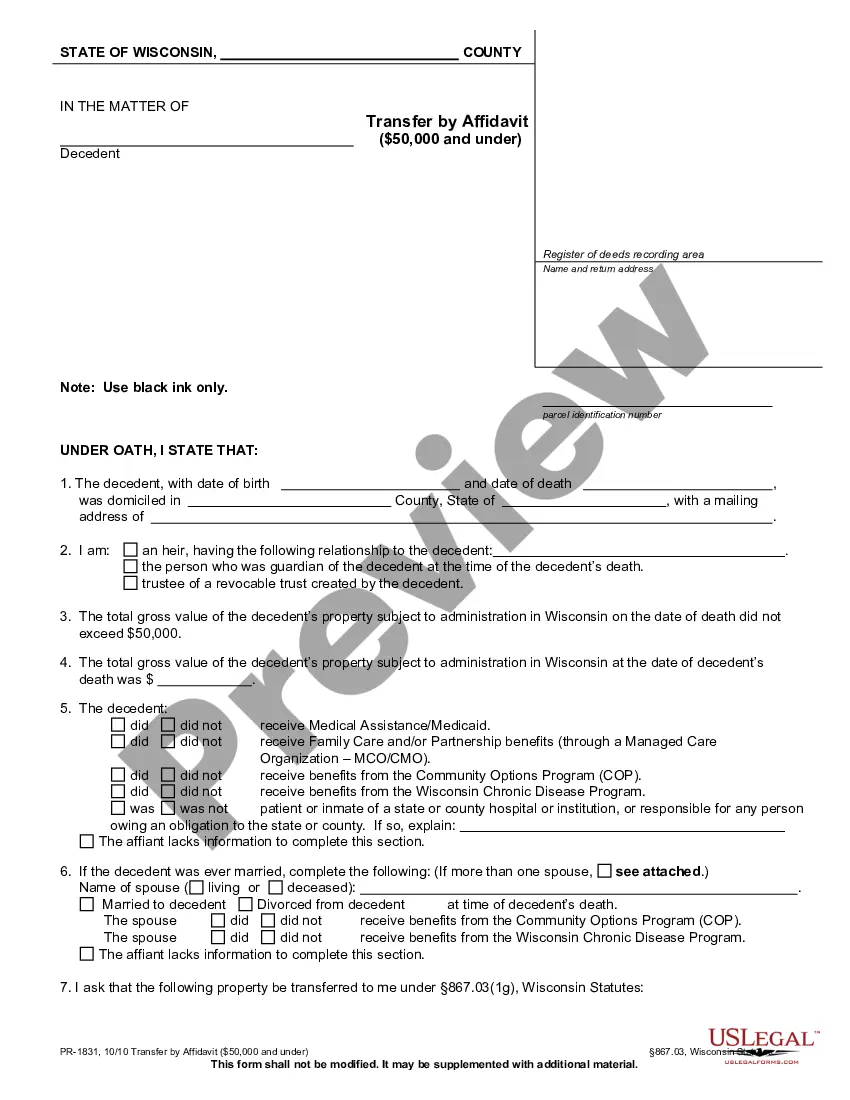

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

The Transfer Affidavit Valued Without Probate California you see on this page is a reusable legal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Transfer Affidavit Valued Without Probate California will take you only a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or review the form description to confirm it fits your requirements. If it does not, make use of the search option to get the right one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Transfer Affidavit Valued Without Probate California (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your papers one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

How to Avoid Probate in California Creating a Living Trust. Setting up a Joint Ownership. Payable-on-Death Designations for Bank Accounts. Transfer-on-Death Registration for Securities. Transfer-on-Death Deeds for Real Estate. Transfer-on-Death Registration for Vehicles. How to Avoid Probate in California - Law Office of Mitchell A. Port askmyattorney.net ? practice-areas ? can-i-a... askmyattorney.net ? practice-areas ? can-i-a...

In California, probate settles a deceased person's estate and is required in California if the estate is worth more than $184,500.

You can transfer property without opening probate if the estate is valued under a set amount. That amount changes every few years and is based on the year the person passed away. You can find the latest limits in Maximum Values for Small Estate Set-Aside & Disposition of Estate Without Administration (form DE-300). Check if you can use a simple process to transfer property ca.gov ? probate ? simple-transfer ca.gov ? probate ? simple-transfer

If probate has started, a personal representative of the estate has to agree in writing to the use of this informal settlement process. The affidavit doesn't have to be filed with the court. To use it, the person claiming the assets presents it to the bank, brokerage or another holder of the asset. Filing a Small Estate Affidavit in California - SmartAsset SmartAsset ? estate-planning ? filing-a-smal... SmartAsset ? estate-planning ? filing-a-smal...

If no Will exists, the property (estate) is divided among the person's heirs. In California, if the person has a spouse and/or children, the property first goes to them. If there is no spouse or children, the property goes to the person's next nearest relatives. Decedents' Estates - Probate - Sacramento Superior Court ca.gov ? probate ? decedent-estate ca.gov ? probate ? decedent-estate