Revocation Living Trust For Property

Description

How to fill out Virginia Revocation Of Living Trust?

- If you're a returning user, log in to your account and download the required form template by clicking on the Download button. Ensure your subscription is active; renew it if it's expired.

- If you’re new to US Legal Forms, begin by reviewing the Preview mode and form descriptions to find the document that meets your local jurisdiction requirements.

- Should you identify any discrepancies or require alternative templates, use the Search tab above to find the appropriate form.

- Once you've identified the correct document, click the Buy Now button and select your desired subscription plan. Account registration will be required to access the legal library.

- Provide your payment information via credit card or PayPal to finalize your purchase.

- After completing your payment, download your form and save it on your device. You can access it anytime from the My Forms section of your profile.

US Legal Forms excels in providing an extensive library of over 85,000 fillable and editable legal forms, ensuring quick access to documents that suit your needs. You can even receive guidance from premium experts to help you fill out your forms correctly.

In conclusion, drafting your revocation living trust has never been easier. With US Legal Forms' extensive resources at your disposal, you can confidently address your property ownership needs. Visit US Legal Forms today and take the first step towards securing your estate.

Form popularity

FAQ

Revoking a revocable trust is generally easy and can be done without significant hassle. Since you maintain control over the trust, you have the authority to make changes or dissolve it entirely at any time. This ease of revocation is one of the appealing features of establishing a revocation living trust for property. Nevertheless, it's advisable to work with professionals, like uslegalforms, who can provide guidance and ensure that your revocation aligns with your overall estate planning goals.

Revoking a revocable trust is typically a straightforward process. You can revoke your trust by drafting a formal document stating your intention to do so, or you can destroy the original trust document. A revocation living trust for property can be reversed as long as you are alive and competent, making it a flexible option in estate planning. Always consider consulting a professional to ensure compliance with legal requirements.

A nursing home can access assets within a revocable trust if you require Medicaid assistance for long-term care. However, because a revocation living trust for property allows you to maintain control over the assets, they may not be directly taken by the nursing home. It's crucial to plan your trust carefully, ensuring that your assets are protected while you receive the necessary care. Consulting with an expert can guide you in safeguarding your estate.

The 5 year rule for trusts generally refers to the timeframe used by the IRS to determine if the assets placed in a revocation living trust for property are subject to taxes. If you create or alter a trust, its terms must be in effect for at least five years to avoid certain complications regarding taxation. This rule ensures that the trust is seen as a genuine estate planning tool rather than a temporary arrangement. Understanding this rule can help you manage your estate effectively.

A downside of putting assets in a trust includes the process of retitling those assets, which can be time-consuming and sometimes cumbersome. This step is necessary to ensure the trust functions properly and meets its intended goals. Furthermore, the trust may be subject to specific rules and management requirements that can complicate situations. Exploring the differences with a revocation living trust for property can help weigh the pros and cons effectively.

One downfall of having a trust lies in the complexity of managing it. Certain trusts, particularly those not regularly updated, may result in unintended consequences or disputes among beneficiaries. Additionally, not fully understanding the terms and responsibilities can lead to mismanagement or noncompliance with legal requirements. A clear understanding of the revocation living trust for property can mitigate these risks and provide peace of mind.

Deciding whether to place assets in a trust can provide numerous benefits, including avoidance of probate and potential tax advantages. It is essential for your parents to consider their financial goals and the specific needs of their beneficiaries. Setting up a trust can ensure that their assets are managed according to their wishes. Consulting resources on revocation living trust for property can clarify the benefits and answer critical questions.

One disadvantage of a family trust is the potential for ongoing management costs. Maintaining a family trust may require legal assistance and tax filings, which can add to your expenses. Moreover, if the trust is not properly managed, it may not effectively achieve the intended goals of protecting family assets. Understanding the nuances of a revocation living trust for property can help you navigate these challenges effectively.

One major mistake parents often make is failing to properly fund the trust. Simply creating a trust is not enough; transferring assets into the trust is crucial to ensure its effectiveness. Many parents overlook this step, leaving their intended beneficiaries without the protections offered by the trust. To avoid this pitfall, seek guidance on the revocation living trust for property and how to effectively manage asset transfers.

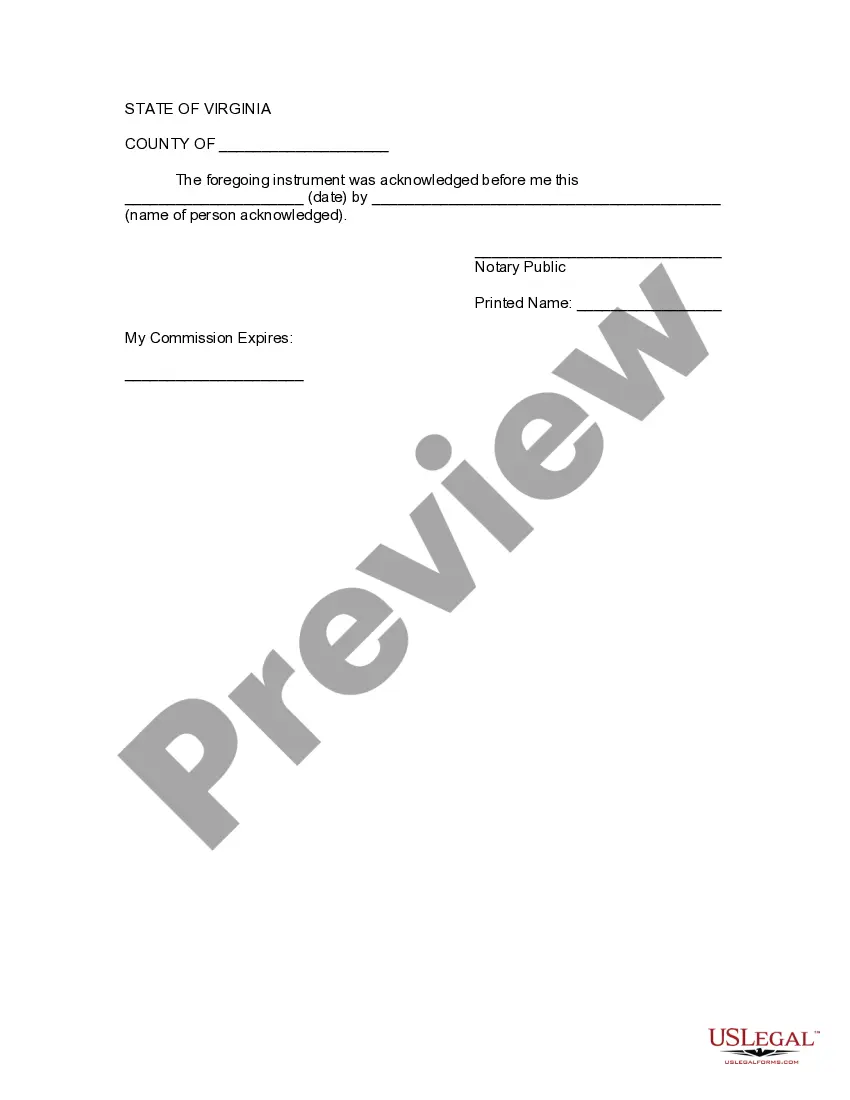

A sample of revocation of living trust typically includes a clear statement declaring that the living trust is being revoked. This document should state the trust's name, the date it was established, and the names of the trust's grantors. It is important to include a signature and date from the grantors to validate the revocation of living trust for property. Legal forms available on the uslegalforms platform can guide you in creating this vital document.