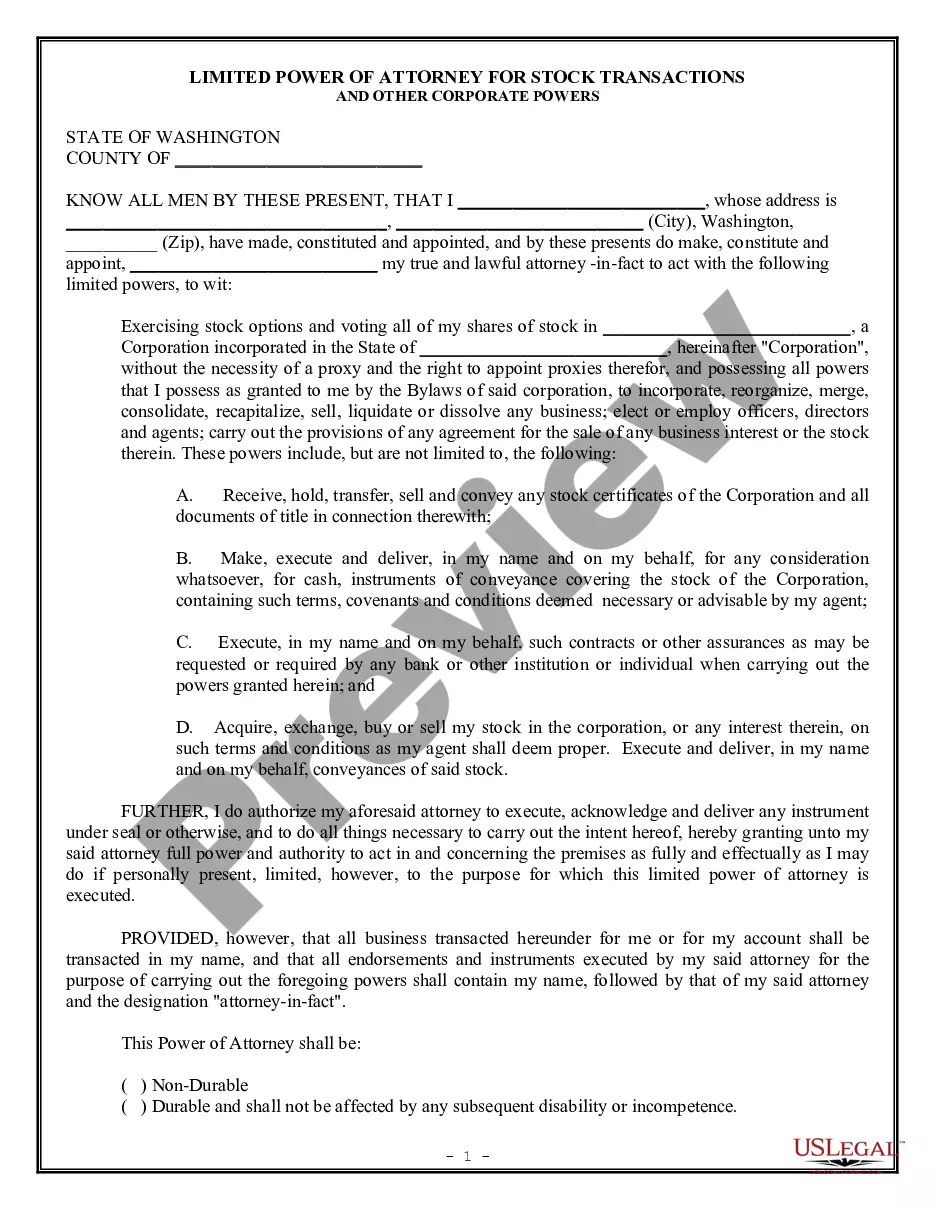

Limited Power Of Attorney Form Washington State Withholding

Description

How to fill out Washington Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Bureaucracy necessitates exactness and correctness.

If you do not regularly perform tasks like completing the Limited Power Of Attorney Form Washington State Withholding, it might lead to some misunderstanding.

Choosing the proper template from the outset will guarantee that your document submission goes smoothly and avert any complications of re-submitting a document or repeating the same task from the beginning.

If you are not a subscribed user, finding the desired template will take a few additional steps.

- Access the appropriate template for your documentation at US Legal Forms.

- US Legal Forms is the largest online forms repository with over 85 thousand samples across various sectors.

- You can discover the latest and most suitable version of the Limited Power Of Attorney Form Washington State Withholding by simply browsing the website.

- Locate, store, and preserve templates in your profile or refer to the description to confirm you have the correct one available.

- With an account at US Legal Forms, it is straightforward to obtain, keep in one place, and navigate the templates you've saved for easy access.

- When on the webpage, click the Log In button to authenticate.

- Then, navigate to the My documents page, where your form history is kept.

- Review the descriptions of the forms and save the ones you require at any time.

Form popularity

FAQ

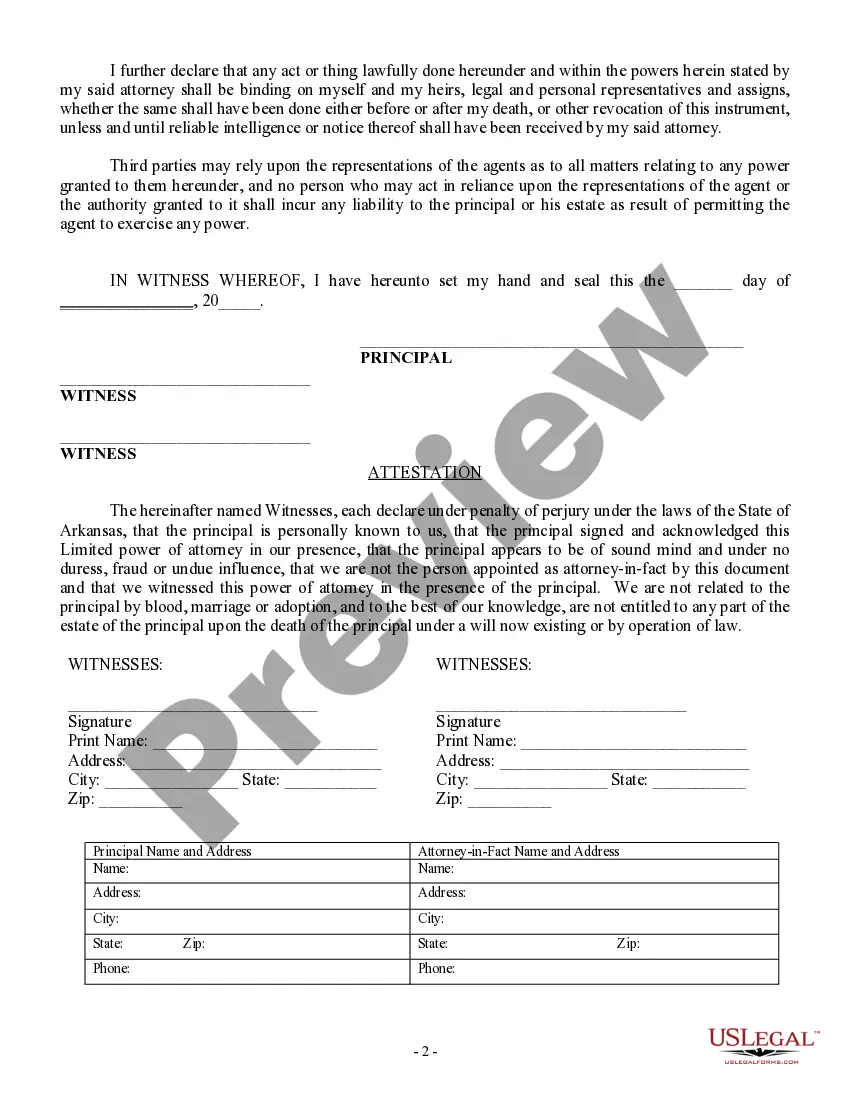

The requirements for a valid Power of Attorney are: The document must be titled Power of Attorney. The document must be signed and dated by you and either notarized or witnessed by two disinterested people.

One must mention the following details on the Power of Attorney format PDF:The name of the principal.The name of the agent.Signature.Details and legal authorities provided to the agent.Other details depending on the Power of Attorney format for authorized signatories.20-Apr-2020

One must mention the following details on the Power of Attorney format PDF:The name of the principal.The name of the agent.Signature.Details and legal authorities provided to the agent.Other details depending on the Power of Attorney format for authorized signatories.

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

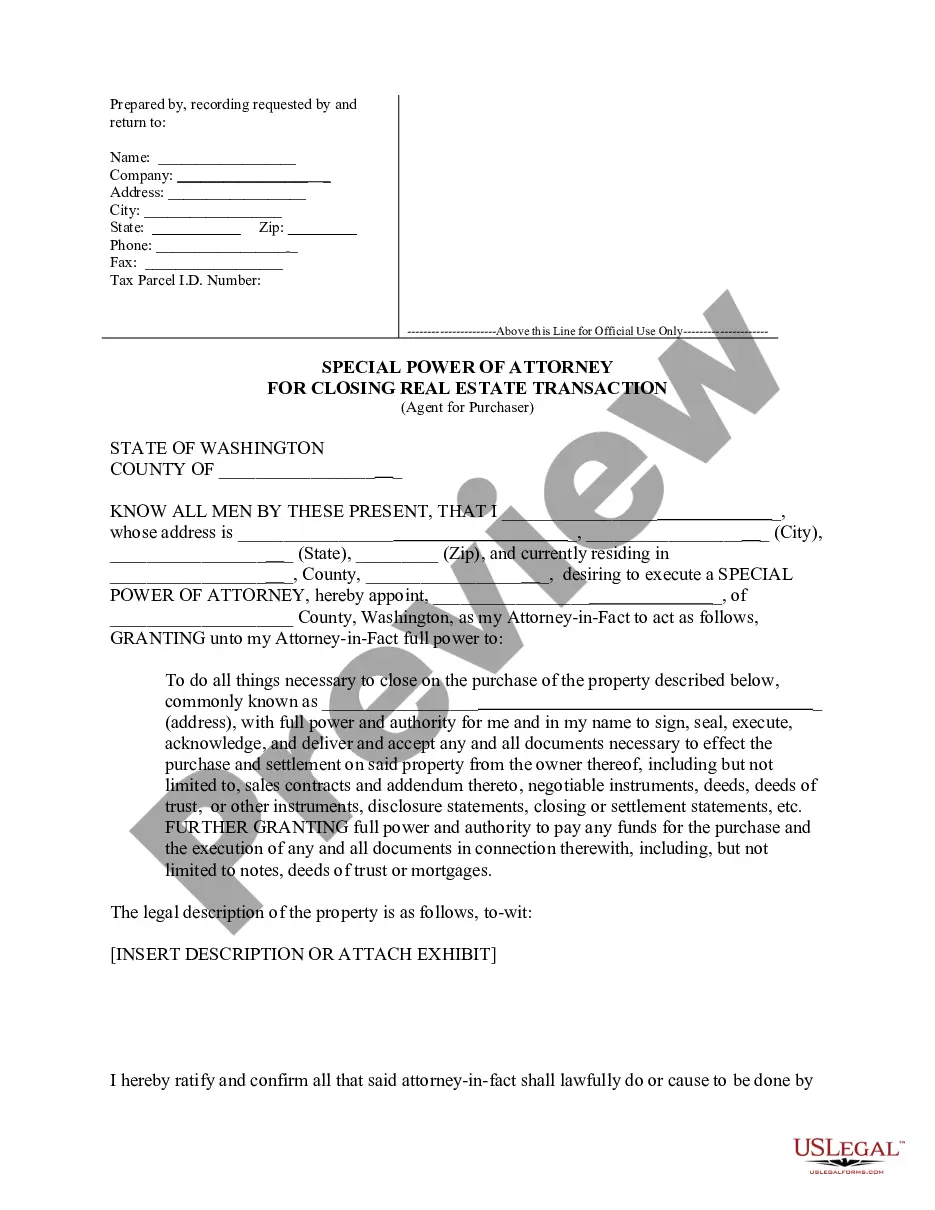

The power of attorney should be recorded because recording provides notice of the agent's authority, allows the agent to obtain certified recorded copies, and is usually required by title companies and other entitles involved in land transactions.