Exemption Virginia Homestead With Multiple Owners

Description

How to fill out Virginia Homestead Deed For Single - Home?

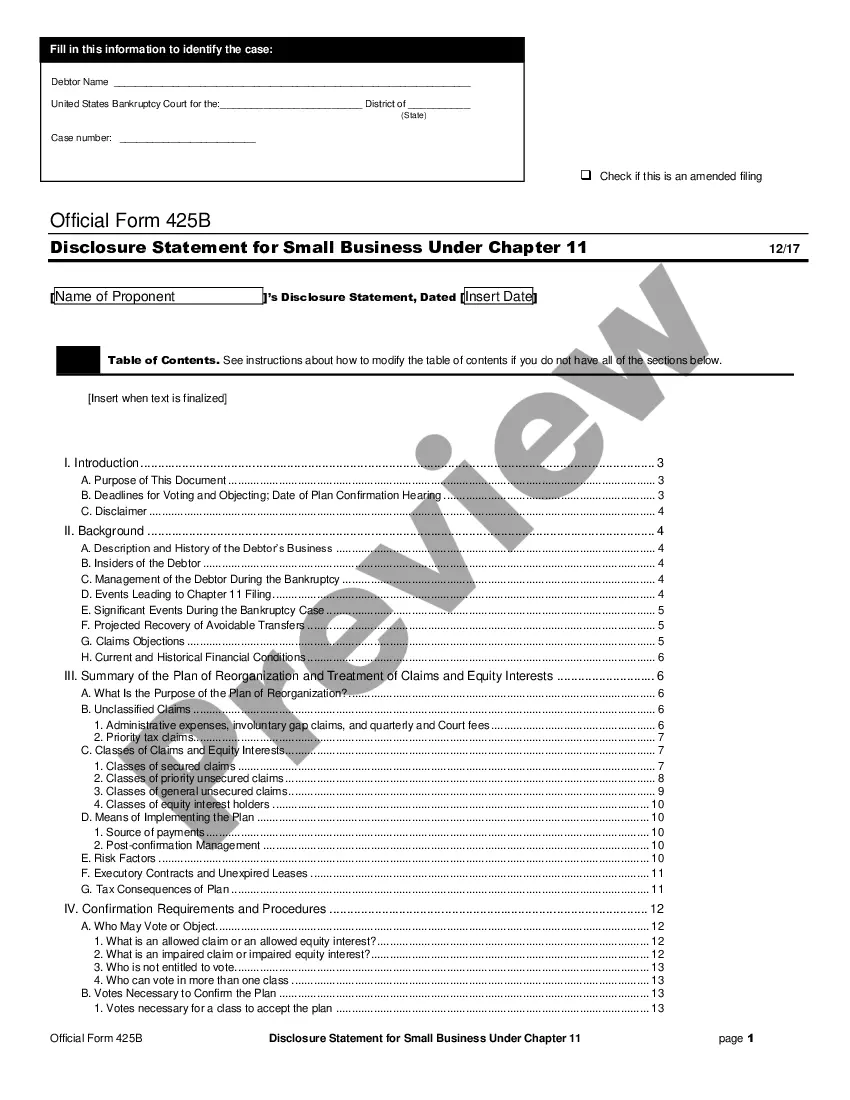

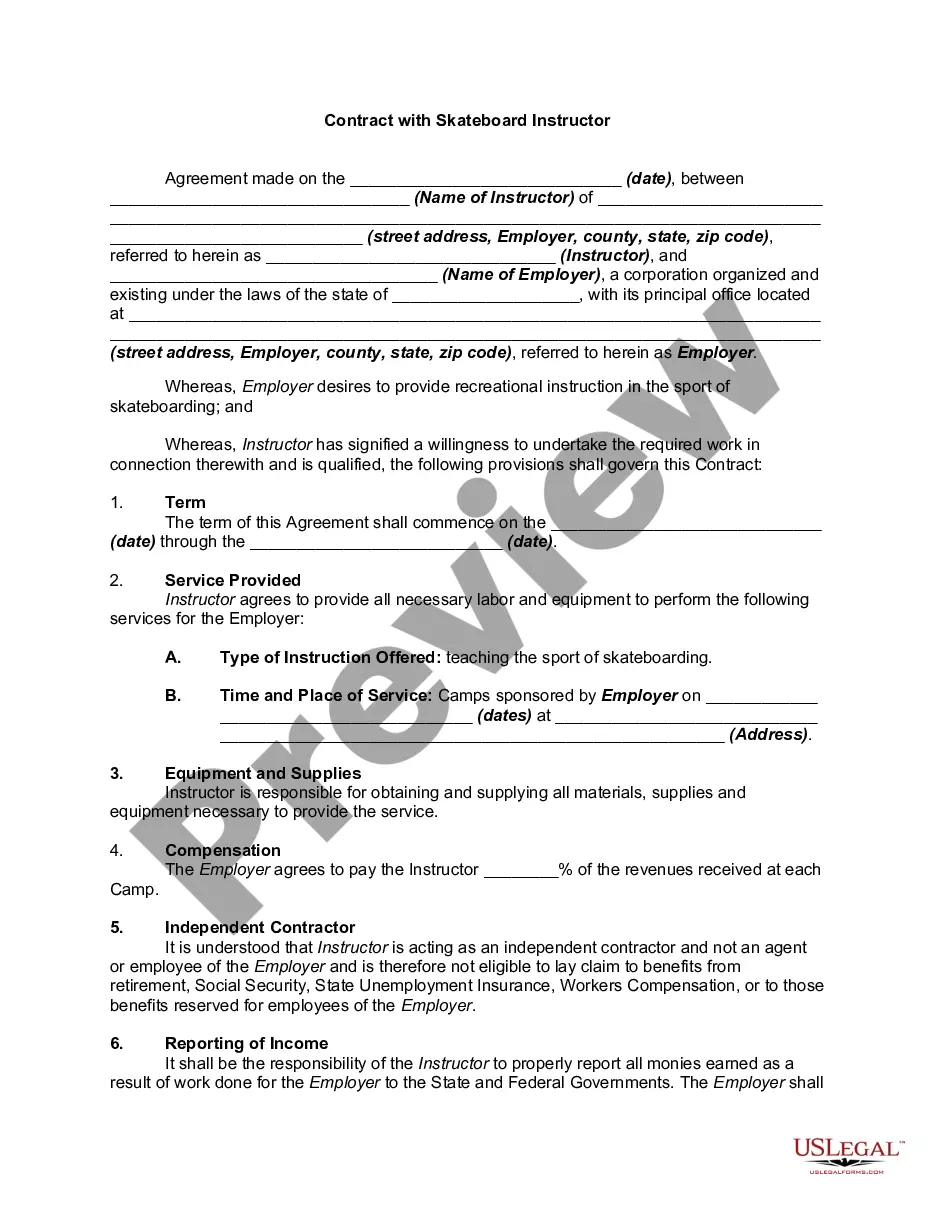

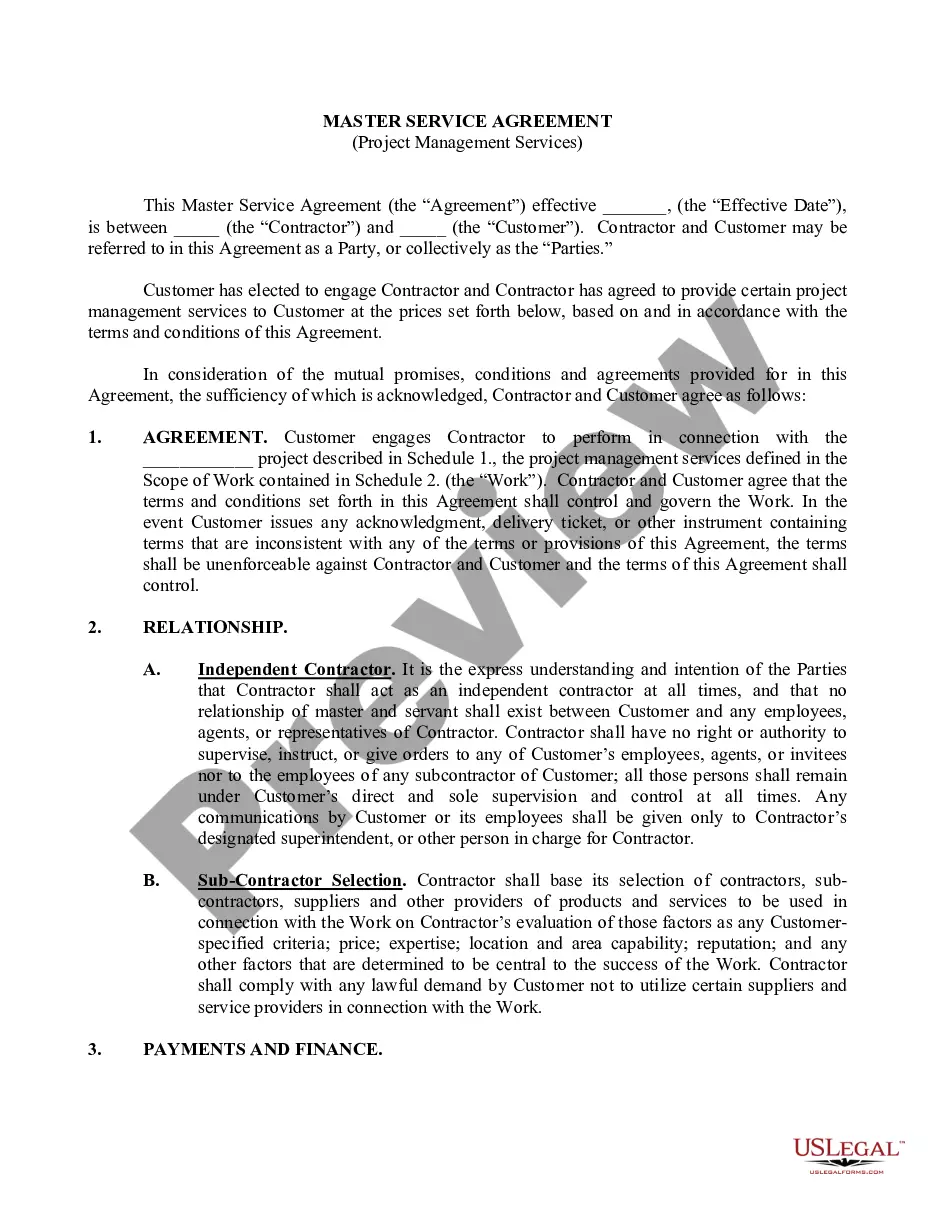

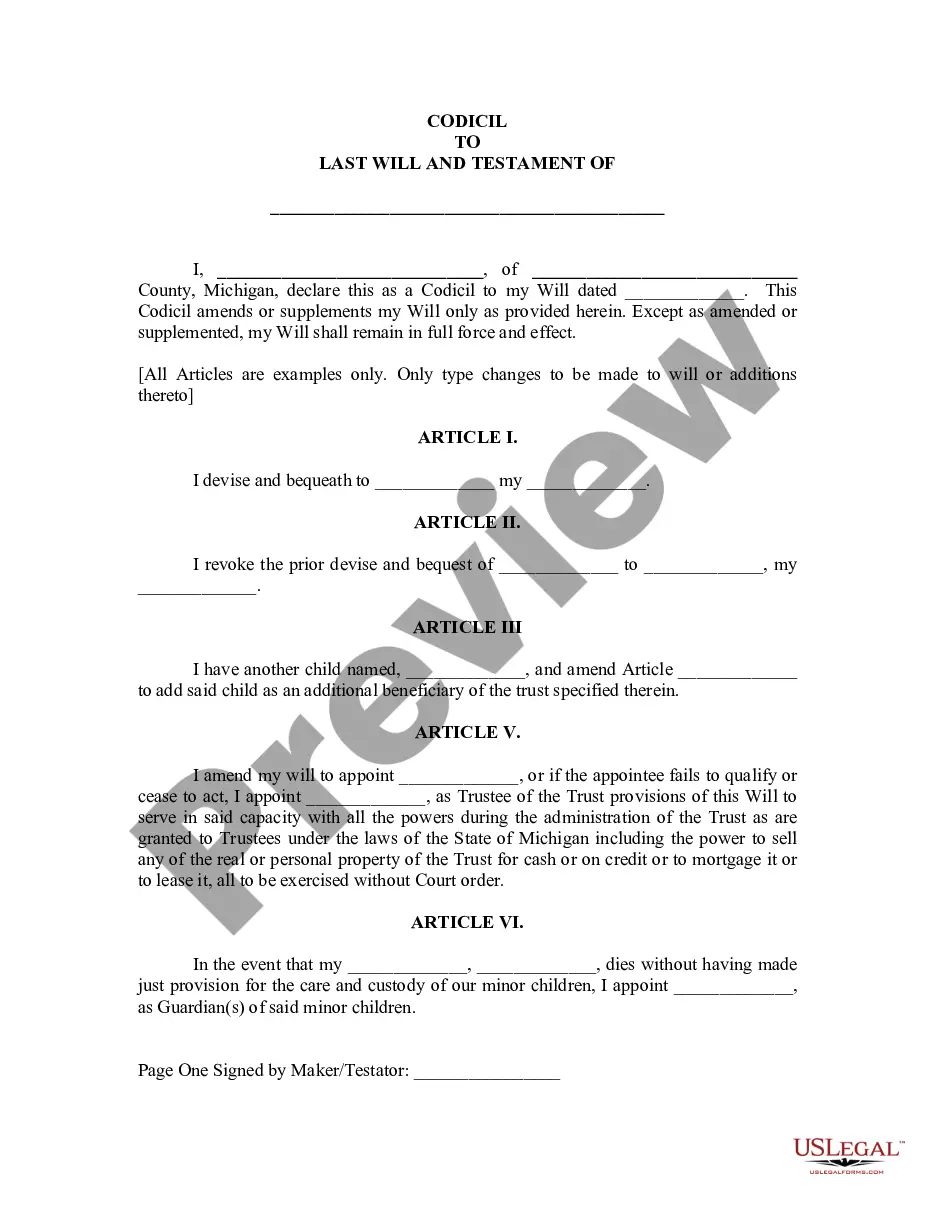

Whether for business purposes or for individual affairs, everybody has to manage legal situations at some point in their life. Filling out legal documents demands careful attention, beginning from picking the appropriate form template. For example, when you choose a wrong edition of the Exemption Virginia Homestead With Multiple Owners, it will be turned down once you submit it. It is therefore crucial to have a trustworthy source of legal papers like US Legal Forms.

If you have to obtain a Exemption Virginia Homestead With Multiple Owners template, stick to these easy steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s description to ensure it suits your situation, state, and region.

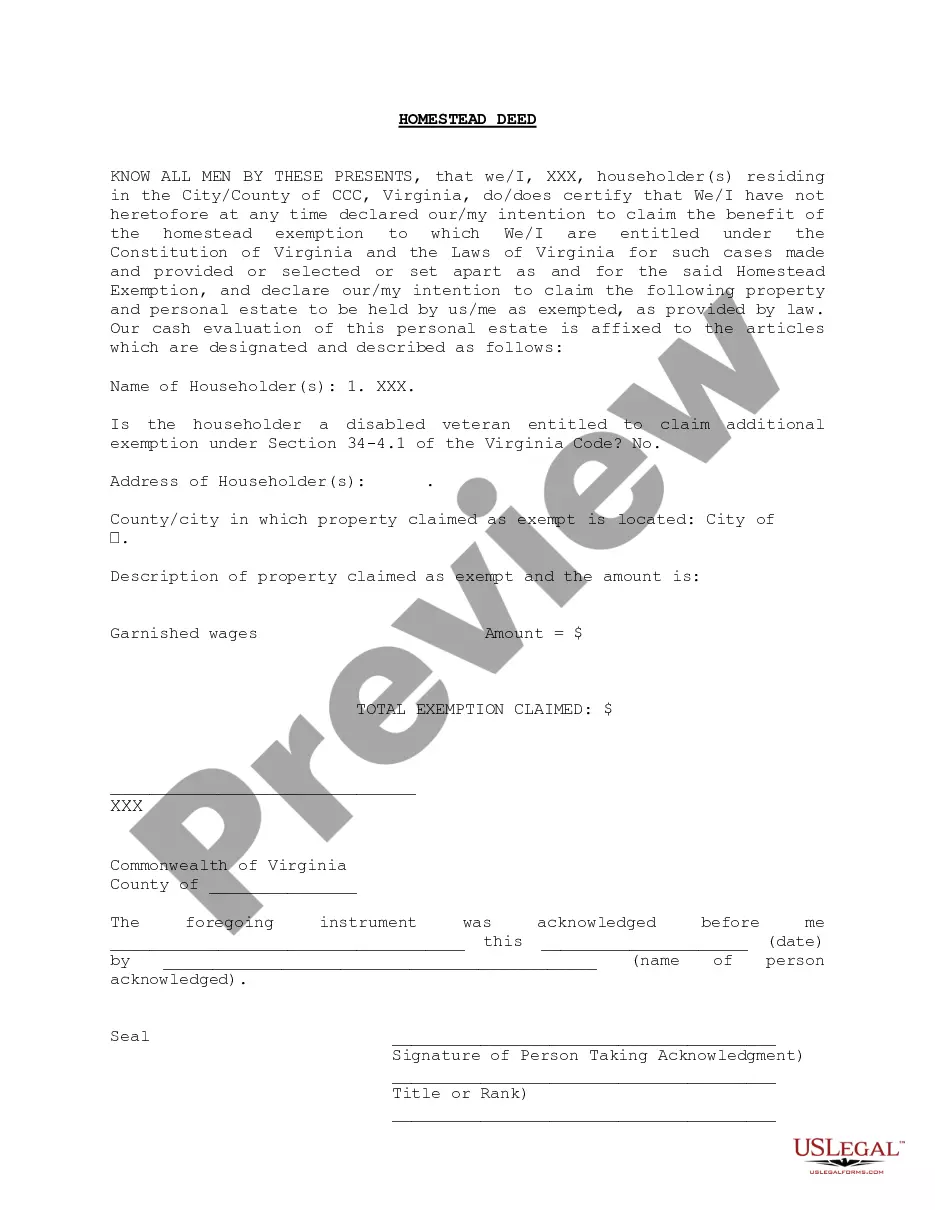

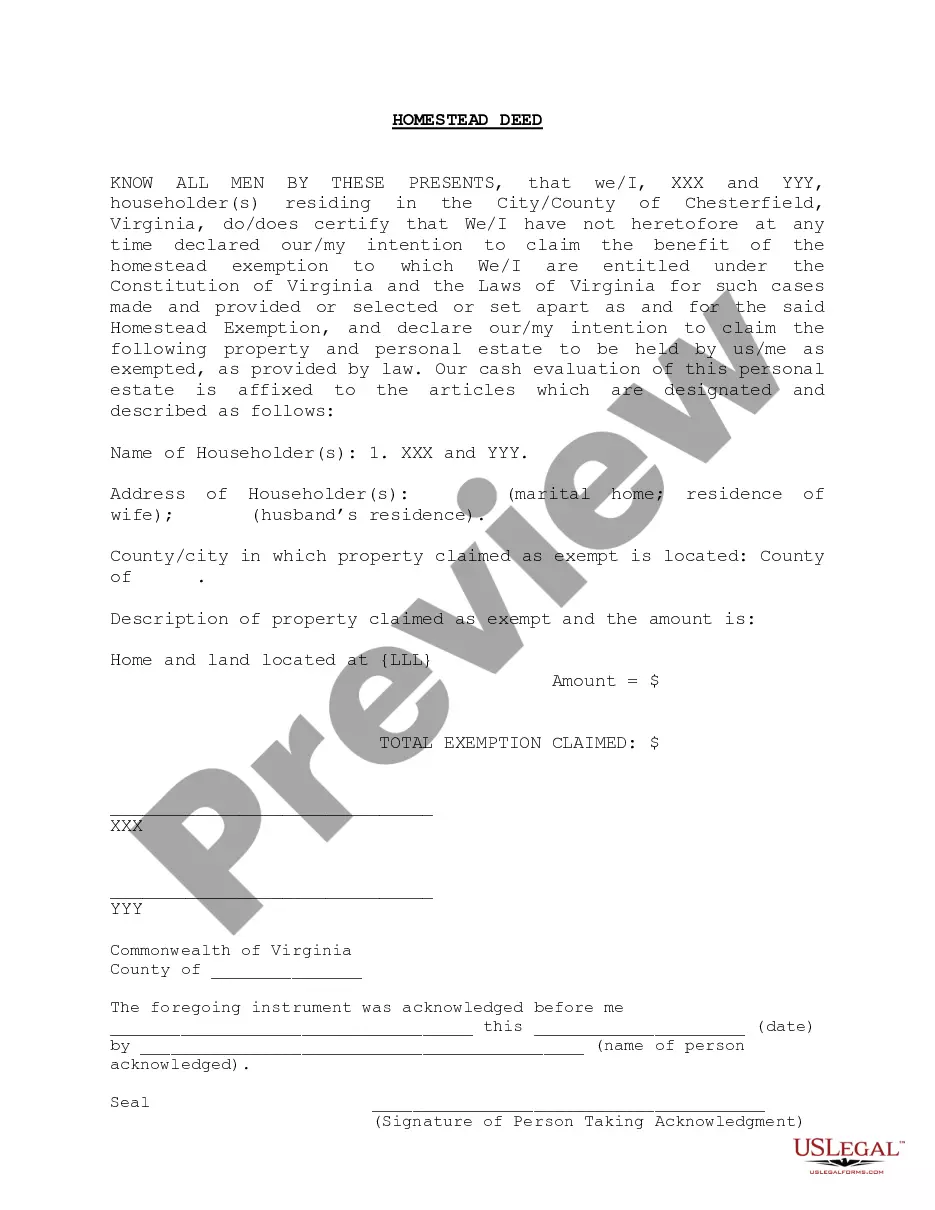

- Click on the form’s preview to examine it.

- If it is the incorrect form, get back to the search function to locate the Exemption Virginia Homestead With Multiple Owners sample you require.

- Download the file if it matches your needs.

- If you already have a US Legal Forms profile, just click Log in to access previously saved files in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Choose the file format you want and download the Exemption Virginia Homestead With Multiple Owners.

- When it is downloaded, you can complete the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the appropriate sample across the web. Use the library’s straightforward navigation to find the proper template for any situation.

Form popularity

FAQ

No. A married couple can claim only one homestead.

Virginia homestead laws allow residents to designate up to $5,000 worth of real estate (including mobile homes) as a homestead, plus $500 for each dependent. If a resident is sixty-five years of age or older, or a married couples files for an exemption together, up to $10,000 may be exempted under the homestead laws.

Both owners must sign the application form and, if both owners otherwise qualify, the homestead exemption will be granted for the entire home. This process is as simple as any other married couple or single individual applying for the exemption.

Homestead can be applied to condominiums, mobile homes, and manufactured homes. However, you can have only one homestead residence. You cannot split it between two different pieces of real property, even if they are both here in Florida or even within the same county.

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.