Limited Business

Description

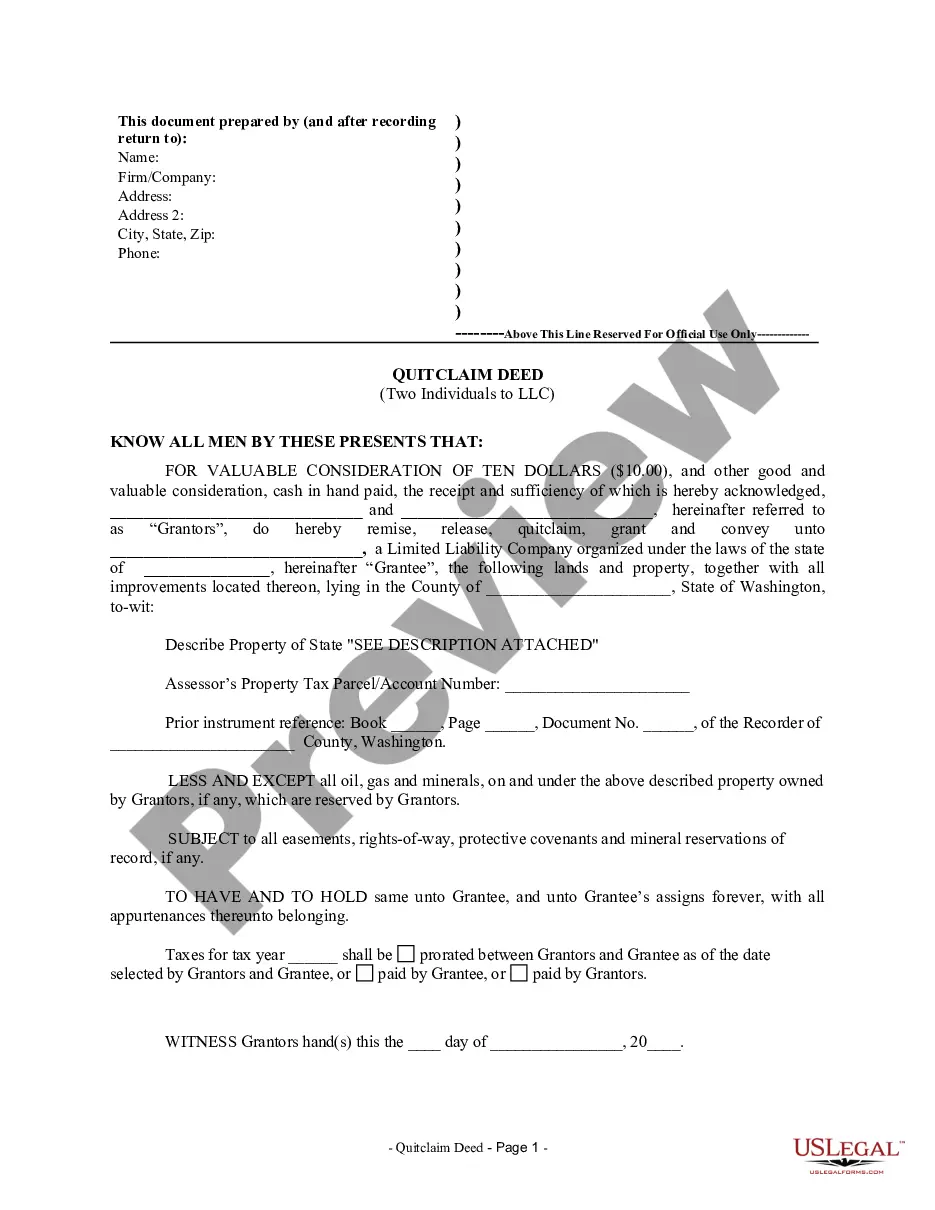

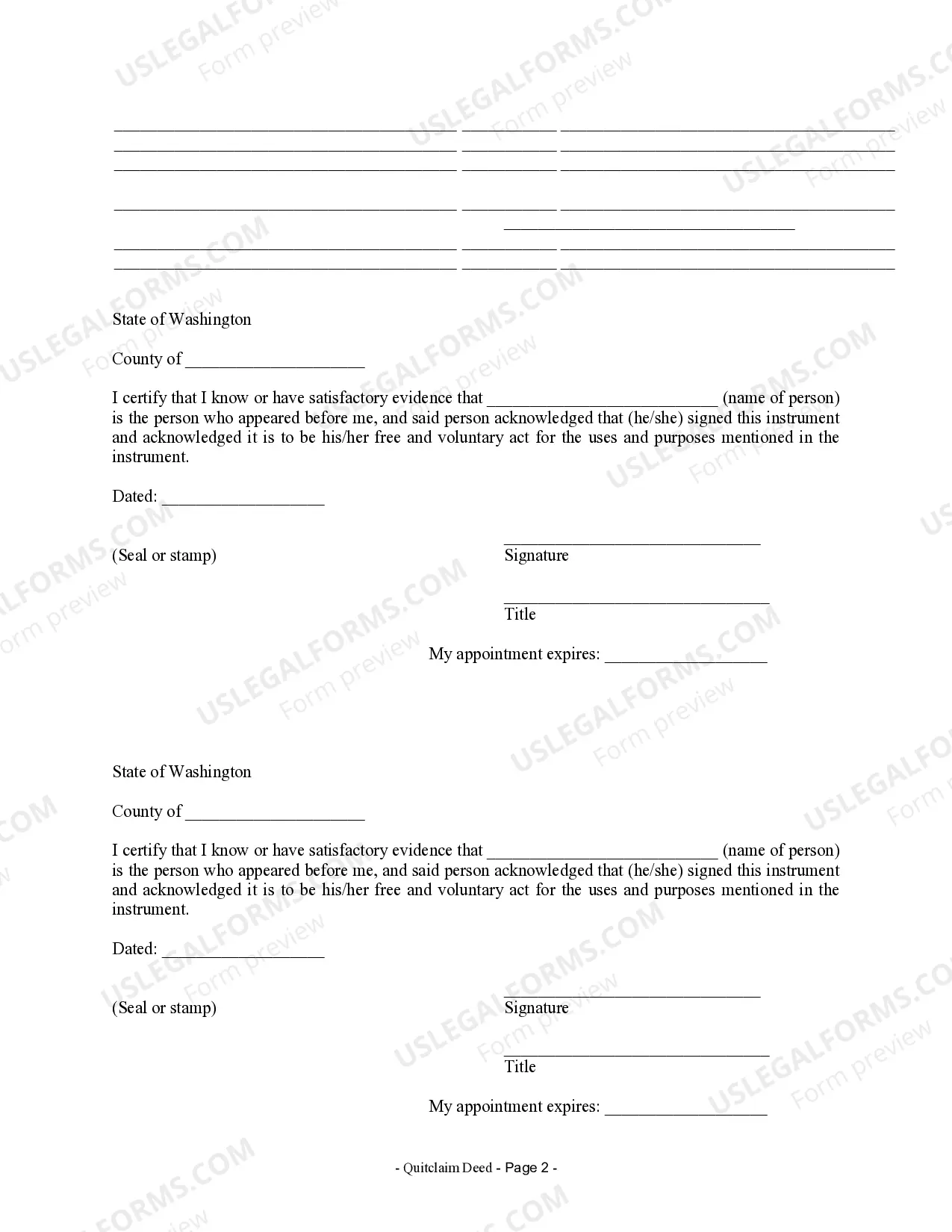

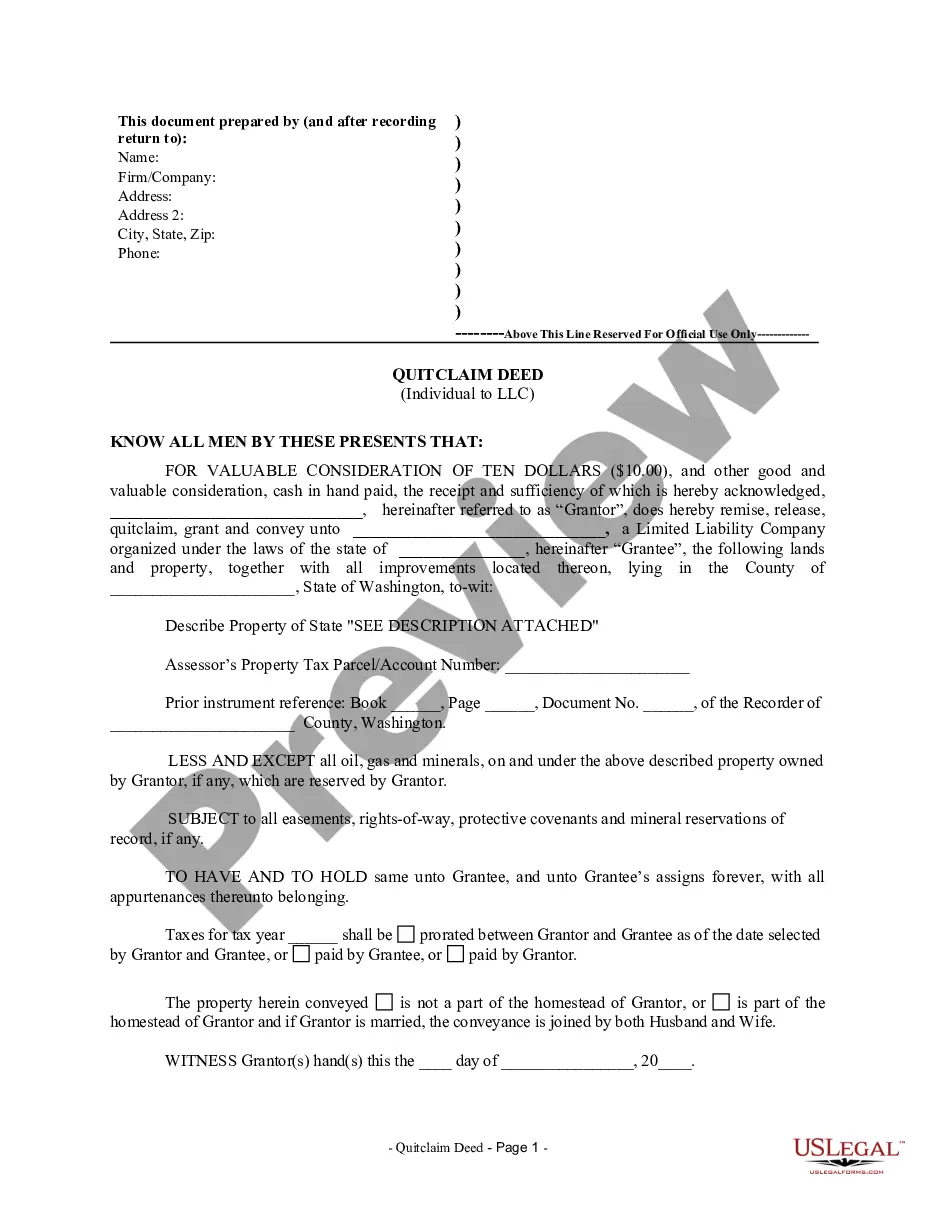

How to fill out Washington Quitclaim Deed By Two Individuals To LLC?

- If you're a returning user, log in to your account and check your subscription status. Ensure it's valid before downloading your desired form by clicking on the Download button.

- For first-time users, start by exploring the Preview mode and form descriptions. Confirm that you've selected the right template that complies with your local jurisdiction.

- If the form doesn’t meet your needs, use the Search feature to find an alternative template.

- Once you've settled on the correct form, proceed by clicking the Buy Now button to select your preferred subscription plan. You will need to create an account for full access.

- Finalize your purchase by entering your credit card details or using your PayPal account.

- After purchase completion, download your form and save it on your device. You can access it anytime in the My Forms section of your account.

In conclusion, US Legal Forms not only provides a robust collection of forms but also ensures that users can rely on expert assistance for document completion.

Start utilizing US Legal Forms today to streamline your business formation and achieve legal clarity with ease.

Form popularity

FAQ

A limited partnership might be preferable for businesses looking to attract investors while limiting their liability. In this structure, general partners manage the business, while limited partners contribute resources without participating in daily operations. This arrangement can appeal to investors seeking limited business liability, potentially increasing your funding options. Explore information on business structures through uslegalforms to make an informed choice.

No, you cannot use 'limited' instead of 'LLC' in a way that misleads about your business structure. 'Limited' usually denotes a company structure that may have different legal implications than an LLC. It's important to accurately represent your business type to comply with state regulations. Resources such as uslegalforms can assist you in understanding these conventions.

In general, you cannot interchangeably use 'limited' and 'LLC' as they refer to different business structures. Using 'limited' typically implies a specific type of entity that may not equate to the protections offered by an LLC. Selecting the correct designation is essential for liability protection and compliance purposes. Consult with platforms like uslegalforms for guidance on naming your limited business appropriately.

A private limited company and an LLC are similar but exist under different legal frameworks. Both structures limit personal liability, but the rules governing their formation and operation vary by jurisdiction. A private limited company is often used in the UK, while the LLC designation is prevalent in the US. Understanding these distinctions can help you choose the right limited business structure for your operation.

Choosing between an LTD and an LLC depends on your business goals. An LTD is typically more suited to larger companies, while an LLC offers simplicity and flexibility for small to medium-sized businesses. Additionally, an LLC provides personal liability protection and simpler tax treatment, which makes it a popular choice for many entrepreneurs. Assessing your unique needs is crucial for determining the best limited business structure.

A limited business example includes a limited liability company (LLC). An LLC combines elements of a corporation and a partnership, allowing for personal liability protection while maintaining flexibility in management. This structure helps many entrepreneurs manage risk and protect their assets effectively. You can easily form an LLC through platforms like uslegalforms.

A limited company, often referred to as a limited business, is a legal structure where the owner's liability is limited to their investment in the company. This means that personal assets are protected from business debts and liabilities. Typically, to qualify, the company must adhere to specific registration requirements based on state laws. Using a platform like US Legal Forms can simplify the process of forming a limited business and ensure compliance with all necessary regulations.

When a business has 'limited' in its name, it signifies that it is a limited liability company or corporation. This means the owners are not personally responsible for the company's financial debts beyond their investment. This structure not only provides legal protection but also establishes a formal business identity. For those considering starting such a venture, platforms like US Legal Forms can simplify the formation process.

Businesses use the term 'limited' to inform potential investors and creditors about their liability structure. It indicates that the owners' financial risk is confined to their investment in the company. This transparency attracts more investors who appreciate the protection it offers. By forming a limited business, owners can also enjoy a professional image in the marketplace.

'Limited' in business signifies a company type where liability is restricted for its owners. This designation indicates that, should the company incur debts, the personal finances of shareholders are safeguarded. Limited liability encourages individuals to start businesses without fearing personal bankruptcy. It's crucial to understand the benefits of operating a limited business for long-term success.