Notice Assignment Trust For The Disabled

Description

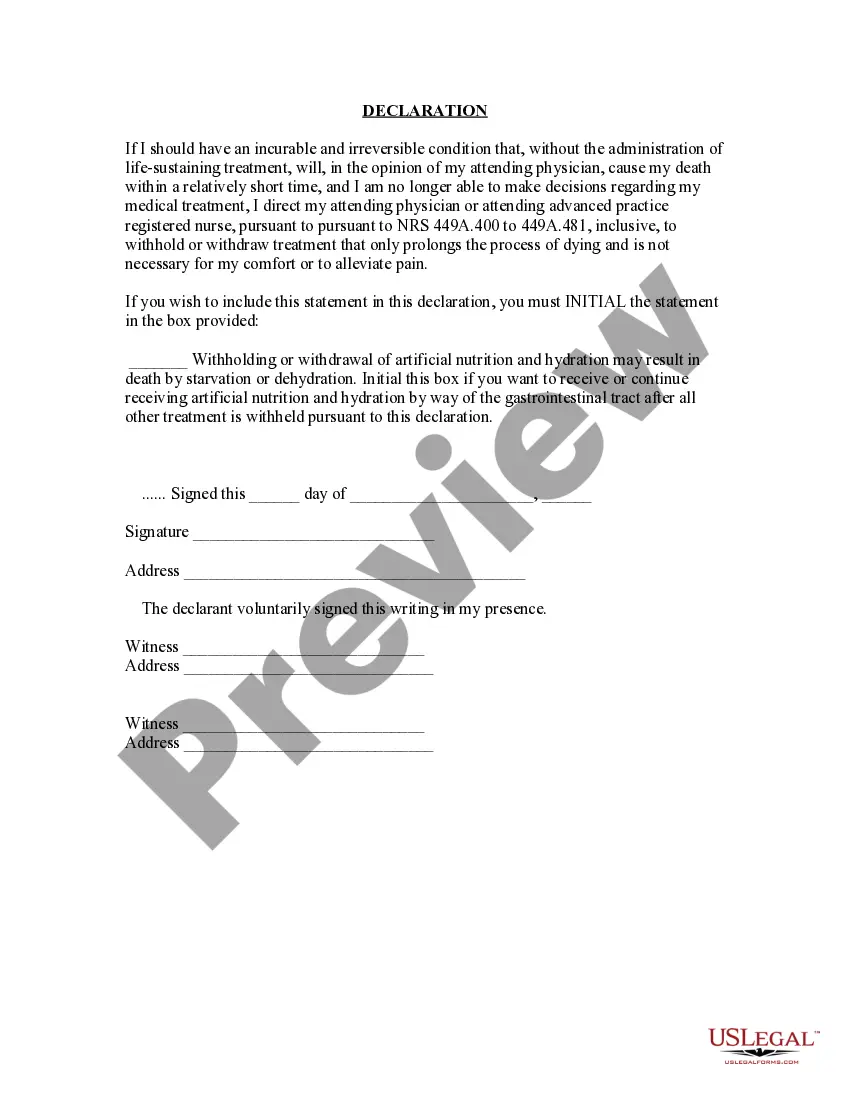

How to fill out Virginia Notice Of Assignment To Living Trust?

- Log in to your US Legal Forms account if you're a returning user and download the necessary template directly by hitting the Download button. Confirm that your subscription is active; renew if needed.

- For first-time users, begin by reviewing the Preview mode and form description. Make certain that the selected form meets your requirements and adheres to local jurisdiction laws.

- If discrepancies arise, utilize the Search tab to locate alternative templates that better suit your needs.

- Once satisfied with your selection, click the Buy Now button and choose a subscription plan that works for you. Create an account to unlock full access to the library.

- Complete your purchase by entering your credit card information or opting for PayPal for secure payment.

- Download your completed form and save it to your device, accessing it anytime via the My Forms section in your profile.

By following these steps, you can successfully create a Notice Assignment Trust for the Disabled with ease.

Start today and explore the extensive resources of US Legal Forms to ensure your legal documents are accurate and timely!

Form popularity

FAQ

There is no specific limit on the amount of assets you can place in a special needs trust. However, the trust must be carefully managed to ensure it does not jeopardize the beneficiary's eligibility for government benefits. A Notice assignment trust for the disabled is designed to provide financial support without disqualifying the disabled individual from receiving necessary assistance.

One downside of a special needs trust is its complexity and the costs associated with setting it up and managing it. While it can provide essential protection for benefits and assets, the legal structure can sometimes make it challenging to navigate. Users must ensure the trust does not inadvertently affect the beneficiary's eligibility for public assistance programs.

The best trust for a disabled child is often a special needs trust, as it can protect the child’s eligibility for government benefits while ensuring their financial needs are met. A Notice assignment trust for the disabled can also be beneficial, especially if it aligns with your estate planning goals. Collaborate with a legal expert to tailor the trust according to your child’s specific requirements.

The minimum amount to fund a trust can vary depending on the type of trust and your specific goals. Generally, there is no set minimum for a Notice assignment trust for the disabled, but it's essential to consider the expenses involved in administering the trust. It's advisable to consult with a financial advisor to determine the best funding strategy based on the needs of the disabled beneficiary.

Setting up a trust for a disabled person involves a few key steps. First, you need to decide on the type of trust you want to create, such as a Notice assignment trust for the disabled. Next, consult with an attorney to ensure compliance with state laws and to help draft the trust document. Finally, fund the trust by transferring assets into it, ensuring the disabled individual benefits while protecting their eligibility for government assistance.

A special needs trust, often referred to as a Notice assignment trust for the disabled, is designed to benefit individuals with disabilities while preserving their eligibility for government assistance. Generally, individuals who are eligible include those who are under the age of 65 and have a disability that qualifies them for Supplemental Security Income (SSI) or Medicaid. It's important to understand that the trust must contain funds that are solely for the beneficiary's needs, which helps ensure they can maintain access to essential services. At US Legal Forms, we provide resources to help you navigate the legal requirements and set up a special needs trust effectively.

The maximum amount you can place in a trust fund varies based on the type of trust and your financial goals. Some trusts have specific limitations, but many allow significant flexibility. When creating a Notice assignment trust for the disabled, it’s wise to consult with a legal professional to navigate any restrictions and maximize benefits for your loved one.

The maximum amount for a special disability trust is often influenced by specific regulations and individual situations. Typically, there can be a fair amount allocated without affecting government benefits, but compliance with legal requirements is crucial. By exploring a Notice assignment trust for the disabled, families can effectively manage assets while ensuring their loved ones receive necessary support.

To set up a trust fund for a disabled person, begin by determining the specific needs of the individual. Next, you will need to draft the trust document, outlining how funds will be managed and distributed. Consulting with a professional who specializes in Notice assignment trust for the disabled can ensure the process is done correctly and efficiently, protecting the beneficiary's interests.

The best trust for a disabled person often depends on specific needs and circumstances. A special needs trust is commonly recommended as it allows the beneficiary to receive support without losing vital governmental benefits. Utilizing a Notice assignment trust for the disabled can enhance financial security, enabling a better quality of life for the individual.