Washington Mutual No Withdrawal Limit

Description

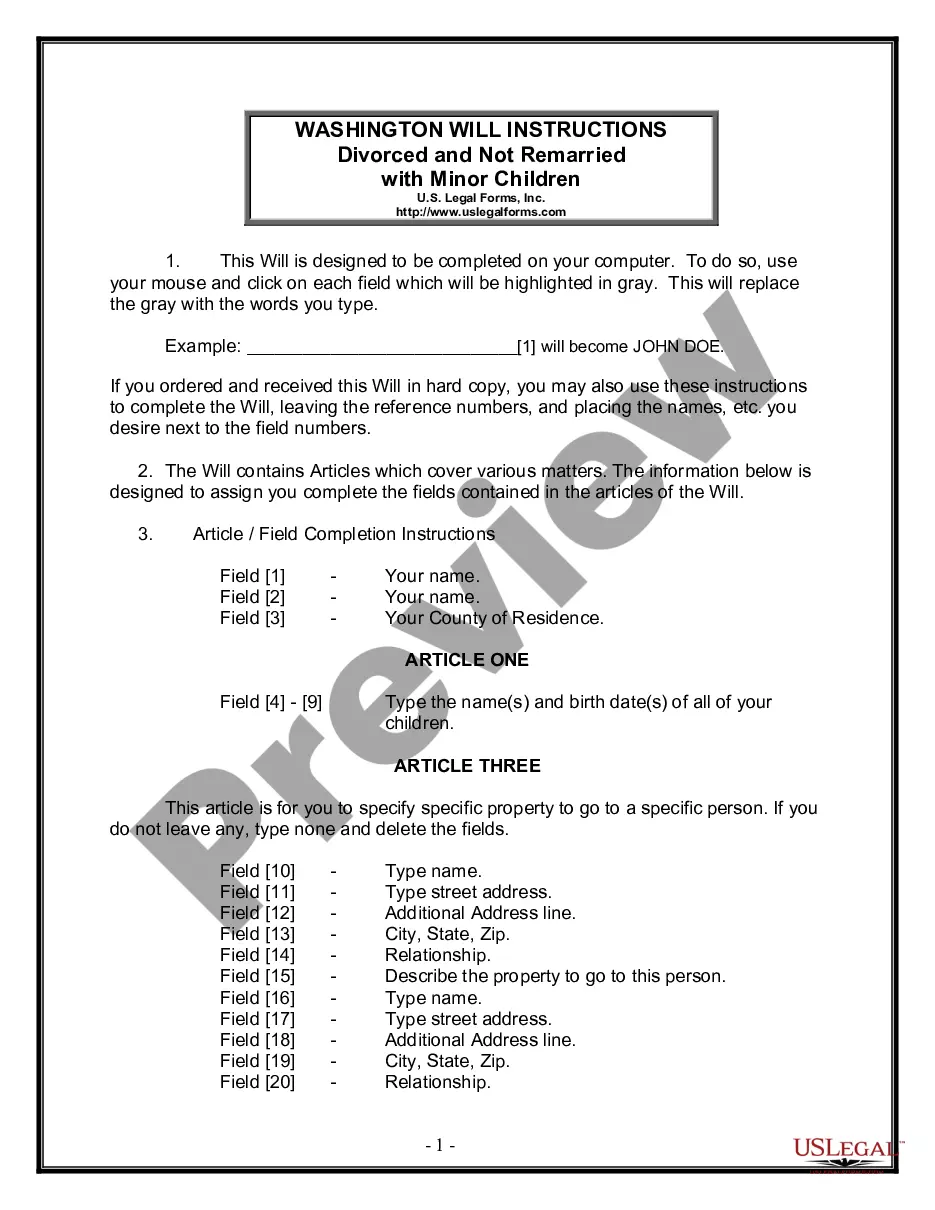

How to fill out Washington Mutual Wills Package For Married Couple With No Children?

The Washington Mutual No Withdrawal Limit you see on this page is a reusable formal template crafted by professional attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 confirmed, state-specific documents for any commercial and personal events. It’s the quickest, simplest, and most reliable method to acquire the paperwork you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you desire for your Washington Mutual No Withdrawal Limit (PDF, Word, RTF) and download the sample onto your device. Fill out and sign the documents. Print the template to complete it manually. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with an eSignature. Download your documents one more time. Use the same file again whenever necessary. Access the My documents tab in your profile to redownload any previously downloaded documents. Register for US Legal Forms to have verified legal templates for all of life's situations at your fingertips.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or check the form description to confirm it meets your requirements. If it does not, utilize the search feature to find the appropriate one. Click Buy Now once you have located the template you need.

- Subscribe and sign in.

- Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already have an account, Log In and check your subscription to continue.

- Obtain the fillable template.

Form popularity

FAQ

On Sept. 25, 2008, the federal government seized control of Washington Mutual and placed it into receivership of the Federal Deposit Insurance Corp. (FDIC) after account holders withdrew $16.7 billion in deposits in a nine-day stretch. The FDIC sold WaMu's banking subsidiaries to JPMorgan Chase for $1.9 billion.

No one lost any money that was deposited in Washington Mutual Bank. If you had an account with Washington Mutual Bank, you now have an account with JPMorgan Chase Bank.

Subsequent to the closure, JPMorgan Chase acquired the assets and most of the liabilities, including covered bonds and other secured debt, of Washington Mutual Bank from the FDIC as Receiver for Washington Mutual Bank.

WaMu was placed into the federal receivership of the Federal Deposit Insurance Corp. (FDIC) on September 25, 2008. Fearing more widespread financial contagion if a buyer was not found, the Federal Reserve held a secret auction of WaMu, announcing the buyer, JPMorgan Chase, that same day.

All deposit accounts were transferred to JP Morgan Chase who acquired WaMu for $1.9 billion. No one lost any money that was deposited in Washington Mutual Bank & no deposit insurance was used.