Deed Of Trust Foreclosure Washington State

Description

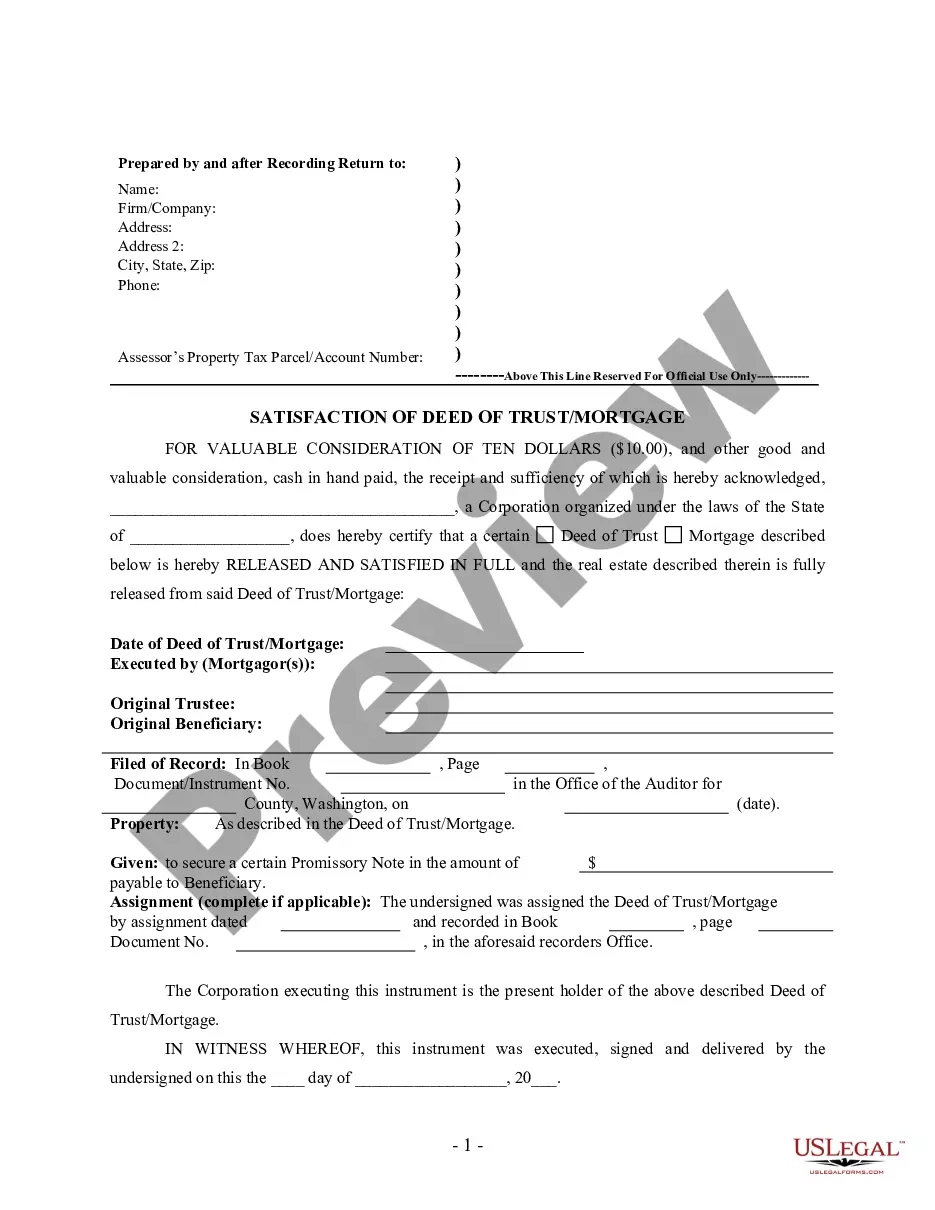

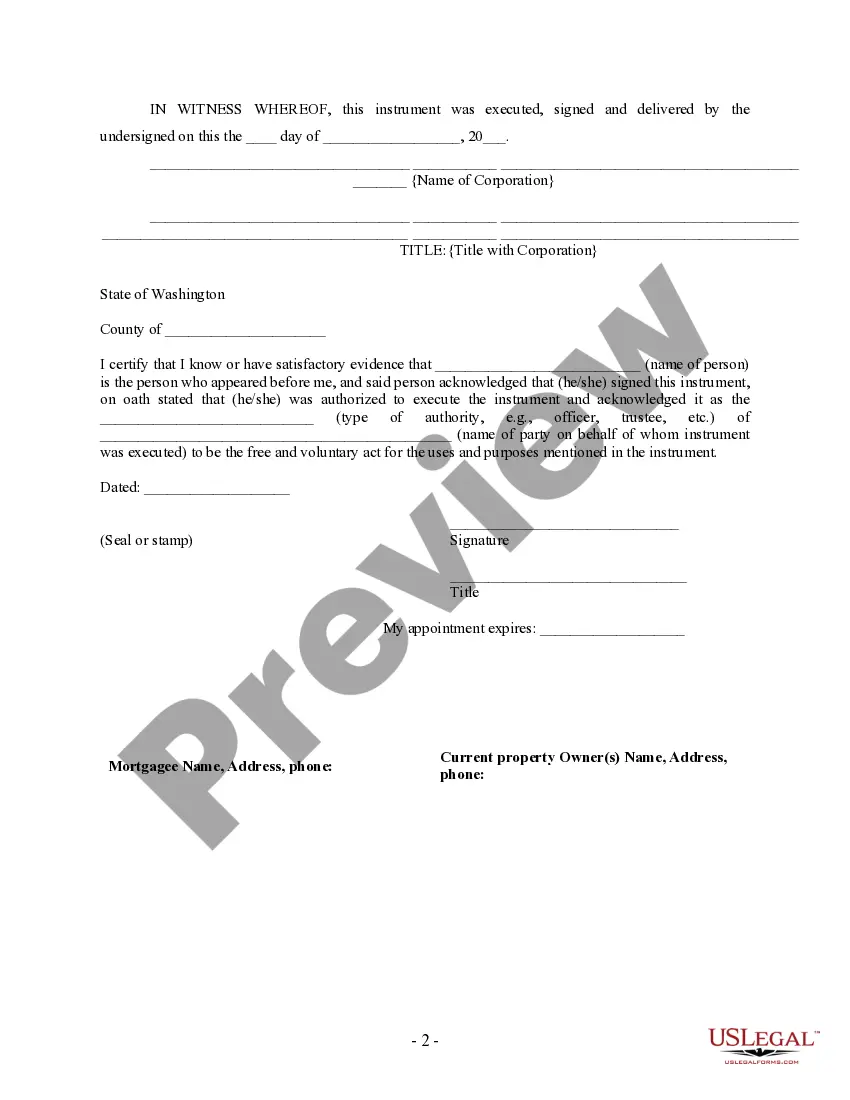

How to fill out Washington Satisfaction, Release Or Cancellation Of Deed Of Trust By Corporation?

Regardless of whether you frequently handle documents or occasionally need to submit a legal report, it is crucial to have access to a repository of information where all the samples are relevant and current.

One action you should take with a Deed Of Trust Foreclosure in Washington State is to ensure it is the latest version, as this determines its eligibility for submission.

If you want to streamline your search for the most recent document examples, check for them on US Legal Forms.

To obtain a form without creating an account, follow these steps: Use the search function to locate the necessary form. Review the preview and description of the Deed Of Trust Foreclosure Washington State to ensure it meets your needs. After confirming the form, simply click on Buy Now. Select a subscription plan that suits you, create an account, or Log In to an existing one. Use your credit card details or PayPal for the payment. Choose the desired document format for download and confirm your selection. Say goodbye to confusion when dealing with legal documents. All your templates will be organized and verified with an account at US Legal Forms.

- US Legal Forms is a collection of legal documents that includes nearly any sample document you might need.

- Search for the templates you need, review their relevance immediately, and discover more about their applications.

- With US Legal Forms, you can access over 85,000 template forms across various domains.

- Locate the Deed Of Trust Foreclosure Washington State samples within a few clicks and save them anytime in your account.

- Having a US Legal Forms account will facilitate your access to all required samples with greater ease and less hassle.

- You just need to click Log In at the top of the website and access the My documents section where all forms are readily available.

- This way, you won't have to waste time searching for the appropriate template or verifying its authenticity.

Form popularity

FAQ

If you've purchased an occupied foreclosure in Washington State, your first step should be to familiarize yourself with local landlord-tenant laws. Notify the occupants about your ownership and discuss potential arrangements. When dealing with a deed of trust foreclosure in Washington State, it's crucial to follow the legal process for eviction if necessary. Consulting resources like U.S. Legal Forms can provide templates and guidance to manage this effectively.

Proof of ownership of a house in Washington is typically established through the recorded deed. This document shows the transfer of property title from one party to another, and it is a public record. In cases involving deed of trust foreclosure in Washington State, having clear proof of ownership is vital for legal processes. Consider using U.S. Legal Forms to ensure that all necessary documents are correctly completed.

The most common deed used to transfer real property in Washington is the warranty deed. This deed guarantees the seller holds clear title to the property, ensuring there are no encumbrances. For those dealing with a deed of trust foreclosure in Washington State, understanding this deed can help you navigate the transaction more effectively. U.S. Legal Forms can provide you with templates based on your specific needs.

A house deed in Washington typically includes the names of the grantor and grantee, a legal description of the property, and the signatures of the parties involved. It may also feature the date of execution and details about the property transfer. When dealing with a deed of trust foreclosure in Washington State, it's crucial for the deed to be accurate to avoid legal issues later. Familiarizing yourself with these documents can help in understanding your property ownership.

Transferring ownership of a house in Washington involves preparing a deed, which states the new owner's name and property details. You will need to sign the deed before a notary, then file it with the county auditor's office. This process is essential when dealing with a deed of trust foreclosure in Washington State. Using U.S. Legal Forms can simplify this procedure, providing templates and guidance.

A deed in lieu of foreclosure in Washington state allows a borrower to voluntarily transfer their property title back to the lender to avoid foreclosure. This option can offer a solution that mitigates the negative effects of deed of trust foreclosure in Washington state. It’s an effective way to settle debts and can be a less stressful alternative for homeowners looking to resolve their financial obligations.

Washington is a deed of trust state, meaning that instead of traditional mortgages, lenders use deeds of trust for securing loans. This structure allows for a more streamlined foreclosure process if payments are not made on time. For homeowners, understanding the implications of living in a deed of trust state is vital when navigating situations of deed of trust foreclosure in Washington state.

A deed in lieu of foreclosure is often considered a favorable alternative to foreclosure. This allows borrowers to transfer the property title back to the lender, avoiding lengthy foreclosure proceedings. This option can reduce the stress and repercussions associated with deed of trust foreclosure in Washington state. By exploring alternatives, homeowners can sometimes achieve a more favorable outcome.

One disadvantage of a deed of trust is that it can streamline the foreclosure process, which means homeowners may face quicker evictions. Additionally, a deed of trust typically gives less control to the borrower over the property during financial distress. This can make dealing with deed of trust foreclosure in Washington state challenging. Understanding these disadvantages upfront can help homeowners make informed decisions.

In Washington state, a deed of trust is valid for a period of 10 years from the date it is executed. After this period, if the deed of trust is not renewed, it may become unenforceable. It is important to monitor the duration of the deed, especially regarding deed of trust foreclosure in Washington state. Ensuring its validity protects both the lender and the borrower.