Limited Business

Description

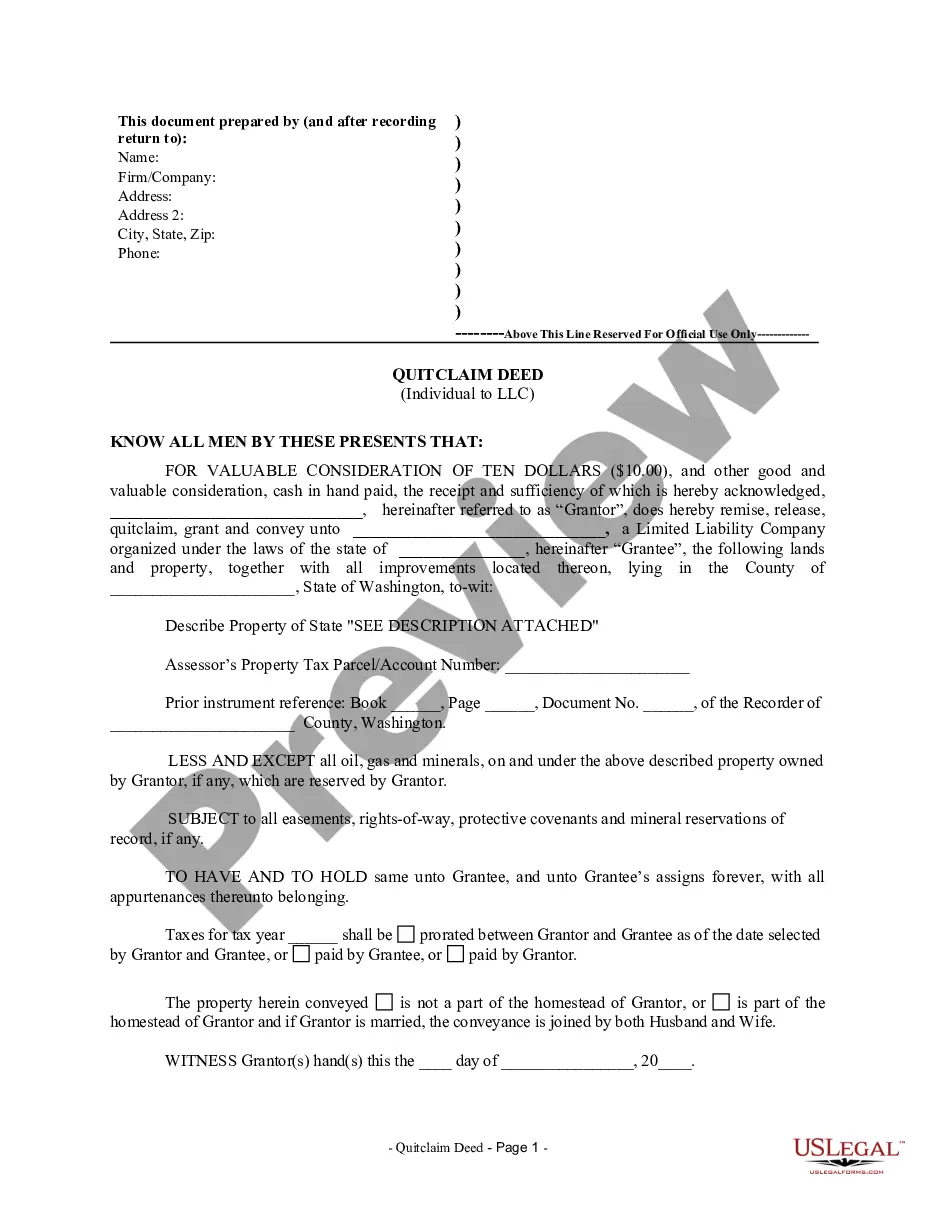

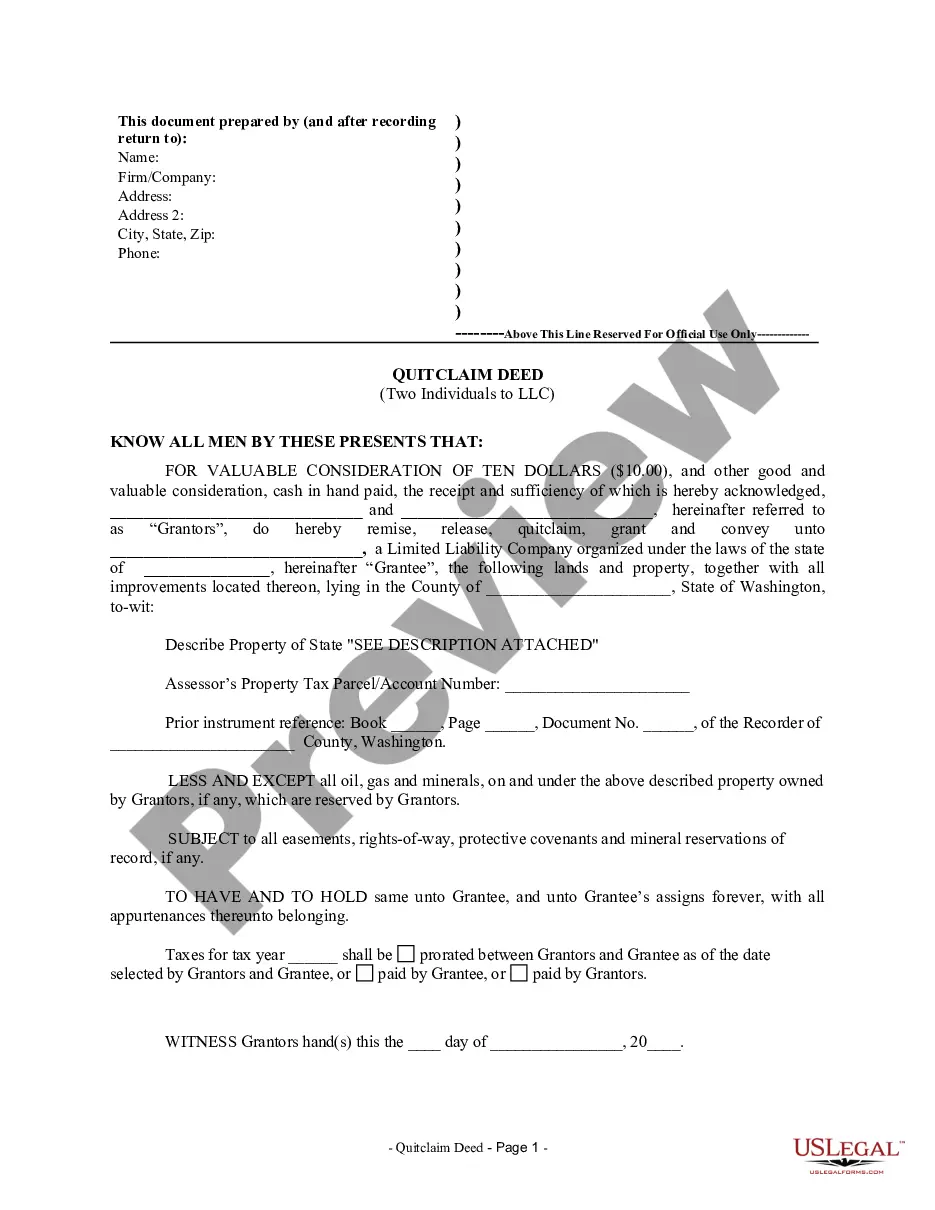

How to fill out Washington Quitclaim Deed From Individual To LLC?

- First, access your US Legal Forms account by logging in. Ensure your subscription is active; renew if necessary.

- If you are new, start by reviewing the Preview mode and form description to confirm that the template fits your requirements and local jurisdiction.

- Utilize the Search tab to find additional templates if the initial choice does not meet your needs.

- When ready, select the template and click the Buy Now button, then choose your preferred subscription plan.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download your form to your device so you can complete it or access it later in the My Forms section.

By following these straightforward steps, you can easily access the extensive collection of over 85,000 editable legal forms available at your fingertips.

Start using US Legal Forms today and empower your limited business with the right tools for legal success!

Form popularity

FAQ

It is generally advisable to avoid using 'limited' instead of LLC due to potential misunderstandings about your business structure. An LLC clearly indicates limited liability, which is essential for distinguishing your legal responsibilities. Utilizing accurate terminology builds trust and clarity with your clients and stakeholders.

While a private limited company and an LLC serve similar purposes, they are not identical. A private limited company is typically associated with UK business structures, while an LLC is prevalent in the United States. Both limit personal liability, but the specific regulations and operational rules can differ.

A common example of a limited business is a limited liability company (LLC), which combines the benefits of both corporations and partnerships. This structure protects personal assets from business debts while allowing for pass-through taxation. Many small businesses opt for an LLC when forming for the first time due to its advantages.

Using 'limited' instead of LLC could confuse people since they are distinct business structures. An LLC offers specific legal protections and operational flexibility that a limited business may not provide. Always clarify your business's legal structure to ensure that you meet compliance requirements and maintain transparency.

The choice between an LTD and an LLC often depends on your specific business needs and goals. An LTD typically offers more formal structures and regulatory requirements, while an LLC provides flexibility with management and fewer compliance obligations. Understanding your priorities can help you determine which limited business structure aligns with your vision.

Choosing a limited partnership over an LLC can benefit those seeking to attract investors while limiting their liability. In a limited partnership, one or more general partners manage the business, while limited partners can contribute capital without participating in operations. This structure can be appealing to investors who want a stake in the profit but prefer to maintain a passive role.

Limited in business signifies a legal framework designed to protect owners and investors by capping liability. It assures stakeholders that their personal assets remain secure even if the business encounters financial difficulties. If you're considering forming a limited business, platforms like uslegalforms can guide you through the process, making it straightforward and compliant.

In business, 'limited' refers to a company structure that provides limited liability to its owners. This structure limits the risks associated with starting and running a business, as owners are only responsible for the company’s debts up to the amount they have invested. Choosing a limited business status can lead to more secure and sustainable growth.

When a business has 'limited' in its name, it indicates that it is registered as a limited company. This status protects the owners from personal liability, ensuring that their personal finances remain separate from business debts. Therefore, 'limited' represents an important legal safeguard for those involved in the business.

Businesses typically use the term 'limited' to indicate their liability status. It shows potential investors and customers that the owners are not personally responsible for all debts incurred by the business. This designation can enhance credibility, making it easier for a limited business to attract funding and partnerships.