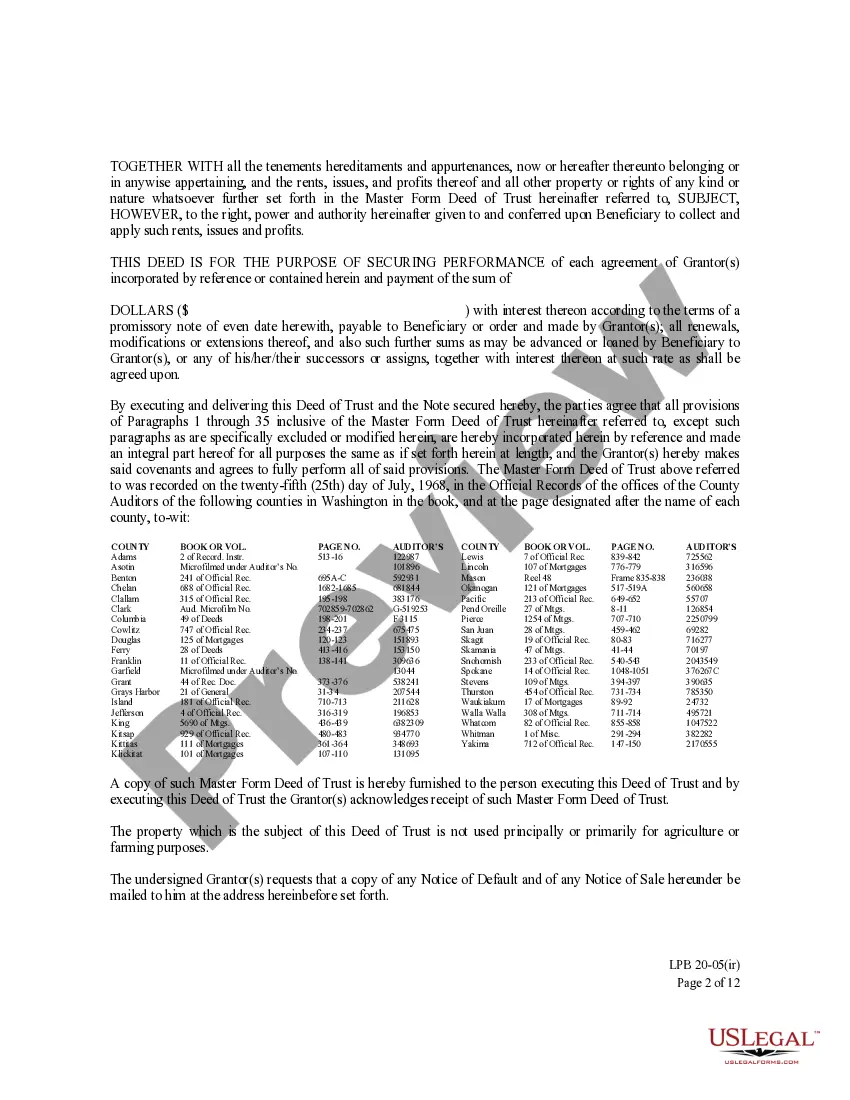

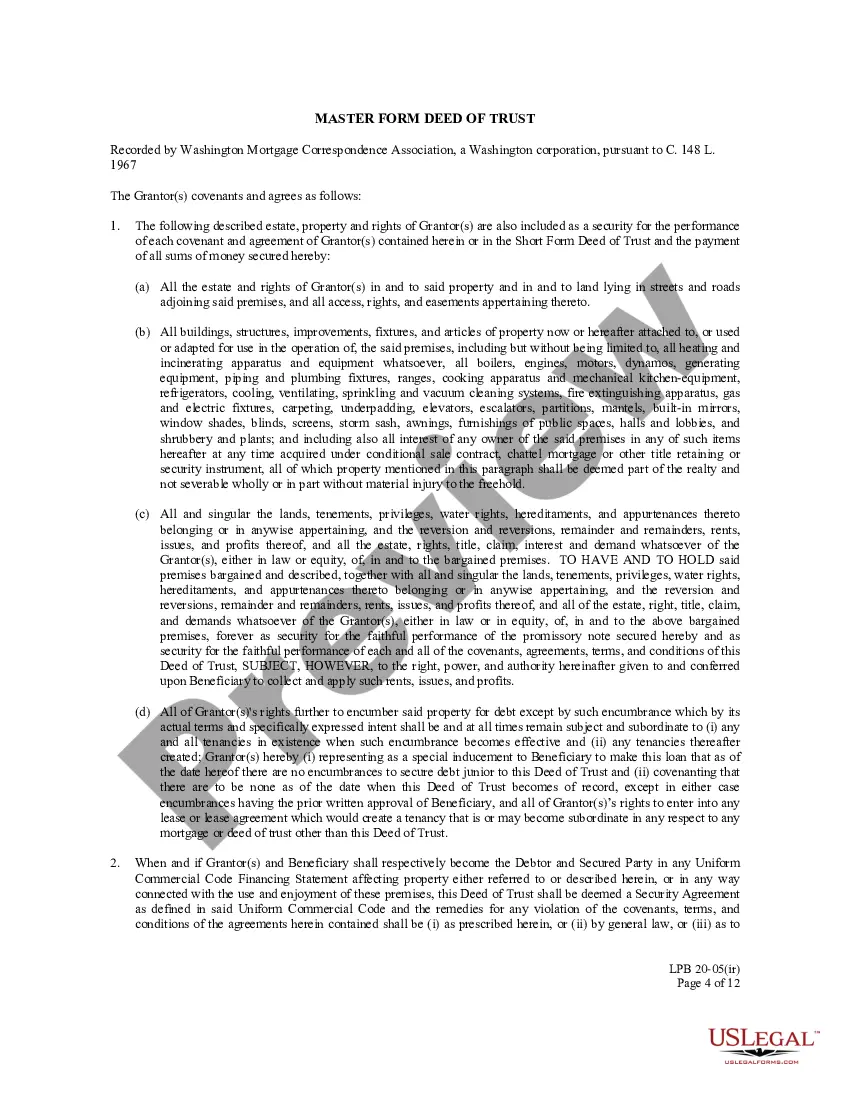

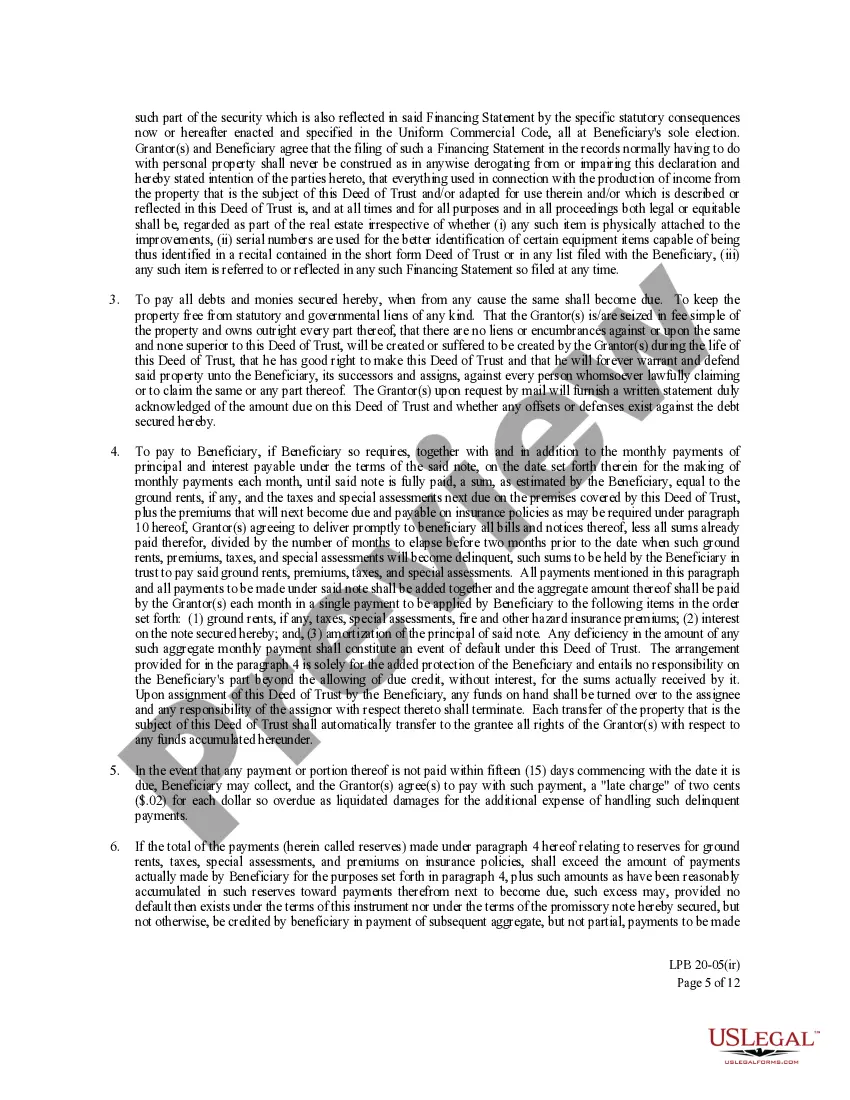

This is an official Washington form for use in land transactions, a Deed of Trust [Short Form and Attachment] (with individual and representative acknowledgments).

Washington Deed Trust Without Settlor

Description

How to fill out Washington Deed Trust Without Settlor?

When you need to complete the Washington Deed Trust Without Settlor following your local state's laws, there may be many choices available.

There’s no requirement to scrutinize every document to ensure it meets all the legal standards if you are a subscriber to US Legal Forms.

It is a reliable service that can assist you in acquiring a reusable and current template on any subject.

Utilizing expertly formulated formal documents is simplified with US Legal Forms. Additionally, Premium subscribers can benefit from powerful built-in tools for online document editing and signing. Give it a try today!

- US Legal Forms is the largest online repository with an archive of over 85,000 ready-to-use papers for business and personal legal situations.

- Each template is confirmed to adhere to the laws of each state.

- Thus, when you download the Washington Deed Trust Without Settlor from our site, you can be assured that you possess a valid and up-to-date document.

- Acquiring the necessary sample from our platform is very straightforward.

- If you already have an account, just Log In to the system, verify that your subscription is active, and save the chosen file.

- In the future, you can click on the My documents tab in your profile and keep access to the Washington Deed Trust Without Settlor anytime.

- If it’s your initial time using our website, kindly follow the instructions below.

- Browse through the recommended page and check it for alignment with your needs.

Form popularity

FAQ

The owners of a unit trust are the unit holders who possess units in the trust. Each unit represents a share of the trust's assets and income. In a Washington deed trust without settlor, unit holders can have direct control and visibility over their investment, which enhances transparency and accountability.

The legal structure of a unit trust consists of trustees and unit holders who own the units representing their interest in the trust. The trustee manages the trust assets in accordance with the trust deed. In the context of a Washington deed trust without settlor, this structure allows for effortless management and a clear understanding of each party's rights.

Establishing a trust in Washington state can be beneficial for asset protection and estate planning. A Washington deed trust without settlor offers unique advantages, such as flexibility and simplified management of the trust. Considering your personal circumstances and goals can help you determine if a trust is right for you.

The Appointer of a unit trust typically has the authority to make critical decisions, such as changing trustees or modifying the trust's terms. This role ensures that the trust operates in line with the beneficiaries' interests. In a Washington deed trust without settlor, the Appointer's powers can enhance the trust's responsiveness to changing conditions.

A unit trust does not necessarily need a settlor. This feature is particularly relevant in the case of a Washington deed trust without settlor, which allows for flexible management and ownership arrangements. Removing the requirement for a settlor can simplify the administration of the trust.

Yes, a unit trust can have a single unit holder. This means that one individual or entity can own all of the units in the trust. In the context of a Washington deed trust without settlor, this structure can provide streamlined management and control over the trust's assets.

In Washington, a trust, including a Washington deed trust without settlor, does not need to be recorded for it to be valid. However, if the trust holds real estate, you should record it to provide clear public notice of the trust's existence. Recording can also help avoid potential disputes by establishing clear ownership of the property. Ultimately, consulting with a legal professional can provide tailored guidance for your specific situation.

In a Washington deed trust without settlor, the roles of settlor and trustee can be separated for efficiency and clarity. While a settlor may serve as a trustee, it's not a requirement. This separation can help streamline management and allow for more strategic decision-making in the trust. It's essential to consider how this structure aligns with your overall estate planning goals.

Choosing between a will and a trust in Washington state depends on your personal circumstances and goals. A trust can help avoid probate, maintain privacy, and provide more control over asset distribution, especially if you consider a Washington deed trust without settlor. In contrast, a will is generally simpler and less expensive but may lead to a lengthy probate process. Evaluate your needs and consult resources such as US Legal Forms to assist you in making an informed choice.

Filling out a quitclaim deed in Washington state involves providing key information, such as the names of the grantor and grantee, a description of the property, and the signatures of the involved parties. You also need to include the appropriate legal language to ensure the deed is valid. Utilizing a Washington deed trust without settlor can complement your quitclaim deed, especially when defining property interests. Consider using US Legal Forms for step-by-step assistance in completing your quitclaim deed.