Washington Mutual Wills Package for Married Couple with No Children

Understanding this form

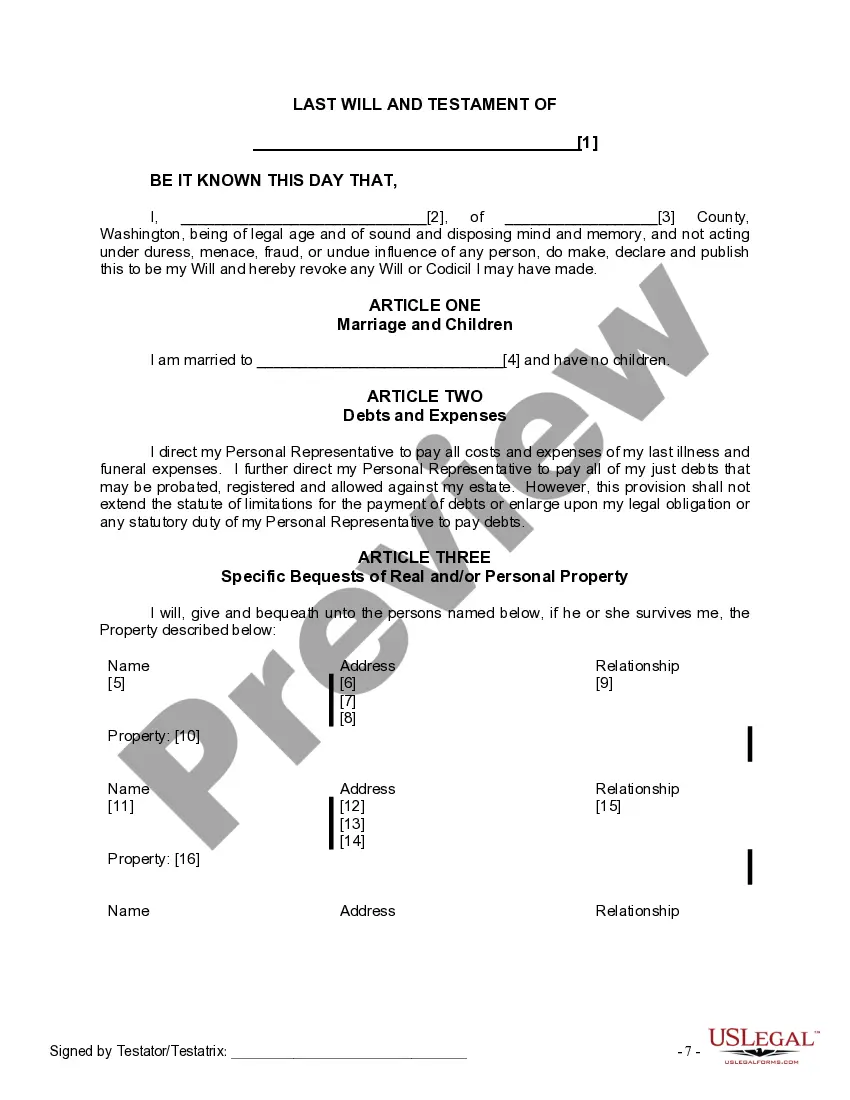

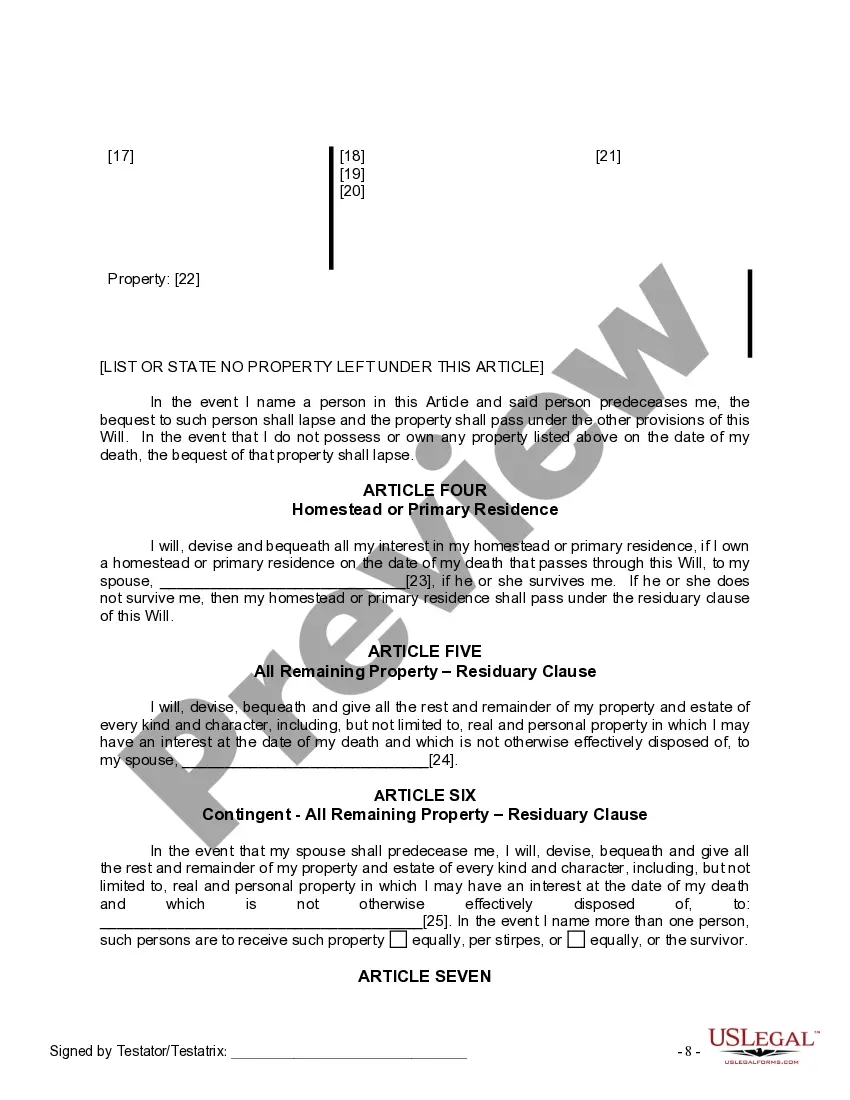

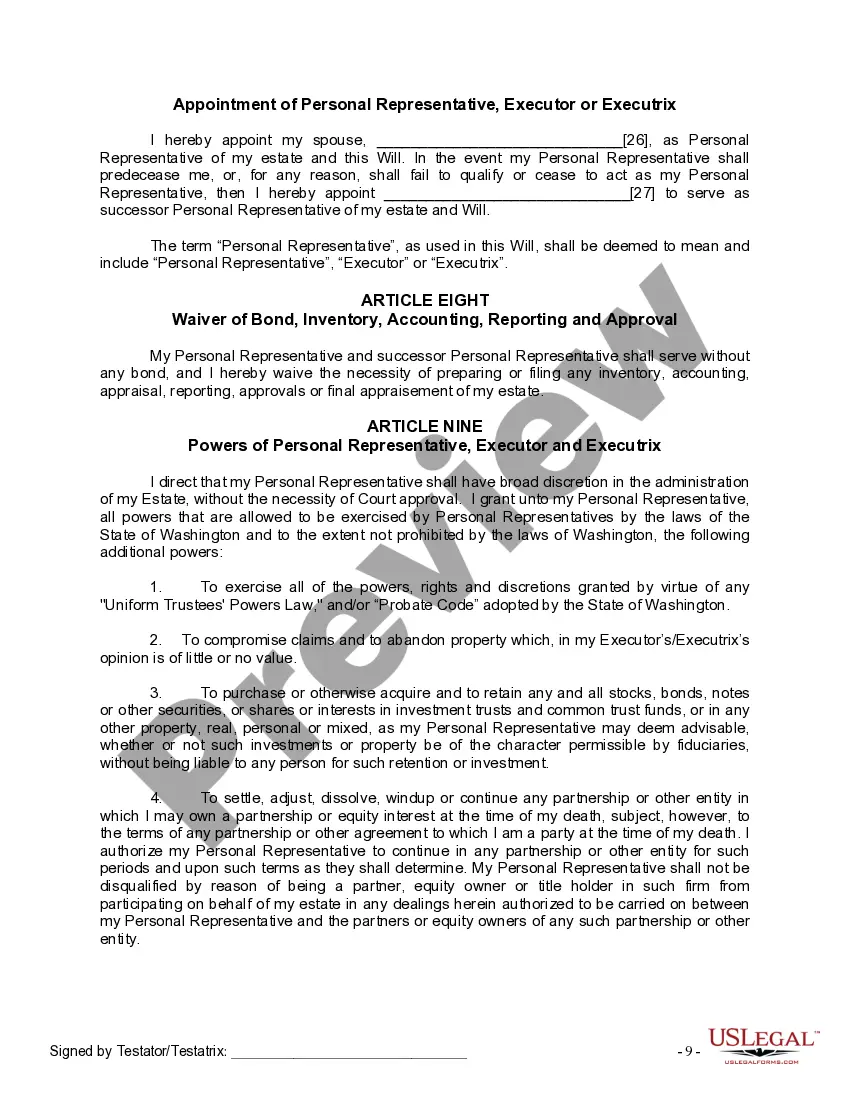

The Mutual Wills Package for Married Couples with No Children consists of two Last Wills and Testaments designed specifically for spouses who wish to mutually agree on their estate distribution. This package ensures that both partners can express their final wishes, designate heirs, and appoint a personal representative or executor. Unlike individual wills, mutual wills create a binding agreement between spouses regarding the distribution of their estate upon death, which helps avoid confusion and potential disputes later on.

Key components of this form

- Two Last Wills: Each spouse has a customized will that outlines their individual wishes.

- Appointment of Personal Representative: Each will allows for designating an executor to manage the estate.

- Specific Bequests: Sections to specify any unique property that may be passed to named beneficiaries.

- Residuary Clause: A provision for distributing the remaining estate after specific bequests.

- Signatory requirements: Instructions for signing in the presence of witnesses and notarization details.

- Optional Provisions: Clauses for unique arrangements, such as funeral instructions or the waiver of bond for the personal representative.

When to use this form

This form is ideal for married couples without children who want to ensure a clear and binding distribution of their assets. Use this package when both partners wish to coordinate their estate plans to avoid potential conflicts and ensure their wishes are honored following their deaths. It is particularly useful for couples with specific assets or wishes they want to document comprehensively.

Who can use this document

- Married couples who want to establish mutual agreements regarding their estates.

- Spouses without children who need to designate heirs other than offspring.

- Individuals seeking to clarify their wishes and ensure their partner is involved in the estate planning process.

- Couples wanting to minimize future legal disputes over estate distribution.

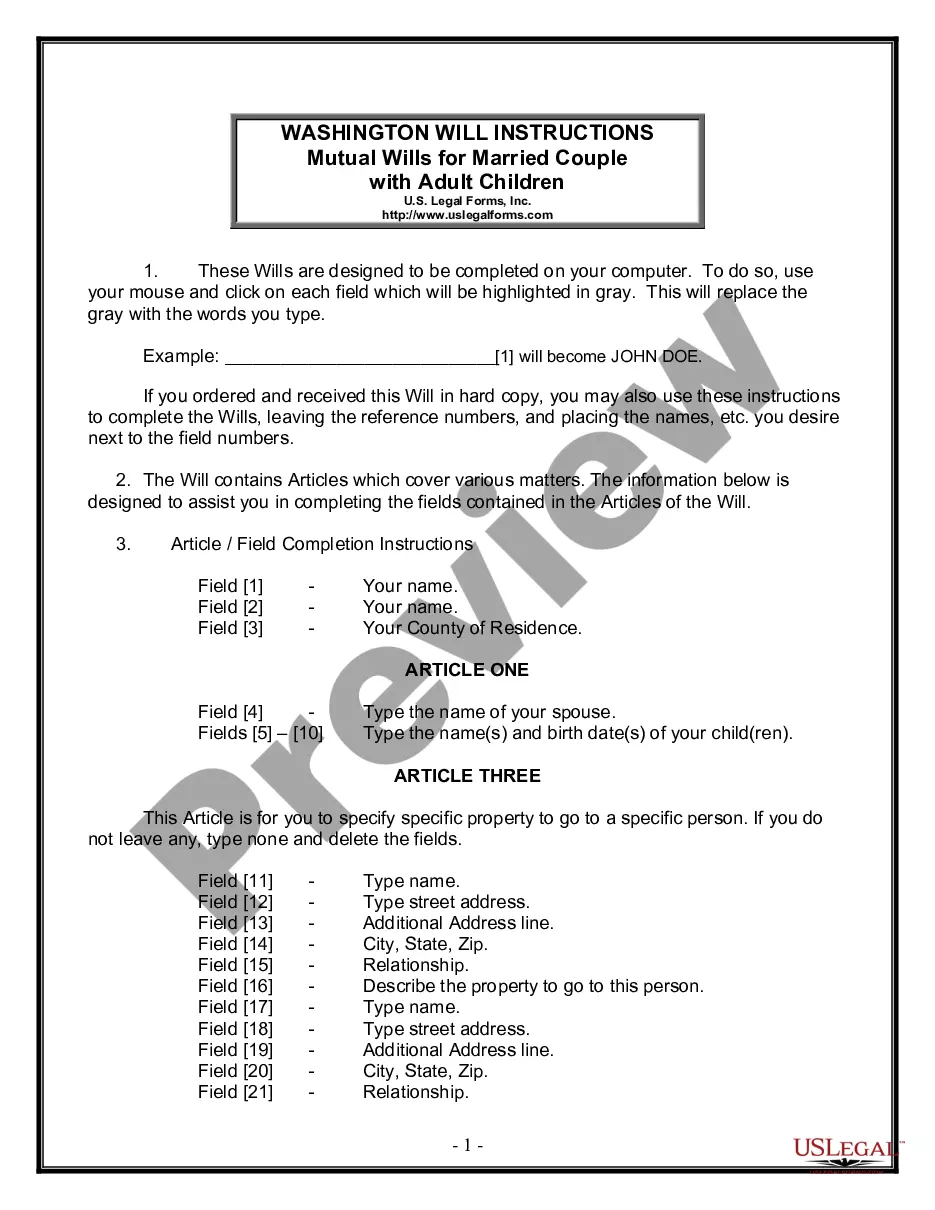

How to prepare this document

- Begin by entering your full names and your county of residence in the designated fields.

- Specify each spouse's wishes regarding property and who will receive specific items.

- Designate a personal representative or executor for each will, making sure they are adult individuals.

- Indicate any special arrangements or bequests in the appropriate articles.

- Review the completed wills for accuracy before printing.

- Sign both wills in the presence of two witnesses, who must also sign, and consider notarizing the wills to enhance their legal validity.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Not having the wills signed in the presence of the required number of witnesses.

- Failing to specify alternate beneficiaries in case the primary ones predecease the testators.

- Overlooking the need for both wills to be effectively coordinated with each other.

- Neglecting to review and update the wills after significant life changes, such as relocation or changes in assets.

Why use this form online

- Convenience of filling out and saving your wills from the comfort of home.

- Editability allows you to make changes easily if your circumstances or preferences change.

- Access to templates drafted by licensed attorneys, ensuring they adhere to legal standards.

- Quick access to instructions helps streamline the completion process.

Looking for another form?

Form popularity

FAQ

Choose an online legal services provider or locate a will template. Carefully consider your distribution wishes. Identify a personal representative/executor. Understand the requirements to make your will legal. Make sure someone else knows about your will. Consult a lawyer if you have a more complicated estate.

When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.Because the surviving spouse becomes the outright owner of the property, he or she will need a Will to direct its disposition at his or her subsequent death.

It is a customary estate planning practice for each spouse to have his or her own will. While some practitioners may draft a joint will for a married couple, it is not recommended.

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.

The surviving spouse has the right to Family Exempt Property.The surviving spouse has the right to receive Letters of Administration, which means that ahead of all other family members, he/she has the right to serve as the Administrator when someone dies intestate.

A joint will is a legal document executed by two (or more) people, which merges their individual wills into a single, combined last will and testament. Like most wills, a joint will lets the will-makers name who will get their property and assets after they die. Joint wills are usually created by married couples.

(And that includes youso be sure you get that done right away if you haven't already.) But did you know that if you're married, your spouse needs a will too? That's right. This is a case where one will isn't enoughyou each need your own.

You and your spouse may have one of the most common types of estate plans between married couples, which is a simple will leaving everything to each other. With this type of plan, you leave all of your assets outright to your surviving spouse. The kids or other beneficiaries only get something after you are both gone.