What is Power of Attorney?

Power of Attorney allows someone to make decisions on your behalf. It is often used when you cannot act for yourself. Explore templates tailored for Virginia to get started.

Power of Attorney documents in Virginia grant authority to another person. Attorney-drafted templates are quick and simple to fill out.

Prepare for later stages of life with essential legal forms, all organized for your convenience.

Designate someone to manage your property and finances, even if you become incapacitated. Protect your assets with comprehensive authority granted to your agent.

Ensure your finances are managed during incapacity with broad powers granted to a trusted agent.

Get everything you need to manage your health, finances, and family care with this essential package of legal forms.

Assign authority for decisions about your child's care and custody, including education and health matters.

Authorize someone to manage your bank accounts, even if you become incapacitated. This ensures financial stability when you can't act personally.

Ensure your medical treatment wishes are honored with this convenient package of essential legal forms.

Prepare for critical health decisions when you're unable to communicate your wishes. Empower someone you trust to make choices on your behalf.

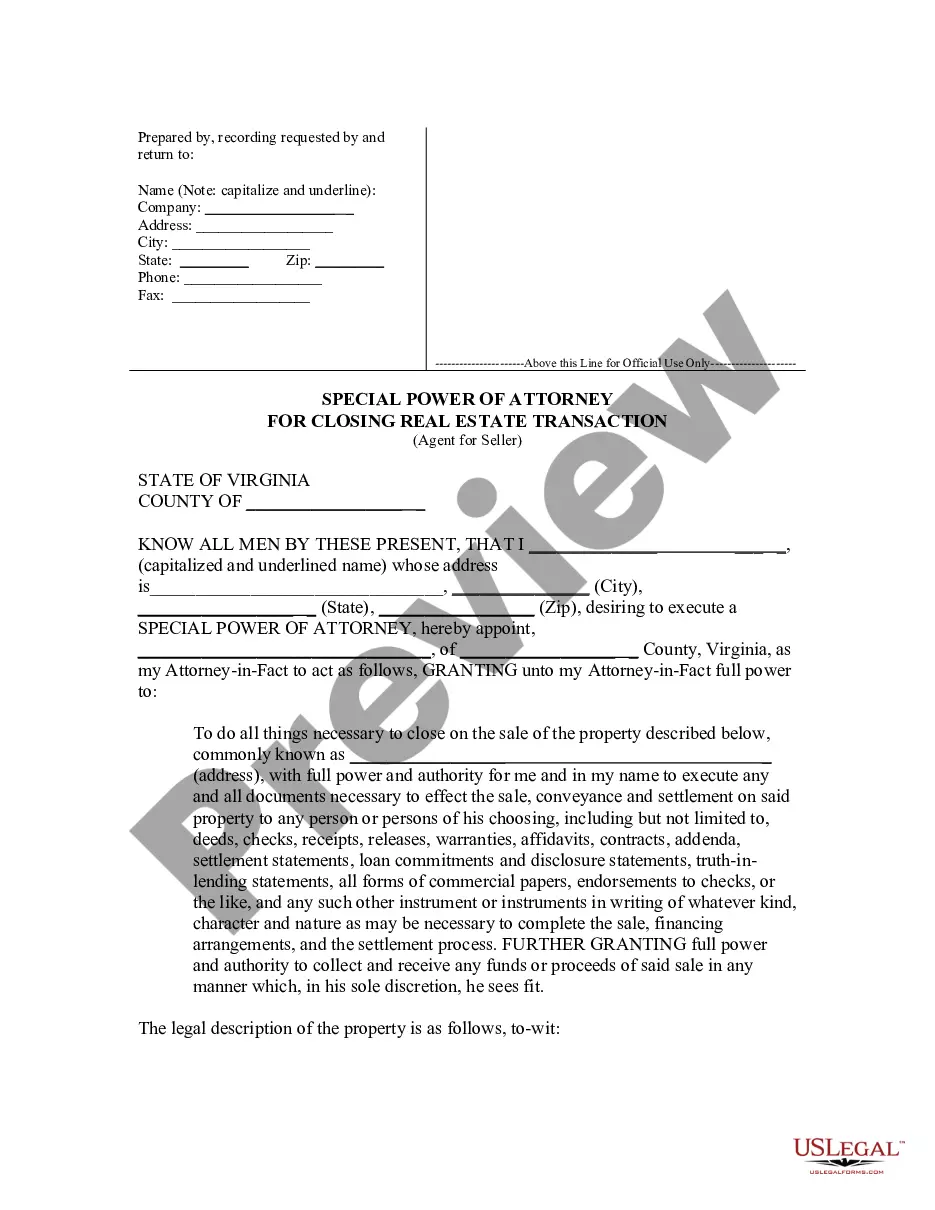

Authorize someone to handle real estate sales on your behalf, streamlining property transactions.

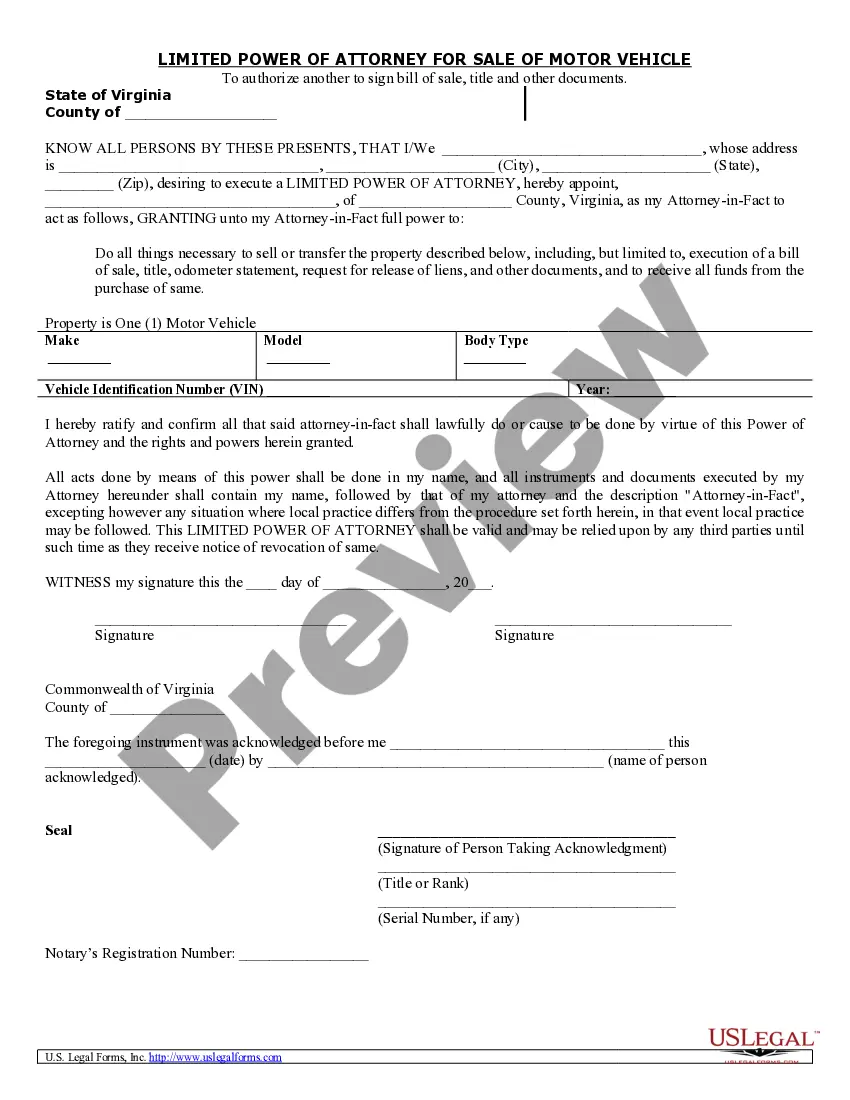

Authorize someone to handle the sale of your vehicle on your behalf, ensuring a smooth transfer of ownership without you present.

A Power of Attorney can be revoked at any time by the principal.

The agent must act in the principal's best interest.

Different types exist for financial and healthcare decisions.

Notarization or witness signatures are often necessary.

It is important to choose a trustworthy agent.

Powers can be broad or limited based on your needs.

Begin your process with these simple steps.

A trust can offer benefits that a will does not, such as avoiding probate.

Without a Power of Attorney, decisions may fall to the court if you can't act.

It's wise to review your Power of Attorney regularly, especially after major life changes.

Beneficiary designations typically override instructions in your will or Power of Attorney.

Yes, you can appoint separate agents for financial and healthcare decisions in your Power of Attorney.