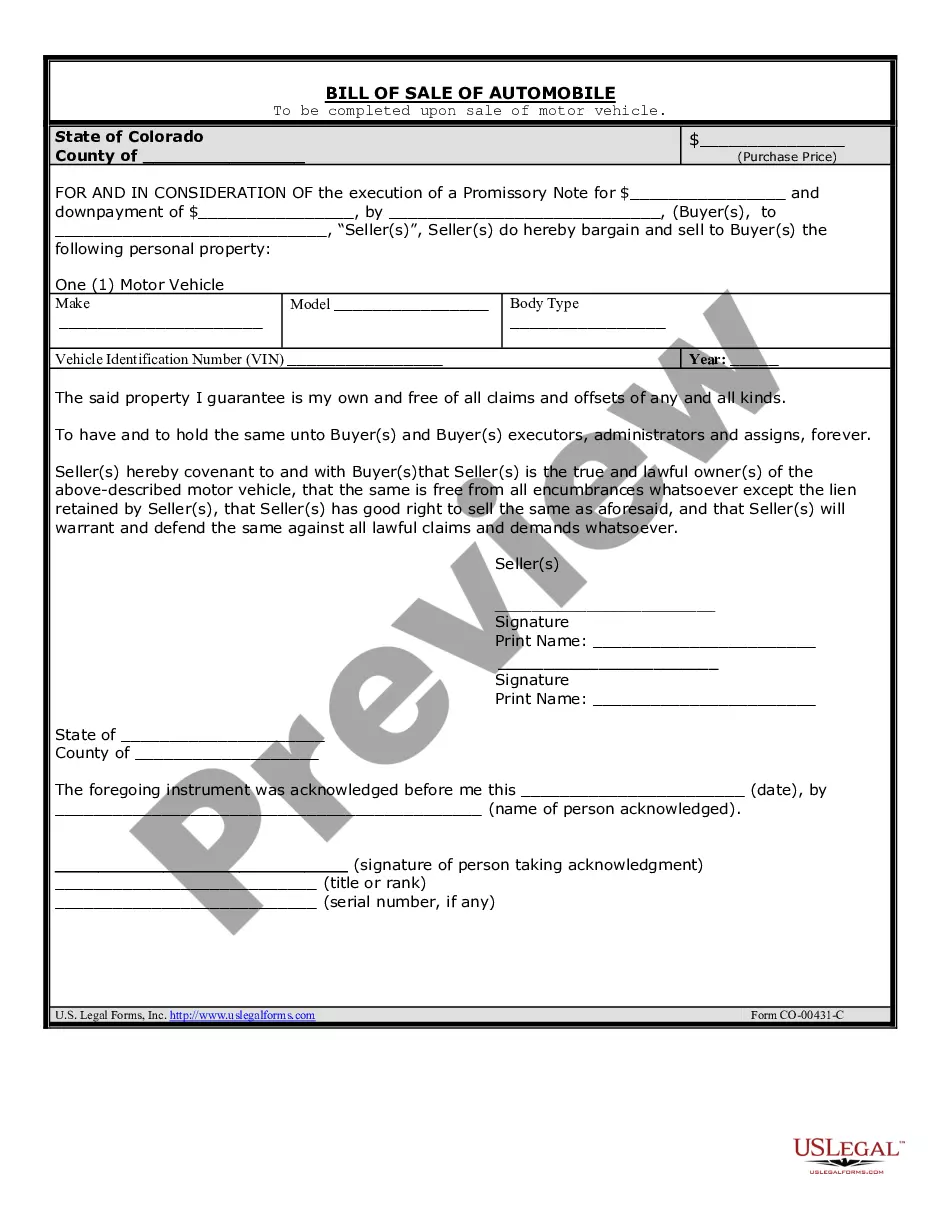

This promissory is a form that can be used in a transaction between one individual and another as opposed to an individual and lender bank.

Title: Understanding Mortgage Note Examples with Interest: A Comprehensive Overview Introduction: In the realm of real estate financing, mortgage notes represent a crucial aspect of lending agreements between borrowers and lenders. A mortgage note is a legal document that outlines the terms and conditions of a mortgage loan, including the repayment amount, interest rate, and payment schedule. This article aims to provide a detailed description of mortgage note examples with interest, including their types and relevant keywords associated with this financial instrument. 1. Fixed-Rate Mortgage Note: A fixed-rate mortgage note is the most common type of mortgage note. In this arrangement, the interest rate remains constant throughout the loan term, offering stability and predictability for borrowers. The predetermined interest rate is decided at the loan origination and remains unchanged, regardless of market fluctuations. Keywords associated with fixed-rate mortgage notes include "fixed interest rate," "constant interest rate," and "stable payments." 2. Adjustable-Rate Mortgage Note: Contrary to the fixed-rate mortgage note, an adjustable-rate mortgage (ARM) note involves an interest rate that can fluctuate over time. ARM's typically have an initial fixed rate period, followed by periodic adjustments based on prevailing market conditions. These adjustments can occur annually, semi-annually, or even monthly. It is important to note that interest rates on adjustable-rate mortgage notes are typically lower during the initial fixed-rate period. Keywords relevant to adjustable-rate mortgage notes include "variable interest rate," "adjustable interest rate," and "interest rate fluctuations." 3. Balloon Mortgage Note: Another type of mortgage note is the balloon mortgage note. This arrangement offers lower monthly payments for an initial period, but requires a large lump sum payment (balloon payment) at the end of the loan term. Balloon mortgage notes are attractive to borrowers who plan to sell their property or refinance before the balloon payment becomes due. Relevant keywords for balloon mortgage notes include "lump sum payment," "final payment," and "short-term lower payments." 4. Interest-Only Mortgage Note: Interest-only mortgage notes offer borrowers the flexibility of making lower monthly payments initially. However, during the interest-only period, the borrower is not paying down the principal balance of the loan. Following this period, the borrower begins making payments on both principal and interest over the remaining loan term. Keywords commonly associated with interest-only mortgage notes include "interest-only period," "principal balance," and "gradual payment increase." Conclusion: Mortgage notes with interest are a prevalent financing tool in the world of real estate lending. They dictate the terms, repayment schedule, and interest rates associated with the mortgage loan. Understanding the different types of mortgage notes, including fixed-rate, adjustable-rate, balloon, and interest-only notes, empowers borrowers to make informed decisions based on their unique financial circumstances. By utilizing the keywords mentioned in this article, individuals can navigate the complex landscape of mortgage note agreements with enhanced clarity and understanding.