Lease Specific Right For A Trust

Description

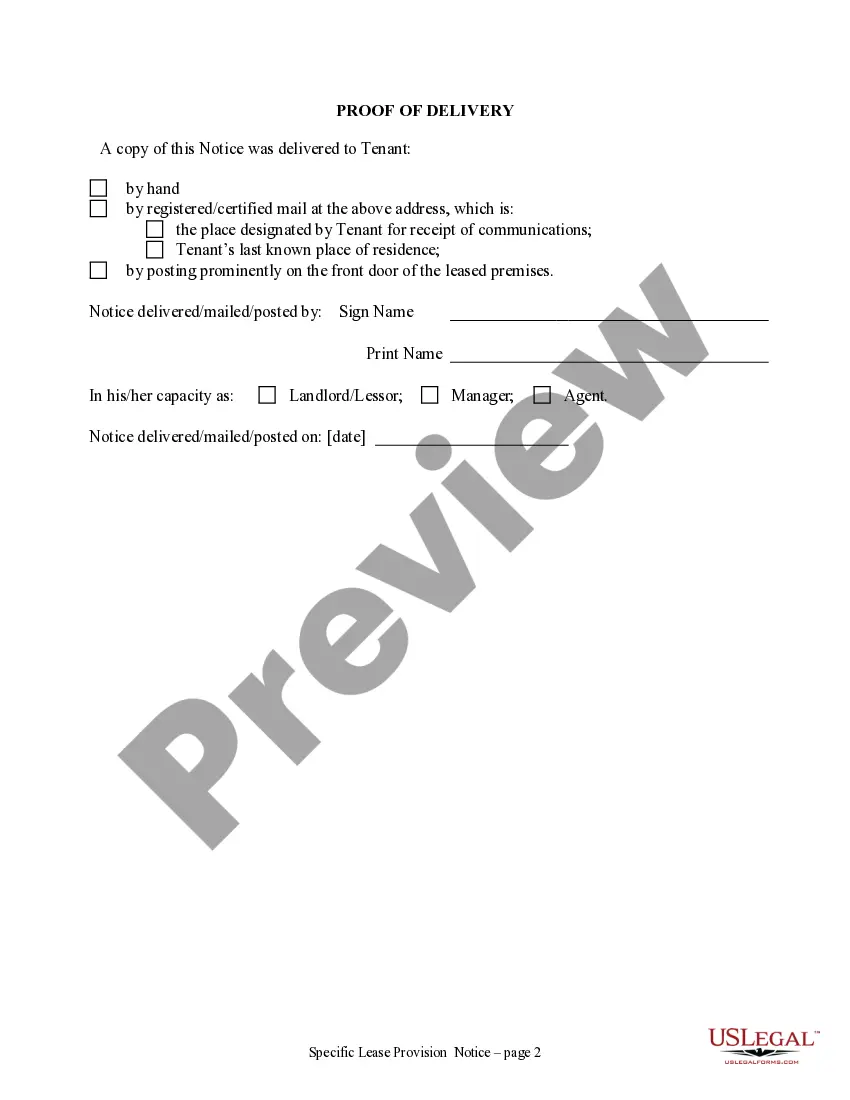

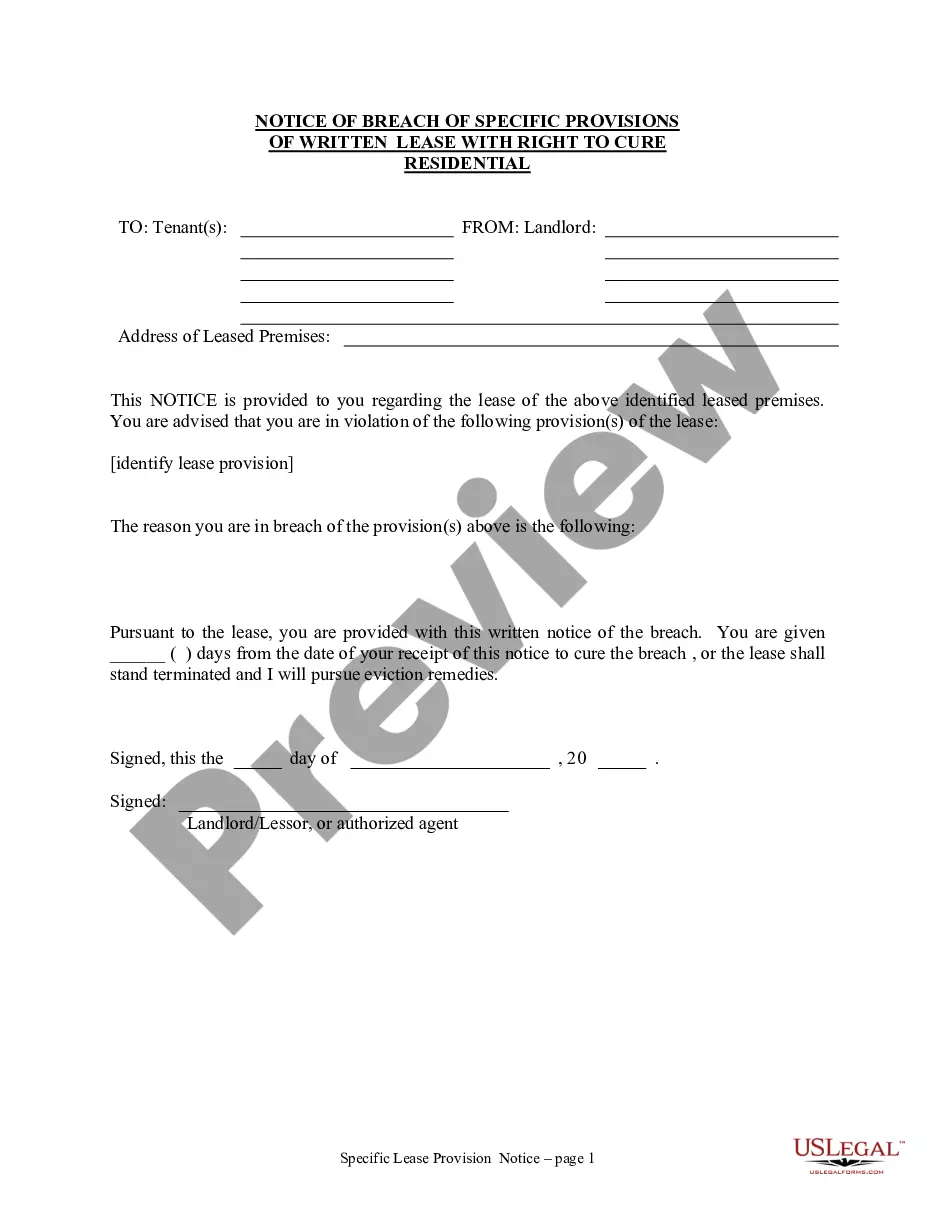

How to fill out Washington Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Nonresidential Property From Landlord To Tenant?

- If you're a returning user, log in to your account to access your documents. Ensure your subscription is active, or renew it if necessary.

- For new users, start by previewing the available forms and their descriptions to find the one that meets your requirements and adheres to local laws.

- If you need a different document, utilize the Search tab to explore other templates until you find the appropriate one.

- Once you've identified the right document, click the Buy Now button to select your preferred subscription plan.

- Complete your registration to gain full access to US Legal Forms' vast resources.

- Provide payment details, either through your credit card or PayPal, to finalize your subscription.

- After purchase, download the form to save it on your device, and you can find it anytime in the My Forms section of your profile.

US Legal Forms is designed to empower individuals and attorneys with a robust collection of over 85,000 legal forms. This extensive online library offers fillable and editable documents that are user-friendly and highly accessible.

With access to premium experts for assistance, you can ensure your documents are completed accurately and effectively. Start your legal journey today with US Legal Forms – secure your lease specific right for a trust now!

Form popularity

FAQ

Putting assets in a trust can come with various downsides. One key concern is the loss of direct ownership, which might affect someone's ability to make quick decisions about assets. Additionally, lease specific rights for a trust can introduce legal complexities that may confuse users. It's wise to consider both the advantages and disadvantages before deciding on this path.

One significant downfall of having a trust is the ongoing management and complexity involved. Trusts require regular administration, which can be time-consuming and may involve additional costs. Moreover, if lease specific rights for a trust are not properly outlined, this can lead to miscommunication and issues down the line. It's essential to carefully manage and review the trust to avoid potential pitfalls.

A trust can receive a step up in basis on rental property, which is an important consideration for property owners. When rental property held in a trust is passed on, it may appreciate in value, thereby potentially lowering capital gains taxes for beneficiaries. Understanding the implications of lease specific rights for a trust in this context is crucial for optimizing your estate plan. Consulting with a financial expert can help clarify these benefits.

Deciding whether your parents should put their assets in a trust can depend on their specific situation. Trusts offer many advantages, including potential tax benefits and easier asset transfer after death. Additionally, a trust can provide specific rights related to lease arrangements, helping to manage rental properties effectively. Consulting with a legal professional can ensure that they choose the right structure for their needs.

The exclusive right to lease refers to the authority granted to a trust to lease property without needing further approval from the grantor or beneficiaries. This lease specific right for a trust allows the trustee to enter binding lease agreements, providing flexibility in managing the trust's assets. It ensures that the trust can generate income efficiently, making it a valuable tool for financial planning. Understanding this right is crucial for effective trust management and can enhance the overall value of the trust.

Filling out a lease agreement form PDF is straightforward if you follow these steps. First, download the form from a reliable source; ensure that it includes options for lease specific rights for a trust if that is relevant to you. Fill in your and your tenant's details, property information, and any terms you wish to include. Consider using tools that allow you to edit and save the PDF easily, such as those offered by USLegalForms, which can simplify the entire process for you.

Yes, you can write your own lease agreement, but you should ensure that it complies with local laws. Utilizing a template can help you include essential clauses and lease specific rights for a trust, providing clarity for both parties. Moreover, platforms like USLegalForms offer professional templates tailored to your needs, making it easier to create a legally sound lease agreement without missing important details. Always review your lease with legal counsel to avoid potential issues.

Deciding whether to gift a house or place it in a trust involves careful consideration of your goals. A trust can offer more control over how the property is managed and distributed, especially if you want to lease specific rights for a trust. However, gifting a house may simplify matters if you want to transfer ownership immediately. Always assess your situation and seek legal advice to ensure your decision aligns with your estate planning needs.

Yes, you can place rental property in a trust, which can be advantageous for estate planning. This action protects the asset and clarifies the lease specific right for a trust for future generations. By doing this, you can effectively manage the rental income and simplify the transfer of ownership after your passing. It’s wise to seek guidance to ensure everything is structured correctly.

You can lease a car through a trust, provided the trust itself is set up properly. The lease specific right for a trust allows the trust to enter contracts, including vehicle leases. This setup can offer benefits like asset protection and potentially favorable tax treatment. Always check with a legal expert to ensure compliance with the leasing company’s requirements.