Va Closing Transaction With Credit Card

Description

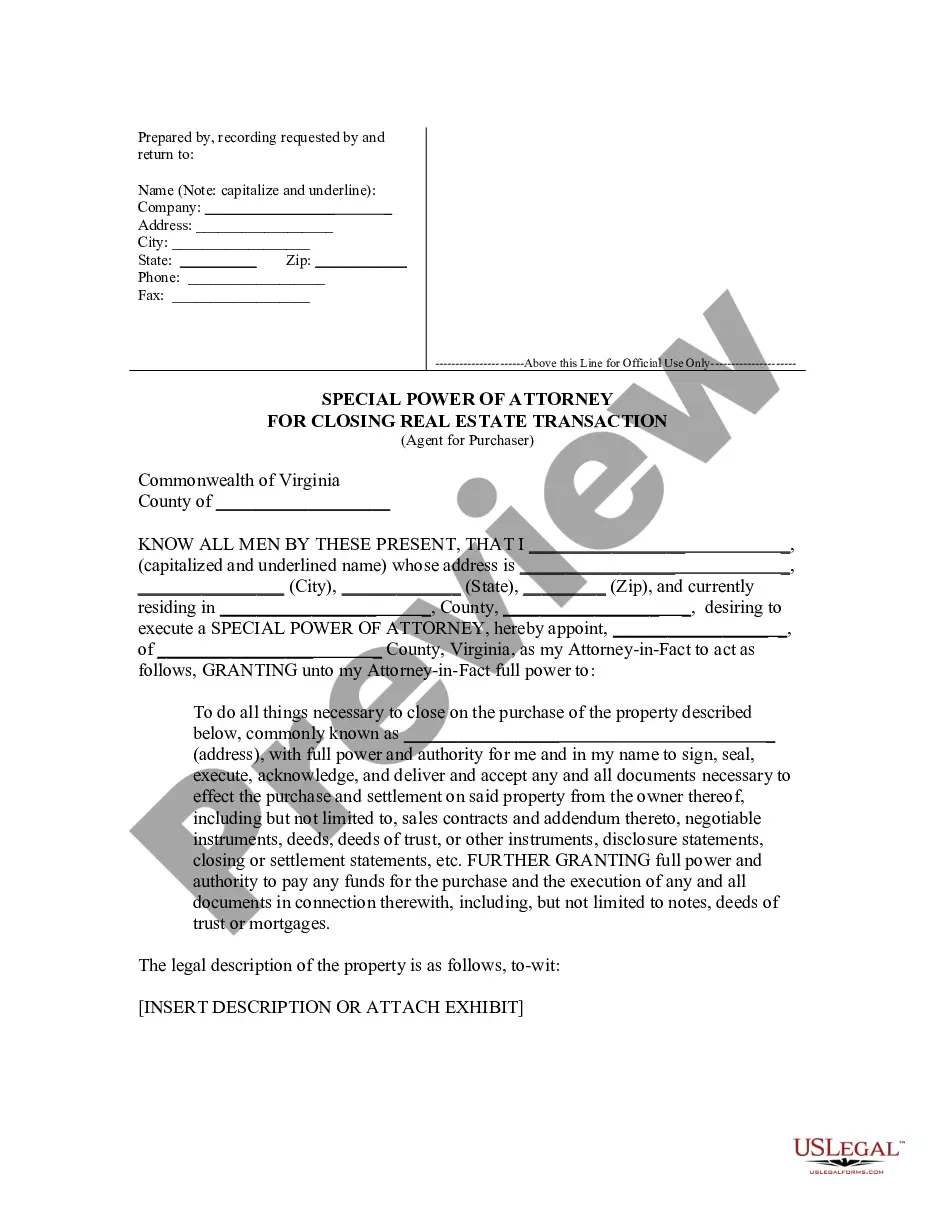

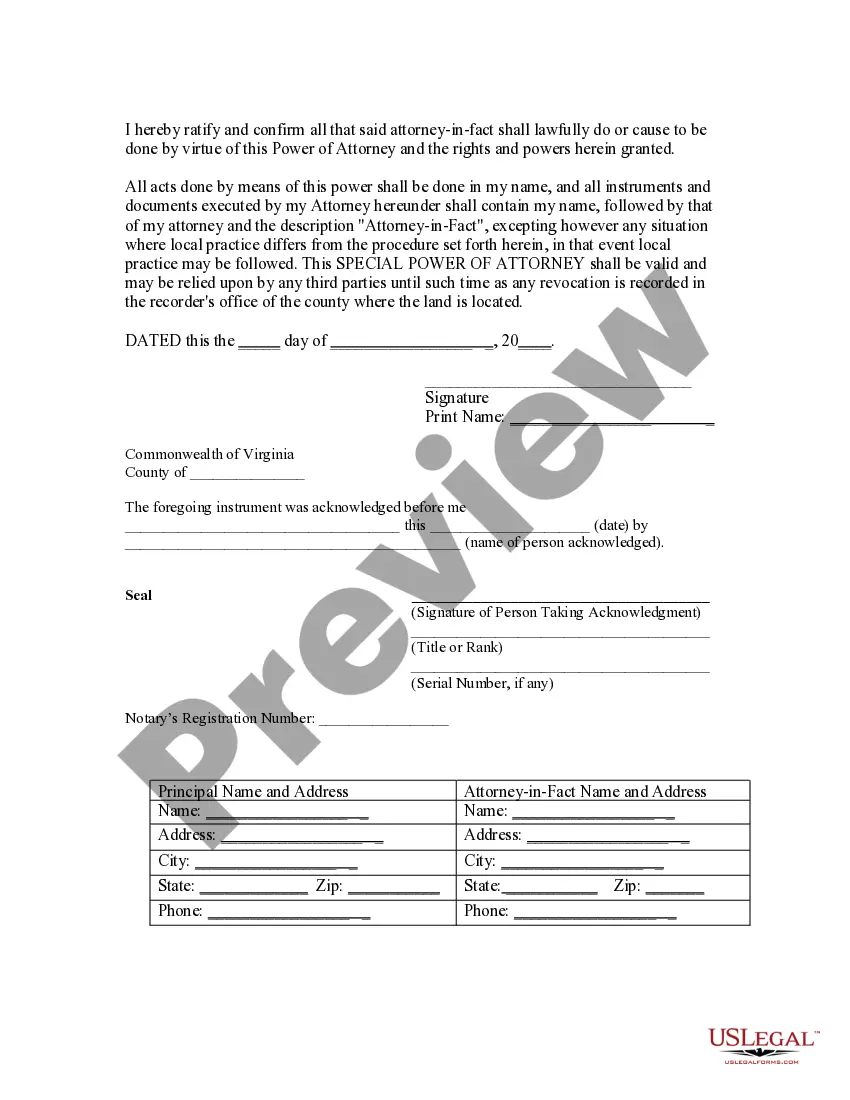

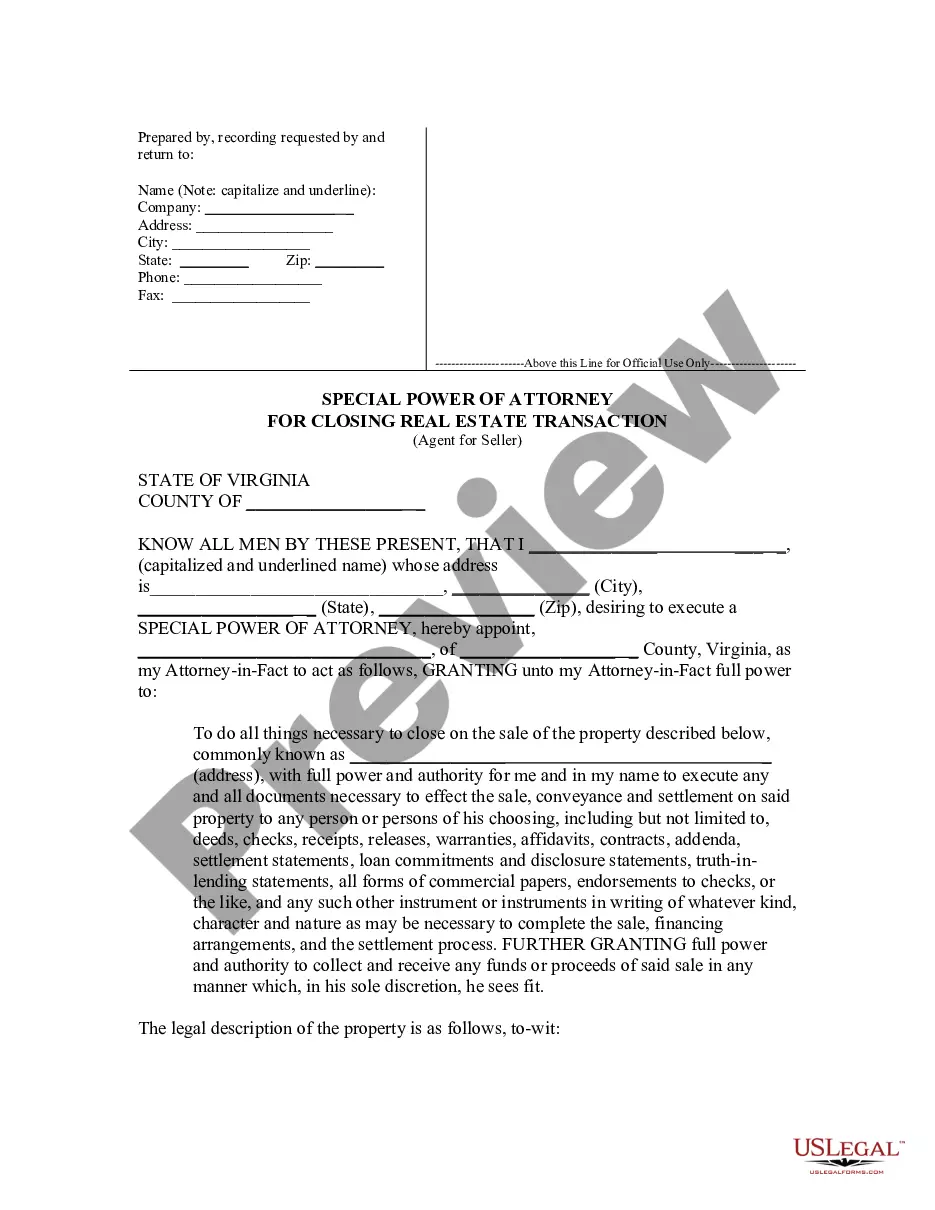

How to fill out Virginia Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

The Va Closing Transaction With Credit Card presented on this page is a reusable legal framework crafted by experienced attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal professionals with more than 85,000 authenticated, state-specific documents for various business and personal circumstances. It’s the fastest, most direct, and most dependable method to acquire the forms you require, as the service ensures bank-grade data security and anti-malware safeguards.

Choose the format you desire for your Va Closing Transaction With Credit Card (PDF, DOCX, RTF) and download the file onto your device.

- Examine the document you need and assess it.

- Browse through the file you searched and preview it or review the form description to verify it meets your needs. If it does not, utilize the search bar to locate the appropriate one. Click Buy Now when you have identified the template you need.

- Register and Log In.

- Select the pricing plan that fits your needs and create an account. Use PayPal or a credit card to complete a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

You can reduce how much you spend on VA closing costs in a variety of ways, such as: Making a down payment to reduce the VA funding fee. Applying to eliminate it, if you qualify. Negotiating so that the seller pays most of the closing costs. Purchasing discount points to reduce the interest rate on your loan.

For Veterans, Active Military, and Families Apply for a debt consolidation loan at VA Financial and you could receive up to $40,000 to repay high interest credit card debt or overdue long term loans. This personal loan combines all your debt into one easy to pay monthly payment, often with a lower interest rate.

The VA loan allows you to roll some of the closing costs into your total loan amount. The big thing is that you can roll your funding fee into the total mortgage amount. Although you'll pay more in interest, this can help you get into a home now.

If the lender does not supervise the progress of construction or make advances to a veteran in excess of 50 percent of the loan during construction, alteration, improvement, or repair, then the lender may charge the veteran up to one percent of the loan amount in addition to the lender's one percent flat charge.

Can VA loan closing costs get rolled into your loan? Although you can't include all of your closing costs in your mortgage, the VA does allow you to roll your VA funding fee into your total loan amount. By financing your funding fee with the rest of your loan, you'll instead repay the amount over time.