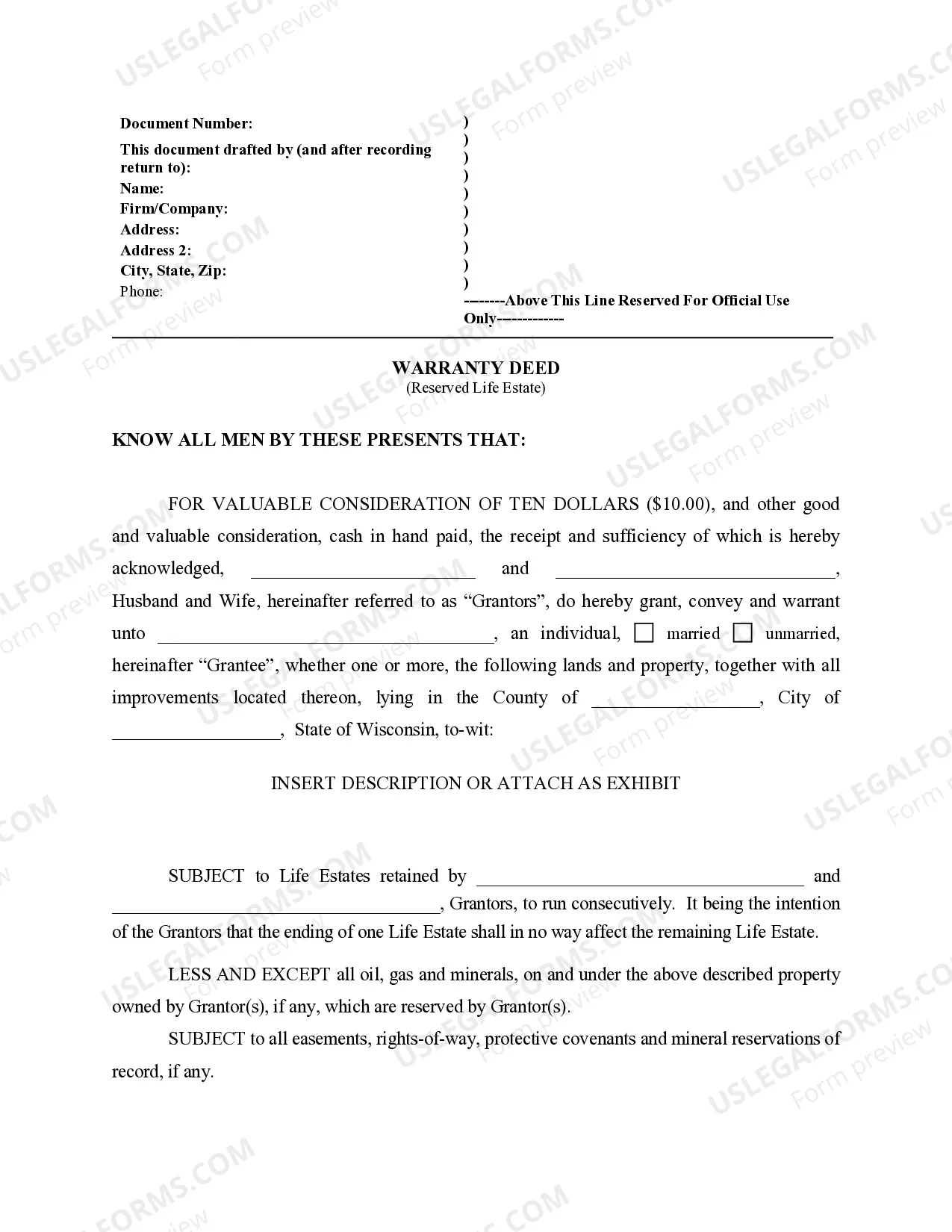

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Life Estate Deed Wisconsin Withholding

Description

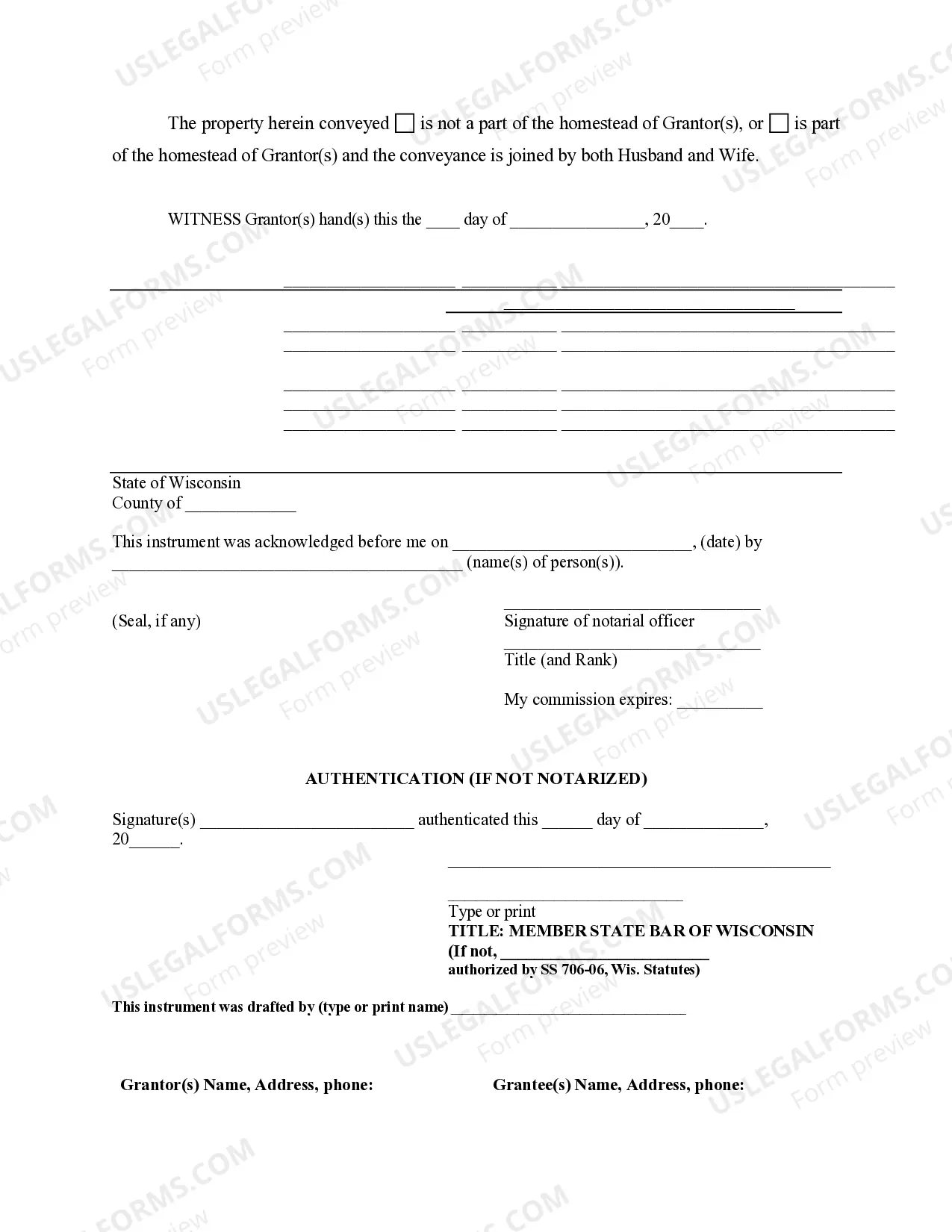

How to fill out Wisconsin Warranty Deed To Child Reserving A Life Estate In The Parents?

Whether for business purposes or for individual affairs, everyone has to deal with legal situations sooner or later in their life. Filling out legal papers demands careful attention, beginning from picking the correct form sample. For example, if you select a wrong version of the Life Estate Deed Wisconsin Withholding, it will be declined when you send it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you have to get a Life Estate Deed Wisconsin Withholding sample, stick to these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it fits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search function to find the Life Estate Deed Wisconsin Withholding sample you need.

- Get the file when it meets your needs.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved templates in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Life Estate Deed Wisconsin Withholding.

- Once it is saved, you can complete the form by using editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time looking for the right sample across the web. Make use of the library’s simple navigation to find the correct template for any situation.

Form popularity

FAQ

The deed transfer tax is $3.00 per $1000.00 or major fraction thereof of consideration. The seller customarily pays the deed transfer tax. Wisconsin does not have a mortgage, recordation or excise tax.

A life estate is created when a property holder transfers ownership of the property to someone else and retains the right to live on the property and the income from it. The new owner of the property is referred to as the remainder person.

The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value.

To determine the value of a life estate, multiply the real value by 6%, then multiply this product by the annuity dollar at the nearest birthday of the owner of the life estate (see table below).

You must sign the TOD designation and get your signature notarized, and then record (file) the designation with the county register of deeds before your death. Otherwise, it won't be valid. You can make a Wisconsin designation of transfer on death beneficiary with WillMaker.