Trust Will Heard

Description

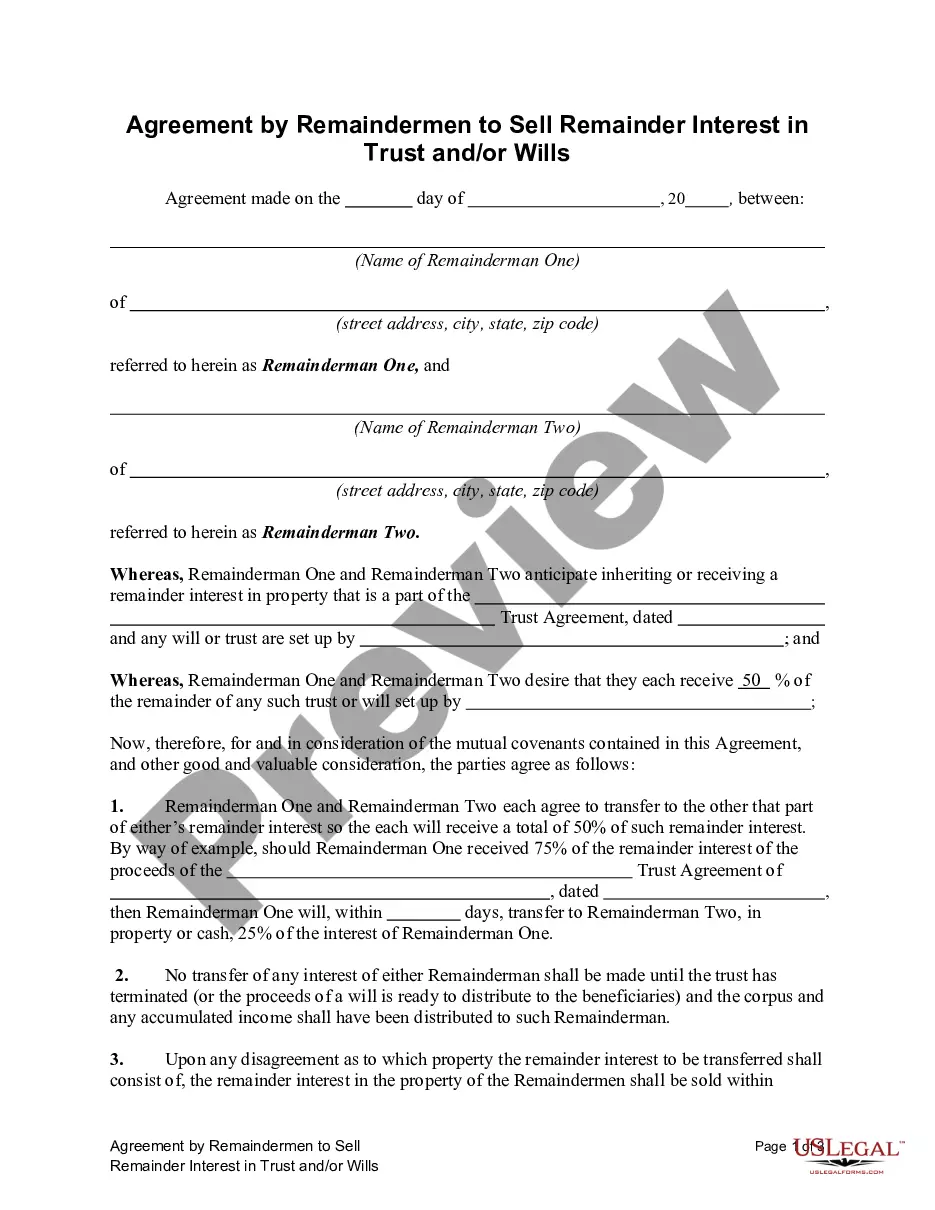

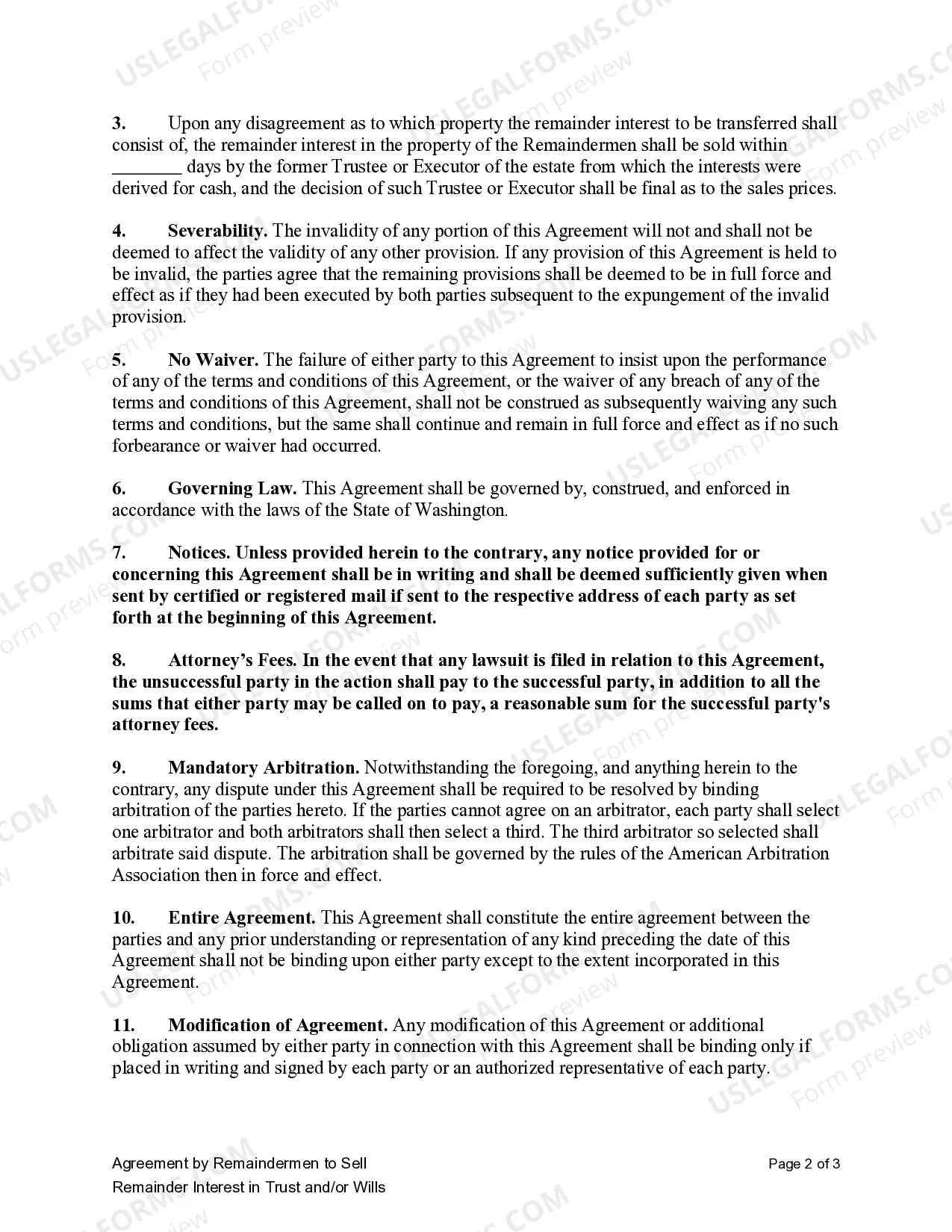

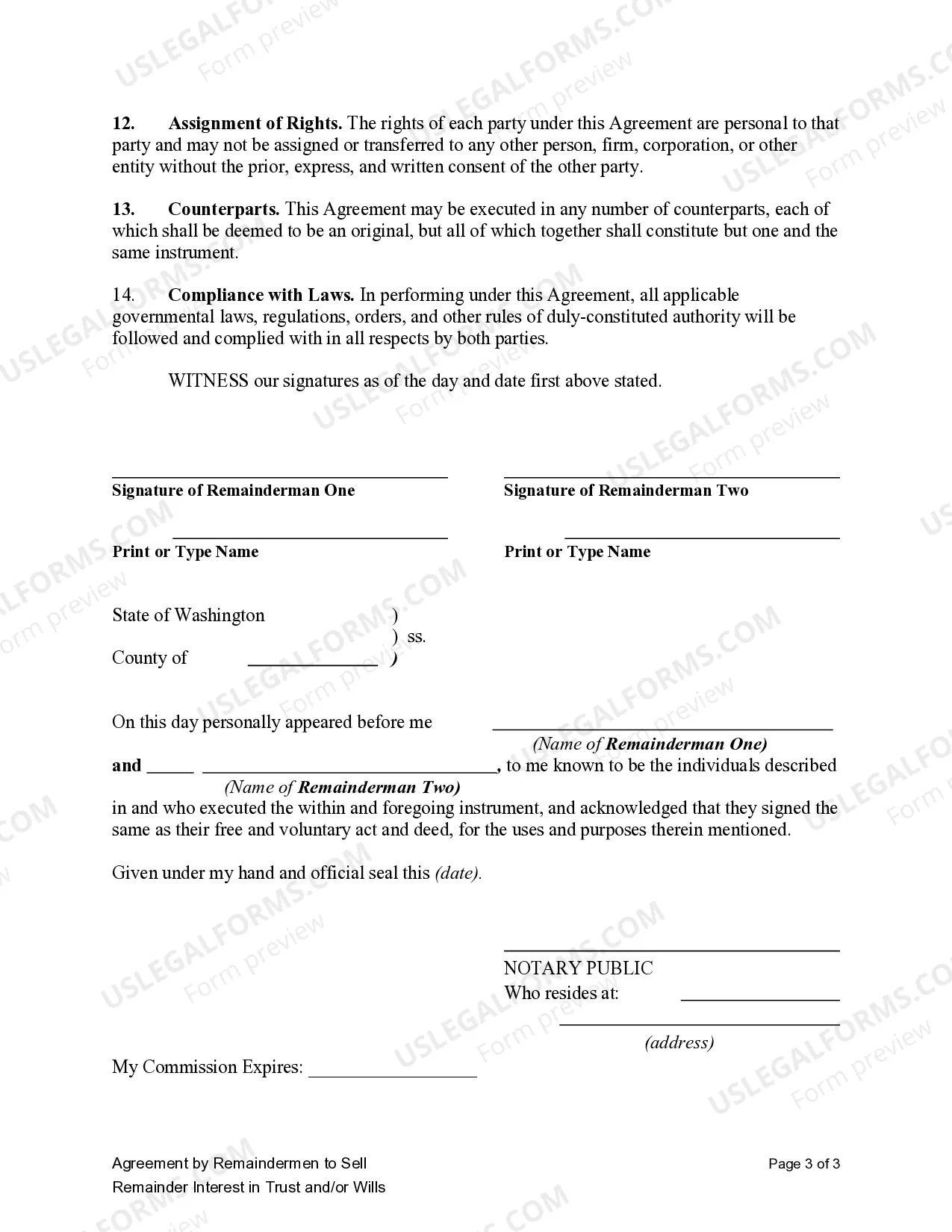

How to fill out Washington Agreement By Remainderman To Sell Remainder Interest In Trust And/or Wills?

- Log in to your existing account at US Legal Forms. Make sure your subscription is up-to-date to continue using the service without interruption.

- If this is your first time, start by browsing the collection. Preview the form description to confirm it meets your local jurisdiction's requirements.

- Utilize the search feature to find a specific form if necessary. If you encounter any discrepancies, look for alternatives before proceeding.

- Select the desired document by clicking the 'Buy Now' button. Choose a subscription plan that fits your legal form needs.

- Complete your purchase by entering your payment details, either through a credit card or PayPal to finalize your subscription.

- Once your payment is confirmed, download the form directly to your device. You can also access it anytime in the 'My Forms' section of your profile.

By following these straightforward steps, you can take full advantage of the impressive resources available at US Legal Forms. The robust form library ensures that you have access to what you need, supported by expert assistance if required.

Don’t hesitate—take control of your legal needs today and ensure that trust will be heard in your documentation process.

Form popularity

FAQ

One significant downfall of having a trust is the difficulty of modifying or revoking it once established. Additionally, maintaining a trust requires ongoing administration and legal oversight, which can be time-consuming. It is vital to carefully consider these factors to ensure your trust will be heard and meet your ongoing needs and objectives.

Placing your home in a trust can lead to potential complications with mortgage banks and tax implications. Furthermore, if not properly managed, your home may be subject to different legal standards. It's crucial to understand these aspects to ensure your trust will be heard and effectively serve its purpose in protecting your home.

Some may choose not to have a trust due to the increased complexity it can introduce to estate planning. In certain cases, individuals may find that they have few assets, making a will sufficient. Consider your personal situation and whether your trust will be heard as part of your estate strategy; sometimes, a straightforward approach may suffice.

To write a simple will, start by clearly identifying yourself and stating that this document is your will. Next, name an executor who will carry out your wishes, followed by detailing how you want your assets distributed. Remember, a simple will should be concise yet comprehensive enough to ensure that your trust will be heard in all matters concerning your estate.

Yes, you can legally contest a trust, but the grounds for doing so typically involve issues like lack of capacity, undue influence, or improper execution. Contesting a trust can be complex, and it requires a solid understanding of legal standards. If you find yourself considering this route, consulting with a knowledgeable attorney is essential to ensuring that your concerns are adequately represented. With USLegalForms, you can access tools and information to help guide your decisions, ensuring your voice is heard.

Choosing a trust over a will offers several advantages. A trust allows your assets to bypass the probate process, which can be lengthy and complicated, thus ensuring quicker distribution to your beneficiaries. Furthermore, a trust provides greater privacy since it does not become public record like a will. This means your family's privacy is protected, and your trust will be heard as intended.

Yes, a trust can indeed be created within a will, specifically known as a testamentary trust. This trust only takes effect after your death, allowing you to manage assets for your beneficiaries according to your wishes. By incorporating a trust in your will, you provide a clear framework for distributing your assets, ensuring your intent is honored. This approach can significantly enhance how your trust will be heard by family and loved ones.

To establish a trust within a will, you first need to draft a legal document known as a testamentary trust. This type of trust is created upon your passing and includes instructions on how your assets will be managed and to whom they will be distributed. It is crucial to outline the terms clearly so your beneficiaries understand how the trust operates. USLegalForms provides comprehensive resources to help you navigate this process smoothly, ensuring your trust will be heard.

When you have both a trust and a will, the trust generally takes precedence over the will. This means your assets that are placed in the trust will be distributed according to its terms, while those not in the trust will follow the instructions in your will. This setup ensures your wishes are clearly communicated, and your loved ones will have a straightforward process to follow. Overall, a trust will heard can help streamline the management of your assets.

A beneficiary typically receives notification from the trustee through a formal letter or a direct conversation. This communication outlines the trust's provisions and focuses on any distributions or responsibilities. Understanding this process is vital to ensure that beneficiaries engage positively with the trust's management. For additional clarity, the uslegalforms platform offers guidance on beneficiary notifications.