This package is an important tool to help you with the legal issues that may arise between roofing contractors, property owners, suppliers and/or subcontractors during a roofing project for new construction or repairs. The heart of this package is the roofing contract that complies with state law.

This package contains the following forms:

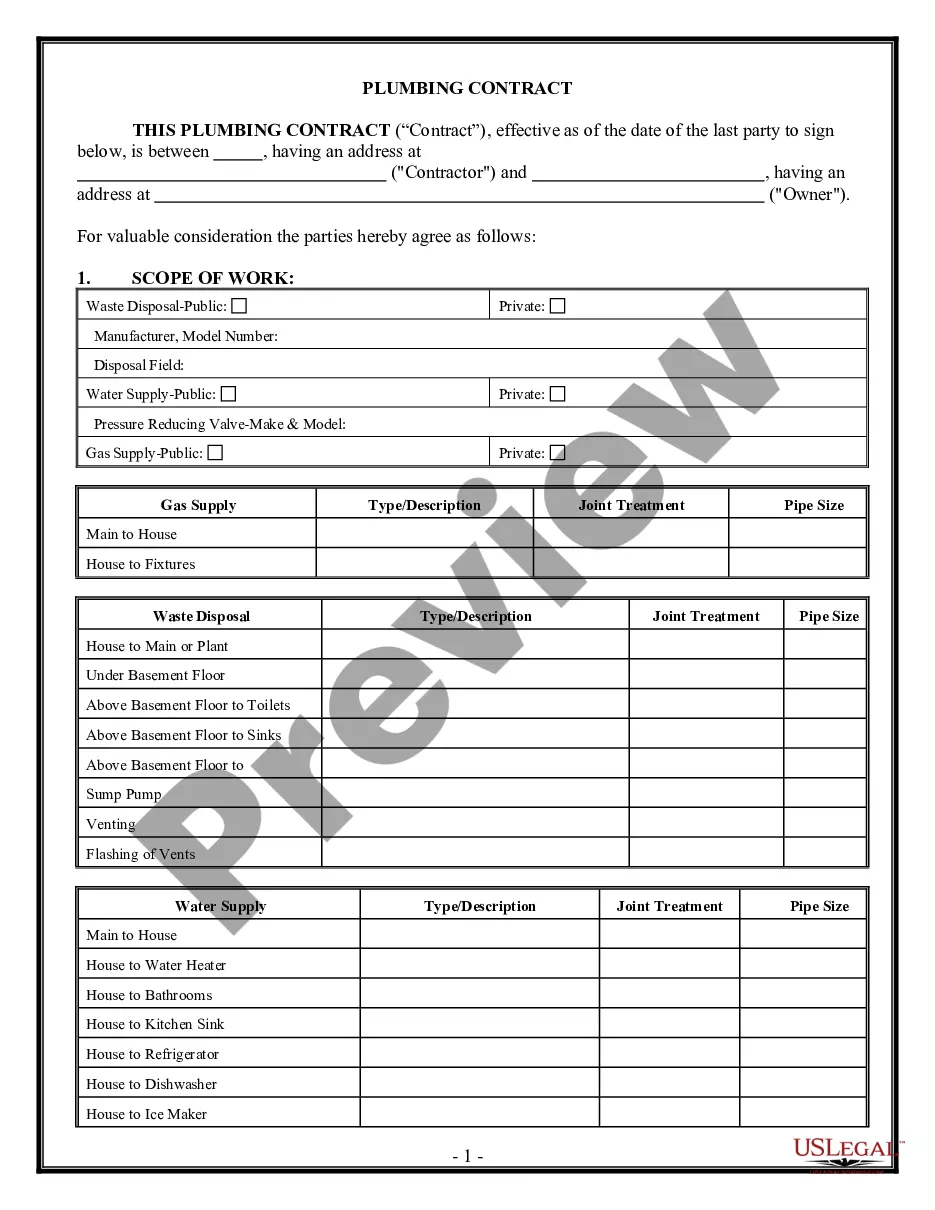

1. Vermont Roofing Contract - Cost Plus or Fixed Fee

2. A Bid Log

3. A Bid Follow Up Letter

4. A Change Order Sheet

5. A Certificate of Completion

6. A Final Project Punch List

7. A Worker Safety and Health Plan

8. An Accident Report Form

9. A Customer Satisfaction Survey and

10. A Company Evaluation by Customer

Purchase this package and more than 50% over purchasing the forms separately!

Roofing contractors in Vermont are legally required to withhold certain taxes and payments when hiring employees or subcontractors. This practice ensures compliance with state and federal tax regulations. The primary types of withholding that roofing contractors in Vermont must be aware of include: 1. Employee Withholding: When a roofing contractor has employees on their payroll, they are responsible for withholding and remitting income tax from their employees' wages. This includes deductions for federal income tax, state income tax, and FICA (Social Security and Medicare) taxes. 2. Vermont Unemployment Insurance (UI) Withholding: Roofing contractors are also required to withhold a certain percentage of their employees' wages to contribute towards Vermont's Unemployment Insurance program. This protects employees who may lose their jobs and need financial assistance. 3. Workers' Compensation Insurance Withholding: As a safety measure, roofing contractors are obligated to withhold a portion of payroll to cover workers' compensation insurance premiums. This insurance provides coverage for employees who may suffer injuries or illnesses on the job, ensuring they receive necessary medical treatment and wage replacement. It's important for roofing contractors in Vermont to understand their responsibilities when it comes to withholding these taxes and payments. Failure to do so can result in penalties and legal consequences. By staying compliant, contractors can maintain their credibility, protect their employees, and contribute to the overall financial stability of their workforce and the state.