Wisconsin Assignment of Mortgage by Individual Mortgage Holder

Overview of this form

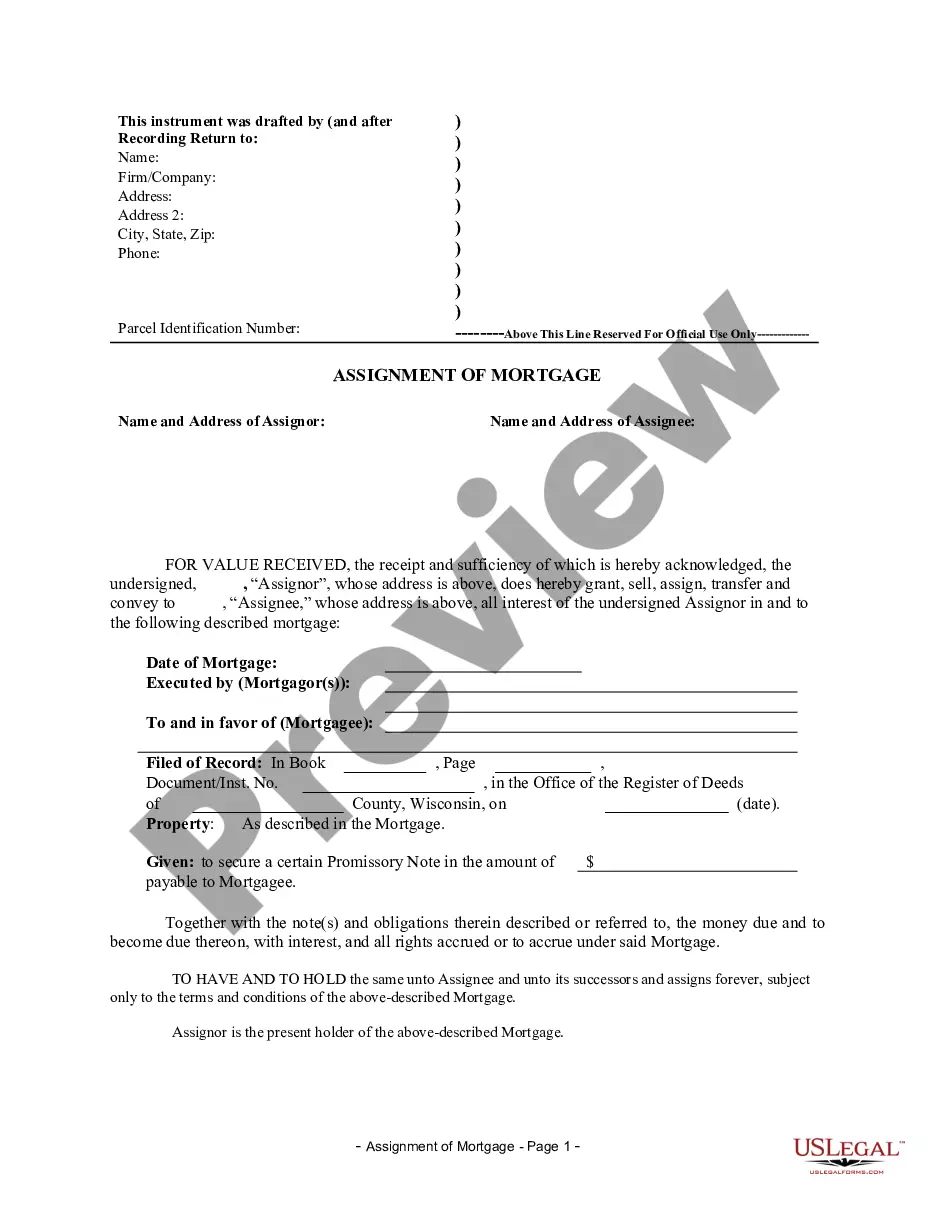

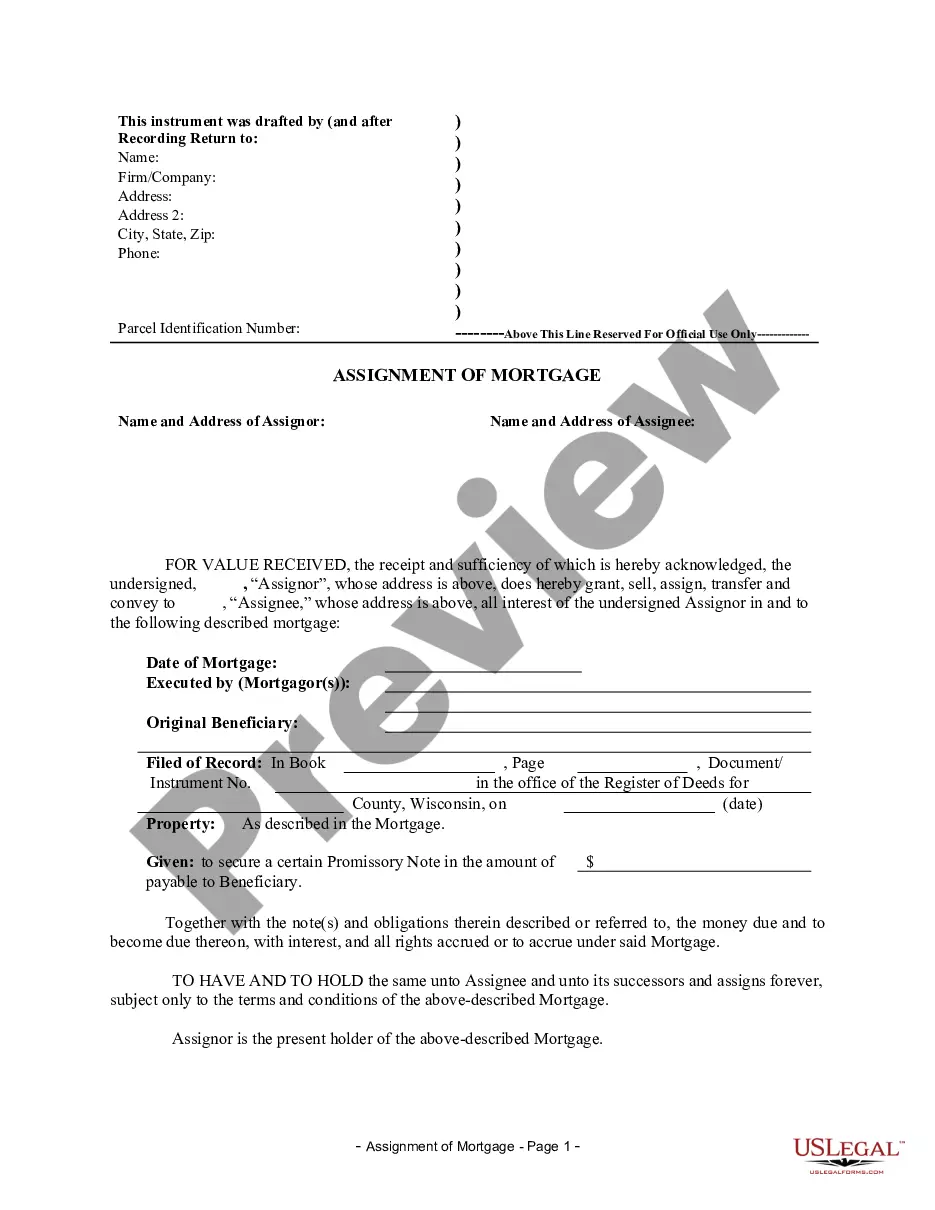

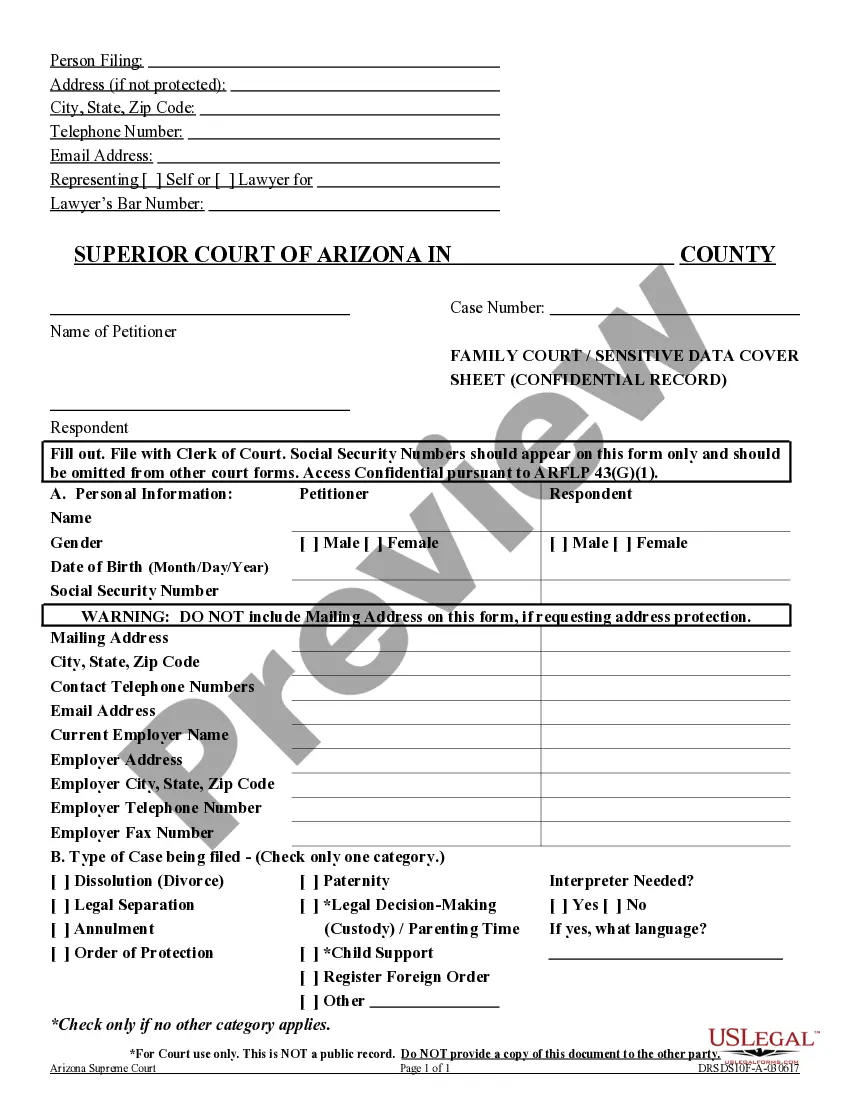

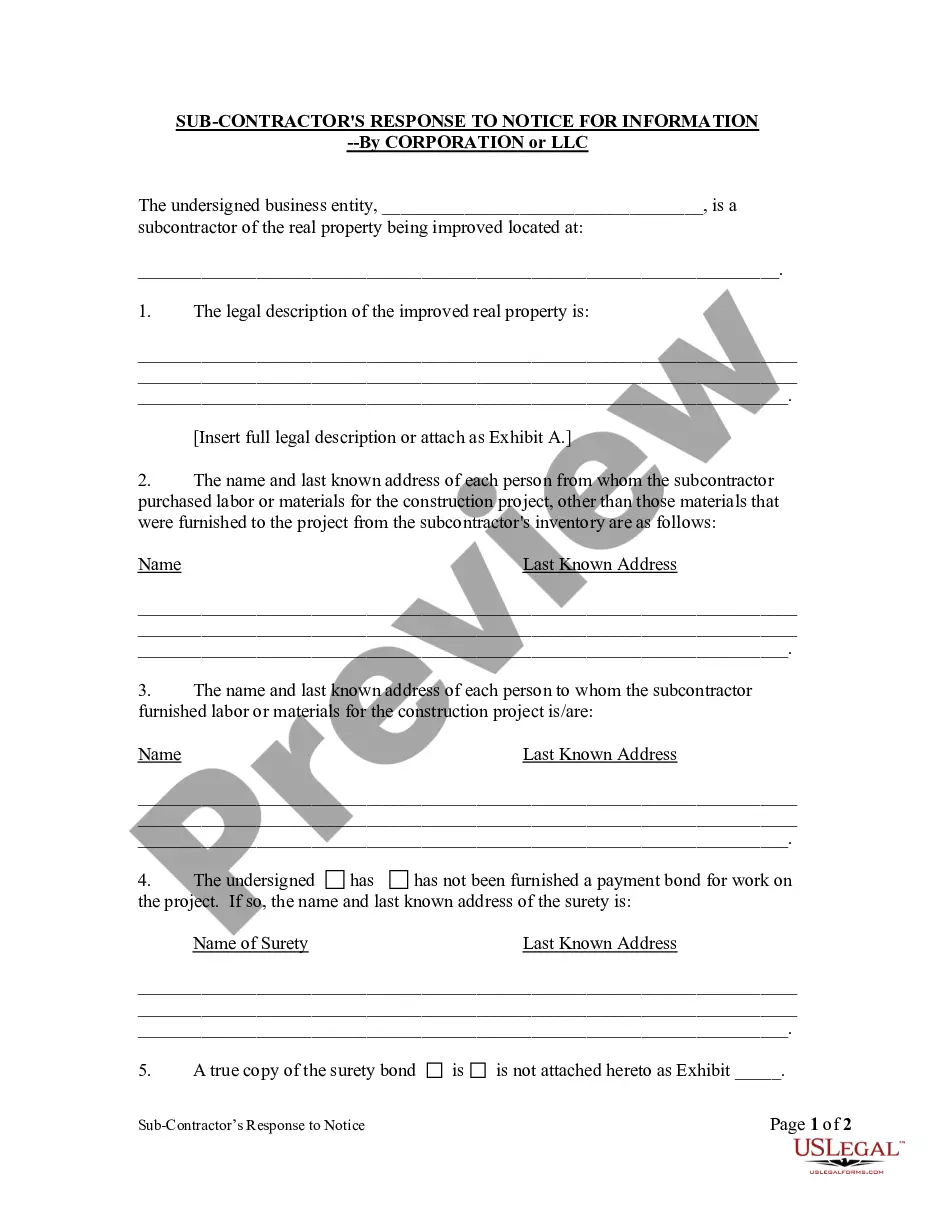

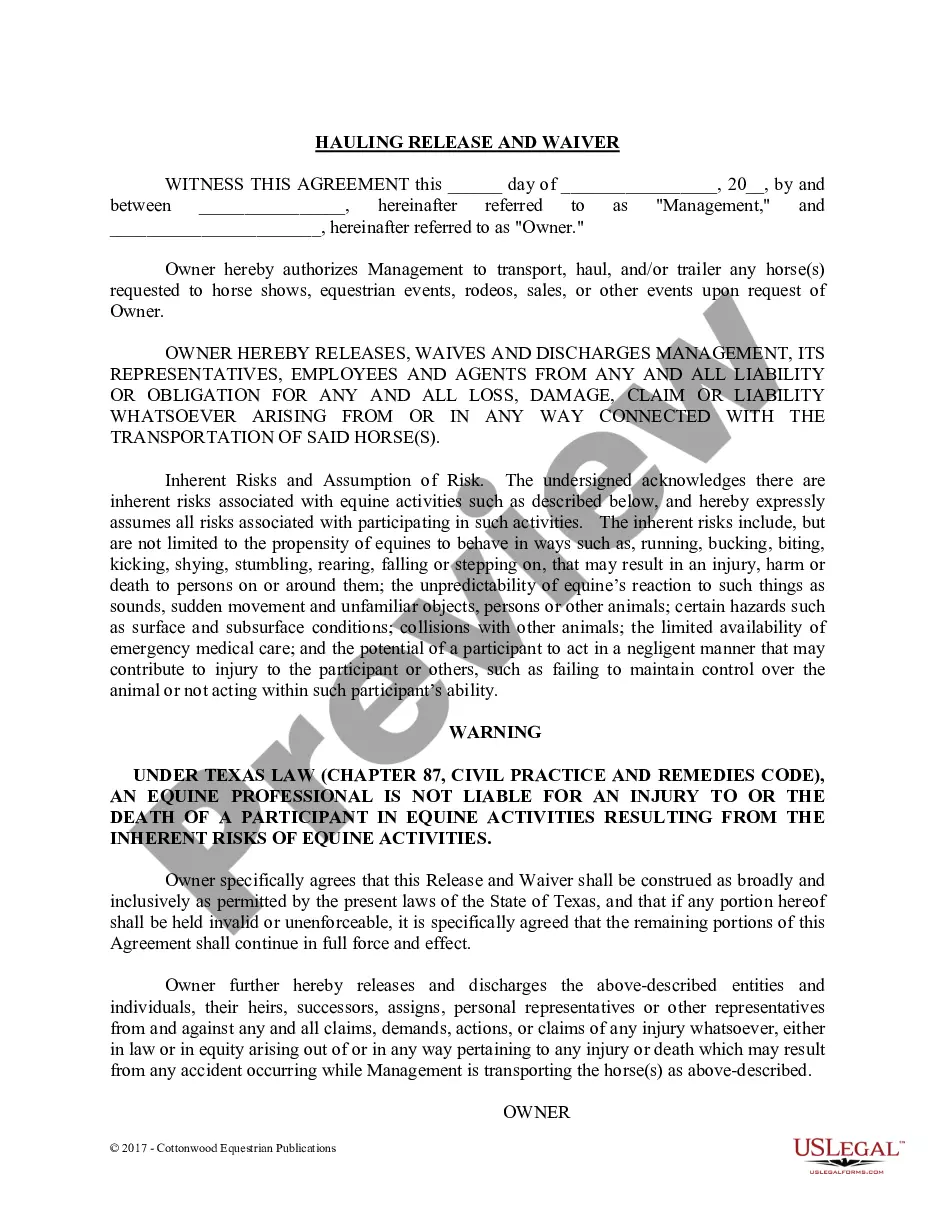

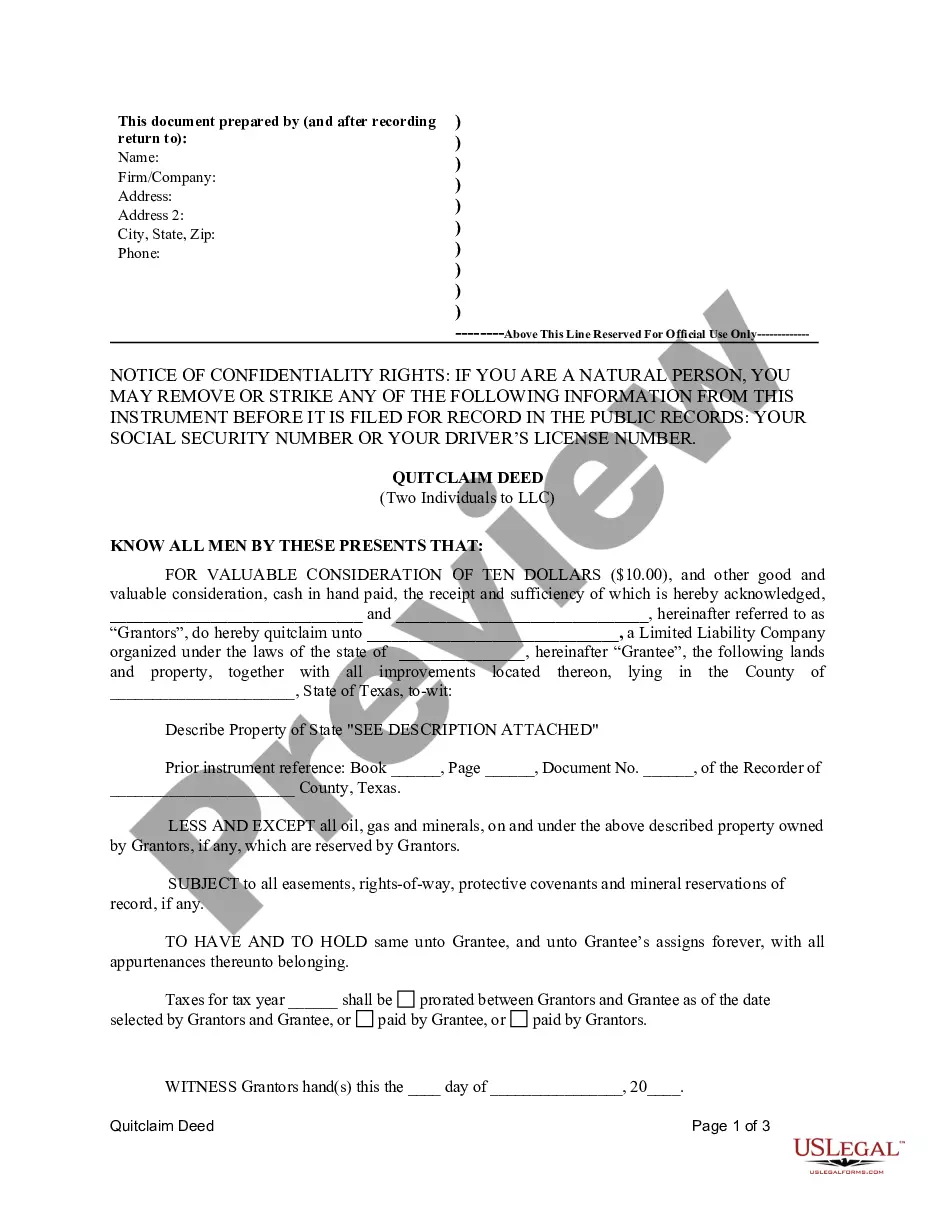

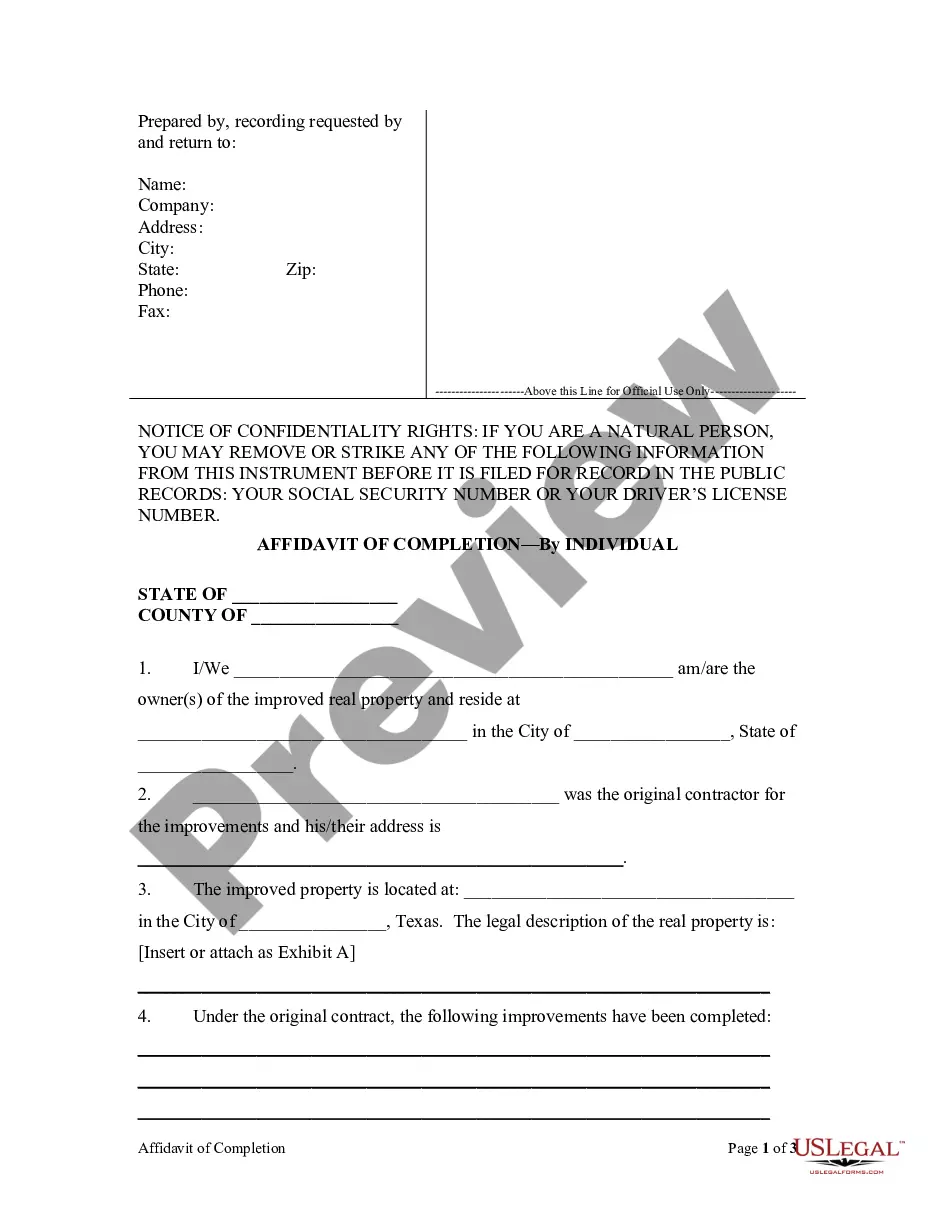

The Assignment of Mortgage by Individual Mortgage Holder is a legal document used to transfer the owner's interest in a mortgage or deed of trust to a third party. This form is specific to individual mortgage holders, distinguishing it from assignments made by entities like banks or corporations. By using this form, the assignor officially conveys their rights and obligations under the mortgage, ensuring clear ownership transfer and legal standing.

Key parts of this document

- Date of Mortgage: The date when the original mortgage was executed.

- Mortgagor and Mortgagee: Names of the parties involved in the mortgage agreement.

- Property Description: Details of the property outlined in the mortgage.

- Promissory Note Amount: The amount secured by the mortgage, payable to the mortgagee.

- Assignee: The individual or entity receiving the mortgage rights.

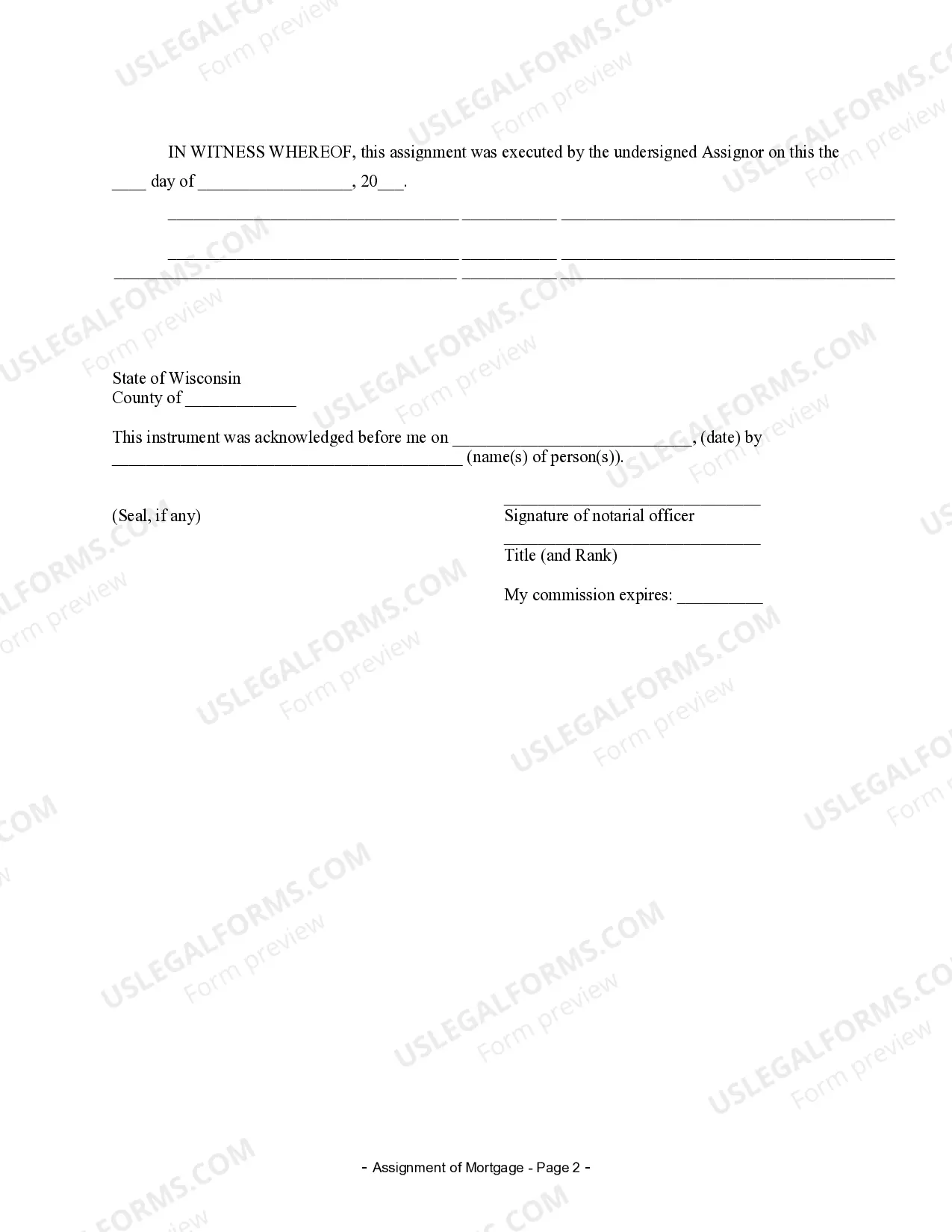

- Signatures: Required signatures of the assignor and a notary public for validation.

When to use this form

This form should be used when an individual who holds a mortgage wishes to transfer their interest to another party. Common scenarios include selling the property, transferring ownership to a family member, or engaging in financial restructuring. It is essential in situations where the mortgage holder needs to document the assignment clearly to avoid disputes and ensure that the new holder has the right to enforce the mortgage terms.

Who needs this form

- Individual mortgage holders looking to transfer their mortgage interest.

- Homeowners selling their property with an existing mortgage.

- Family members wishing to transfer ownership of a mortgaged property.

- Individuals participating in financial agreements that involve mortgage assignments.

Completing this form step by step

- Identify the parties: Write the names of the mortgagor (current mortgage holder) and the mortgagee (the party receiving the assignment).

- Specify the property: Enter the legal description of the property associated with the mortgage.

- Enter the mortgage details: Include the date of the original mortgage and the specific amount of the promissory note.

- Affix signatures: The assignor must sign the form, and the signature should be notarized.

- File with the appropriate county office: Submit the completed form to the Register of Deeds in the county where the property is located.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include the property description, which is crucial for identifying the mortgage.

- Not obtaining a notarization, which can invalidate the assignment.

- Incorrectly leaving out the date when the assignment is executed.

- Neglecting to indicate the book and page number from the original mortgage filing.

- Forgetting to have all involved parties sign the document, which could lead to legal challenges.

Why use this form online

- Convenience: Download the form instantly and complete it at your own pace.

- Editability: Make necessary modifications to suit your specific situation.

- Reliability: Ensure that you are using a legally vetted form drafted by licensed attorneys.

- Accessibility: Access your completed documents from anywhere at any time.

Looking for another form?

Form popularity

FAQ

South Carolina. Florida. Louisiana. Arkansas. New Mexico. Kansas. North Dakota. Wisconsin.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

When a borrower prepays their mortgage or makes the final mortgage payment, a satisfaction of mortgage document must be prepared, signed, and filed by the financial institution in ownership of the mortgage. The satisfaction of mortgage document is created by a lending institution and their legal counsel.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

In title theory states, the borrower does not actually keep title to the property during the loan term.Foreclosure proceedings in a lien theory state may be more difficult for the lender than in a title theory state, due to the fact that the buyer is holding title to the land and not the lender.

In lien theory states, the buyer, who is also the borrower, will hold the deed to the real estate property for the life of the mortgage.The mortgage agreement serves as the lender's lien on the property until the loan is paid back completely, but the buyer holds the title to the property instead of the lender.

The Mortgage Satisfaction Act (2013 Wisconsin Act 66), enacted in December 2013, governs satisfaction procedures, including required payoff statements and penalties for secured lenders who do not timely submit a satisfaction of mortgage for recording.

A mortgagee is a lender: specifically, an entity that lends money to a borrower for the purpose of purchasing real estate. In a mortgage transaction, the lender serves as the mortgagee and the borrower is known as the mortgagor.