Lease Specific Right With The Right

Description

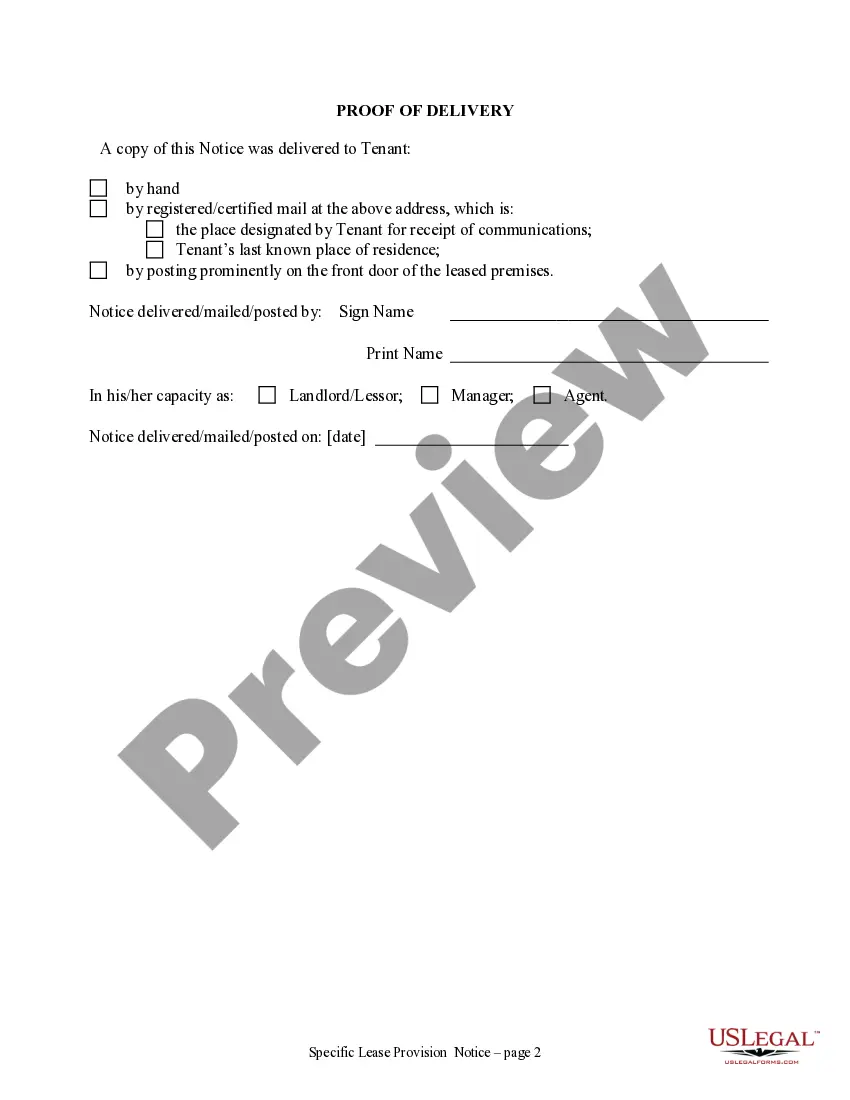

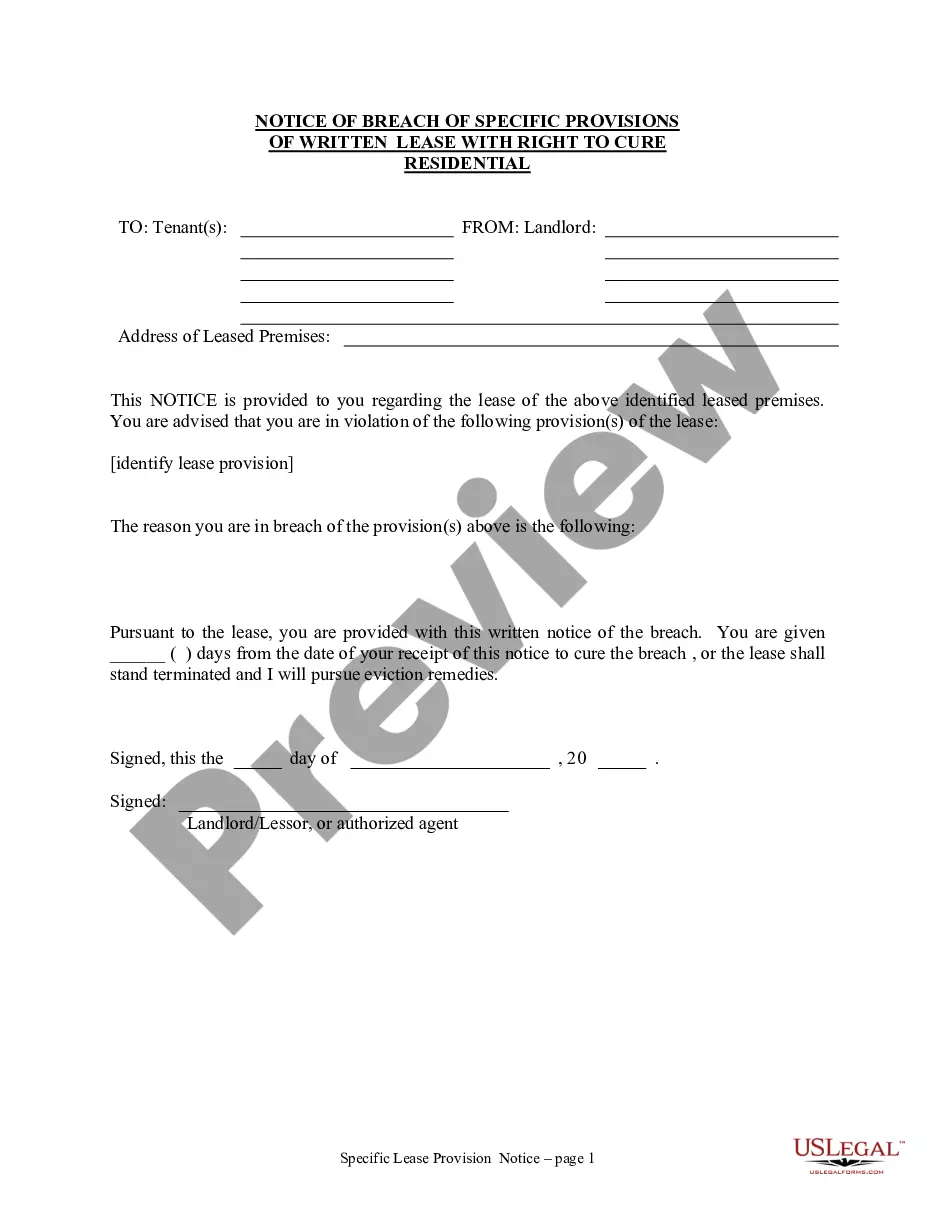

How to fill out Washington Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Nonresidential Property From Landlord To Tenant?

- Log in to your US Legal Forms account if you're an existing user. Ensure your subscription is active; otherwise, renew it through your payment plan.

- For first-time users, start by browsing the extensive library of forms. Use the Preview mode to view details and ensure compliance with your local jurisdiction.

- If you don't find the right form, utilize the Search tab to locate a template that fits your needs accurately.

- Select your desired document and click on the Buy Now button. Choose a suitable subscription plan to access the forms.

- Complete the payment process by entering your credit card details or using your PayPal account.

- Download your chosen form and store it on your device. You can also access it anytime through the My Forms section in your account.

By following these steps, you can easily obtain and manage legal forms that are tailored to your needs. US Legal Forms not only provides a robust collection of forms but also connects you with premium experts for personalized assistance.

Ready to lease specific rights with the right documents? Visit US Legal Forms today and take control of your legal needs!

Form popularity

FAQ

A rights lease is an agreement outlining specific rights granted to the tenant within the lease, such as the right to renew, sublet, or access common areas. This type of lease clarifies expectations and protections, ensuring tenants know their lease specific rights with the right terms outlined. For those navigating such agreements, USLegalForms can provide valuable resources to help you draft a beneficial rights lease confidently.

The right to use lease grants a tenant the ability to occupy and utilize the leased property as specified in the agreement. This right encompasses various aspects such as maintaining the property and adhering to the lease terms. By ensuring your lease specific rights with the right conditions are clearly defined, both landlords and tenants can prevent misunderstandings. Using reliable documentation from USLegalForms can support this clarity.

Leasing and renting are closely related, but they have distinct differences. Leasing typically involves a longer-term commitment, such as a year, while renting usually refers to shorter-term arrangements. Understanding these differences is vital in establishing lease specific rights with the right agreements in place. USLegalForms provides resources to help you navigate both leasing and renting agreements confidently.

'Right to lease' signifies the legal authority granted to an individual or entity to lease a property. This right can vary based on property ownership, existing agreements, and local laws. Understanding this concept is crucial for landlords and tenants alike, ensuring the protection of lease specific rights with the right framework in place. Engaging with legal professionals can clarify this right in your leasing context.

The First Amendment to a lease refers to a legal modification made to an existing lease agreement. This amendment usually addresses changes in terms such as rent adjustments, duration extensions, or alterations in tenant responsibilities. It is essential for both landlords and tenants to ensure that their lease specific rights with the right provisions are updated and clearly documented. Always consult legal guidance when drafting or modifying lease agreements.

The 90% rule in leasing is a guideline that assists in determining whether a lease should be considered a finance lease. If the present value of lease payments equals or exceeds 90% of the asset's fair value, this is an indicator of a finance lease. This rule influences the way both lessors and lessees recognize and account for leases. Familiarizing yourself with the 90% rule can strengthen your position in securing a lease specific right with the right contractual terms.

The 90% rule for leasing dictates that if the present value of lease payments is at least 90% of the leased asset's fair market value, it qualifies as a finance lease. This classification affects how companies report leased assets on their financial statements. By understanding and applying this rule, you can make informed decisions that will help you secure a lease specific right with the right parameters for your leasing needs.

The 90% lease rule outlines a guideline where a finance lease's present value should represent at least 90% of the asset's fair value. This threshold is crucial for properly categorizing a lease under accounting standards. By adhering to this rule, both parties can ensure that their agreement reflects their financial commitments appropriately. Knowing the 90% lease rule can help you secure a lease specific right with the right conditions.

The new lease accounting rule, introduced by the Financial Accounting Standards Board (FASB), requires companies to recognize all leases on their balance sheets. This change aims to provide a clearer picture of financial obligations. Companies must categorize leases as either operating or finance leases, each with different implications. Understanding this rule is vital for accurately reflecting your lease specific right with the right financial standards.

Finding the right tenant is crucial for maintaining a successful rental property. Start by clearly defining your criteria, such as income level and rental history. Utilize online platforms and social media to advertise your property effectively. Additionally, thoroughly screen potential tenants through background checks and interviews. Using these strategies can help you secure a lease specific right with the right tenant for your property.