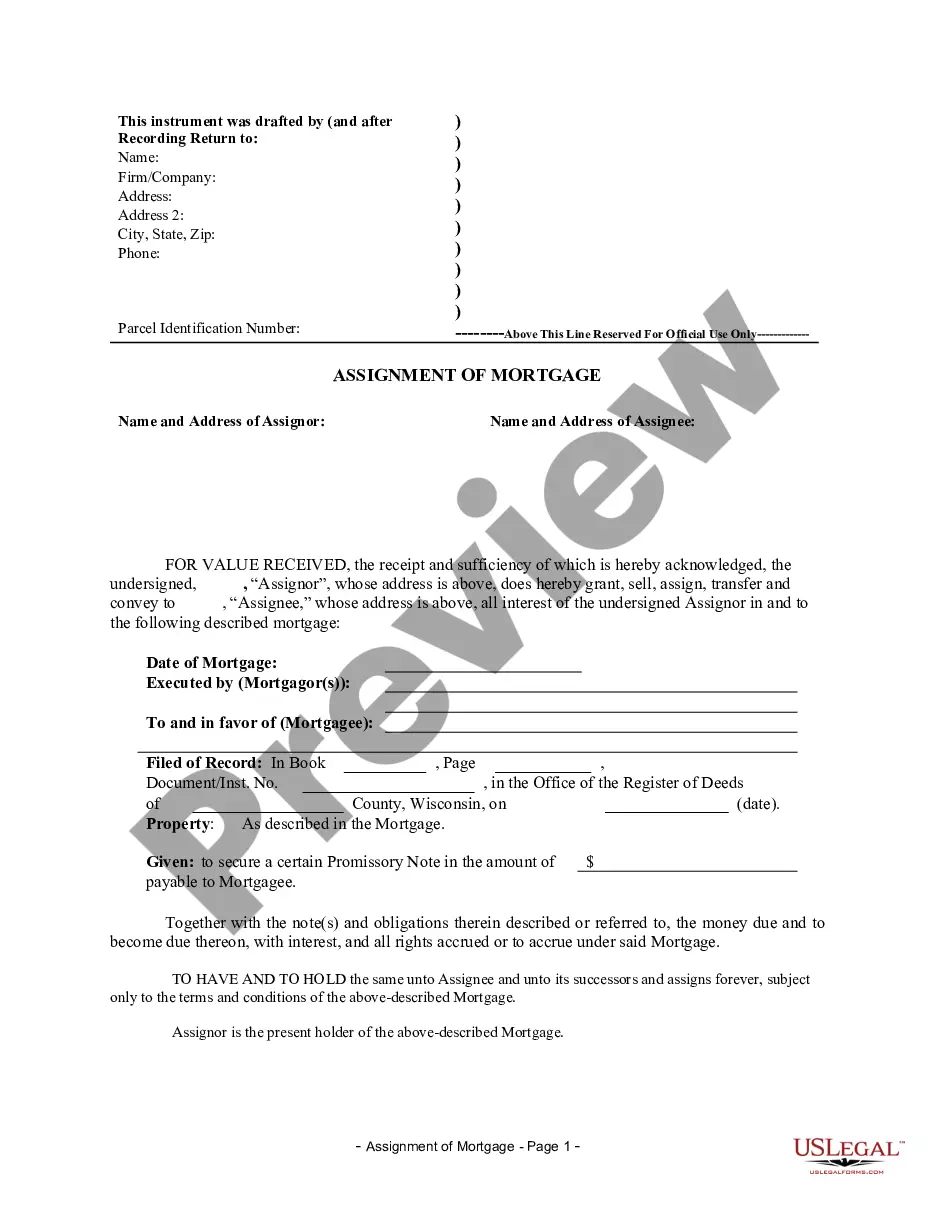

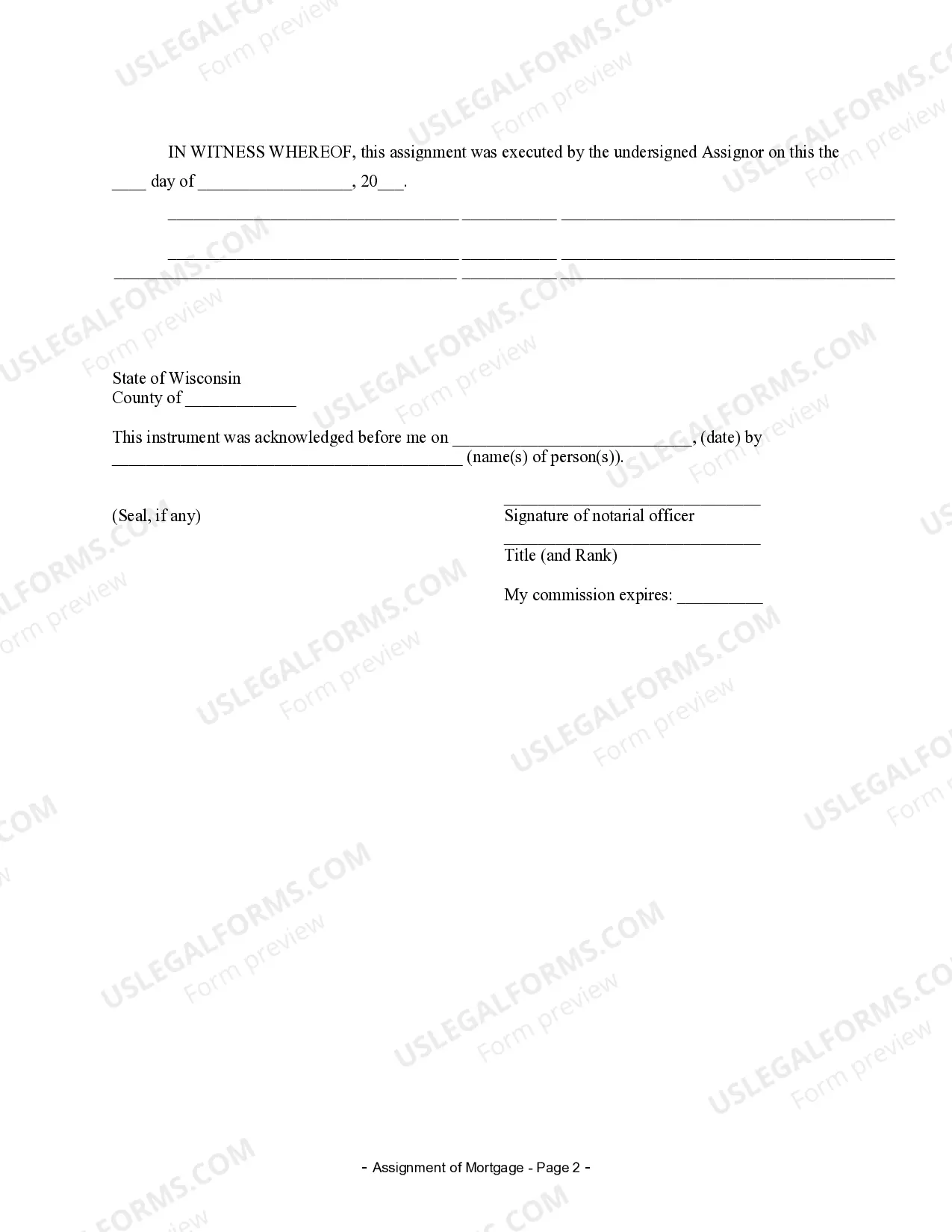

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Wisconsin Assignment Of Mortgage Form For Taxes

Description

How to fill out Wisconsin Assignment Of Mortgage Form For Taxes?

When you need to complete the Wisconsin Assignment Of Mortgage Form For Taxes that adheres to your local state's criteria, there can be various choices to select from.

There's no need to examine every document to verify it meets all the legal requirements if you are a US Legal Forms member.

It is a trustworthy source that can assist you in obtaining a reusable and current template on any subject.

Obtaining appropriately prepared official documents becomes seamless with US Legal Forms. Additionally, Premium users can take advantage of the powerful integrated solutions for online document editing and signing.

- US Legal Forms is the most extensive online directory with a compilation of over 85k ready-to-use forms for business and personal legal situations.

- All templates are confirmed to be in accordance with each state's regulations.

- Consequently, when retrieving the Wisconsin Assignment Of Mortgage Form For Taxes from our platform, you can be confident that you have a valid and current document.

- Acquiring the necessary sample from our site is quite simple.

- If you already possess an account, just Log In to the system, ensure your subscription is active, and save the chosen file.

- Afterward, you can access the My documents tab in your account and maintain access to the Wisconsin Assignment Of Mortgage Form For Taxes whenever you wish.

- If it's your first time visiting our website, please follow the steps below.

- Review the suggested page and verify it for alignment with your needs.

Form popularity

FAQ

The mortgage form for taxes in Wisconsin includes several important documents, notably the Wisconsin assignment of mortgage form for taxes. This form helps ensure proper documentation of your mortgage and tax obligations. Using the correct forms is vital, as it guarantees that everything is in legal compliance. Consider using uLegalForms; they provide a wide range of templates that simplify this process for you.

Yes, Wisconsin does impose a mortgage tax. This tax applies when you record a mortgage transaction, including the Wisconsin assignment of mortgage form for taxes. The amount can vary based on the mortgage amount, so it's crucial to be informed about the rates. Utilizing a reliable source can help you navigate these requirements effectively.

You can access Wisconsin tax forms through the Wisconsin Department of Revenue's website or your local tax collector's office. For added convenience, platforms like U.S. Legal Forms provide various legal forms, including those necessary for tax preparation and submission. This can be particularly helpful if you need the Wisconsin assignment of mortgage form for taxes, as these platforms simplify the process of acquiring required documents.

The HT 110 form in Wisconsin is a specific document related to the mortgage registration tax. It is used to report the payment of the mortgage tax when a mortgage is recorded. If you're dealing with mortgage documentation in Wisconsin, knowing about this form is beneficial. The Wisconsin assignment of mortgage form for taxes can guide you on how to properly fill out and submit your HT 110 form.

Mortgage tax and property tax are not the same, although both are related to real estate ownership. Mortgage tax refers to taxes imposed when registering a mortgage, while property tax is assessed based on the value of the property you own. Understanding these differences is essential for financial planning in Wisconsin. For clarity and additional information on forms, consider checking the Wisconsin assignment of mortgage form for taxes.

Yes, Wisconsin does have a mortgage registration tax, which applies when you register a mortgage on real property. This tax is calculated based on the mortgage amount, and understanding it is crucial for Wisconsin homeowners. Familiarizing yourself with the Wisconsin assignment of mortgage form for taxes can help ensure compliance and accurate tax payment. Utilizing resources from U.S. Legal Forms can simplify this process.

You can obtain your mortgage tax form through various sources, including your local tax office and online resources. If you prefer a more straightforward approach, you can access the Wisconsin assignment of mortgage form for taxes directly from legal form websites. Additionally, U.S. Legal Forms offers a user-friendly platform for obtaining necessary documentation conveniently. It's important to ensure you have the correct form to avoid any issues.

Several states impose a mortgage registration tax, including Wisconsin. This tax may vary in amount and application across different states. Homeowners in Wisconsin should be aware of these taxes when dealing with mortgage documentation. For more information or to obtain the correct forms, you can refer to the Wisconsin assignment of mortgage form for taxes.

Recording a mortgage is essential for establishing priority in claims against the property. While it is not legally mandatory to record a mortgage, failing to do so can lead to issues in proving ownership or enforcing rights. The public record helps safeguard against future disputes regarding property interests. To avoid these complications, use a Wisconsin assignment of mortgage form for taxes to facilitate the recording process.

When a mortgage is assigned, the rights and responsibilities of the mortgage contract are transferred from one lender to another. The borrower is typically notified of this change, although their mortgage terms remain the same. This assignment can affect the management of the mortgage, including payment processing and customer service. To ensure clarity during this transition, consider utilizing a Wisconsin assignment of mortgage form for taxes.