Donation Donee Tax With Us

Description

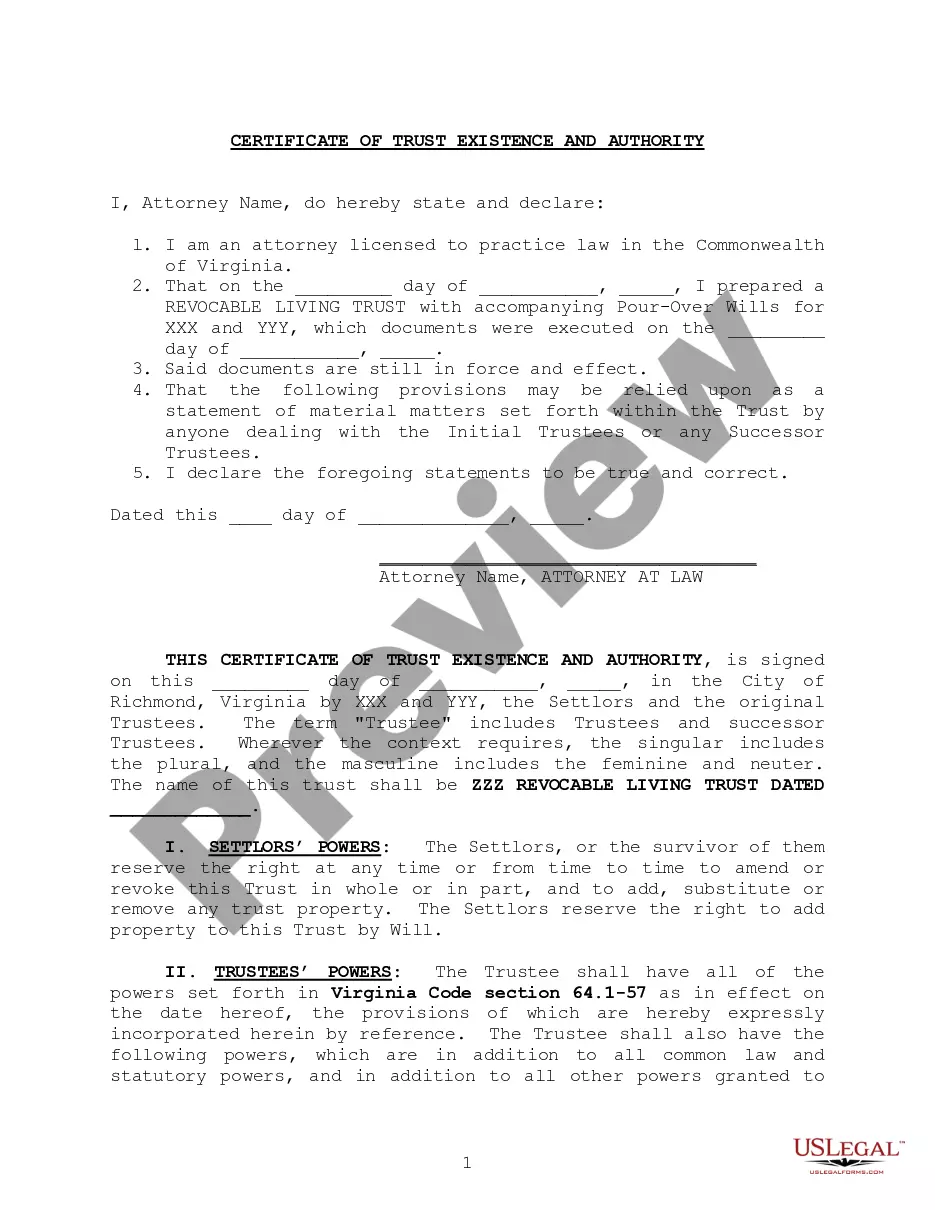

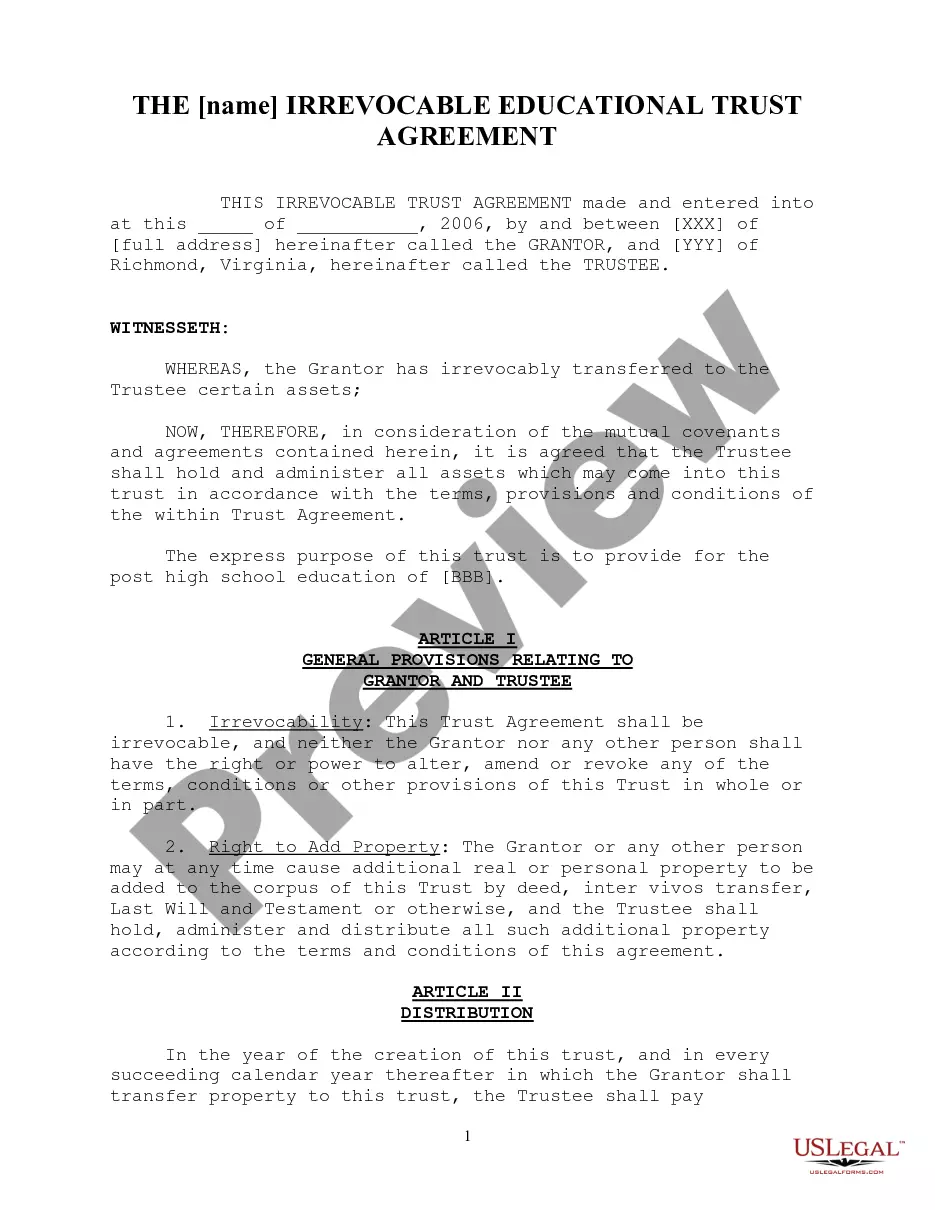

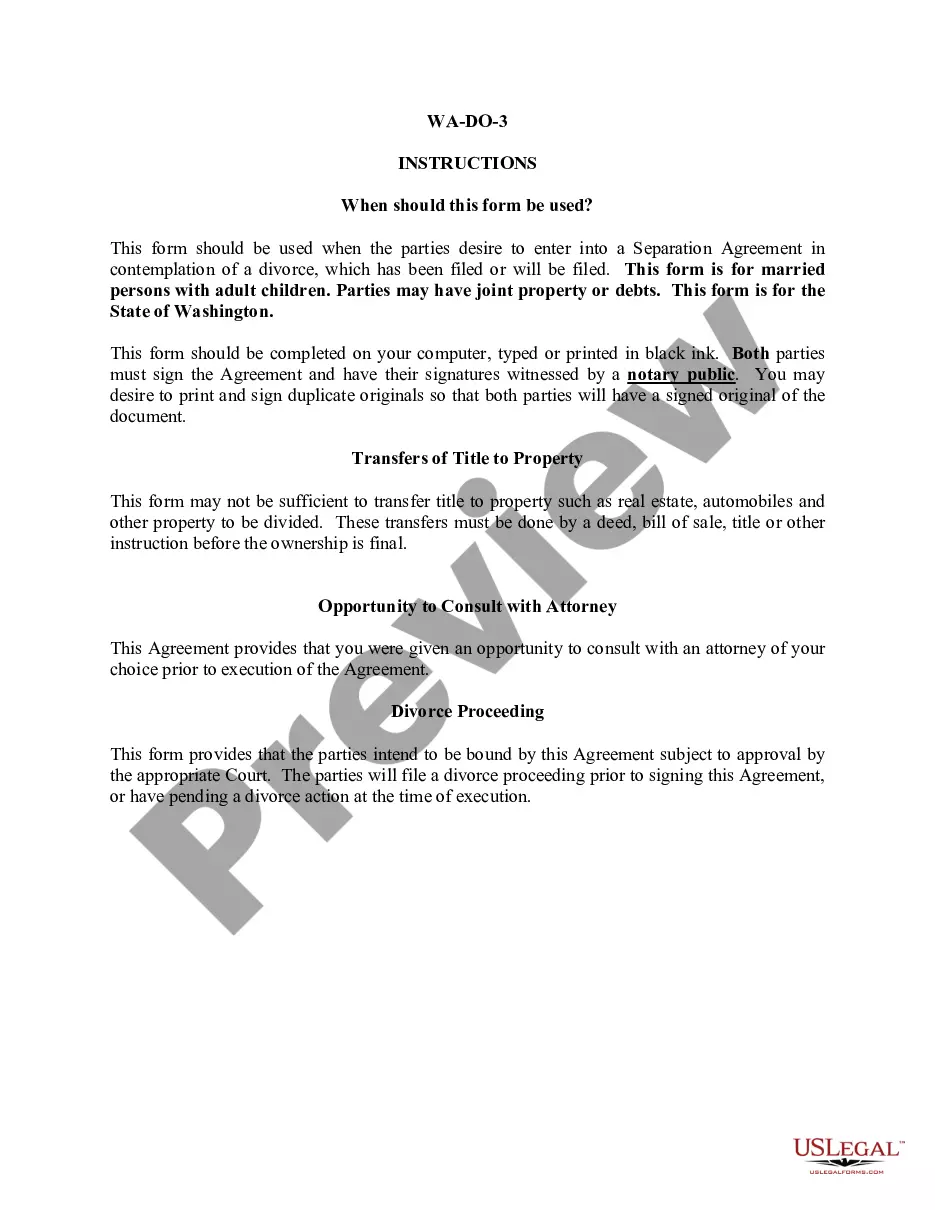

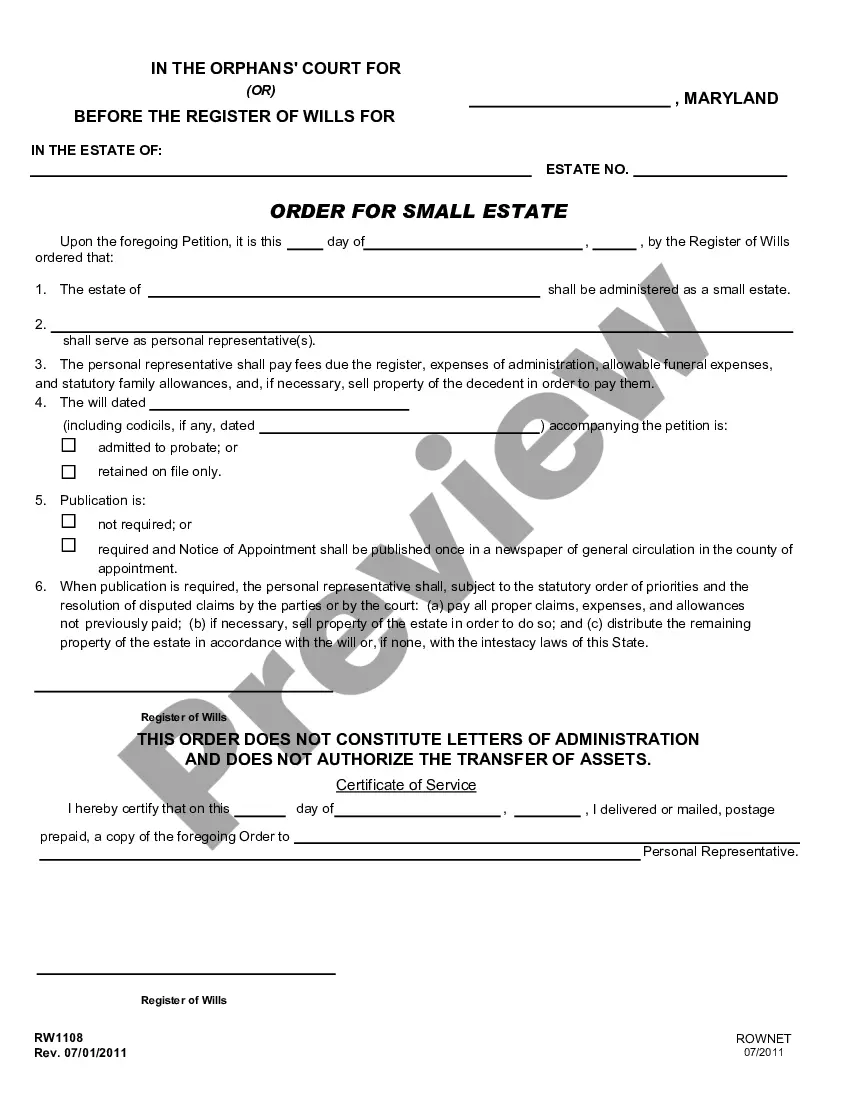

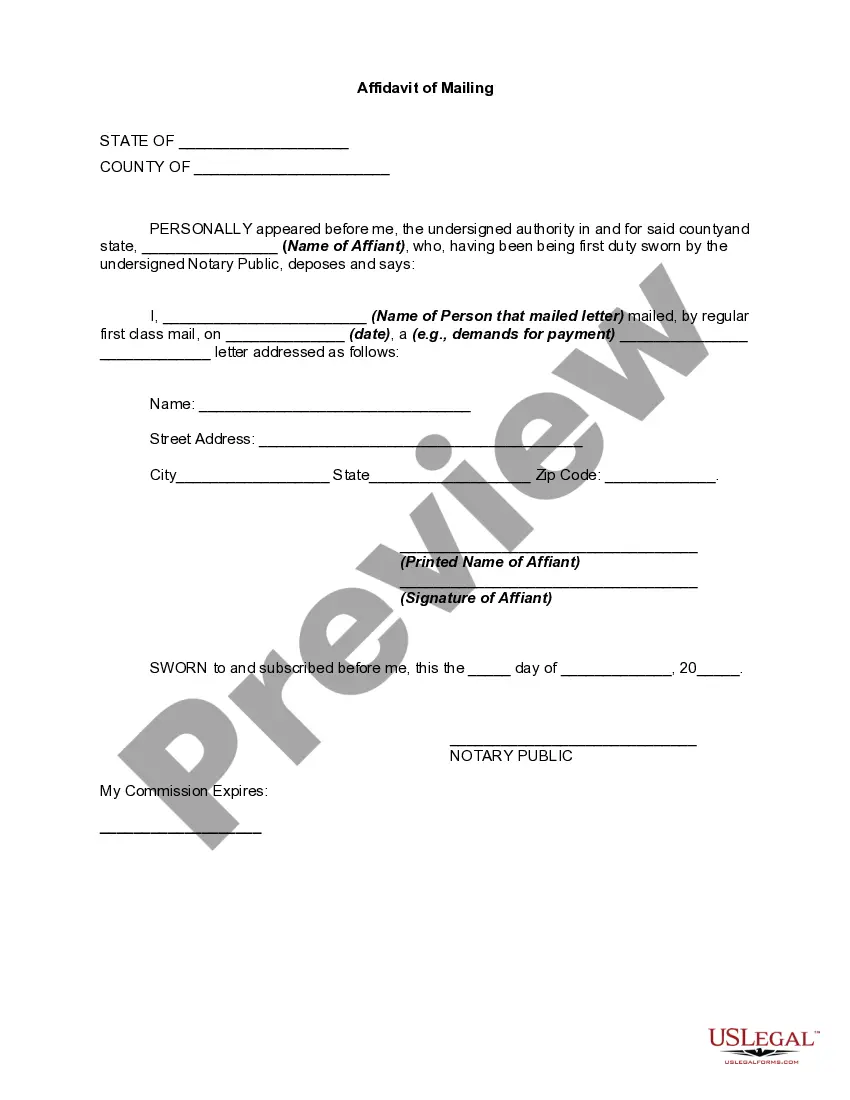

How to fill out Virginia Educational Trust Letter?

- If you're a returning user, start by logging into your account at US Legal Forms. Ensure your subscription is active. If it's expired, simply renew it based on your chosen payment plan.

- For first-time users, begin by exploring the preview mode and detailed descriptions of the forms. Ensure that you've selected a document that aligns with your specific needs and complies with your local jurisdiction.

- If you need a different template, utilize the search function to find alternative forms that may be more suitable for your requirements.

- Once you've identified the correct document, click on the 'Buy Now' button and select your preferred subscription plan. You will need to create an account to fully access the library.

- Proceed to make your payment by entering your credit card information or using your PayPal account to finalize the transaction.

- Finally, download your chosen form to your device. You can access the completed document anytime through the 'My Forms' section in your account.

US Legal Forms offers advantages such as a vast collection of over 85,000 fillable legal forms and packages, outpacing competitors in both quantity and affordability. Their platform not only facilitates ease of access but also connects you with premium experts who can assist in ensuring your documents are completed accurately.

In conclusion, using US Legal Forms makes handling donation donee tax straightforward and efficient. Take your first step today by exploring their comprehensive legal library and start your journey towards hassle-free legal documentation.

Form popularity

FAQ

In most cases, donations are not taxable for the receiver. If you receive a donation, it is usually treated as a gift rather than income, which means you won't be taxed on it. Nevertheless, there may be exceptions based on the nature of the donation, so it's wise to explore the donation donee tax with us to ensure you have accurate information.

When you receive a gift, it is generally not considered taxable income for you as the recipient. The IRS does not tax individuals on the value of gifts received. However, the donor may need to file a gift tax return if their gift exceeds a certain amount. Understanding the donation donee tax with us can clarify these nuances further.

To acknowledge receipt of a donation, send a formal letter or email thanking the donor for their contribution. Clearly state the amount donated, the date, and reaffirm how their support will make an impact. Uslegalforms offers templates for acknowledgment letters, helping you to streamline this process while staying compliant with donation donee tax with us.

Yes, charitable donations are generally tax deductible in the USA, provided the organization is recognized as tax-exempt by the IRS. Donors must itemize their deductions when filing taxes to benefit from these deductions. To maximize understanding of the process, consider exploring resources on donation donee tax with us for more guidance.

To create a receipt for tax purposes, include important details such as the donor's name, donation amount, date of donation, and an acknowledgment of whether any goods or services were provided in exchange. You can personalize your receipt easily with our templates at uslegalforms, ensuring clarity and compliance with donation donee tax with us.

Documenting donations for taxes involves keeping accurate records of all contributions. This includes saving receipts, maintaining a detailed ledger of donations, and ensuring you report values correctly. Our resources at uslegalforms can guide you through documentation, ensuring your records align with donation donee tax with us.

To fill out a donation tax receipt, start by entering the donor's details, including their name and contact information. Next, specify the date of the donation, the amount contributed, and a brief description of any items donated. If you use uslegalforms, we provide templates that simplify the process, ensuring your receipt meets all legal requirements for donation donee tax with us.

A receipt of donation should clearly outline essential information, including the donor's name, the donation date, the amount, and a description of the donated items. You can also include your organization's name and tax identification number. By following this format, you ensure compliance with the donation donee tax with us, making it easier for donors to claim tax deductions.

Claiming donations on your taxes can be worthwhile, especially if you itemize your deductions. It not only reduces your taxable income but also supports non-profit organizations. Leverage tools from uslegalforms to understand how to navigate the donation donee tax with us effectively.

To write off charitable donations on your taxes, you need to itemize your deductions on Schedule A of your tax return. Keep receipts and documentation to support your contributions. This practice enables you to benefit from the donation donee tax with us while supporting causes you care about.